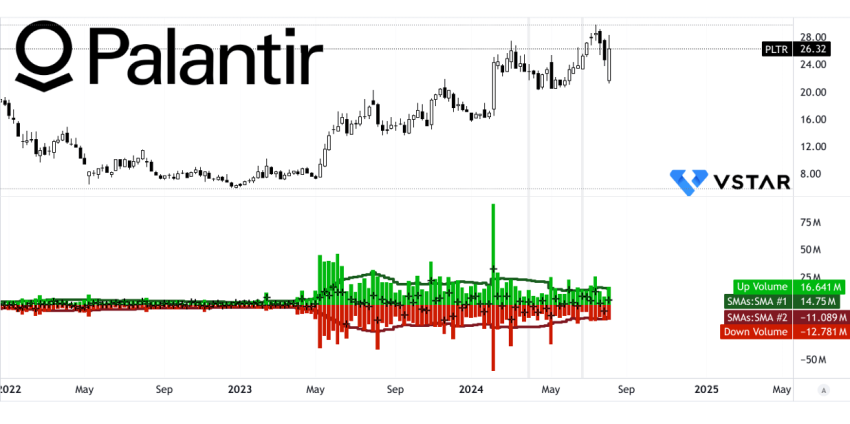

Palantir stock analysis is currently making waves as investors navigate a tempestuous trading environment for Palantir Technologies Inc. (Nasdaq: PLTR). Recently, the stock has experienced volatility, trading at $177.29, reflecting a significant decline of over 5% in a single session. This selloff comes on the heels of substantial returns, with PLTR still boasting an impressive year-to-date increase of 137%. As market analysts delve into PLTR stock news, some are highlighting the potential impacts of insider trading and analyst predictions on price targets. Amid these fluctuations, insights from the recent Palantir earnings Q3 2025 report may offer a glimpse into the company’s resilience and long-term prospects.

A closer examination of Palantir stock reveals the underlying complexities at play in the market for this innovative tech firm. Investors and analysts are attentively watching the company’s updates, particularly the developments surrounding its artificial intelligence initiatives and strategic partnerships. The recent downturn hasn’t overshadowed the bullish sentiment driven by Palantir’s vital collaborations in defense and infrastructure projects. As discussions around Palantir Technologies unfold, the tension between valuation concerns and growth opportunities continues to captivate interest amongst market players, making Palantir stock an intriguing focal point for those tracking tech equities.

Current Market Sentiment on PLTR Stock

As of mid-December 2025, Palantir Technologies Inc., trading under the ticker PLTR, is witnessing a notable downturn in its stock prices. One major factor driving this trend is the fluctuating market sentiment influenced by a mixture of investor anticipation and real-world events. Despite an impressive year-to-date performance where we saw a surge of over 137%, the current trading session reflects a drop of more than 5% in response to concerns about overvaluation and potential insider trading. Market analysis indicates that PLTR’s volatility stems from the market’s fear of insider sales impacting the stock’s momentum, which further complicates investor confidence.

In addition to insider trading fears, the ongoing discussions regarding Palantir’s valuation have caused significant ripples in stock performance. Analysts are noting that the fluctuating nature of PLTR stocks highlights a cycle where investors react sharply to news—good or bad. With the market closely monitoring developments surrounding insider transactions and overall market narratives, the sentiment surrounding Palantir remains agile and decidedly mixed. This environment creates both risks and opportunities for investors, necessitating careful analysis of the broader implications of any news related to PLTR stock.

Key Factors Impacting Palantir Technologies Update

Amidst the recent downturn, several pivotal developments have emerged that continue to solidify Palantir’s operational foothold in various sectors, particularly defense and large-scale industrial applications. The recent partnership with the U.S. Navy, through its ShipOS initiative, promises to revolutionize operational efficiency in shipbuilding—indicating a serious commitment to leveraging AI in practical, mission-critical applications. With an authorization of up to $448 million, this move highlights how the U.S. government is placing significant trust in Palantir’s technology to enhance productivity and reduce operational timelines, underscoring the long-term value of PLTR.

Moreover, Palantir’s efforts in developing infrastructure for AI—with initiatives such as the Chain Reaction project—demonstrate its ambition to integrate deeper into the AI ecosystem. Collaborating with industry leaders like Nvidia and CenterPoint Energy, this strategy underlines Palantir’s objective to not only provide analytics but also to function as a foundational operating system for AI infrastructure. These ongoing initiatives are essential narratives driving investment interest, juxtaposed against the recent stock volatility, thus portraying a company with robust growth potential despite market fluctuations.

Palantir Insider Trading Issues and Their Implications

Insider trading activity is often a hot topic for investors when analyzing stock movements, and Palantir is no exception. Recent reports of CFO David Alan Glazer selling shares of PLTR have sparked discussions among investors regarding the implications of insider trading on stock price stability. This sale, valued at over $1.6 million, although not indicative of a broader trend, contributes to the narrative that influences investor perception of the stock. The markets tend to react sensitively to insider sales, particularly for high-profile companies like Palantir that rely heavily on momentum.

Such incidents of insider trading can lead to quick shifts in market confidence, emphasizing the importance of understanding the broader context behind these transactions. With ongoing uncertainties regarding valuation and future growth potential, any sale can fuel sell-off pressure. As analysts continue to scrutinize insider trading patterns at Palantir, it’s crucial for investors to stay informed on how these actions correlate with the company’s ongoing performance and market sentiment, while also recognizing the balance between essential disclosures and strategic timing by insiders.

Palantir Earnings Q3 2025: Insights and Predictions

The recent earnings report for Q3 2025 was pivotal for Palantir Technologies, providing insight into the company’s financial health despite the prevailing market volatility. Reporting revenues of approximately $1.18 billion and an impressive year-over-year growth of 63%, the figures exceeded expectations and underscored the company’s resilience in the face of economic uncertainty. However, as the stock fell post-announcement, the market reacted to forecasted revenue growth for Q4, which, although slightly less robust than Q3, still exceeded analysts’ predictions.

This nuanced performance illustrates the duality of investor expectations versus actual results, often leading to reactions that might not align with fundamental growth trajectories. Understanding Palantir’s earnings in the context of long-term strategy is critical; as its operational scope expands into areas such as AI infrastructure and defense, sustained growth could stabilize PLTR’s stock despite the occasional turbulence. Future guidance remains a key factor for investors, with analysts carefully weighing forecasts to formulate accurate price targets going forward.

Understanding PLTR Price Targets: Analyst Perspectives

As December approaches its midpoint, Palantir Technologies finds itself at a crossroads, illuminated by divergent analyst perspectives on its stock price targets. With a mixture of buy, hold, and sell recommendations circulating in the market, the absence of a clear consensus reflects the stock’s complex nature. Some analysts, like those from Mizuho, have shifted their price target to $205 while maintaining a neutral stance, emphasizing the need for a balanced outlook in the face of fluctuating market conditions. This varying range of predictions signals underlying tensions between bullish and bearish sentiments surrounding PLTR.

Moreover, the analysts’ insights, including Goldman Sachs’ increment to $188 and Daiwa’s target of $200, provide a valuable context for assessing Palantir’s potential trajectory. The ongoing narrative of insider trading, earnings performance, and technological deployments provides a fertile ground for speculation and volatility. Investors and stakeholders alike should closely monitor these dynamic insights as they play a critical role in shaping market expectations and ultimately influencing trading strategies related to Palantir stock.

Future Projections for Palantir Stock Movements

Looking ahead, speculating on the movement of Palantir Technologies stock is heavily influenced by the broader economic landscape, particularly in the fields of AI and defense. With ongoing partnerships, such as those with the U.S. Navy and the corporate alliances for AI infrastructure, there exists a strong foundation for continued growth. However, the market’s sensitivity to insider movements and valuation concerns underscores the necessity for caution. Investors should keep an eye on upcoming quarterly earnings, as these updates will be integral in assessing whether the bullish trajectory can be maintained, or if bearish trends will persist.

Moreover, the future use of AI in various sectors could redefine the landscape for tech stocks, and Palantir’s position as a frontrunner in this space highlights significant potential for price recovery. As this company ventures beyond strict analytics into operating system capabilities, the potential for stock appreciation is tied closely to its performance in tangible project implementations. Staying abreast of these developments will be key for investors looking to navigate the volatility associated with PLTR.

The Strategic Importance of Palantir’s Defense Sector Partnerships

Palantir’s strategic partnerships in the defense sector, exemplified by its work with the U.S. Navy, serve as crucial drivers of growth and innovation. The recent $448 million partnership for the ShipOS initiative not only signifies substantial financial backing but also reflects the deep integration of AI into mission-critical operations. This collaboration is expected to substantially enhance operational efficiencies for the Navy, showcasing Palantir’s ability to create significant value through technology. For investors, these developments bolster confidence in Palantir’s long-term resilience and innovative capacity in a field where precision and speed are vital.

Furthermore, these defense sector engagements validate Palantir’s reputation as a key player in the AI landscape, where understanding national security requirements is paramount. As the geopolitical landscape continues to evolve, contracts with government entities like the Navy not only provide a revenue stream but also enhance credibility. For stakeholders, this implies a stable foundation for future earnings, suggesting that Palantir may offer a uniquely strategic investment opportunity amidst its volatility. Investors should carefully monitor these developments, as successful implementations could be pivotal in framing future growth narratives.

Deciphering the AI Bubble: Implications for Palantir

In the current economic climate, discussions surrounding the so-called ‘AI bubble’ have gained traction, and Palantir finds itself in the midst of this dialogue. The skepticism that arises during periods of heightened investment speculation can pose risks for companies heavily invested in AI technologies. For Palantir, market apprehension about capital expenditures and the potential for overvaluation are palpable. Such narratives have contributed to dips in stock price, necessitating a thorough evaluation of the company’s long-term strategic initiatives against this fluctuating backdrop.

However, investors must also recognize the potential upside that exists if Palantir can successfully navigate through these turbulent waters. By focusing on substantive deployments and tangible outcomes from its AI initiatives, the company can work to differentiate itself from companies that are purely speculative in nature. Ensuring clarity in where and how their AI technologies are deployed may create a pathway for stability and growth, deflecting the pessimistic narratives that often accompany volatile markets.

Investor Sentiment: Navigating the Palantir Roller Coaster

Investor sentiment towards Palantir Technologies continues to be a roller coaster, characterized by sharp highs and equally significant lows. The interplay of robust technological promises, such as the ShipOS and Chain Reaction projects, juxtaposed with concerns about valuation and insider trading is fueling a climate of uncertainty. This environment highlights the broader challenge for Palantir; as a tech stock with ambitious growth projections, it faces scrutiny from investors who are both hopeful and cautious. The resulting volatility can make investment decisions daunting, particularly for those not closely tracking market fluctuations.

Moreover, understanding the underlying narratives driving sentiment is crucial for informed decision-making. Analysts offer a range of perspectives that reflect this dichotomy, with some bullishly supporting the stock based on operational performance while others issue warnings based on external market pressures. As Palantir continues to unveil new partnerships and projects, investor sentiment will likely oscillate, representing both opportunity and risk. For savvy investors, staying informed and adaptable will be key to capitalizing on PLTR’s stock movements.

Frequently Asked Questions

What are the latest insights on Palantir stock analysis and its recent performance?

As of December 18, 2025, Palantir Technologies Inc. (Nasdaq: PLTR) is experiencing significant volatility, currently trading at $177.29 after a decline of 5.58% for the day. Despite this dip, the stock is still up over 137% year-to-date. Analysts attribute the downturn to concerns regarding valuation and insider trading, although the company’s operational profile remains strong. Recent partnerships, such as the U.S. Navy’s $448 million ShipOS initiative, highlight ongoing support for the bullish narrative surrounding Palantir.

What were Palantir’s earnings results for Q3 2025 and how do they impact the stock analysis?

In Q3 2025, Palantir reported a revenue of $1.18 billion, a 63% increase year-over-year, and an adjusted EPS of 21 cents, surpassing expectations. Looking ahead, Palantir projects Q4 revenue between $1.327 billion and $1.331 billion. These results support a strong bullish stance among many investors, despite some concerns about a slowdown in growth, especially given the stock’s high valuation multiples.

How does insider trading affect Palantir stock analysis?

Insider trading has a significant influence on Palantir stock analysis. Notably, CFO David Alan Glazer’s recent sale of approximately $1.67 million in shares raised concerns about insider sentiment, particularly in a high-momentum environment. Insider selling can unsettle investors and contribute to the stock’s volatility. Therefore, any transaction by insiders is closely monitored and can impact trading behavior and perceptions of Palantir’s financial health.

What are the future price targets for Palantir stock according to analysts?

Analysts have provided a wide range of price targets for Palantir stock, reflecting a divided sentiment in the market. For instance, Goldman Sachs recently raised its target to $188, while Daiwa has set it at $200. Conversely, some analysts maintain a neutral outlook. The divergence among analysts’ recommendations—seven buys, 17 holds, and three sells—highlights the complex valuation dynamics surrounding PLTR.

What key developments are influencing Palantir stock analysis currently?

Current developments significantly impacting Palantir stock analysis include the U.S. Navy’s $448 million partnership under the ShipOS project, which demonstrates substantial real-world deployments of Palantir’s technology. Additionally, the renewal of contracts with international governments, like France’s DGSI, underscores Palantir’s embedded position in critical defense and intelligence operations, bolstering its long-term growth potential despite short-term stock fluctuations.

| Key Aspects | Details |

|---|---|

| Current Trading Status | PLTR trading at $177.29, down 5.58% from the previous day. |

| Year-to-Date Performance | Up 137% year-to-date despite recent pullback. |

| Recent Concerns | Valuation risks and insider selling impacting market sentiment. |

| Key Partnerships | ShipOS partnership with U.S. Navy authorized for $448 million. |

| Earnings Report | Q3 2025 revenue: $1.18 billion, 63% year-over-year growth. |

| Analyst Sentiment | Diverse analyst coverage: 7 buys, 17 holds, 3 sells. |

Summary

Palantir stock analysis reveals that while the company is experiencing a decline on December 18, 2025, the underlying narrative remains strong. Recent contracts and partnerships, particularly in defense and AI infrastructure, underscore the company’s growth potential. Despite facing valuation concerns and market volatility, Palantir has shown resilience with significant year-to-date gains, making it a stock worth watching for potential investors.