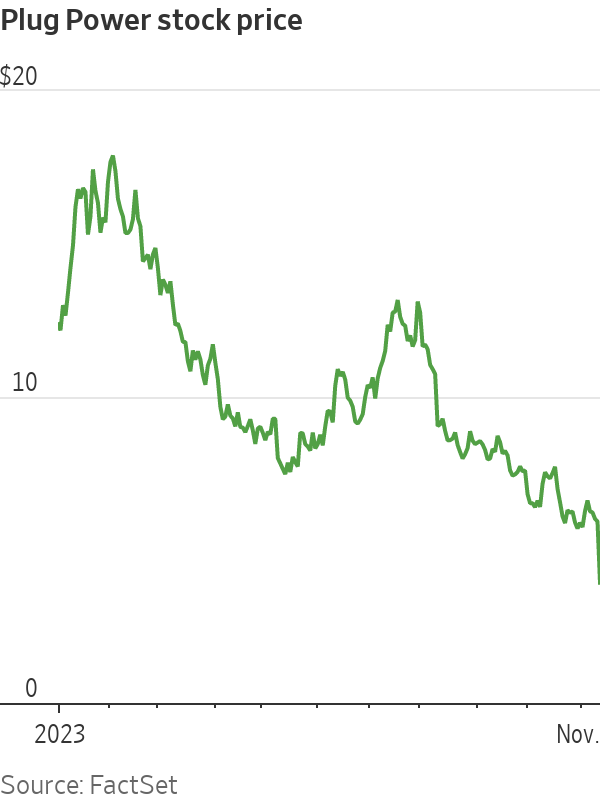

Plug Power stock news is making waves as the shares hover near the $2 mark, following a tumultuous trading period riddled with uncertainty. On December 26, PLUG closed at $2.07, marking a 1.43% decline, adding to concerns reflected in the latest Plug Power stock analysis. Analysts continue to express caution, with many settling on a Hold consensus that leaves investors questioning the long-term investment outlook for Plug Power. As the hydrogen sector evolves, fluctuating PLUG share prices highlight the risks and potential rewards within this emerging market. Investors are looking for fresh updates that could either reinforce or challenge Plug Power’s position in the competitive hydrogen stocks arena as the year draws to a close.

Recent developments surrounding shares of Plug Power Inc. are drawing attention from market analysts and investors alike. The PLUG ticker has been at the heart of discussions about the future of hydrogen energy, particularly as it continues to navigate turbulent market conditions. With a focus on Plug Power’s financial health and market strategies, observers are keenly analyzing the stock’s performance amid varying projections and commentary. As the company prepares for a key governance meeting, the upcoming weeks could prove pivotal in reshaping its investment narrative. Keeping an eye on the latest Plug Power market update will be crucial for those interested in participating in the future of clean energy.

Current Status of Plug Power Stock

As of the latest trading sessions, Plug Power Inc. (NASDAQ: PLUG) is experiencing considerable fluctuation, with shares hovering near the $2 mark. This price point has been a critical psychological threshold for traders, especially following a tumultuous trading week characterized by low volumes and holiday-induced market inertia. Analysts and investors are closely watching for potential catalysts that could provide a necessary boost in the share price, especially given that PLUG’s 52-week range highlights significant volatility. Currently, the stock remains significantly below its 52-week high of $4.58, demonstrating the challenges it faces as it attempts to stabilize.

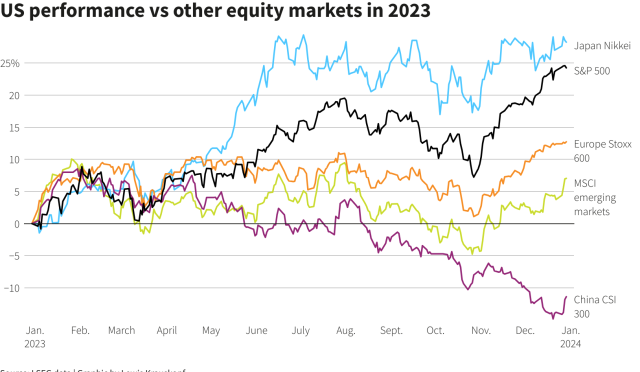

Evaluating the price movement in the context of Plug Power’s broader market performance is crucial for investors. The stock’s recent decline on December 26, 2025, can be attributed to a broader market dip, including slight downturns in notable indexes like the Nasdaq and Dow Jones. This trend underscores the company’s high-beta status—indicating that PLUG shares often react more sensitively to market changes compared to its counterparts in the hydrogen stocks sector. Investors aiming to analyze Plug Power stock must consider not only intra-market comparisons but also understand the overall market sentiment toward energy stocks at this time.

Analyst Sentiment and Investment Outlook

Current analyst sentiment towards Plug Power stock leans heavily towards a ‘Hold’ recommendation, reflecting a cautious approach given the wide disparity in target forecasts. With an averaged projection of $2.80 from various brokerages, investors are reminded that despite some bullish positions, many analysts remain skeptical about the company’s ability to maintain performance amidst prevailing economic uncertainties. This discrepancy highlights a critical point for investors: the conflicting views on whether Plug Power can successfully transition from its historically tumultuous state into a more stable growth trajectory.

Furthermore, the spread of analysts’ ratings—6 sells, 6 holds, 5 buys, and 1 strong buy—illustrates the uncertainty surrounding Plug Power’s path forward. While several brokers see potential for significant upside, others remain adamant about the risks associated with cash burn and operational execution. As the company prepares to navigate these choppy waters, shareholders should remain vigilant of upcoming financial reports and market updates that could sway these predictions.

Insider Activity and Its Implications

Insider trading activity at Plug Power has garnered attention from investors, particularly recent reports of stock transactions involving key executives. Recently, José Luis Crespo, the company’s President & Chief Revenue Officer, purchased 37,300 shares at $2.34, signaling a vote of confidence in the company’s future endeavors. Such insider buying can bolster investor sentiment, as it suggests executives are optimistic about Plug Power’s operational prospects and stock valuation, particularly against the backdrop of its previous highs.

Conversely, the planned sale of 40,000 shares by Chief Strategy Officer Benjamin Haycraft underlines a contrasting sentiment, as insider sales often evoke caution among investors. They can interpret these actions as signs of potential liquidity issues or lack of confidence in short-term performance. Investors must weigh these dynamics carefully, considering how insider sentiment aligns with broader institutional and retail investor perspectives as they monitor Plug Power stock’s trajectory.

Market Updates and Recent Developments

The dynamics surrounding Plug Power stock are currently defined by several market updates, particularly with the approaching special shareholders’ meeting scheduled for January 29, 2026. This meeting will address crucial proposals, including a potential increase in authorized shares, a move that often foreshadows future capital raises that could dilute current shareholdings. As such, this development plays into broader investor concerns regarding capital structure and funding that underpin Plug Power’s strategic initiatives.

In the wake of these developments, Plug’s operational progress continues to evolve as the company secures contracts and forms partnerships. Notably, the award of a NASA contract could validate its market position in supplying liquid hydrogen, a step that may enhance investor confidence if profitability and cash flow management aligns with corporate goals. As stakeholders closely track these unfolding stories, the intersection of operational success and financial prudence will be pivotal in shaping investor sentiment moving into 2026.

Hydrogen Sector Trends Affecting Plug Power

The hydrogen sector is witnessing increasing attention as global energy demands shift towards cleaner alternatives, and Plug Power is strategically positioned within this burgeoning market. As authorities and corporations alike pivot towards hydrogen as a clean energy source, the potential for catalysts that could uplift the PLUG share price increases significantly. The potential expansion into markets such as data centers also highlights how Plug may leverage growing demand amidst the electrification trend.

However, along with these opportunities comes heightened competition and scrutiny within the hydrogen stocks segment. This evolving landscape means that investors should be prepared for volatility as companies navigate regulatory landscapes and technological advancements. Plug Power’s ability to adapt and respond to these market dynamics will prove crucial in determining its longevity and attractiveness to potential investors concerned about long-term sustainability.

Upcoming Catalysts and Investor Strategies

As Plug Power ventures into 2026, several upcoming events are poised to influence trading dynamics significantly. Investors should monitor the timelines of financial reporting and any updates related to financing arrangements, especially due to the heightened focus on the company’s balance sheet durability. Given the latest trends in PLUG’s stock fluctuations amid broader market conditions, timing purchases or reallocating resources could be critical for investors looking to capitalize on future growth.

Furthermore, keeping an eye on market reactions to the outcomes of shareholder meetings and new operational contracts will provide added insights into the company’s trajectory. Investors would benefit from developing strategies that leverage technical analysis, especially around key price levels such as the pivotal $2 mark, and adapting to the unpredictable nature of investment in emerging markets like hydrogen. Anticipating how broader economic factors might interact with Plug Power’s stock movement will aid in crafting informed and timely investment strategies.

Frequently Asked Questions

What is the latest Plug Power stock news regarding PLUG share price?

As of December 26, 2025, Plug Power Inc. (NASDAQ: PLUG) closed at approximately $2.07, reflecting a 1.43% decline for the day. The stock has fluctuated between a low of $0.69 and a high of $4.58 over the past year, underscoring its volatile trading pattern. Investors should keep an eye on the stock’s performance as it navigates the hurdles of cash burn and execution amidst a cautious analyst consensus.

How does the Plug Power investment outlook appear for 2026?

The investment outlook for Plug Power remains uncertain. Analysts predominantly rate the stock as a ‘Hold,’ with average 12-month price targets around $2.80. However, there is significant divergence in forecasts, suggesting cautious sentiment among investors as the company grapples with execution challenges and financing needs. Upcoming governance meetings and potential share increases set for late January 2026 may further influence investor sentiment.

What are the key factors affecting Plug Power stock analysis?

Recent Plug Power stock analysis indicates that volatility is heavily influenced by cash burn rates, insider trading reports, and market liquidity. The stock’s performance is tethered to discussions about the company’s financing strategies, including significant convertible debt offerings to stabilize its balance sheet. Additionally, the company’s ability to secure contracts, such as the NASA liquid hydrogen supply, will be critical for maintaining investor confidence moving into the new year.

What should investors monitor regarding hydrogen stocks like Plug Power?

Investors interested in hydrogen stocks like Plug Power should monitor critical updates such as contract awards, execution efficiency, and financial health reports. Key upcoming events include the special shareholder meeting on January 29, 2026, where proposals potentially leading to equity dilution are expected to be discussed. Keeping an eye on market trends and how PLUG shares react within the broader clean energy landscape is also advisable.

What was Plug Power’s market update as we approach the new year in 2026?

Plug Power’s recent market update highlights shares trading near $2 following significant trading volume during a low-liquid holiday week. There is notable concern regarding the balance between cash needs and operational performance, raising questions about its long-term viability as a leading player in the hydrogen sector. Investors should be prepared for potential shifts in sentiment as the company approaches critical financial disclosures.

| Key Point | Details |

|---|---|

| Current Stock Price | $2.07 as of Dec. 26, 2025, down 1.43% on that day. |

| 52-Week Range | $0.69 (low) to $4.58 (high). |

| Market Cap | Approximately $2.8–$2.9 billion |

| Analyst Consensus | Predominantly Hold/Neutral with average target around $2.80. |

| Recent Insider Activity | One buy (37,300 shares at $2.34) and one sale (40,000 shares at $2.20). |

| Upcoming Events | Special stockholder meeting on Jan. 29, 2026, which includes proposals for increasing authorized shares. |

| Market Sentiment | Cautions abound regarding financing and the company’s ability to stabilize operations. |

Summary

Plug Power stock news indicates that investors should remain cautious as shares hover around $2 amidst mixed analyst opinions and ongoing debates about the company’s financial health. As the stock heads into the new trading week, the focus is on the company’s ability to navigate its financing needs and operational challenges while gaining solid ground on future growth prospects. Investors are advised to keep an eye on upcoming events, such as the special meeting in January, which could significantly impact market sentiment and stock performance.