Net Worth to Be Considered Wealthy, To be considered wealthy in the U.S., a net worth of approximately $2.3 million is commonly recognized as the financial threshold in 2025; however, this figure can fluctuate significantly based on your region due to varying costs of living.

Recent surveys indicate that the perception of wealth can differ from one location to another, with the West needing up to $3 million to maintain this status, while regions like the Southeast require considerably less, around $1.8 million.

Despite the slight decrease from last year’s $2.5 million mark, achieving a wealth by region can feel increasingly elusive for many, influenced by economic factors such as inflation and rising interest rates. Interestingly, while conventional net worth requirements set the stage for wealth, many Americans prioritize emotional richness, valuing happiness and personal connections alongside financial security.

Thus, an examination of net worth to be considered wealthy reveals a multifaceted understanding of what it means to truly thrive economically and emotionally.

Wealth is often quantified in monetary terms, but the definition of being financially successful goes beyond simple numbers.

The financial benchmarks for being deemed affluent fluctuate across the United States, as geographical disparities shape the perception of wealth. Consequently, varying wealth threshold USA ratings illustrate how residents in different regions experience and define their financial well-being. Exploring the indices of prosperity reveals that achieving a desirable net worth isn’t the sole determinant of richness; many seek a blend of financial comfort and personal fulfillment.

This broader view leads to diverse interpretations of how to be wealthy, emphasizing emotional well-being and relational richness as pivotal components of a fulfilling life.

Understanding the Wealth Threshold in the USA

In the context of the USA, the wealth threshold is a crucial metric that helps individuals understand what it means to be considered wealthy. As of 2025, Americans collectively agree that a net worth of approximately $2.3 million is necessary to achieve this status. This figure, however, fluctuates based on regional disparities, indicating that the perception of wealth is significantly influenced by local economic conditions, including cost of living and housing prices. In urban centers like San Francisco, the threshold can rise to an alarming $3 million, illustrating the stark differences in financial expectations across the country.

Moreover, the concept of wealth is often misunderstood. While many equate it to having a substantial net worth, surveys indicate that emotional and social factors, such as happiness and quality of relationships, also play pivotal roles in how wealth is perceived. Nearly 45% of Americans believe true wealth transcends monetary amounts, favoring the notion of being rich in non-financial ways. This broader interpretation highlights that achieving a comfortable living may be more attainable for many, as financial comfort entails a significantly lower threshold.

Regional Variations in Wealth Perception

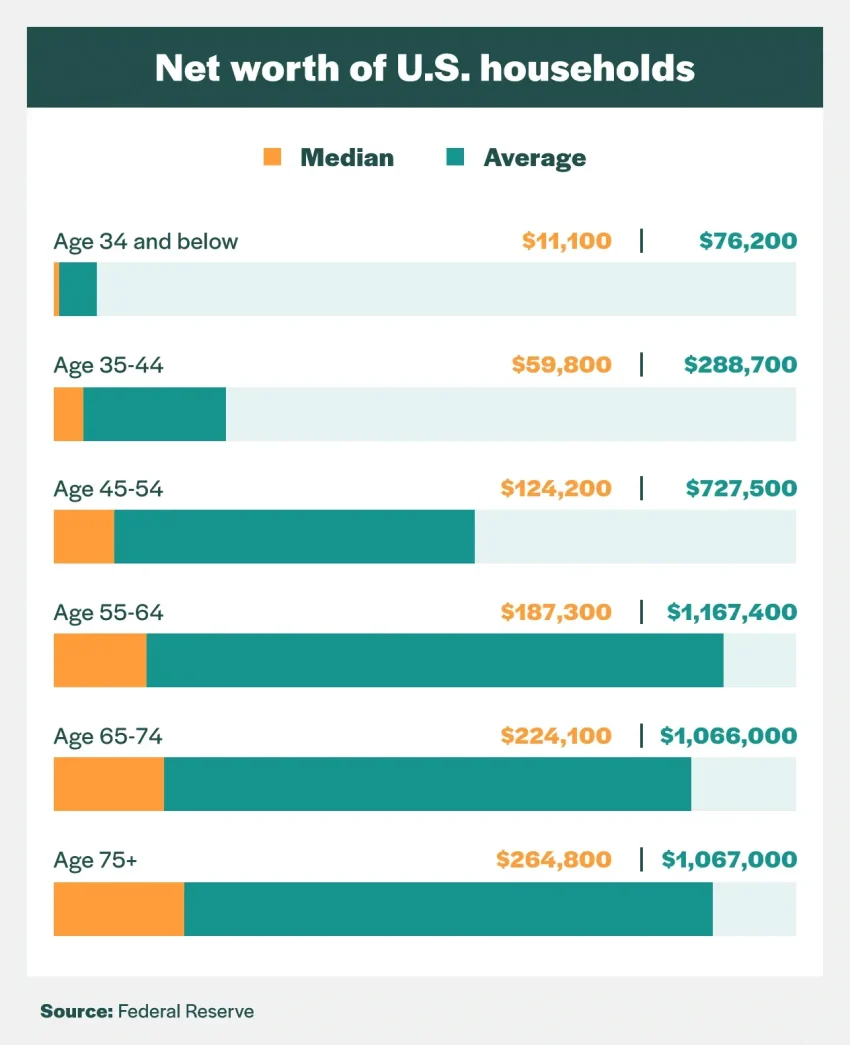

Wealth perception varies dramatically across different regions in the United States, as shown by the average net worth considered necessary to be wealthy. For instance, in the Northeast, individuals cite a minimum of $2.4 million, while those in the Midwest feel that $2.1 million suffices. The South reports a much lower benchmark of $1.8 million for someone to be considered affluent. These disparities underscore the influence of local economic conditions and the varying costs associated with living in different regions.

This regional perspective can significantly affect personal finance strategies, as individuals plan their wealth-building activities with their area’s economic landscape in mind. Those in higher-cost regions may find themselves in a competitive mindset, pushing them further toward wealth accumulation through investments and entrepreneurship. Conversely, residents in regions with lower thresholds might feel comfortable at lower net worth levels, potentially allowing for greater balance and satisfaction in life beyond financial metrics.

Financial Comfort: What Does It Mean?

Financial comfort is an essential aspect of economic well-being, defined as the point at which individuals feel secure and capable of meeting their needs without financial worry. According to recent surveys, the average net worth needed to achieve financial comfort in the U.S. is approximately $839,000. This figure represents a significant increase from previous years, indicating a shifting landscape where inflation and economic factors are affecting people’s perceptions of sufficiency. Interestingly, this threshold is markedly lower than that for wealth, emphasizing a distinction between feeling financially stable and being considered wealthy.

The regional breakdown further illustrates this distinction, with varying comfort levels across the country. For instance, in the West, individuals deem a net worth of $1.1 million necessary for financial security, while in the South, the figure dips to just $615,000. Almost half of Americans express that they are either financially comfortable or on the path to achieving this state, suggesting that while the path to wealth may seem daunting, many feel optimistic about reaching a level of financial security that allows for a fulfilling life.

The Impact of Economic Changes on Wealth Perception

Economic changes play a vital role in shaping how wealth is perceived across the U.S. Fluctuations in interest rates, inflation, and overall economic stability directly influence individual expectations surrounding net worth thresholds. In recent years, respondents have highlighted these economic factors as barriers to reaching what they deem to be wealthy, despite decreasing figures in wealth benchmarks. This paradox raises important discussions about the evolving definitions of financial security and the relentless pressures of modern economic life.

Furthermore, while the required net worth to be considered wealthy might decrease, the everyday realities faced by many Americans often tell a different story. For many, rising costs of living paired with slow wage growth create a sense of financial strain, making it feel increasingly challenging to reach financial milestones commonly associated with wealth. As a result, public sentiment has shifted towards valuing personal well-being and happiness alongside financial metrics in the today’s economic climate.

Building Wealth: A Comprehensive Approach

To truly build wealth in today’s economy, individuals need to adopt a comprehensive approach that goes beyond merely accumulating a desirable net worth. This multi-faceted approach incorporates principles of fiscal responsibility, investment strategies, and personal development. For instance, understanding various financial instruments like stocks, bonds, and real estate can empower individuals to make informed decisions that significantly enhance their portfolio. Additionally, cultivating skills that elevate one’s professional profile plays a crucial role in increasing earning potential.

Engaging in continuous education and networking opportunities can create pathways to advancement that contribute to increased financial health. With resources and platforms like online courses, podcasts, and financial literacy workshops, individuals are better equipped than ever to navigate the increasingly complex landscape of wealth-building. Embracing these avenues can significantly impact one’s trajectory towards not only financial comfort but also achieving true wealth as defined by personal goals and regional benchmarks.

The Role of Happiness and Relationships in Wealth

Interestingly, many Americans associate wealth not just with financial success but also with emotional and relational richness. Surveys indicate that a significant percentage of individuals feel they are wealthy beyond their financial holdings based on their happiness, health, and relationships. This correlation emphasizes the importance of nurturing personal connections and focusing on well-being as fundamental components of a fulfilling life. In many cases, individuals find that their true wealth is measured not by net worth but by the quality of their experiences and the strength of their relationships.

This perspective shifts the conversation about wealth from mere financial discussions to a more holistic approach that combines wealth with happiness. For instance, people often cite experiences that bring joy and a sense of community as pivotal in their definitions of being wealthy. Thus, those striving for wealth can benefit from balanced efforts towards physical health, emotional well-being, and nurturing meaningful relationships alongside their financial goals.

Navigating Career Opportunities for Wealth Building

Career choices play a significant role in achieving wealth and financial comfort. In a competitive job market, individuals must strategically navigate opportunities that not only enhance their skill sets but also provide strong income potential. Engaging in professional development initiatives, including classes that focus on both hard and soft skills, can be a game-changer for many aspiring to increase their net worth. This investment in oneself is crucial for building a personal brand that stands out in a crowded market.

Moreover, leveraging networks and seeking mentorship can also propel individuals toward financial prosperity. Building a robust professional network opens doors to unexpected opportunities, partnerships, and collaborations that foster personal and financial growth. By positioning themselves effectively within their industries, individuals can accelerate their journey toward reaching the wealth threshold while also creating pathways for lifelong financial security.

Personal Finance Strategies for Everyone

Developing effective personal finance strategies is essential for anyone looking to enhance their financial well-being and work towards their wealth goals. Key aspects of financial planning include budgeting, saving, and investment. Making informed choices about daily expenditures can lead to substantial savings, while strategically investing in assets can significantly increase one’s net worth over time. Additionally, understanding risk management and asset diversification can help to protect gains and promote steady growth.

Furthermore, the rise of digital financial tools and resources has made it easier for individuals to manage their finances efficiently. Online budgeting apps, investment platforms, and financial education courses are now widely available, helping users to grasp complex financial concepts. By taking advantage of these resources, individuals can create customized financial plans that align with their aspirations, making the path to wealth more accessible and achievable.

The Importance of Financial Literacy

Financial literacy has never been more crucial in a world where economic conditions are constantly evolving. Understanding the fundamentals of finance, such as interest rates, credit scores, and investment vehicles, empowers individuals to make sound financial decisions. Being well-informed allows individuals to navigate the complexities of the economic landscape, thereby reducing the barriers that prevent them from reaching their net worth goals.

Educational initiatives aimed at enhancing financial literacy can have a profound long-term impact on communities. By providing individuals with the tools and understanding necessary to manage their wealth effectively, these programs can pave the way for individuals to achieve financial independence. Ultimately, fostering a culture of financial education can lead to greater economic mobility as people learn how to cultivate wealth in alignment with their personal values and regional realities.

Frequently Asked Questions

What is the net worth to be considered wealthy in the USA by region?

As of 2025, Americans believe that to be considered wealthy in the USA, your net worth should be approximately $2.3 million. However, this figure varies by region: $3 million in the West, $2.4 million in the Northeast, $2.1 million in the Midwest, and $1.8 million in the South.

How does the wealth threshold in the USA compare to previous years?

According to recent data, the wealth threshold in the USA was reported at $2.5 million last year, but it has decreased to $2.3 million in 2025, indicating a shift in perceptions about what it takes to be considered wealthy amidst economic challenges.

What factors influence the net worth requirements to feel wealthy?

Factors such as the cost of living, inflation, and economic uncertainty play significant roles in shaping the net worth requirements to feel wealthy. For instance, residents in high-cost areas like California may need a higher net worth to feel the same level of financial security.

What does it mean to achieve financial comfort according to Americans?

To feel financially comfortable, Americans suggest an average net worth of $839,000, which can allow for a sensible lifestyle without excessive financial stress. The regional variations also apply: for example, $1.1 million in the West and $615,000 in the South.

How do Americans define wealth beyond just net worth?

While many associate wealth with net worth, nearly 45% of Americans define being wealthy in terms of happiness, physical health, relationships, and overall well-being, suggesting that true wealth encompasses more than just financial assets.

What is the relationship between net worth and feeling rich in non-financial terms?

Interestingly, many Americans feel rich in non-financial ways; about 80% reported feeling wealthy due to strong personal relationships, happiness, and ample free time, demonstrating that wealth is perceived holistically beyond mere dollars.

What lifestyle changes can help individuals meet the net worth requirements for wealth?

To reach the net worth requirements to be considered wealthy, individuals may need to make lifestyle adjustments such as reducing expenses, increasing income through career advancements, or investing wisely to grow their assets.

Is the feeling of financial comfort considered achievable by most Americans?

Yes, nearly half of Americans feel they are financially comfortable or on their way to being so, indicating that the threshold for financial comfort is perceived as more attainable than the higher net worth associated with wealth.

| Region | Net Worth to be Considered Wealthy | Financial Comfort Threshold |

|---|---|---|

| West | $3 million | $1.1 million |

| Northeast | $2.4 million | $979,000 |

| Midwest | $2.1 million | $800,000 |

| South | $1.8 million | $615,000 |

Summary

To be considered wealthy, a net worth of over $2 million is generally deemed necessary across the U.S., with specific thresholds varying significantly by region. In 2025, Americans perceive a net worth of $2.3 million as the average benchmark for wealth, reflecting a slight decrease from previous years. Regional disparities highlight the higher amounts required in areas like the West, with $3 million needed to achieve that label. Interestingly, while financial thresholds have been set, many Americans associate wealth with broader definitions, including happiness and healthy relationships, indicating a more complex view of what it means to truly ‘feel’ wealthy. Ultimately, achieving financial comfort appears more attainable than the wealth benchmark itself, with nearly half of the surveyed individuals feeling they are on a path to financial comfort.