In the context of Norway’s political landscape, the wealth tax has emerged as a pivotal issue in the ongoing national debate. As Norway approaches its general election, discussions surrounding the wealth tax are intensifying, with voters contemplating whether to maintain, amend, or abolish this form of taxation entirely. Proponents argue that this wealth tax, or “formuesskatt,” is a fundamental aspect of progressive taxation in Norway, helping to mitigate wealth inequality and contribute to the nation’s welfare system. Critics, however, claim that this tax hampers entrepreneurs and discourages investment, leading to calls for policy reform. As the final votes are cast, the future of this contentious tax policy may very well shape Norway’s economic and social future.

The ongoing discussions around Norway’s asset-based levy highlight broader themes in contemporary fiscal policy. Often referred to as a “formuesskatt,” this wealth tax has become a significant topic amid the approaching Norwegian general election. Many view it as a tool for promoting equitable distribution of wealth, while others express concerns over potential negative impacts on personal entrepreneurship and investment climate. The debate encompasses essential aspects of taxation, including the implications of progressive taxation in Norway and the ongoing efforts to tackle wealth disparity. As opposing factions prepare their arguments, the outcome of this debate could redefine the landscape of tax policy in Norway.

Understanding Norway’s Wealth Tax

Norway’s wealth tax, known as formuesskatt, has become a pivotal point of contention in the national political discourse. As the general election approaches, debates surrounding the wealth tax are heating up, showcasing a clear divide between parties advocating for progressive taxation and those arguing for its reduction or abolition. Advocates for the wealth tax assert that it plays a critical role in maintaining Norway’s status as one of the most equitable societies in Europe by targeting wealth inequality. This tax system ensures that wealthier citizens contribute a fair share towards funding public services and social security, thereby enhancing the overall quality of life for all Norwegians.

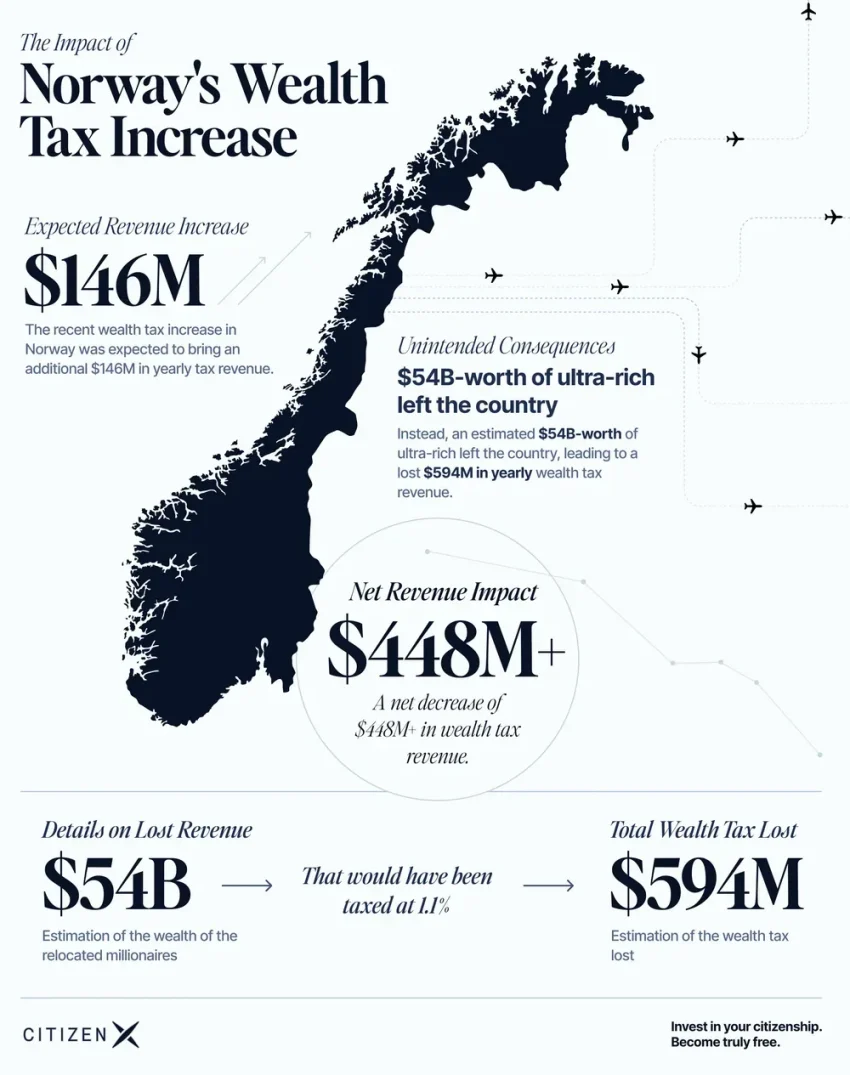

On the other hand, critiques from successful entrepreneurs and business owners suggest that the wealth tax serves as a deterrent, potentially pushing affluent individuals to consider relocation. The exodus of high-net-worth individuals from Norway, driven by fears of additional tax burdens, reflects a growing anxiety surrounding the implications of such taxation on investment opportunities within the country. This tug-of-war illustrates how tax policy in Norway isn’t just a financial issue; it’s a deeply embedded socio-political dilemma that touches on fairness, economic stability, and national identity.

The Role of Wealth Tax in Norway’s Progressive Taxation

The wealth tax is a cornerstone of Norway’s progressive taxation model, a system designed to balance the economic scales and redistribute wealth among the population. This approach aims to mitigate wealth inequality by placing the tax burden more heavily on those who can afford it. Unlike flat tax systems, Norway’s progressive taxation, which includes formuesskatt, is intended to ensure that individuals with higher incomes and substantial assets contribute appropriately to the welfare state that benefits all citizens. Proponents argue that such a system has been fundamental in allowing Norway to develop comprehensive social services, including healthcare and education.

However, this model faces criticism, especially from wealthy individuals who feel it hampers entrepreneurship and business growth. Detractors argue that progressive taxation, while aiming to address inequality, potentially stifles economic innovation by taxing entrepreneurs on their unrealized gains. Critics like economist Mathilde Fasting point out that such policies may prevent investment in new ventures, thus harming overall economic vitality. Therefore, the debate surrounding Norway’s wealth tax is not merely about fiscal policy but also about what type of society and economy Norway aims to cultivate.

Wealth Inequality in Norway: The Impact of Wealth Tax

Wealth inequality remains an urgent topic in Norway, and the wealth tax is viewed by many as a necessary mechanism to combat this issue. By taxing wealth rather than income, Norway adjudicates that those with greater financial means have a responsibility to support efforts aimed at reducing economic disparity. As the wealth tax generates significant revenue—approximately 32 billion kroner—it funds essential public services that benefit the wider population. Citizens have access to social safety nets and educational programs, which the wealthy benefit from indirectly as well, leading to a more stable social fabric.

Nevertheless, the tension persists as wealthy individuals voice concerns about how this wealth tax impacts their financial freedom and investment capabilities. There is an ongoing debate concerning the threshold for taxation, with recent discussions suggesting that the existing limit of 1.7 million kroner may be too low, thus burdening too many individuals. The challenge for policymakers is to formulate a balance that addresses wealth inequality while ensuring that Norway remains an attractive place for business and investment, sparking further national discourse on the implications of such a tax policy.

The Political Landscape Surrounding Wealth Tax in Norway

The political implications of the wealth tax have culminated in a fierce battleground during the Norwegian general elections. Party leaders have seized this opportunity to either fortify or dismantle the existing taxation policies, essentially utilizing the wealth tax as a litmus test for voter priorities. The Socialist Left Party advocates for the retention of the wealth tax, positioning it as a fundamental aspect of social justice. On the other end of the spectrum, the Progress Party and moderates like Høyre are making compelling arguments advocating for its abolition or reform, appealing to a growing segment of the electorate that prioritizes economic freedom over collective responsibility.

As public sentiments shift in favor of more business-friendly policies, the outcome of this election could significantly alter Norway’s tax landscape. The potential establishment of a cross-party commission to reevaluate tax policies, as proposed by Labour leader Jens Stoltenberg, may address these concerns. However, the fear remains palpable among those who see the wealth tax as integral to upholding Norway’s welfare system. Therefore, regardless of the electoral outcome, the wealth tax will continue to ignite discussions about economic fairness and the future of tax policy in Norway.

Future Projections: Wealth Tax and Norway’s Economy

Forecasts for the future of Norway’s economy and wealth tax suggest an uncertain yet pivotal trajectory. With assertions that wealth tax revenue could surpass 32 billion kroner in the upcoming years, the financial stakes are high. Critics such as Fasting warn that provisions under current policies might drive wealth out of the country, generating anxiety about potential dilution of Norway’s economic influence. If high-net-worth individuals opt to relocate to more tax-friendly jurisdictions, the implications for public funding could be severe, prompting debates among economists about sustainable tax policy in a rapidly evolving global economy.

Conversely, there is a cohort of stakeholders like entrepreneur Karl Munthe-Kaas who argue for the wealth tax, emphasizing its role in society’s overall welfare structure. They claim that while the tax may seem burdensome, it helps create a competitive landscape where basic needs are met, fostering an environment ripe for innovation and growth. How Norway navigates these challenges will likely determine not just the efficacy of the wealth tax but also the broader social contract in ensuring fairness amid prosperity.

The Debate Over Abolishing Wealth Tax in Norway

The debate over the potential abolition of the wealth tax has ignited passionate responses from various sectors of Norwegian society. Supporters of abolishment, including influential business figures, argue that the wealth tax stifles entrepreneurship and discourages the investment necessary for economic growth. They contend that taxing accumulated wealth disincentivizes individuals from reinvesting their profits back into the economy, thereby hindering overall development and innovation.

In contrast, advocates for maintaining the wealth tax emphasize its role in promoting social equity and funding essential public services. They point out that the revenues generated from this taxation are critical in creating a safety net for all citizens, underscoring the importance of collective contribution. As political parties stake out their positions on this contentious issue leading up to the elections, the future of Norway’s economic landscape will be shaped significantly by the outcomes of these discussions.

Implications of Wealth Tax for Global Business Owners in Norway

The implications of the wealth tax are particularly pronounced for global business owners operating in Norway. For many, the wealth tax represents a double-edged sword—a necessary contributor to public services, but also a deterrent to high-net-worth individuals considering their investment strategies. Business leaders such as Roger Hofseth assert that a burdensome wealth tax can push entrepreneurs to seek more favorable tax conditions abroad, indicating a potential trend of relocating business operations to countries with less taxing regimes.

However, the situational context of the wealth tax reveals its complexity. While it may seem an inconvenience for wealthy entrepreneurs, they also benefit from the high levels of infrastructure, education, and healthcare funded by the tax. This irony adds layers to the debate: is it fair for the wealthy, who benefit immensely from societal infrastructure, to evade the tax that sustains it? The ongoing discussions are pivotal as they forge a path toward a tax policy that honors both economic vitality and social responsibility.

Public Sentiment Towards Wealth Tax in Norway

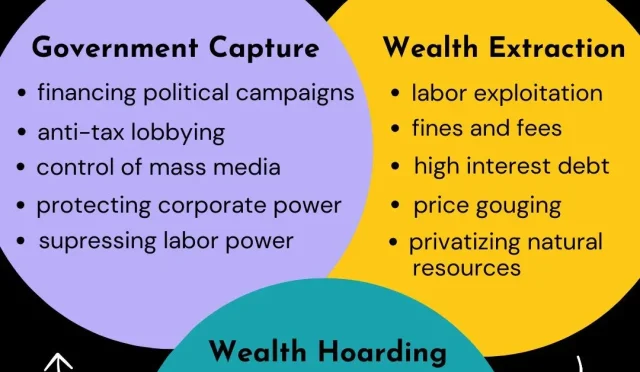

Public sentiment surrounding the wealth tax in Norway is fraught with dichotomy, indicative of the broader ideological divides present in society. Surveys and anecdotal evidence suggest that many citizens appreciate the wealth tax’s contribution to a fairer society and the social benefits it yields. However, as economic conditions fluctuate and the cost of living rises, there is an emerging discourse critical of this taxation model, particularly among younger generations who may not yet qualify to pay the tax but feel its implications.

This sentiment is reflected in grassroots movements and increasing visibility of lobbying groups advocating for changes. The tension between fairness and economic freedom is palpable, with citizens grappling with their identities in relation to wealth and contribution to society. As Norway navigates this cultural zeitgeist, the outcomes of ongoing discussions about the wealth tax will undoubtedly shape public policy and societal values in the years to come.

Analyzing the Effectiveness of Wealth Tax Policies

The effectiveness of wealth tax policies in Norway remains under scrutiny, particularly as the country assesses the ramifications on its economy. Critics argue that the tax disproportionately affects wealthy individuals, potentially leading to an exodus of capital and entrepreneurial talent. They assert that these policies hinder competitiveness and could ultimately lead to a diminished tax base. However, proponents argue that revenue from the wealth tax is crucial for funding essential services that drive equitable growth, suggesting that without it, the societal structure underpinning Norway’s success may erode.

Furthermore, discussions around reforming the wealth tax resonate with broader themes of evolving economic landscapes and changing societal values. As globalization reshapes business operations and citizen expectations, policymakers face the challenge of aligning tax structures with the realities of modern economies while staying true to Norway’s foundational principles of equity and shared prosperity. As such, the dialogue around the wealth tax continues to evolve, reflecting the complexities and challenges inherent in governance.

Frequently Asked Questions

What is the current status of the wealth tax in Norway?

As of now, Norway maintains a national wealth tax known as the formuesskatt. This tax is levied at a rate of 1% for individuals with assets exceeding 1.7 million kroner and at 1.1% for those with assets over 20.7 million kroner. The debate surrounding this wealth tax is heated, particularly in the context of the upcoming Norwegian general election.

How does the wealth tax in Norway contribute to progressive taxation?

The wealth tax in Norway is a key component of the country’s progressive taxation system. It aims to address wealth inequality by ensuring that the affluent contribute to funding public services, thus promoting a more equitable society. Proponents argue that this wealth tax supports public goods and social security, which are vital for maintaining Norway’s status as one of Europe’s most equal societies.

What impact does the wealth tax have on wealthy individuals in Norway?

The wealth tax significantly affects wealthy individuals in Norway, as it constitutes a large portion of their personal taxation. Taxable assets such as properties, investments, and shares are considered, with exemptions on primary residences. This tax has been a contentious issue, especially as some wealthy individuals have voiced concerns about its impact on their financial decisions and propensity to leave Norway.

Why has the wealth tax become a polarizing issue in the Norwegian general election?

The wealth tax has emerged as a polarizing topic in Norway’s general election due to its implications for wealth inequality and economic policy. Supporters argue it is essential for funding social programs, while opponents claim it discourages investment and entrepreneurship. This division reflects broader ideological battles between left and right parties regarding tax policy Norway.

What are some proposed changes to the wealth tax by Norwegian political parties?

Some political parties, such as the populist Progress Party, propose abolishing the wealth tax entirely, citing it as a barrier to investment and economic growth. In contrast, other parties propose retaining or even increasing the tax, emphasizing its role in funding essential public services and reducing wealth inequality in Norway.

How does Norway’s wealth tax compare to those in other countries?

Norway’s wealth tax stands out as one of the few in Europe still taxing capital assets directly, alongside Spain and Switzerland. The structure and rates of the formuesskatt distinguish it from other taxation systems, which often focus on income tax, capital gains, or inheritance taxes, and can involve numerous loopholes.

What arguments do supporters of the wealth tax in Norway make?

Supporters of the wealth tax argue that it is a fair system that contributes to social equity by redistributing wealth from the richest individuals. They contend that this tax is crucial for maintaining Norway’s welfare state and public services, which benefit all citizens and create a stable, educated, and healthy society.

What are the potential consequences of abolishing the wealth tax in Norway?

Abolishing the wealth tax could lead to increased wealth inequality, a reduction in public finances, and potentially a decline in public services. Critics warn that if the tax were eliminated, it might encourage wealthy individuals to relocate, further eroding Norway’s tax base and social safety net.

How is the wealth tax adherence and payment monitored in Norway?

In Norway, tax compliance is facilitated through public access to tax returns for individuals, allowing for high transparency in wealth reporting. The wealth tax is computed based on declared assets minus debts, minimizing opportunities for evasion and ensuring compliance among high-net-worth individuals.

What are some alternatives to wealth tax in Norway suggested by critics?

Critics of the wealth tax in Norway suggest alternatives such as reforming capital gains tax, targeting dividend payments, or focusing on inheritance taxes as more efficient ways to address wealth inequality without discouraging investment or business growth.

| Key Points |

|---|

| Norway’s wealth tax, known as formuesskatt, generates around 32 billion kroner (£2.4 billion) annually. |

| Defenders argue it supports a progressive tax system and social equality in Norway. |

| Critics, including entrepreneurs, campaign against it, claiming it hampers business growth and wealth retention. |

| Recent changes have seen over 30 billionaires and multimillionaires leave Norway due to its tax policies. |

| Economists warn of the potential negative impact on investment and economic growth due to high wealth tax. |

| The current rate is 1% for assets above 1.7 million kroner and 1.1% for those above 20.7 million kroner. |

| The wealth tax framework has existed since 1892, positioning Norway among a few nations that maintain it. |

| Entrepreneurs express concerns that the tax puts locals at a disadvantage compared to foreign investors. |

| Public debate reveals a sharply divided populace, intensifying political tensions around this tax. |

| Proponents argue it is necessary for funding public goods and ensuring social welfare. |

Summary

Norway’s wealth tax has become a focal point in the nation’s political discourse, illustrating the deep divide in public opinion regarding its necessity and impact. The discussion highlights the wealth tax’s significance in contributing to Norway’s social equality, while also sparking fears of economic repercussions and exodus among the wealthy. As the country approaches elections, the fate of the wealth tax remains uncertain, continuing to fuel debates among both supporters and critics.