Millionaire Growth in America: Trends and Insights 2024

The millionaire growth in America has reached unprecedented heights, with the population of American millionaires now totaling 23.8 million, according to the latest UBS millionaire report. Despite facing tumultuous market conditions and a potential recession, the United States continues to generate new wealth at a remarkable pace, adding 379,000 millionaires in the past year alone. This growth underscores a significant wealth gap, as millionaires in the U.S. benefit from favorable economic conditions, contrasting sharply with the struggles of lower-income households amidst rising wealth inequality. As we look toward the landscape of 2024, it’s evident that American millionaires hold a disproportionate share of the nation’s wealth, making it crucial to understand the factors driving this surge in affluent individuals. In light of these developments, the discussion surrounding the implications of this millionaire growth is more vital than ever.

In exploring the surge of affluent individuals in the United States, we uncover a fascinating narrative surrounding wealth accumulation among the top earners in society. With a record-setting 23.8 million affluent households, America leads the globe in the concentration of rich individuals. The recent UBS report highlights the emergence of a new tier of individuals whose net worth exceeds one million dollars, revealing insights into the ongoing trends of wealth disparity in contemporary society. As the economy faces uncertainties, including impending recession fears, the financial landscape remains a pivotal point of discussion, particularly regarding the balance of riches perceived between the wealthy and less economically stable citizens. Thus, understanding the dynamics behind the increase in American millionaires sheds light on broader economic factors affecting growth and wealth distribution in the United States.

The Rise of Millionaires in America

According to the recent UBS millionaire report, the United States has a staggering 23.8 million millionaires as of 2024, representing a significant increase fueled by various economic factors. This rise in millionaire growth in America reflects not only the recovery of the economy post-recession but also the enduring strength of the American market. The report highlights that approximately 379,000 new millionaires were created in just one year, showcasing a remarkable daily average increase of over a thousand millionaires. This scenario makes America home to the highest number of millionaires globally, illustrating the robust opportunities present within the country.

However, despite this impressive statistic, the wealthy elite in America are not immune to the challenges of wealth inequality. Economist James Mazeau notes the persistent wealth gap that has emerged amidst this growth. While the millionaire population swells, it accentuates the disparities in wealth distribution, as historically, wealth accumulation has become more concentrated at the top. Understanding this nuance is critical for addressing broader economic challenges, including enhanced support for middle and lower-income individuals, whose share of total wealth remains disproportionately low.

Factors Contributing to America’s Millionaire Growth

The growth of millionaires in the U.S. can largely be attributed to key market elements such as a stable dollar and a flourishing stock market. The strong performance of Wall Street has driven asset values upward, providing numerous individuals the opportunity to ascend into millionaire status. Real estate continues to thrive as a formidable contributor to wealth increase, with property values soaring in many U.S. markets, enabling more homeowners to become millionaires. The resilience of American equities throughout late 2024 has further bolstered this upward trajectory, showcasing a healthy investment environment.

Nevertheless, challenges loom on the horizon, particularly in 2025, with the onset of a trade war and fears of recession that could disrupt this millionaire growth trajectory. UBS reports that while the first half of the year has shown volatility, it still remains uncertain whether this will significantly hinder the overall wealth increase for American households. Key to navigating these fluctuations will be innovative policy measures that ensure opportunity remains for wealth accumulation across various societal segments, thereby addressing the pervasive wealth inequality that diminishes the economic potential for many.

Understanding Wealth Inequality Among Millionaires

Despite the increase in the millionaire population, wealth inequality remains a critical issue in the American landscape. As highlighted in the UBS millionaire report, approximately 40% of the world’s millionaires reside in the U.S., yet a significant portion of the nation’s wealth is concentrated among a small elite. This concentration of wealth is evident even within the millionaire ranks, where high-net-worth individuals significantly outpace their counterparts in wealth accumulation. Mazeau points out, for example, that the performance of the tech sector has notably propelled certain millionaire individuals to unprecedented wealth, further contributing to the chasm between those at the top and those experiencing slower financial growth.

Additionally, it’s essential to recognize that the wealth growth among everyday millionaires—individuals with net worths between $1 million and $5 million—has been remarkable, quadrupling since 2000. They collectively hold a wealth greater than that of all the billionaires combined. This underscores an essential aspect of the American economy; much of the wealth is not merely for the ultra-rich but is also shared among millions who are experiencing notable financial growth. This revelation challenges the narrative of wealth inequality and calls for more attention to the success stories of these ‘everyday millionaires’ as they play a crucial role in the broader economic landscape.

The Global Context of U.S. Millionaires

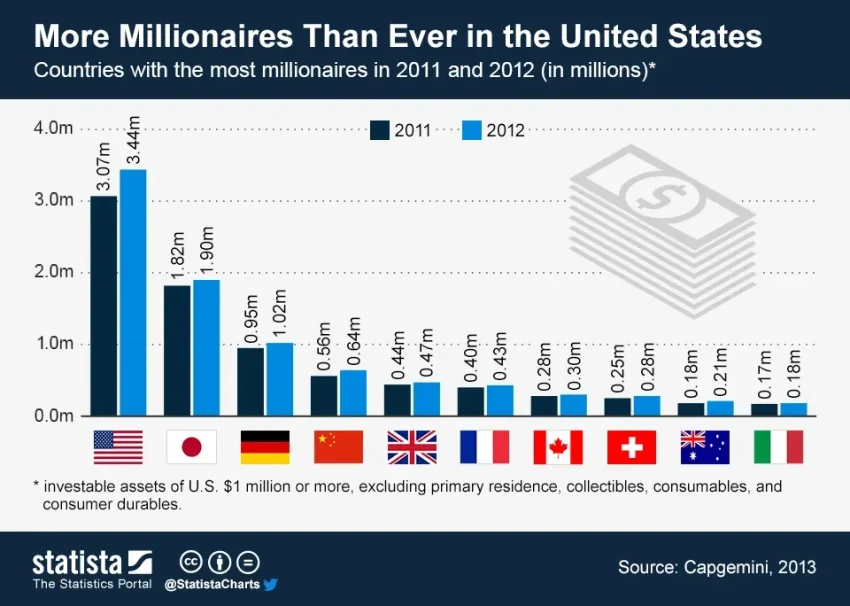

When evaluating the rise in millionaires in America, it’s vital to place it within a global context. While the U.S. holds a commanding lead with 23.8 million millionaires, countries like China and Turkey are also witnessing significant increases in their millionaire populations. The noted increase of 379,000 new millionaires in America brings to light the competitive nature of wealth accumulation on a global scale. For instance, China followed closely with a rise of 141,000, reflecting how emerging markets are shaping the landscape of global wealth distribution.

Yet, it’s critical to acknowledge the discrepancies in wealth growth across different nations. For instance, Japan faced a net loss of 33,000 millionaires, underscoring the uneven nature of wealth creation globally. As globalization progresses, the mechanisms of wealth generation become increasingly complex, with local economies, currency stability, and policy frameworks playing pivotal roles. Understanding the dynamics of global wealth trends is essential as it informs both individual financial strategies and broader economic policies aimed at promoting wealth equity.

Market Volatility and Its Impact on Millionaires

The fluctuations and uncertainties in market conditions significantly influence the wealth of millionaires and potential millionaires alike. With the looming trade war and recession fears projected for 2025, many are concerned about the impact on U.S. millionaires’ growth. Amidst a declining dollar and turbulent markets, the millionaire segment must navigate a challenging economic landscape. This environment highlights the importance of strategic financial planning and market adaptability for maintaining and growing wealth.

UBS economist James Mazeau suggests that even with a forecasted slowdown in millionaire growth this year, the fundamental engines of the U.S. economy remain intact. While billionaires may face substantial fluctuations, millionaires still have avenues to explore in areas such as real estate and stock investments. This resilience implies that, despite adversity, wealth creation could persist, potentially reshaping the perceptions of millionaire growth during periods of economic strain.

The Role of Technology in Wealth Operations

Technology serves a dual purpose in the wealth landscape, acting both as a facilitator for millionaire growth and as a contributor to wealth disparities. The tech sector’s performance has significantly influenced millionaire wealth accumulation, creating it for individuals who capitalize on new technological advances. This phenomenon underscores the extraordinary wealth enabled by innovations and entrepreneurial ventures, as many of today’s millionaires have emerged from the tech boom.

However, the economy’s transition into a predominantly technology-driven sphere raises concerns regarding accessibility and inequality. As wealth continues to concentrate within tech-driven industries, those not participating in this landscape may find themselves left behind. Recognizing this trend is crucial to formulating inclusive economic strategies that ensure opportunities for wealth generation extend beyond tech hubs and incorporate broader populations—sustaining a diverse millionaire community.

Real Estate: A Pillar of American Millionaire Wealth

Real estate has long been a cornerstone in the wealth portfolios of many American millionaires. The resurgence in property values has contributed significantly to the increase in millionaire status among average citizens, enabling homeowners to benefit from rising real estate markets. As UBS reports, even in the face of market volatility, American real estate remains resilient, serving as a stable asset for many households aiming to secure their financial futures.

Moreover, the real estate market offers potential new pathways for wealth generation, particularly in urban areas seeing revitalization. As more individuals make strategic investments in property, they are not only enhancing their own wealth but also contributing to the overall betterment of their communities. The role of real estate in millionaire growth cannot be understated, as it continues to provide opportunities for wealth accumulation and a buffer against potential economic downturns.

Unpacking the Wealth Gap: Millionaires vs. Everyday Citizens

The disparity between millionaires and the average citizen reinforces ongoing discussions about the wealth gap in America. While the number of millionaires rises, the benefits of this growth do not trickle down uniformly. The concentration of wealth indicates that while certain segments thrive, many everyday citizens struggle to achieve financial stability. Understanding the nuances of this wealth gap—largely characterized by income inequality—is crucial for developing policies that address these disparities.

This wealth inequality raises important questions as to how resources can be allocated more fairly. Economists suggest that the persistent growth of everyday millionaires, who collectively surpass the wealth of all billionaires, illustrates the potential for broader economic benefits if nurtured correctly. A balanced approach to wealth creation is necessary not only for fostering a healthy economy but also for creating a society in which opportunities for financial success are equitable.

Future Projections for Millionaire Growth in the U.S.

Looking ahead, the trajectory of millionaire growth in America will likely be shaped by multiple factors, including economic policies, market conditions, and potential external economic pressures. As suggested by the UBS report, the potential for slower growth in the upcoming years does not necessarily translate to a complete halt in wealth creation. Policymaking aimed at fostering entrepreneurship, investing in education, and supporting small businesses could further bolster the growth of millionaires in the U.S.

Additionally, an essential aspect of future millionaire growth will involve addressing the underlying factors contributing to wealth inequality. As discussions around wealth distribution intensify, proactive measures could enhance financial opportunities for lower-income brackets. Thus, the focus should be not only on increasing the number of millionaires but also on ensuring a more equitable system that promotes shared prosperity across all segments of society.

Frequently Asked Questions

How much has millionaire growth in America increased recently?

In 2024, America saw an increase of 379,000 new millionaires, bringing the total to 23.8 million. This marks a significant milestone, making the U.S. the country with the highest number of millionaires globally.

What factors contribute to the millionaire growth in America?

The recent millionaire growth in America can be attributed to a strong performance in the stock market and a stable U.S. dollar. These economic conditions have propelled wealth creation, despite challenges expected in 2025 due to a trade war and recession fears.

What does the UBS millionaire report indicate about American millionaires in 2024?

According to the UBS millionaire report, there are 23.8 million millionaires in the U.S. in 2024, reflecting a 1.5% increase from the previous year. This solid growth showcases America’s dominance in global wealth.

How does the wealth gap impact millionaire growth in America?

While millionaire growth in America is impressive, the wealth gap remains a significant issue. UBS economist James Mazeau highlighted that even among the wealthy, there is a concentration of wealth, indicating persistent wealth inequality in the U.S.

What trends are observed among American millionaires and wealth inequality?

The trends reveal that despite strong millionaire growth in America, there exists pronounced wealth inequality. The wealthiest individuals hold a disproportionate share of total wealth, often outpacing the growth experienced by the broader middle class.

How has the number of everyday millionaires changed over time in America?

The number of ‘everyday millionaires’ in America, defined as those with a net worth between $1 million and $5 million, has quadrupled since 2000, with approximately 52 million individuals fitting this category by 2024.

What challenges are predicted for millionaire growth in America in 2025?

Predictions for 2025 suggest that millionaire growth in America might slow down due to economic turbulence from the trade war and fears of a recession, which may impact both the stock market and the strength of the U.S. dollar.

Which countries follow America in terms of millionaire growth?

After America, mainland China ranks second with 6.3 million millionaires, experiencing a notable increase. However, Turkey reported the highest percentage growth in millionaires globally, showcasing the uneven nature of wealth accumulation worldwide.

Is real estate contributing to millionaire growth in America?

Yes, real estate has been cited as a resilient sector in contributing to millionaire growth in America. Despite potential economic challenges, real estate values continue to rise, aiding wealth generation among millionaires.

What insights does the UBS report offer regarding global millionaire populations?

The UBS report indicates that global millionaire populations increased by over 684,000, reaching approximately 60 million. This growth is uneven, with notable increases in some countries while others, like Japan, have experienced losses.

| Key Point | Details |

|---|---|

| Growth in Millionaire Population | America saw an increase of 379,000 millionaires, bringing the total to 23.8 million, the highest in the world. |

| Reasons for Wealth Increase | The increase was largely due to strong stock market performance and a stable dollar. |

| Future Market Predictions | Concerns over a trade war and recession fears could impact household wealth growth in 2025. |

| Global Millionaire Comparison | The U.S. has 23.8 million millionaires while China follows with 6.3 million. |

| Wealth Concentration | Wealth inequality is significant even among billionaires, with a few centibillionaires holding substantial wealth. |

| Middle-Class Wealth Growth | The number of “everyday millionaires” (net worth between $1 million and $5 million) has quadrupled since 2000, surpassing billionaire wealth collectively. |

Summary

Millionaire growth in America has reached unprecedented levels, with 23.8 million millionaires now residing in the country. This remarkable growth stems from robust market conditions despite the potential challenges posed by a volatile economic landscape in 2025. The landscape of wealth in America highlights a significant increase in the middle-class millionaire segment, showcasing the overall prosperity and resilience of the U.S. economy. While potential disturbances loom, the trend of millionaire growth signifies a positive outlook, emphasizing continued opportunities for wealth accumulation across different economic strata.