Instrumental capital is fundamentally reshaping the economic and geopolitical landscape in the 21st century. This term refers to the strategic use of state-directed funds, particularly through mechanisms like sovereign wealth funds, to achieve both financial gains and political objectives. As nations engage in advanced geoeconomics, they channel investments to bolster their statecraft, influencing global capital flows and international relations. Nowhere is this more evident than in the dynamic financial ecosystems of the Middle East, where wealthy Gulf monarchies are leveraging their vast resources to forge paths toward long-term prosperity. By establishing themselves as pivotal players in global finance, these nations are redefining the strategic interplay between capital and power.

The concept of strategic financial resources is integral to understanding contemporary state behavior and global economics. This body of state-directed wealth, often mobilized through sovereign investment funds, is not only about generating returns but also about exerting influence in the world arena. Engaging in what some refer to as geo-finance, these nations merge their economic pursuits with broader political ambitions, altering the balance of power. In particular, the active role of Middle Eastern governments in directing capital highlights a new model where financial assets serve dual purposes: as vehicles for growth and tools of statecraft. Through this lens, we can see how instrumental capital is fundamentally altering the interactions between national actors on the global stage.

The Rise of Instrumental Capital: A New Era in Global Finance

Instrumental capital has emerged as a dominant force in shaping not only financial strategies but also geopolitical landscapes. This phenomenon is especially notable in the context of sovereign wealth funds, which have evolved from mere investment tools into powerful instruments of statecraft. As nations strive to enhance their economic standing and influence, they are increasingly deploying these funds to achieve both financial returns and strategic objectives. The intersection of capital and state interests has never been so pronounced, leading policymakers to view geo-economics through the lens of national security.

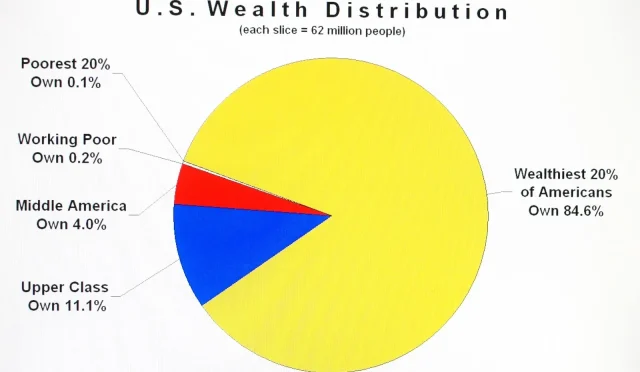

As countries like those in the Middle East harness the power of instrumental capital, they are reshaping global capital flows in unprecedented ways. The investment landscape is shifting, with Middle Eastern sovereign wealth funds taking center stage as they seek opportunities that align with national priorities. With combined assets nearing $6 trillion, these funds are driving significant investments across various sectors, from technology to infrastructure, thereby influencing international relations and alliances. This strategic deployment of capital is not just about profit—it’s about positioning, power, and the future of statecraft.

Frequently Asked Questions

What is instrumental capital and how does it relate to sovereign wealth funds?

Instrumental capital refers to the strategic use of state-directed investments to achieve political and economic goals. Sovereign wealth funds, which are state-owned investment funds that manage national savings for the purpose of generating wealth, are key examples of instrumental capital in action. These funds allocate capital not only for financial returns but also to enhance a country’s geopolitical influence and statecraft.

How are Middle Eastern sovereign wealth funds influencing global capital flows?

Middle Eastern sovereign wealth funds are crucial players in global capital flows, controlling assets exceeding $5.6 trillion. As of 2025, these funds accounted for 40% of state-investor deal values worldwide, totaling $56.3 billion. Their aggressive investment strategies are reshaping economic opportunities across the globe and shifting the dynamics of international finance.

In what ways does instrumental capital impact geoeconomics in the Middle East?

Instrumental capital significantly influences geoeconomics in the Middle East by using financial resources to bolster national interests, promote economic diversification, and secure technological advancements. Gulf monarchies leverage their sovereign wealth funds to shape economic policies that align with their geopolitical strategies, effectively transforming the region into a pivotal player in global finance.

What role does statecraft play in the management of instrumental capital?

Statecraft involves the application of diplomatic and strategic behavior to pursue a nation’s goals, with instrumental capital serving as a tool for achieving these aims. Through sovereign wealth funds, governments can invest in key industries and technologies while also bolstering their influence in global markets, thereby integrating financial strategies with political objectives.

Why are Gulf monarchies considered leaders in the use of instrumental capital?

Gulf monarchies are seen as leaders in instrumental capital due to their significant financial resources, strategic vision, and the ability to direct investments toward ambitious projects. Their approach to leveraging sovereign wealth funds not only supports economic diversification but also enhances their geopolitical standing in an increasingly competitive global environment.

How does the history of instrumental capital, starting from the Dutch East India Company, relate to current global finance trends?

The Dutch East India Company is an early example of instrumental capital, as it combined government backing with private investment to achieve national goals. This historical precedent parallels today’s trends where states utilize sovereign wealth funds as instruments of economic and political strategy, illustrating a continuous evolution in the relationship between capital deployment and state interests.

What is the significance of the Gulf Cooperation Council in terms of instrumental capital and finance?

The Gulf Cooperation Council (GCC) is significant as it embodies a collective leveraging of financial resources and strategic objectives among member states. By using instrumental capital, the GCC countries are not only impacting regional stability but are also playing a vital role in shaping global markets through coordinated economic diversification efforts and technological investments.

How are contemporary sovereign wealth funds evolving in their investment strategies?

Contemporary sovereign wealth funds are evolving from passive investors to active capital allocators, pursuing dynamic investment strategies that align with national priorities. This shift allows them to engage in high-stakes ventures that emphasize technological leadership and economic strength, reflecting the increasing importance of instrumental capital in global finance.

| Key Point | Details |

|---|---|

| Instrumental Capital | The use of state-directed funds to pursue dual goals of financial returns and state power projection. |

| Sovereign Wealth Funds | These have grown significantly, with the Middle East accounting for a large portion of global state-investor deal value. |

| Historical Context | The concept dates back to the 16th and 17th centuries with the Dutch East India Company, supported by the Dutch government. |

| Shifting Strategies | Gulf monarchies are adapting their wealth-driven strategies to promote economic diversification and technological leadership. |

| Gulf Cooperation Council | GCC countries are using their financial resources strategically to enhance global market influence and regional stability. |

Summary

Instrumental capital is fundamentally transforming the geopolitical landscape as sovereign wealth funds increasingly influence international relations. The strategic application of these funds is reshaping global finance and statecraft, marking a significant evolution in how countries interact and compete on the world stage.