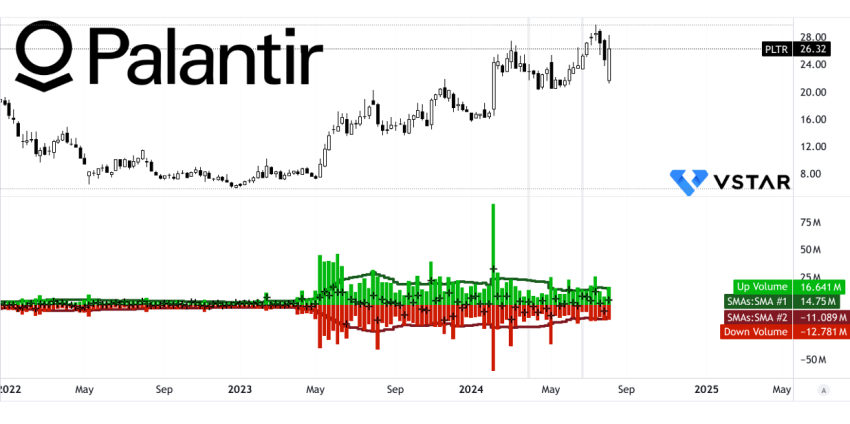

Palantir Stock Analysis reveals a compelling picture as the company gears up for the U.S. market opening on December 22, 2025, after an impressive week fueled by significant contracts and news updates. The recent spotlight on Palantir Technologies Inc. (NASDAQ: PLTR) comes amid rising interest in its strategic initiatives, such as the $448 million Navy ShipOS investment and its partnership with Nvidia. Share prices for PLTR have recently lifted to around $193.38, reflecting a 4.2% gain, positioning the stock as a leading player in the AI and government technology space. Market analysts are closely watching the **PLTR forecast** as Palantir exhibits strong performance metrics—earning optimistic projections tied closely to its latest earnings report. As news continues to circulate about ventures, including the Navy’s modernization efforts and federal AI initiatives, investors remain keen on how these developments will shape Palantir’s future trajectory.

When examining the current landscape for Palantir’s shares, one finds a blend of optimism and caution. Known primarily for its advanced data analytics platforms, Palantir is at the forefront of transforming operations within the U.S. government and commercial enterprises. The recent investment in Navy ShipOS underscores the pivotal role the company plays in modernizing military infrastructure, while collaborations with tech giants like Nvidia further bolster its position in the AI sector. With the backdrop of favorable **Palantir news** and encouraging earnings analyses, stakeholders are eager to decipher the implications of upcoming operational updates. As anticipation builds around potential revenue streams and infrastructure projects, the dynamics surrounding PLTR stock will be crucial for both investors and analysts alike.

Understanding the Palantir Stock Analysis in December 2025

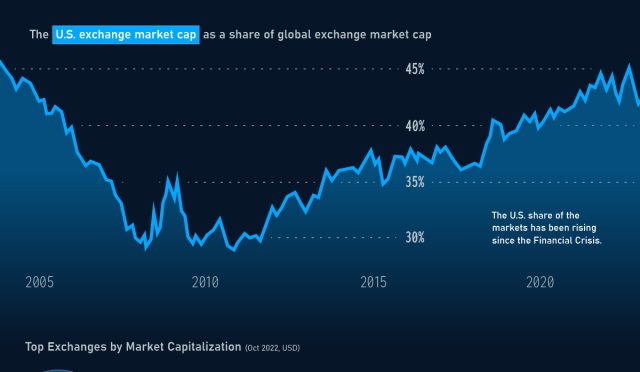

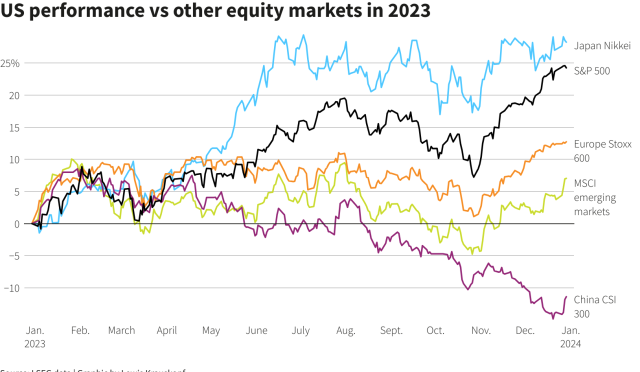

As Palantir Technologies Inc. (NASDAQ: PLTR) gears up for trading on December 22, the underlying stock analysis highlights a significant upward trajectory recently. Trading at about $193.38, an increase of around 4.2%, reflects a favorable investor sentiment buoyed by news related to military contracts and technological advancements. Investors are clearly reacting to the company’s robust fundamentals characterized by impressive year-over-year growth, which can be a driving force for potential price appreciation. Additionally, being added to the S&P 500 positions Palantir favorably within institutional portfolios, further emphasizing its growing relevance in the tech space.

The analysis also suggests sensitivity in the stock’s valuation, which poses risks amid expectations. Investors must remain vigilant as minor shifts in corporate performance can lead to substantial price impacts for Palantir due to its elevated valuation metrics. Hence, keeping abreast of developments in Palantir’s Navy ShipOS contract and Nvidia partnership will be crucial, as these initiatives could underpin future earnings growth and impact investor perception.

Frequently Asked Questions

What is the latest news impacting Palantir stock analysis as of December 2025?

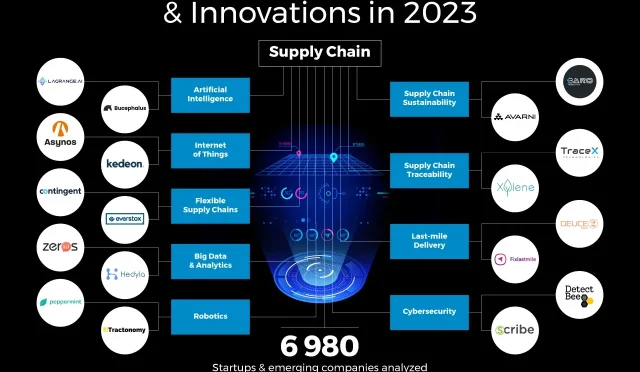

As of December 2025, key news impacting Palantir stock includes the U.S. Navy’s $448 million investment in a Shipbuilding Operating System utilizing Palantir’s software, and a partnership with Nvidia to develop the ‘Chain Reaction’ platform, aimed at expediting AI infrastructure construction. These developments underscore Palantir’s central role in government AI initiatives and infrastructure modernization.

How does the Navy’s Ship OS initiative affect the Palantir stock forecast?

The Navy’s Ship OS initiative is expected to positively impact Palantir’s stock forecast by enhancing operational efficiencies in shipbuilding through AI integration. The project’s success will likely strengthen Palantir’s position in government contracts, boosting investor confidence and potentially leading to higher stock valuations.

What are analysts saying about the Palantir stock price target following recent earnings?

Following Palantir’s Q3 2025 earnings report, which showed significant revenue growth, analysts have varied opinions on the stock price target. Some, like BofA’s analyst, set high targets near $255, while others reflect caution with an average target below the current price, mainly due to valuation concerns amid rapid growth.

How does the Nvidia partnership influence the future of Palantir’s stock?

Palantir’s partnership with Nvidia is significant as it aims to develop ‘Chain Reaction’, a platform targeting AI infrastructure bottlenecks. This collaboration not only enhances Palantir’s product offerings but also positions the company as a key player in the AI landscape, which could drive future revenue growth and positively impact stock performance.

What were the key highlights from Palantir’s Q3 2025 earnings that investors should note?

Key highlights from Palantir’s Q3 2025 earnings include a 63% year-over-year revenue increase, with U.S. commercial revenue rising by 121%. The overall adjusted free cash flow margin was approximately 46%, demonstrating strong financial health, which is critical for investor sentiment and stock valuation going forward.

What risks should investors consider in Palantir stock analysis moving into 2026?

Investors should consider valuation risk as Palantir trades at high multiples, making it sensitive to any signs of growth deceleration or contract delays. Additionally, macroeconomic factors such as interest rates and overall market performance could significantly impact Palantir’s stock trajectory in 2026.

| Key Points | Details |

|---|---|

| Current Stock Status | As of December 19, 2025, PLTR shares were around $193.38, up 4.2% for the day, reflecting significant trading volume of about 76.9 million shares. |

| Navy ShipOS Initiative | The U.S. Navy announced a $448 million investment in a Shipbuilding Operating System utilizing Palantir’s software, enhancing shipbuilding efficiency. |

| Nvidia Partnership for AI Infrastructure | Collaborating with Nvidia and CenterPoint, Palantir aims to streamline AI infrastructure construction through a new platform named Chain Reaction. |

| Federal AI Initiative Involvement | Palantir is part of the U.S. Tech Force and agreements with the DOE’s Genesis Mission, reinforcing its ties to federal AI spending. |

| Recent Earnings Highlights | Q3 2025 revenue increased 63% YoY, with a strong forecast for Q4, emphasizing substantial cash flow amid growing demand for AI. |

| Analyst Opinions | Analyst targets vary widely, with a current average at approximately $172.28 and a bull case price at $255 due to concerns over high valuation. |

Summary

Palantir Stock Analysis reveals a dynamic upward momentum going into December 22, 2025, fueled by significant partnerships and government initiatives aimed at enhancing AI capabilities. With the U.S. Navy’s $448 million investment in the Shipbuilding Operating System and collaboration with Nvidia to tackle AI infrastructure challenges, Palantir is solidifying its reputation as a leader in AI-driven solutions. However, despite the robust growth in earnings and revenue, the high valuation poses risks for investors. Therefore, while Palantir’s narrative is strong, the market remains cautious as it approaches the opening of trading, emphasizing the need for execution amid lofty expectations.