Intergenerational Wealth Australia: Challenges Ahead

Intergenerational Wealth Australia is becoming a focal point in economic discussions, as experts warn of the implications of wealth transfers that will occur in the coming decades. With the transfer of assets such as housing and superannuation playing pivotal roles, the topic raises significant concerns about equity and opportunity for younger generations. Economists, including former Reserve Bank deputy governor Guy Debelle, emphasize the growing challenge of managing these vast sums, which are projected to reach trillions of dollars. Additionally, issues related to housing wealth cannot be overlooked, as soaring property prices create barriers for younger Australians trying to enter the market. This dynamic not only seeks to address wealth transfer in Australia but also ignites debates surrounding inheritance ethics and the broader economic challenges Australia faces.

The dynamics of wealth transfer between generations in Australia present a critical area of focus for policymakers and economists alike. As a significant amount of financial resources shifts from older to younger generations, the resulting economic landscape raises several pressing questions about access and fairness. The disparities in housing markets and retirement savings, particularly regarding superannuation, highlight the struggles faced by younger Australians amid rising living costs and economic challenges. Moreover, the ethics surrounding inheritance and asset distribution become increasingly significant, emphasizing the need for thoughtful dialogue about how these assets can be transitioned to support socio-economic mobility. Overall, the discussion encapsulates the essence of preventing intergenerational wealth disparity while addressing the impacts of wealth concentration.

The Dynamics of Intergenerational Wealth Transfer in Australia

Intergenerational wealth transfer in Australia is increasingly becoming a focal point of economic discussions. As highlighted by Guy Debelle, former deputy governor of the Reserve Bank of Australia, there is a pressing need to manage the upcoming transfer of wealth from older generations to their younger counterparts. This shift is not only significant in magnitude—JBWere estimates that it could reach a staggering $5.4 trillion over the next two decades—but also complex, as it intertwines with issues of housing wealth and superannuation. As retirees enjoy substantial wealth, predominantly in real estate, the dynamics of transferring this wealth effectively must be scrutinized to ensure equitable opportunities for younger generations.

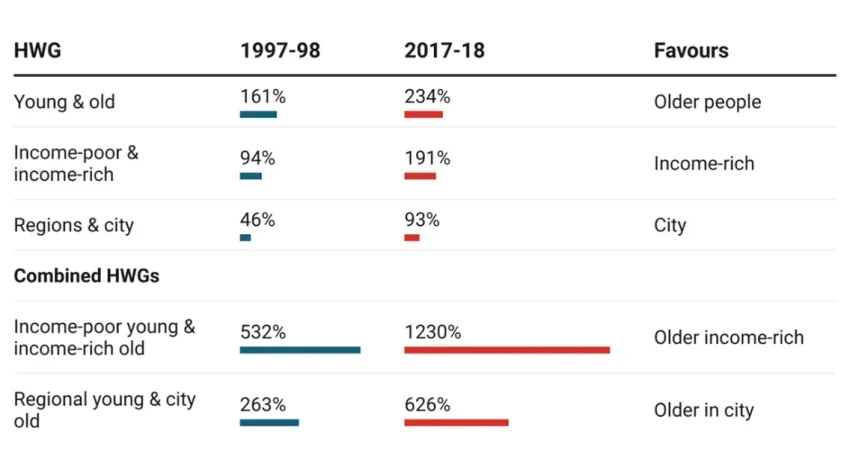

The complexities underlying this transfer are accentuated by the challenges young Australians face—many entering the housing market at inflated prices. The Productivity Commission’s findings illustrate that while older Australians have seen their wealth grow considerably, younger generations find themselves grappling with economic challenges that hinder their ability to accumulate assets. This disparity raises essential questions about the timing and impact of wealth transfers, particularly as many beneficiaries might already be entrenched in their economic trajectories by the time they receive inheritances.

Housing Wealth Issues and Economic Inequalities

One of the primary concerns regarding intergenerational wealth in Australia is the issue of housing wealth. Over the decades, housing prices have risen dramatically compared to average incomes, creating a situation where older Australians often hold significant wealth in real estate, while younger generations struggle to break into the market. The Reserve Bank’s data indicates a growing divide where the accumulation of wealth is rapidly favoring homeowners, exacerbating economic inequalities. This housing wealth issue highlights the need for policy reforms that address these inconsistencies and ensure that homeownership is an attainable goal for younger Australians.

As the Australian economy continues to evolve, the implications of housing wealth on intergenerational transfers become more pronounced. The argument posed by Dr. Debelle suggests that the disconnect between rising property values and worker earnings could lead to broader societal issues, including a potential loss of the social contract. Re-evaluating housing policies and potentially encouraging older Australians to downsize could alleviate some of this pressure by allowing wealth to circulate more fairly while ensuring that younger generations have better access to housing.

Superannuation and Its Role in Wealth Distribution

Superannuation plays a crucial role in the context of intergenerational wealth management in Australia. As older generations enjoy growing superannuation balances, the actual release of these funds into the economy—and their effects on wealth distribution—becomes pertinent. Debelle points out that managing these financial assets is vital to ensuring that the benefits of superannuation actually reach younger Australians, who will eventually inherit these funds through various mechanisms, such as direct bequests or family wealth dispersals.

The connection between superannuation and housing wealth is particularly noteworthy. Many older individuals rely heavily on their super balances to supplement income during retirement, often using these funds to maintain or upgrade their housing wealth rather than drawing upon them for consumption. This creates a paradox where younger individuals might benefit from superannuation equity later, yet currently find themselves squeezed out of the housing market. Policymakers must consider these dynamics to develop strategies that facilitate a smoother transition of wealth through superannuation without compromising the financial stability of the current workforce.

Ethical Considerations on Inheritance in Australia

The ethics of inheritance is another area ripe for discussion amid the shifting landscape of intergenerational wealth in Australia. As highlighted in recent dialogues, there is a growing concern about the fairness and morality surrounding the transfer of wealth from older generations to younger ones. With the average inheritance received around the age of 60, many in the workforce may already be established in their personal lives and careers by the time they receive these assets. This raises pertinent questions about whether the timing and nature of these wealth transfers adhere to principles of equity and social justice.

Additionally, these inheritance ethics extend beyond mere financial implications; they encompass broader societal impacts, including how wealth concentration may perpetuate existing disparities. For instance, younger Australians who come into significant inheritances may experience benefits that aren’t universally accessible, thereby further complicating discussions around economic equality. Addressing these ethical dilemmas calls for open dialogues that could lead to more transparent and equitable policies surrounding wealth distribution.

Navigating Economic Challenges and Wealth Reform

Australia faces a number of economic challenges that complicate the intergenerational wealth transfer process. High property prices, stagnating wages, and inflation are just a few factors that may impede younger generations’ ability to attain financial stability. The notion of wealth transfer becomes increasingly critical in this context, as younger Australians grapple with the implications of their predecessors’ economic decisions. Reforming the existing frameworks, which govern areas like taxation and wealth distribution, might be essential to mitigate these economic pressures.

In contemplating reforms, one must consider not just the financial aspects but also the broader socio-economic landscape. For example, analyzing the tax implications for wealth transfers can alleviate or exacerbate inequalities, thereby impacting social cohesion. Economists and policymakers must collaborate to devise strategies that not only facilitate wealth distribution but also address these underlying economic challenges, ensuring that prosperity is shared more equitably across generations.

The Future of Housing Affordability and Intergenerational Wealth

As discussions about intergenerational wealth advance, the future of housing affordability becomes a focal point. With a significant portion of wealth tied up in property, it is crucial that younger generations have access to affordable housing. Australia’s housing market has seen unprecedented price surges, creating barriers for young earners aiming to enter the market. Ensuring that housing remains affordable while allowing older generations to unlock their housing wealth through downsizing or alternative living arrangements is central to navigating this challenge.

Furthermore, policies aimed at maintaining housing affordability could lead to sustainable economic growth. By fostering environments where young Australians can invest in their futures—both through homeownership and accumulating their own wealth—the cycle of housing wealth can be appreciated as a societal asset rather than merely a point of contention. This equilibrium is vital to establishing a stable economic environment that can support prosperity across generations.

Implications for Future Generations: Economic Equity

The implications of intergenerational wealth transfer extend far beyond immediate financial considerations; they also touch upon the fundamental principles of economic equity. As older Australians prepare to pass down their wealth, it is essential to consider how these transactions influence the financial landscape for future generations. Discussions led by economists like Debelle emphasize the importance of promoting fairness and inclusivity in wealth distribution, ensuring that every generation can build upon the legacies of their predecessors without being burdened by historical inequities.

Moreover, exploring options for equitable tax systems can create frameworks that favor responsible wealth management and contribute to long-term economic stability. Encouraging younger Australians to participate actively in economic systems—from real estate to investment opportunities—can redefine intergenerational wealth as a collective growth venture rather than an exclusive privilege. This shift will not only empower future generations but also contribute to a robust economic framework that benefits all Australians.

Policy Recommendations for Sustainable Wealth Management

In light of the evolving discussions around intergenerational wealth and economic challenges in Australia, policy recommendations are crucial for sustainable management. Addressing the inequities posed by housing wealth and superannuation requires an integrated approach, involving regulatory measures that consider the needs of both older and younger demographics. Effective strategies may include incentivizing older Australians to downsize, thereby releasing housing equity into the market and providing opportunities for younger individuals to purchase homes.

Additionally, reform in taxation that fairly addresses inheritances can foster more equal wealth distribution, thus preventing the concentration of wealth in specific demographics. Establishing advisory boards that are tasked with continuous evaluation of wealth transfer impacts and economic trends can ensure policies remain relevant and responsive. A forward-thinking approach that anticipates challenges while seeking collaborative solutions could ultimately lead to a more balanced economic landscape.

The Role of Financial Education in Wealth Transfer

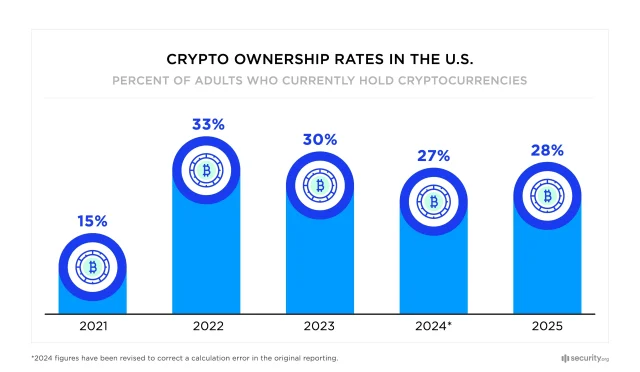

Financial education is crucial in navigating the complex dynamics of intergenerational wealth, particularly as the upcoming transfer of wealth presents both opportunities and challenges. Younger Australians must be equipped with the knowledge and skills necessary to manage inherited assets responsibly. Programs focused on financial literacy can empower individuals to make informed decisions regarding investments, superannuation, and homeownership, ultimately promoting economic resilience in future generations.

Moreover, instilling a sense of responsibility around wealth management and best practices can diminish the likelihood of mismanaging inherited resources. By encouraging conversations about inheritance ethics and the importance of sustainable financial practices, families can cultivate an environment where wealth is viewed not just as a financial asset but as a tool for social mobility and community improvement. Prioritizing financial education will contribute to healthier economic outcomes for both individuals and society as a whole.

Frequently Asked Questions

What are the main challenges of intergenerational wealth transfer in Australia?

Intergenerational wealth transfer in Australia presents significant challenges, particularly regarding the disparity in wealth between older and younger generations. Economists highlight that superannuation and housing are crucial to these challenges. As older Australians possess a substantial portion of total wealth, the timing of asset transmission creates concerns over economic equity and potential housing affordability crises.

How does housing wealth impact intergenerational wealth issues in Australia?

Housing wealth is a pivotal factor in intergenerational wealth issues in Australia. Older generations typically own more property, accumulating wealth from rising real estate prices. This situation leads to increased household wealth among retirees while younger Australians struggle to enter the housing market, amplifying the challenges of wealth distribution and access to affordable housing.

What role does superannuation play in the wealth transfer phenomenon in Australia?

Superannuation plays a crucial role in the intergenerational wealth transfer in Australia. It has significantly contributed to the financial prosperity of older Australians, allowing them to accumulate substantial retirement savings while younger generations may face challenges in building comparable wealth. As retirees benefit from growing superannuation balances, addressing this imbalance becomes vital for future economic stability.

What economic challenges does Australia face regarding inheritance ethics?

Australia faces substantial economic challenges relating to inheritance ethics, particularly as the average age for receiving an inheritance is around 60. This raises questions about the fairness of wealth distribution and the ethical implications of delayed wealth transfers to younger generations who may already be established in their careers and housing. Policymakers are called to evaluate reforms that ensure equitable access to inherited wealth.

How is Australia’s tax system affecting intergenerational wealth transfer?

The current tax system in Australia has sparked debate regarding its impact on intergenerational wealth transfer. Concerns have been raised that the tax framework may undermine the social contract by favoring older generations disproportionately. Discussions around potential reforms suggest that adjusting tax policies could help facilitate a more equitable transfer of wealth from older to younger Australians, particularly amid rising housing prices.

What are the long-term implications of intergenerational wealth transfer in Australia?

The long-term implications of intergenerational wealth transfer in Australia are profound, particularly as $5.4 trillion is estimated to be transferred over the next 20 years. This transfer may affect economic stability and social equity if not managed carefully. Younger generations may face challenges related to housing affordability and wealth distribution, necessitating proactive policy interventions to address these evolving economic landscapes.

Why is there a need for policy reform in intergenerational wealth transfer in Australia?

There is an urgent need for policy reform regarding intergenerational wealth transfer in Australia due to widening wealth disparities and housing affordability issues. As older generations prepare to pass down their assets, optimizing policies related to taxation, inheritance, and housing can ensure that the transfer is equitable, timely, and beneficial for younger Australians, fostering a more inclusive economic environment.

| Key Topic | Details |

|---|---|

| Intergenerational Wealth | Australia faces significant challenges with wealth transfers from older generations to younger ones, as highlighted by economist Guy Debelle. |

| Superannuation and Housing | These are key components of intergenerational wealth issues, as retirees’ wealth has grown disproportionately compared to younger Australians. |

| Productivity Commission Report | The 2021 report indicates that while overall wealth has increased, it remains uneven across demographics. |

| Retirement Wealth Growth | Retirees are experiencing substantial increases in their wealth, raising questions about when inheritances will happen. |

| Future Wealth Transfer | An estimated $5.4 trillion will be transferred from older Australians to younger generations over the next 20 years. |

| Ethical Questions | Concerns are growing about the timing of inheritances and their impact on social equality and the tax system. |

Summary

Intergenerational wealth in Australia is becoming an increasingly pressing issue as wealth transfers from older generations to younger ones loom on the horizon. With an estimated $5.4 trillion set to change hands in the coming decades, the implications of this shift raise critical questions regarding economic inequality and social policies. As property values soar and an uneven distribution of wealth persists, it is essential for policymakers to consider the ethical ramifications of inheritances and adapt tax systems accordingly. Addressing these challenges will be vital to ensuring a fair and sustainable economic landscape as Australia navigates this significant generational transition.

#WealthTransfer #IntergenerationalWealth #AustraliaFinance #FamilyLegacy #FinancialChallenges