New York City Wealth Flight: Mamdani’s Tax Proposal Impact

New York City wealth flight has become a pressing issue as politicians like Zohran Mamdani rise to prominence, proposing significant tax increases targeting the city’s millionaires. Mamdani’s proposal for a millionaire tax has ignited fears of an exodus among the affluent, with many wealthy New Yorkers contemplating relocation to more tax-friendly states like Florida. Despite this concern, the NYC real estate market has shown resilience, with luxury property contracts increasing even after Mamdani’s primary victory. However, the volatile combination of tax policy impact and public safety issues poses real threats to the economic fabric of the city. As the debate unfolds, the future landscape of New York’s millionaire demographic hangs in the balance, and with it, the health of the city’s economy relies heavily on retaining its elite earners.

As concerns about affluent residents leaving the city mount, the topic of wealth migration from New York City has gained considerable attention. The rise of political figures advocating for higher taxes on the wealthy has raised alarms among business owners and millionaires, prompting a reevaluation of their ties to the city. With many facing the prospect of increased financial burdens, discussions surrounding high-net-worth individuals’ movement towards more favorable environments, such as neighboring states, have intensified. Additionally, the impact of local tax policies on New York’s economy and community services cannot be overlooked. The implications of these economic shifts highlight the critical intersection of taxation, urban living, and the retention of lucrative residents.

Understanding Mamdani’s Millionaire Tax Proposal

Zohran Mamdani’s political rise and his millionaire tax proposal are stirring up significant conversations in the heart of New York City. Aiming for a 2% increase on incomes over $1 million, Mamdani’s tax initiative is positioned as a way to balance social equity within an economically stratified city. As wealthy New Yorkers remain a pivotal segment, their contributions to the tax base are substantial—over 40% of income taxes come from just the top 1% of earners. This concentration of wealth and tax liability makes Mamdani’s proposals particularly impactful as they could challenge the status quo if implemented.

The implications of Mamdani’s tax policy on New Yorkers are profound and multifaceted. Many affluent residents express concerns about the potential financial burden that could accompany living in a city with the highest tax rates in the nation. The juxtaposition of rising taxes and the luxurious amenities of the NYC real estate market presents a critical dilemma: will the millionaire tax alienate a class that has long deemed New York their home? The fear of a wealth flight, although possibly exaggerated, remains a constant undercurrent in discussions surrounding the future of New York’s tax policy.

Wealth Flight: The Impact of Tax Policies on New York City

The phenomenon often referred to as wealth flight speaks to the alarming trend of affluent individuals departing New York City, primarily prompted by burdensome tax policies. Despite the alluring charm of NYC, the soaring tax rates—driven further by Mamdani’s proposals—could lead some high-income residents to seek refuge elsewhere, such as tax-friendly Florida. This shift, widely discussed among real estate brokers, has led to an uptick in inquiries from wealthy New Yorkers contemplating moves to areas with a lower cost of living and more favorable tax structures. As such, understanding the intersections of tax policy and economic behavior becomes crucial.

However, it is essential to dissect the nuance of this wealth flight narrative. While some individuals may choose to relocate, research indicates that the majority of high earners are not fleeing New York at alarming rates. In fact, studies show that the top 1% of earners in the city leave at a markedly low rate compared to those in other income brackets. These insights suggest that while tax policy can influence decisions, lifestyle and access to opportunities are often greater motivating factors for the magnetic pull of New York City.

NYC Real Estate Market Dynamics Amidst Wealth Concerns

The New York City real estate market has always been a resilient cornerstone of its economy, indicating a complex relationship with wealth populations amidst taxing concerns. Reports following Mamdani’s primary success have revealed that high-end luxury apartments continue to attract buyers, countering fears of a declining market due to potential wealth flight. In 2023, contracts signed in the luxury sector demonstrated a resurgence, fueled by an unwavering demand from both local and international investors—a sign that, for now, wealthy New Yorkers still favor the NYC lifestyle.

Simultaneously, developers are adamant about the potential ramifications of Mamdani’s taxation plans. As they band together to oppose his policies, the overarching narrative is one of uncertainty. Increasing levels of taxes may impact investment sentiment, challenging developers to pivot strategies while navigating the affluent clientele still itching to retain their New York addresses. Ultimately, if policies discourage investment and ownership, the ripple effects on the real estate market could be significant, impacting everything from pricing to available housing stock.

The Resilience of Wealth Generating in NYC

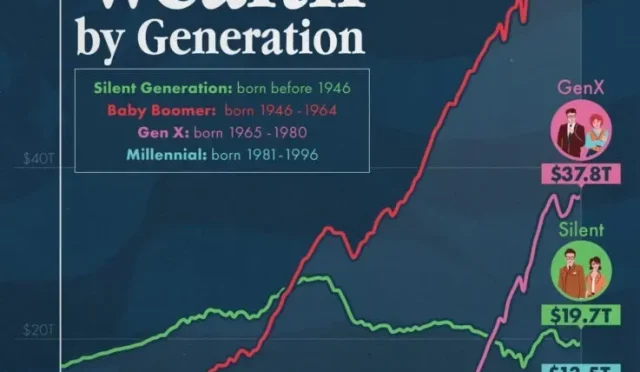

Despite ongoing debates and uncertainties surrounding tax policies in New York City, the resilience of its wealthy demographic remains notable. Over the past decade, the population of millionaires has doubled, demonstrating a robust capacity for wealth regeneration that many presume could contribute to the city’s enduring economic might. The increase in high-net-worth individuals—from 30,400 pre-Covid to over 34,127 by 2022 as noted by the Fiscal Policy Institute—highlights that the allure of NYC as a wealth-generating hub remains intact, even amidst fears of taxation and wealth flight.

Furthermore, this resilience in wealth generation is crucial for sustaining New York’s fiscal health. As indicated, a small loss of high-income residents could lead to significant revenue reductions, amplifying the importance of effectively managing tax policies that influence these individuals’ decisions. Aside from immediate financial implications, a thriving affluent population also contributes to local businesses, cultural institutions, and various enterprises that make New York City vibrant. Maintaining this ecosystem becomes essential for policymakers, as they walk a fine line between taxation and retaining a powerful economic engine.

Reassessing Concerns Over Tax Policy Impact

While concerns persist regarding the impact of increased taxes on high earners, assessments of past patterns suggest a more complex picture than merely wealth flight. Historical data shows that significant tax hikes have often resulted in gradual shifts rather than sudden departures of wealthy residents. Understanding this trend, it becomes clear that while tax policy can and does affect the decisions of wealthy New Yorkers, it is the combination of lifestyle quality, availability of resources, and social factors that holds the greater weight in their retention.

It’s also notable that, when wealthy individuals do relocate, they often set their sights on neighboring states that maintain high-quality amenities akin to New York, suggesting that lifestyle preferences may supersede tax considerations. Therefore, it could be argued that fear of wealth flight might stem more from perception than reality, as many affluent residents choose to remain in New York City for its unique charm and opportunities, regardless of increasing tax burdens.

The Debate Over Policing and Public Safety in NYC

The intersection of public safety and residency decisions among wealthy individuals is another critical aspect concerning the potential wealth flight from New York City. As concerns grow regarding Mamdani’s stance on policing—an area many perceive as critical for both business and personal safety—there is a looming anxiety among high earners. An escalation in crime rates could prompt affluent individuals to reconsider their city investments, placing further pressure on the NYC economy that heavily relies on the top earners.

Moreover, the relationship between public safety and wealth retention is underscored by the potential economic implications. As businesses contemplate relocation to safer spaces, the outsize contribution of the wealthy to the city’s tax base hangs in the balance. Policymakers must critically evaluate how perceptions of safety align with economic vitality, as failure to maintain a secure environment could catalyze a broader pattern of out-migration.

Responses from NYC Business Owners and Developers

Business owners and real estate developers have voiced significant concerns in light of Mamdani’s proposals, indicating a potential destabilization of the NYC economy. The combination of increased taxes and stringent regulations could threaten their profitability, leading to discussions about relocation out of the city, to lower-cost states with more favorable business climates. This interaction between taxation, regulation, and business survival has created a charged atmosphere among the entrepreneurial community.

As the election approaches, real estate developers have mobilized to counteract Mamdani’s influence, portraying a united front against policies that they believe could stifle growth. Their response reflects a broader sentiment within the business community that worries about the long-term viability of doing business in such a high-tax environment. The reaction underscores how critical these policies are not just for individual residents, but for the city’s overall economic landscape, illustrating the delicate balance between monetary demands and business sustainability.

A New Generation of New York Millionaires

Entering the post-Covid economic landscape, New York City continues to produce a new generation of millionaires, showcasing its resilience through an evolving societal framework. Despite apprehensive narratives surrounding wealth flight, new entrepreneurial ventures have emerged, driving innovation and economic growth within the city. With an increasing number of individuals amassing wealth in unconventional sectors, such as technology and creative industries, it’s evident that the allure of New York remains compelling for many.

Contrary to depictions of mass departures, rich data highlights a simultaneous growth within the upper echelons of the socioeconomic landscape. New York has not only regained its footing post-pandemic but is also attracting fresh talent and investment, enhancing its profile as a global economic powerhouse. This phenomenon signifies a continued cycle of wealth generation and revitalization in the city, which is critical in the face of tax changes proposed by Mamdani, showcasing the complexities of wealth within a high-tax framework.

The Long-Term Effects of Wealth Redistribution Policies

Discussions surrounding wealth redistribution policies, particularly under proposals like Mamdani’s millionaire tax, spark vital considerations about the long-term impacts on New York City’s economic fabric. Advocates argue that redistributive tax policies can enhance the quality of life for lower-income residents, potentially leading to a more equitable society. However, as depicted by the current narratives, such policies can inadvertently catalyze movement among wealthy individuals who contribute significantly to the city’s revenue.

The balance between equity and economic viability becomes paramount in policy discussions. Implementing heavier tax burdens can foster economic disparities, ironically driving out those whose wealth is crucial for funding public services and initiatives that support the city’s broader population. Consequently, policymakers face a challenge: to achieve income equity while managing economic dynamics that sustain New York City’s vitality. The consideration of the long-term effects of tax policies thus becomes essential not only for high earners but for the city as a whole.

Frequently Asked Questions

How is Mamdani’s millionaire tax proposal affecting New York City wealth flight?

Zohran Mamdani’s proposal to implement a millionaire tax in New York City has raised concerns about potential wealth flight among high earners. Although some wealthy New Yorkers are exploring relocation options to states like Florida, the overall impact on the NYC real estate market remains to be seen, with strong demand for luxury apartments still present.

What is the connection between NYC real estate market trends and wealth flight in New York City?

The NYC real estate market has shown resilience amid fears of wealth flight, as demand for high-end properties continues to rise. This trend suggests that despite Mamdani’s millionaire tax proposal and concerns over high taxes, wealthy New Yorkers are still investing in the city’s real estate.

Are wealthy New Yorkers actually leaving due to Mamdani’s tax policies?

While there is speculation that wealthy New Yorkers might leave the city in response to Mamdani’s proposed millionaire tax, research indicates that only a small percentage are relocating. The majority of high earners tend to stay in New York, as the city continues to produce new millionaires.

What effect does the millionaire tax have on the behavior of New York millionaires?

The proposed millionaire tax by Mamdani could influence the behavior of New York millionaires by incentivizing some to consider moving to lower-tax states. However, studies show that lifestyle factors are often more influential than taxes on their decisions to relocate.

How does New York City’s tax policy impact the potential for wealth flight?

New York City’s taxing policies, particularly the proposed millionaire tax, could lead to an increase in wealth flight if high earners choose to relocate to avoid higher taxes. This potential shift puts pressure on city revenue, highlighting the importance of maintaining a favorable tax policy.

What are the broader implications of wealth flight for New York City?

Wealth flight from New York City carries potential implications for the local economy, including reduced tax revenue and lower public services. If high-income New Yorkers leave due to policies like Mamdani’s millionaire tax, it could exacerbate economic decline and diminish the city’s ability to attract new businesses.

How many millionaires currently reside in New York City, and how does that affect the wealth flight narrative?

Currently, over 2.4 million millionaires reside in New York City. This significant number challenges the wealth flight narrative, as the city continues to generate new wealth even amidst discussions about potential tax increases.

Is New York City’s millionaire tax likely to deter future high earners?

While Mamdani’s millionaire tax could create a deterrent effect for some potential high earners considering moving to New York City, historical data shows that wealth flight due to tax increases is not as widespread as commonly believed, suggesting that many still find the city’s opportunities attractive.

What statements have analysts made regarding the wealth flight from New York City?

Analysts, including Nathan Gusdorf from the Fiscal Policy Institute, argue that the narrative of wealth flight is often exaggerated. They highlight that New York continues to create new millionaires, countering claims that high taxes are driving away affluent residents.

How does the proposed millionaire tax affect business owners in New York City?

The proposed millionaire tax by Mamdani has sparked discussions among business owners about leaving the city or closing their businesses. High taxes may lead to increased operational costs, making it financially challenging for them to continue in New York.

| Key Points | Details |

|---|---|

| Mamdani’s Primary Victory | Zohran Mamdani wins mayoral primary, raising concerns about wealth flight. |

| Proposed Millionaire Tax | An additional 2% tax on those earning over $1 million, totaling 16.776% including current city tax, making it the highest in the nation. |

| Impact on Real Estate | Increased inquiries from wealthy New Yorkers to relocate to Florida, but no significant decline in high-end market so far. |

| California vs. Florida Migration | High-income earners look elsewhere, but many stay within New York’s vicinity, moving to tax-friendly areas. |

| Top 1% Contribution | Responsible for over 40% of NYC’s income tax, small losses could greatly affect city revenue. |

| Potential Economic Repercussions | Predicted decline of services and further out-migration if high earners leave. |

| Resilience of High-End Market | Total number of millionaires grew over the past decade, with strong demand for luxury apartments. |

| Media Narrative vs. Reality | Experts argue that wealth flight conversations are exaggerated; NYC continues to produce new millionaires. |

| Impacts of Tax Policy | High earners are sensitive to tax changes, but lifestyle choices drive many migration decisions. |

Summary

New York City wealth flight is becoming a hot topic following Zohran Mamdani’s political rise and his proposed millionaire tax. While there are concerns about affluent residents potentially leaving the city, evidence suggests that the high-end real estate market remains stable and the number of millionaires is actually on the rise. Factors such as lifestyle, rather than solely tax policies, play a significant role in the decisions of wealthy New Yorkers when considering relocation. As the city continues to generate new wealth, the narrative of an imminent wealth flight may be more complicated than it appears.

#NYCWealthFlight #MamdaniTaxProposal #UrbanEconomy #TaxPolicy #WealthMigration