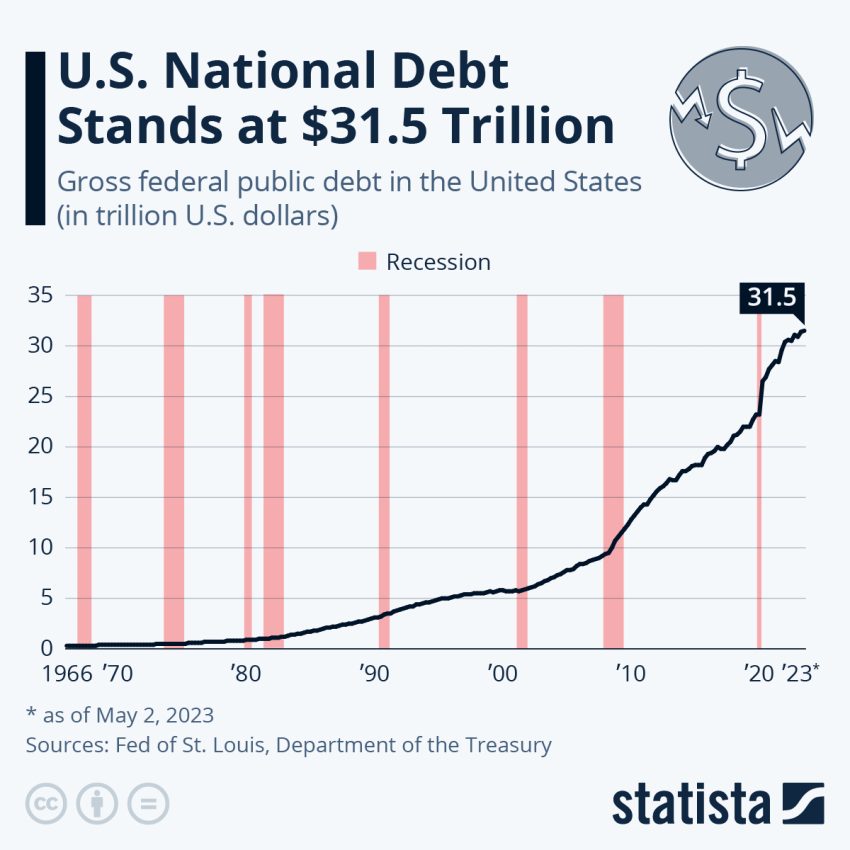

The concept of national debt is pivotal in understanding a country’s economic landscape, especially as governments grapple with unprecedented levels of borrowing and fiscal challenges. With public debt surpassing $100 trillion globally, leading economists like Paul Donovan of UBS warn that governments may increasingly target private wealth to address their financial woes. Historical precedents show that government borrowing strategies often include appealing to citizens through tax-free bonds and other incentives that channel personal savings into state financing. As the specter of wealth taxation looms—particularly in light of the projected $80 trillion Great Wealth Transfer—policymakers must navigate complex economic realities to fund their obligations. In this precarious environment, the balance between encouraging individual investment and imposing burdensome taxation on wealth will define the future of government financing and economic resilience.

When we talk about public financing, it’s essential to consider the public liabilities that nations accumulate over time. With interest rates rising and funding becoming more difficult, many governments are exploring different avenues to mobilize available resources, including encouraging citizens to invest in government securities. This practice not only secures much-needed capital for state expenditures but also attempts to alleviate the pressures of mounting debt through mechanisms like tax-incentivized savings vehicles. As we approach a significant generational shift in wealth—what some are dubbing the Great Wealth Transfer—the discourse surrounding effective wealth management and taxation strategies becomes even more critical. In essence, the relationship between government borrowing and personal wealth is likely to evolve, sparking debates about the best paths to economic sustainability.

Understanding National Debt in Today’s Economy

National debt is a critical issue that shapes the economic landscape. As Paul Donovan from UBS highlights, governments are increasingly turning to private wealth as a possible funding source. The staggering levels of national debt, now exceeding $100 trillion globally, place immense pressure on governments to explore all available avenues for financing. This situation raises the stakes, prompting questions about how policymakers will balance fiscal responsibility and their approach to mobilizing private wealth in support of public finances.

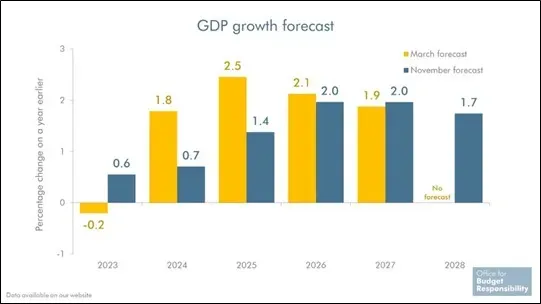

The relationship between national debt and GDP is crucial for assessing economic health. High debt-to-GDP ratios can lead to higher borrowing costs, as lenders may perceive increased risk associated with extended credit. Economic growth remains essential; without it, governments can struggle to repay debts or even cover interest payments. This underscores the importance of innovative financial strategies, as suggested by Donovan, such as tax incentives for purchasing government bonds to create a more stable funding environment.

Government Borrowing and Its Impact on Private Wealth

Governments with significant debt burdens often look for ways to mitigate their financial obligations without burdening their constituents excessively. Strategies may include encouraging private individuals to invest in government bonds through attractive options like tax-free bonds. This approach not only helps to reduce borrowing costs but can also foster a sense of shared responsibility among citizens. By directly linking savings to funding essential public services, governments can cultivate more favorable economic conditions while managing their debt levels.

However, the reliance on private wealth for government borrowing can lead to a host of challenges. Not all citizens may have the financial means to invest in these bonds, potentially widening the gap between wealthier and less affluent populations. Moreover, increased government borrowing may reduce the funds available for private sector investments, which are crucial for overall economic growth. Thus, as Donovan points out, it’s imperative for governments to navigate this complex landscape carefully to avoid unintended consequences.

Tax-Free Bonds: An Attractive Option for Investors

Tax-free bonds present an attractive investment opportunity for individuals looking to maximize their returns while supporting government initiatives. These bonds offer the dual benefit of being exempt from federal taxes and ensuring a steady income stream. By incentivizing individuals to purchase these types of securities, governments can effectively mobilize private capital to support public spending, particularly in times of heightened fiscal pressure. As Paul Donovan points out, similar historical strategies have proven effective in financing public projects.

Investors, especially those in higher tax brackets, stand to benefit significantly from tax-free bonds. They can achieve higher net returns compared to taxable alternatives, allowing more disposable income to circulate within the economy. This favorable landscape can ultimately support government efforts to manage national debt, providing a stable financial base while giving investors a sense of contributing to essential public ventures. However, the sustainability of this strategy relies on maintaining a favorable bond market environment.

Wealth Taxation: A Controversial Solution to National Debt

Wealth taxation is a topic that sparks significant debate among policymakers and economists alike. With rising national debts, some authorities, as indicated by Donovan, may consider implementing more contentious strategies such as capital gains taxes or inheritance taxes to rectify financial imbalances. Proponents argue that taxing the wealthy is a fair means of redistributing resources to tackle national debts effectively. Conversely, opponents warn that such measures could discourage investment and hinder economic growth, making it a precarious balancing act.

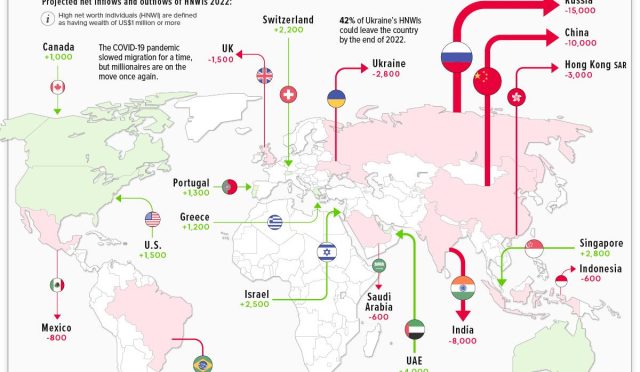

Moreover, as the Great Wealth Transfer looms on the horizon, with billions in wealth anticipated to pass from older generations to the younger ones, wealthy households might face increasing scrutiny about their responsibilities towards national finances. Policymakers may see this as an opportunity to capture a portion of these assets through taxation, thereby addressing pressing debt issues while promoting economic equity. Nonetheless, the challenge remains in designing a wealth taxation framework that is both equitable and effective without stifling economic progress.

The Great Wealth Transfer and Its Implications

The Great Wealth Transfer presents a pivotal moment in economic history, with estimates suggesting that $80 trillion will transition to younger generations over the next two decades. This massive wealth redistribution has prompted significant discussions around its implications for national debt and government finance. Donavan implies that the government will seek ways to tap into this windfall to help alleviate growing national debts, thus raising concerns about how such actions might affect private sector investment opportunities.

As wealth moves up the generational ladder, governments may feel compelled to act swiftly. Should politicians decide to impose taxes on this newfound wealth, the repercussions could resonate throughout the economy, affecting consumption patterns and savings. It highlights the urgent need for coherent policies that not only facilitate this transfer responsibly but also harness it constructively to address mounting public debt. Overall, understanding the dynamics of the Great Wealth Transfer is essential as its consequences will shape future economic policies.

Pension Funds and Their Role in Government Financing

Pension funds represent a significant pool of private wealth, and historically, governments have sought to guide these investments toward financing public debt. As Donovan notes, regulatory measures can encourage pension funds to support domestic government bonds, providing a stable financing source while potentially ensuring a secure retiree income stream. This interconnectedness highlights the vital role pension funds play in national fiscal health.

However, the dependence on pension funds for public financing raises questions about investment strategies. While governments benefit from the stability provided by pension allocations to government bonds, individuals risk sacrificing potential gains by concentrating their investments in lower-yielding securities. Striking the right balance is crucial, and it may require transparent communication and trust between governments and pension fund managers to align public interests effectively.

Market Behavior Influenced by Government Policies

Government actions can significantly influence market behavior, impacting how individuals and institutions allocate their resources. As Paul Donovan suggests, creating incentives for purchasing government bonds can directly affect how savings circulate within the economy. When markets perceive that the government is stable and capable of repaying its debts, confidence flourishes, leading to more robust investment.

Conversely, if markets sense mismanagement or high-risk debt situations, they may react negatively, demanding higher interest rates or withdrawing investments altogether. This situation can place additional strain on governments less able to borrow or refinance their obligations. Thus, understanding government policies’ ripple effects on market behavior is crucial for both public confidence and the overall stability of the economy.

Challenges Facing Policymakers in Addressing National Debt

Policymakers face significant challenges in navigating the complexities of national debt. As Paul Donovan warns, the inherent risk of over-relying on private wealth can lead to unfavorable economic conditions, should government strategies not resonate with the public. Political pressures, changing economic conditions, and market perceptions all play a role in how effectively national debt can be managed.

Moreover, the need for transparency and public support cannot be overstated. Citizens must perceive that their contributions—whether through taxes, bond purchases, or other means—are valued and utilized effectively. Striking a balance between necessary revenue generation and maintaining investor confidence poses ongoing challenges. Therefore, successful debt management will require thoughtful policymaking, public engagement, and sustainable economic strategies.

Conclusion: The Road Ahead for National Debt Strategies

The road ahead for managing national debt involves a multifaceted approach that integrates innovative financial strategies, engages with private wealth, and considers the implications of the Great Wealth Transfer. Strategies such as incentivizing tax-free bond purchases or implementing wealth taxes will require careful crafting to ensure they foster growth and sustainability.

Ultimately, the successful management of national debt rests on the collaboration between governments, financial markets, and the public. Effective communication, transparency in policymaking, and a strong shared vision for economic stability will be essential as countries navigate the complex landscape of fiscal challenges ahead.

Frequently Asked Questions

What is the national debt and how does it relate to government borrowing?

The national debt refers to the total amount of money that a government owes to creditors through various forms of borrowing, such as bonds and loans. Government borrowing occurs when a government overspends and needs to finance its deficit, often leading to increased national debt. Policymakers, like those mentioned by UBS’s Paul Donovan, may leverage this borrowing to finance expenditures by tapping into private wealth.

What role do tax-free bonds play in managing national debt?

Tax-free bonds are municipal bonds that are issued by state and local governments to finance public projects while providing returns to investors without tax obligations. This incentivizes individuals to invest their savings into government bonds, effectively channeling private wealth into public finances, which can help manage and reduce national debt, as highlighted by Paul Donovan during discussions on economic strategies.

How might wealth taxation impact government strategies for national debt reduction?

Wealth taxation involves taxing individuals based on the value of their assets, such as capital gains and inheritance. Paul Donovan suggests that during times of high national debt, governments may resort to wealth taxation as a means to raise revenue. This strategy can be contentious, as it could influence how wealth is redistributed and ultimately affect investment opportunities.

What is the ‘Great Wealth Transfer’ and its significance regarding national debt?

The ‘Great Wealth Transfer’ refers to the anticipated transfer of an estimated $80 trillion in wealth from older generations to younger ones over the next 20 years. This transfer is significant for national debt discussions, as policymakers, including those like Paul Donovan, expect that governments will attempt to mobilize this considerable wealth to finance their debts, influencing fiscal policies and economic stability.

How can regulatory measures guide private wealth towards government debt?

Regulatory measures can influence how private investors allocate their funds, particularly pension funds. By encouraging these funds to invest in domestic government debt, as seen in historical contexts like the UK post-1945, governments can effectively manage national debt levels without incurring higher interest rates from the market.

What strategies are governments likely to adopt to address high national debt levels?

To address high national debt levels, governments are likely to adopt strategies such as incentivizing investment in tax-free bonds, implementing wealth taxation, and mobilizing private wealth through targeted regulations. Paul Donovan emphasizes that favorable methods often include encouraging private investment in government bonds, while more contentious methods might involve direct taxation.

| Key Point | Explanation |

|---|---|

| Governments Eyeing Private Wealth | With significant debt burdens, governments are looking at private wealth to support their financing needs. |

| Methods of Leveraging Wealth | Governments historically mobilize private wealth through market influences, incentives for buying bonds, and regulatory measures. |

| Debt-to-GDP Ratio Importance | Economists are more concerned about the debt-to-GDP ratio as it showcases the economy’s ability to generate revenue needed for debt repayment. |

| Taxation as Revenue Method | There are contentious methods like capital gains or inheritance taxes, but the focus is often on financial repression and directing funds into bonds. |

| The Great Wealth Transfer | With trillions expected to be inherited, governments may seek to mobilize this wealth to alleviate public debt burdens. |

| Government Strategies | Various government strategies, including tax-free bonds and leveraging wealth taxes, aim to manage growing debt without elevating interest rates. |

| Public and Political Concern | The rise in global public debt exceeding $100 trillion raises concerns among both politicians and the general public about financial stability. |

Summary

The National Debt is a pressing issue for governments as they seek ways to manage and alleviate the burden of significant financial liabilities. With public debt soaring beyond $100 trillion globally, policymakers are likely to harness private wealth and implement various strategies to ensure fiscal sustainability. This reliance on private funds reflects a critical juncture in economic policy, as the interplay between private wealth mobilization and public finance becomes increasingly paramount in securing financial stability for the future.