Income Inequality: The Impact on Lower-Income Canadians

Income inequality has become a pressing issue in modern society, particularly highlighted by the struggles of lower-income groups. As household wealth in Canada rises, reaching a staggering $17.6 trillion, the disparity between the rich and the poor is growing alarmingly. While financial assets have seen unprecedented increases, those in the lowest 20 percent of the income distribution are experiencing minimal benefits, with only a 3.2 percent boost in disposable income. Much of this growth for lower-income households has stemmed from government assistance, yet average wages continue to decline. As a result, the wealthiest Canadians possess a disproportionate share of financial assets, exacerbating income inequality and raising significant concerns about the wellbeing of the most vulnerable in our society.

The widening gulf between affluent and disadvantaged communities, often referred to as wealth disparity, continues to garner attention. Various dynamics, including fluctuating household capital and asset ownership, paint a stark picture of inequality in Canada. Despite a modest rise in financial holdings among some, lower-income groups are left trailing behind as they struggle to keep pace with the soaring costs of living. With government aid playing a crucial role in supporting these households, the underlying challenges of stagnant wages and job security persist. Observing these patterns is essential to understanding the fundamental shifts in income distribution and the pressing need for equitable solutions.

Understanding the Impact of Income Inequality on Lower-Income Groups

Income inequality continues to be a pressing issue in Canada, particularly affecting lower-income groups. Despite a reported increase in household wealth, with figures rising to $17.6 trillion, the benefits of this growth are unevenly distributed. The most vulnerable populations, especially those in the bottom 20 percent of the income distribution, are grappling with stagnant earning potential and limited financial assets. Their disposable income grew by just 3.2 percent—significantly behind the broader trend. This disparity highlights the systemic issues that plague lower-income communities as they struggle to achieve financial stability.

Moreover, much of the increase in disposable income for these lower-income groups can be attributed to government assistance, which rose by an impressive 30 percent. While this support provides essential relief, it underscores the fragility of financial independence for these households. Many in lower-income brackets are finding it increasingly difficult to accumulate wealth or invest in financial assets, creating a cycle of dependency on external aid. As the income gap widens, the need for policy reforms that address income distribution becomes increasingly urgent.

The Role of Government Assistance in Mitigating Income Disparities

Government assistance plays a crucial role in buffering lower-income households against the effects of income inequality. With average wages falling by 0.7 percent, the financial support provided by the government has become a lifeline to families struggling to make ends meet. This assistance not only boosts disposable income but also aids in maintaining a semblance of stability amidst rising living costs. However, reliance on government support also raises questions about the long-term sustainability of this approach and whether it adequately addresses the root causes of income disparities.

Additionally, the temporary nature of such financial support can lead to concerns about future security among lower-income groups. While the current rise in disposable income is beneficial, it is essential to look beyond immediate relief measures. Long-term strategies are needed to enhance earning potential, such as improving access to education and quality jobs that can equip lower-income Canadians with the skills necessary to compete in a growing economy. Only through such comprehensive efforts can we hope to create a more equitable income distribution that fosters both economic growth and social stability.

Trends in Household Wealth Growth: A Closer Look

In analyzing the recent trends in household wealth growth, it is evident that the overall increase—0.8 percent leading to a total of $17.6 trillion—mask significant underlying challenges. While financial assets have reached record highs and real estate values have appreciated, the benefits are skewed heavily towards higher-income households. The growing concentration of wealth among the richest 20 percent raises essential questions about the inclusivity of the Canadian economy. These trends exacerbate existing income inequality and leave lower-income groups further marginalized.

The stark contrast between the wealth accumulation of higher-income households and the stagnation experienced by lower-income Canadians can be alarming. The rich can leverage their financial assets to generate further income through investments; in contrast, those at the bottom lack such opportunities. As wealth continues to concentrate, it creates an uneven playing field where social mobility becomes increasingly challenging for lower-income citizens. It is crucial to evaluate our economic policies to ensure that wealth creation benefits all Canadians, not just a privileged few.

The Stagnation of Wages and Its Effects on Lower-Income Canadians

The decline in average wages, particularly among lower-income groups, has serious implications for overall economic health. As these wages fell by 0.7 percent, many households found it harder to keep pace with rising living costs and essential needs. With fewer opportunities for wage growth and increasing financial pressure, many lower-income Canadians struggle to save or invest in their futures. This stagnation is a clear indicator of the challenges faced by the workforce, particularly in sectors that typically employ lower-income individuals.

This wage stagnation also contributes to the broader issue of income inequality, as the wealthiest households continue to see significant increases in their earnings and financial assets. With the majority of income growth captured by the upper echelons of the income distribution, lower-income groups find themselves trapped in a cycle of impoverishment. They often lack the means to break free from this cycle, making equitable wage growth a crucial element in addressing income disparity. Comprehensive economic reform, including wage policies that support vulnerable workers, is necessary to foster a more inclusive economy.

Real Estate Values and Their Impact on Lower-Income Groups

The increase in real estate values, albeit at a slower rate, poses both opportunities and challenges for lower-income groups. While rising property values can signify economic health, they also risk exacerbating housing affordability issues. Many lower-income Canadians find themselves priced out of the housing market as wealthier individuals capitalize on increasing property values. The growing gap in real estate ownership highlights the barriers facing those who are already struggling financially and further underlines the need for policies aimed at promoting affordable housing.

Additionally, as real estate becomes an increasingly important financial asset, lower-income households’ inability to invest in property puts them at a significant disadvantage. They miss out on potential wealth-building opportunities that come with homeownership. The relationship between rising real estate values and income distribution must be critically examined to ensure that lower-income groups are not left to navigate the consequences of market fluctuations. Public policies that prioritize affordable housing, when combined with supportive financial assistance, can help address these disparities.

Financial Assets: A Record High but Uneven Distribution

The recent increase in financial assets reaching a record high of 0.9 percent is commendable, yet it illustrates a significant disparity in wealth distribution. The wealthiest segment of the population continues to hold a disproportionate share of these financial assets, exacerbating the wealth gap. Lower-income groups, in contrast, are less likely to have substantial financial portfolios or investment capabilities. This lack of access to financial assets not only limits their ability to build wealth but also hinders their overall economic mobility.

Furthermore, without sufficient financial literacy and resources, lower-income households often find it challenging to navigate investment opportunities. The disparity in wealth accumulation not only reflects current economic conditions but also outlines the potential for future generations of lower-income Canadians to remain economically disadvantaged. Initiatives focused on enhancing financial education can empower lower-income individuals to make informed choices regarding their financial future, which is vital for striving towards a more equitable financial landscape.

The Importance of Income Distribution in Economic Policies

Income distribution plays a pivotal role in shaping economic policies aimed at enhancing overall societal welfare. When wealth is concentrated in the hands of a few, the resulting income inequality can lead to social discontent and decreased economic growth. Policy decisions that prioritize equitable income distribution can promote a healthier economy by ensuring that all citizens have access to essential financial resources. In this context, it is crucial to assess how government assistance, wages, and investment in lower-income groups can foster a more balanced economic environment.

Furthermore, addressing income distribution impacts long-term prosperity. By implementing policies that support lower-income households, such as improved minimum wages and investment in community resources, the government can create a more inclusive economic landscape. Economic policies that incorporate considerations for lower-income groups can mitigate income inequality and contribute to a more robust middle class, fostering comprehensive economic growth that benefits everyone.

Challenges Facing Lower-Income Canadians Amidst Economic Growth

Despite reports of economic growth, many lower-income Canadians continue to face significant challenges. The growth in household wealth, while an encouraging statistic, does not reflect the day-to-day realities of those struggling to maintain a basic standard of living. The notion that wealth accumulation is evenly spread across all socio-economic groups is misleading; rather, it highlights deep-rooted inequalities that remain unresolved. The slow-growing financial conditions of lower-income Canadians in the wake of overall economic successes should prompt renewed focus on inclusive growth strategies.

Moreover, as wealth creation trends favor higher income brackets, the disparities faced by lower-income groups only widen, further entrenching systemic inequality. The challenges facing these Canadians are multifaceted, including stagnant wages, rising living costs, and limited access to crucial financial resources. It is vital for policymakers to recognize these disparities and work towards solutions that empower lower-income groups to partake in the benefits of economic growth, rather than consistently being left behind.

Moving Towards a More Equitable Economic Future

To achieve a more equitable economic future, concerted efforts must be made to address the underlying issues of income inequality in Canada. The current system, which allows wealth to concentrate among the affluent, creates barriers for lower-income groups seeking financial stability. As the income gap continues to widen, it presents a call to action for policymakers, businesses, and society as a whole to invest in programs that uplift and support the most vulnerable. Emphasizing education, job training, and decent wages is essential in paving the way for a more balanced economic landscape.

Additionally, creating policies that prioritize affordable housing, accessible health care, and government assistance programs can help to alleviate the burden on lower-income groups. By bridging the gap between different income brackets and ensuring equal opportunities, Canada can work toward an economic structure that does not just thrive but is sustainable and inclusive. The actions taken today will determine the landscape of tomorrow, where all Canadians can share in the prosperity of a more equitable economic future.

Frequently Asked Questions

How does income inequality affect lower-income groups in Canada?

Income inequality significantly impacts lower-income groups in Canada, pushing them further behind economically. For instance, while the overall household wealth in Canada increased by 0.8 percent, lower-income groups experienced a mere 3.2 percent rise in disposable income. This disparity highlights the skewed income distribution where wealth creation benefits the wealthy disproportionately, leaving lower-income families with limited financial assets and access to opportunities.

What are the contributing factors to income inequality in Canada?

Several factors contribute to income inequality in Canada, including rising financial assets concentrated among the wealthiest and uneven wage growth across different income groups. Although lower-income families saw a boost from government assistance, rising taxes, and net transfers, average wages overall decreased by 0.7 percent, exacerbating the income gap. As a result, wealth generated in the economy is not equitably shared, leading to growing income disparities.

How does government assistance impact income distribution among lower-income groups?

Government assistance plays a crucial role in supporting lower-income groups amidst rising income inequality. In recent years, net transfers from government aid rose by 30 percent, helping to increase disposable income for these households. However, despite this influx of support, the bottom 20 percent of the income distribution still lag behind, indicating that while assistance mitigates some effects of income inequality, it is not a comprehensive solution to the systemic issues at play.

Why is household wealth concentration a concern for income inequality?

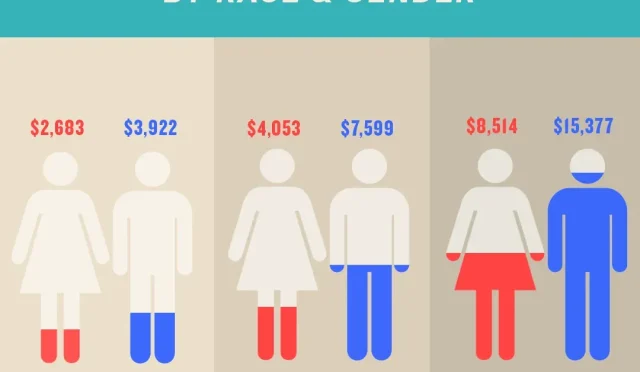

The concentration of household wealth among the upper echelon directly correlates with income inequality. Recent statistics indicate that the wealthiest 20 percent of Canadians hold an excessive share of financial assets and real estate, resulting in a record-high income gap between the highest and lowest income households. This concentration can stifle economic mobility for lower-income groups, reinforcing a cycle of poverty and limiting their access to financial assets and prosperity.

What trends indicate the growing income inequality in Canada?

Trends indicating growing income inequality in Canada include the widening gap between the richest and poorest households, with the income difference now at a record high. While household wealth increased, primarily benefitting high earners, lower-income groups saw only modest gains in disposable income, primarily through government assistance. Additionally, while problematic wage trends and decreased investment earnings have affected lower-income Canadians, higher-income groups continue to thrive, emphasizing the imbalance in income distribution.

| Key Points |

|---|

| Lower-income groups are falling behind in the trade war with the US. |

| Canadians’ household wealth rose by 0.8% to $17.6 trillion in Q1. |

| Financial assets increased by 0.9% for six consecutive quarters. |

| Real estate values increased, albeit at a slower rate. |

| Bottom 20% only saw a 3.2% increase in disposable income. |

| Mainly driven by 30% rise in government assistance and reduced taxes. |

| Average wages fell by 0.7% and investment earnings decreased. |

| Wealthiest 20% hold a disproportionately large share of assets. |

| The income gap between highest and lowest households at a record high. |

Summary

Income inequality has become a pressing issue as it underscores the widening gap between the wealthy and lower-income groups in Canada. Despite an overall increase in household wealth, the benefits are disproportionately skewed towards the affluent, leaving those in the bottom income brackets struggling to keep up. The significant disparities in wage growth, coupled with the concentrated gains in financial assets among the wealthiest, highlight the urgent need for policies aimed at addressing these imbalances.

#IncomeInequality #CanadaWealthGap #LowIncomeImpact #EconomicDisparity #SocialJusticeCanada