Mobile Millennial Millionaires Redefine Wealth Management

Mobile millennial millionaires are reshaping the landscape of wealth management, challenging traditional financial institutions with their demand for digital engagement and personalized investment solutions. This tech-savvy demographic is quickly becoming a powerful force, seeking financial technology that caters to their unique lifestyles and aspirations. As a result, millennial wealth management is experiencing a significant transformation, with firms adapting to these evolving preferences. Reports indicate that millennials with wealth exceeding $1 million are gravitating towards digital platforms that offer real-time insights and customized advice. Consequently, to stay competitive, wealth management trends are shifting, emphasizing the need for innovative digital wealth management strategies that resonate with this affluent generation.

The rise of affluent individuals among the younger generation, often referred to as digital-native millionaires or affluent millennials, signals a pivotal moment in financial services. This emerging group is characterized by a strong inclination towards online financial solutions that offer immediacy and customization. As these financially empowered individuals prioritize their unique investment philosophies, the conversation around wealth management is evolving. Firms are now compelled to rethink their traditional approaches, embracing technology-driven services that cater specifically to the nuances of this new class of investors. The convergence of digital innovation and wealth stewardship is not just a trend; it is rapidly becoming a necessity in the financial technology landscape tailored for millennials.

Understanding the Rise of Mobile Millennial Millionaires

Mobile millennial millionaires are redefining the wealth management landscape with their unique preferences and technological savviness. This generation, characterized by its comfort with digital platforms, is increasingly challenging traditional wealth managers who have relied on face-to-face interactions and conventional methods. As digital natives, these millennial millionaires prioritize convenience and accessibility, which has led to a significant shift towards online financial management tools and platforms.

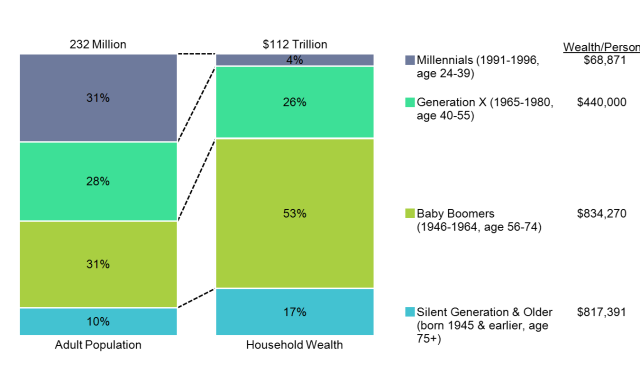

Research indicates that the rising wealth of millennials over the $1 million mark is driving the demand for innovative wealth management solutions tailored to their specific needs. They seek customization and real-time insights into their financial portfolios, which has resulted in traditional firms either adapting their strategies or risking obsolescence. This shift necessitates a fundamental reevaluation of how wealth management services are delivered.

The Impact of Financial Technology on Millennial Wealth Management

Financial technology (fintech) is a game-changer for millennial millionaires, revolutionizing how they approach wealth management. The integration of digital tools into everyday financial transactions provides this demographic with unprecedented control over their investments. Fintech companies are utilizing advanced algorithms and user-friendly interfaces to make wealth management more accessible, allowing users to manage their portfolios at the touch of a button.

Moreover, the popularity of robo-advisors and investment apps among millennials highlights a growing trend towards automated investment management. These platforms use technology to offer personalized investment advice and portfolio management at reduced costs compared to traditional wealth management firms. As millennials increasingly stock their portfolios through these innovative channels, wealth managers must reexamine their value propositions to remain competitive.

Wealth Management Trends Shaping the Future for Millennials

As we look to the future, several key trends are emerging within the wealth management industry, all influenced by the demands of millennial clients. One significant trend is the increase in socially responsible investing, aligning financial goals with personal values. Millennial millionaires are particularly drawn to investments that reflect their belief systems, such as sustainability and ethical business practices.

Additionally, wealth management firms are beginning to emphasize educational content and financial literacy. This adjustment comes from the understanding that millennial clients value knowledge as much as traditional advising. By providing innovative resources that aid in financial decision-making, firms can foster trust and loyalty within this burgeoning demographic, ultimately leading to long-lasting relationships.

The Shift Towards Digital Wealth Management

The digital transformation of wealth management is not just a trend; it’s a necessity for attracting and retaining millennial clients. The latest advances in mobile technology and online platforms are reshaping service delivery, ensuring that clients have access to financial tools anytime, anywhere. This tech-oriented approach resonates deeply with mobile millennial millionaires who expect flexibility and real-time engagement.

Wealth management firms that prioritize a digital-first approach can leverage these technologies to enhance client relationships and streamline operations. By facilitating a seamless experience through various channels—including mobile apps, webinars, and virtual consultations—firms can cater to the preferences of millennials who favor interaction with brands that innovate and adapt quickly.

Adapting to Meet Millennial Expectations in Wealth Management

In response to the rise of mobile millennial millionaires, wealth managers are actively evolving their service offerings to better meet the expectations of this demographic. This includes investing in user-friendly technology that provides immediate access to financial data and performance metrics. Firms that can create personalized experiences—integrating artificial intelligence and machine learning—stand to gain a competitive edge.

Furthermore, transparency in fee structures and investment strategies has become paramount as millennials seek trust and clarity in their financial dealings. By adopting a more open approach to client engagement, wealth managers can foster long-term relationships with millennial clients who demand accountability and integrity in their financial partnerships.

The Role of Personalized Wealth Management Solutions

Personalization has emerged as a critical factor in successfully attracting millennial millionaires. Wealth management firms must go beyond generic services to offer tailored solutions that resonate with individual financial goals. This includes customized investment strategies that align with personal interests, such as green energy, technology innovation, or arts funding which significantly appeal to millennial values.

Moreover, leveraging data analytics to understand client preferences can enhance service delivery. By analyzing patterns and behaviors, wealth managers can anticipate client needs and deliver timely advice, making the relationship more proactive rather than reactive. This level of dedication to personalized services is essential for meeting the heightened expectations of today’s younger investor.

The Crucial Role of User Experience in Wealth Management

In today’s fast-paced digital environment, user experience (UX) plays a vital role in the success of wealth management platforms aimed at millennials. A well-designed interface that prioritizes ease of use can significantly influence a client’s satisfaction and loyalty. Mobile millennial millionaires value platforms that offer clean, intuitive layouts, avoiding complicated navigation or excessive jargon that can lead to frustration.

Furthermore, incorporating feedback loops to capture client input on their user experience can foster an ongoing relationship, encouraging users to feel invested in the platform’s development. This engagement not only improves UX but also builds a community around the financial service, allowing firms to adapt quickly to the ever-changing needs of their millennial clientele.

The Challenges Facing Traditional Wealth Management Firms

Traditional wealth management firms are facing significant challenges as they compete with technologically advanced fintech companies. The preference of mobile millennial millionaires for digital services has left many conventional firms struggling to keep pace. Due to their rigid structures and reliance on outdated practices, these firms often lack the agility needed to attract and retain a younger audience.

Additionally, maintaining a significant share of a market that is shifting toward online and digital solutions requires substantial investment. Traditional wealth managers must not only upgrade their technology but also shift their organizational culture to embrace innovation and customer-centricity. Failing to effectively address these challenges could result in a diminishing role in a rapidly evolving marketplace.

Preparing Wealth Managers for the Future

As the wealth management industry continues to evolve, it is critical for wealth managers to prepare themselves for the future. This preparation includes adopting a growth mindset and embracing continuous learning to stay informed about emerging trends and technologies. With the influx of millennial millionaires, being well-versed in financial technology and digital strategies will be crucial for success.

Collaborating with fintech startups could also provide traditional wealth managers with the technological edge needed to compete effectively. By harnessing innovative solutions and combining them with their established knowledge and experience, wealth managers can offer enhanced solutions that meet the diverse needs of their millennial clients. This proactive approach will ensure they remain relevant and prosperous in a shifting financial landscape.

Frequently Asked Questions

What are mobile millennial millionaires and why do they matter in wealth management?

Mobile millennial millionaires are individuals under the millennial generation who have a net worth exceeding $1 million and prefer to manage their wealth digitally. This demographic is vital for wealth management as they prioritize innovative digital solutions and personalized financial strategies, challenging traditional firms to adapt their approaches.

How does digital wealth management cater to mobile millennial millionaires?

Digital wealth management caters to mobile millennial millionaires by offering user-friendly platforms for investment tracking, real-time financial insights, and personalized advice. These tools align with their tech-savvy lifestyle and demand for efficient financial management, helping wealth managers engage this demographic effectively.

What trends in wealth management are impacting mobile millennial millionaires?

Current wealth management trends impacting mobile millennial millionaires include the rise of technology-driven platforms, the demand for customized financial solutions, and a focus on ethical investments. Wealth managers need to stay updated on these trends to attract and retain this lucrative client base.

Why is financial technology for millennials crucial in today’s wealth management landscape?

Financial technology for millennials is crucial because it provides tailored solutions that meet the unique preferences of tech-oriented investors. By leveraging apps, robo-advisors, and online investment tools, wealth managers can enhance their service offerings and keep pace with the expectations of mobile millennial millionaires.

What challenges do traditional wealth managers face with mobile millennial millionaires?

Traditional wealth managers face challenges in attracting mobile millennial millionaires due to their reliance on conventional methods such as face-to-face meetings. The demand for digital engagement and innovative solutions means that firms not adapting to these preferences risk losing this significant market segment.

How can wealth management firms adapt to attract mobile millennial millionaires?

Wealth management firms can attract mobile millennial millionaires by investing in technology, offering flexible digital solutions, and emphasizing tailored, personalized services that resonate with their lifestyle and values. Adopting a mobile-first approach can significantly enhance client engagement.

What is the future of wealth management for mobile millennial millionaires?

The future of wealth management for mobile millennial millionaires is likely to be dominated by digital engagement, with firms that prioritize technology and innovation leading the way. The industry will evolve to meet the needs of this powerful demographic, focusing on seamless user experiences and customized investment strategies.

How significant is the impact of mobile millennial millionaires on wealth management trends?

Mobile millennial millionaires are having a profound impact on wealth management trends by driving firms to adopt digital solutions and prioritize client-centric services. Their preferences are reshaping how wealth is managed, pushing the industry towards greater technological integration and personalized financial experiences.

| Key Points | Details |

|---|---|

| Emergence of Mobile Millennial Millionaires | Millennials with over $1 million are rising as a significant economic force, preferring digital and online financial tools. |

| Preference for Digital Engagement | They favor platforms that offer seamless interactions and real-time insights over traditional wealth management methods. |

| Threat to Traditional Wealth Managers | Wealth managers relying on in-person meetings may struggle to retain these clients due to their digital-first preferences. |

| Investment in Technology by Wealth Firms | To meet these demands, firms are significantly investing in technology to offer flexible and user-friendly services. |

| Potential Industry Changes | The financial landscape will evolve, favoring firms that adapt to technology while risking obsolescence for those that do not. |

Summary

Mobile millennial millionaires are reshaping the wealth management industry, pushing traditional firms to adapt to a digital-first approach. As they prioritize seamless and real-time financial tools, wealth managers must innovate and invest in technology to remain relevant. The future of financial services hinges on understanding and catering to the unique preferences of this affluent demographic.

#MillennialWealth #MobileMillionaires #WealthManagement #NextGenFinance #DigitalInvesting