Private Wealth Asia is navigating a dynamic landscape marked by evolving client expectations and rapid technological advancements. As wealth management strategies shift, Singapore stands at the forefront, balancing the demands of generational wealth with the transformative potential of AI in finance. With a growing focus on transparency in fees, financial professionals are adapting to a more cost-conscious clientele seeking clarity and value. This trend highlights the industry’s need to build trust, particularly among younger investors who prioritize personalized relationships alongside tech-enabled solutions. In this vibrant market, Private Wealth Asia is redefining its approach to ensure that wealth preservation remains a priority, addressing the complexities of contemporary financial needs.

The sector of affluent asset management in Asia is undergoing significant transformation as it responds to both client desires and technological impacts. Singapore’s role as a wealth management hub is being reinforced as it faces competition from global financial centers while striving to meet the challenges of the modern economy. Wealth custodians are increasingly recognizing the value of clear fee structures and the importance of nurturing generational connections. As the industry embraces innovations like artificial intelligence, it also grapples with the necessity of maintaining human relationships that foster trust. This evolving narrative around wealth in Asia speaks to broader changes in how financial advisory services are structured and delivered.

The Evolution of Wealth Management in Singapore

As Singapore stands at the forefront of wealth management in Asia, it is essential to understand the ongoing evolution in this sector. The geography has been a safe haven for affluent individuals seeking stability amidst generational wealth transitions and fluctuating market conditions. The rise of digital tools and platforms has redefined client interactions, yet despite technological advancements, the core principles of trust and personalization remain critical. Singapore’s strong regulatory framework provides not only reassurance but also establishes a strong center of gravity, making it a preferred choice for wealth managers.

However, as the industry evolves, Singaporean wealth management faces challenges that come with new client expectations. The trend is shifting towards greater engagement and transparency in fees, brought about by a more informed clientele. Wealth owners are increasingly seeking clarity about the cost of services, which compels institutions to adopt fee structures that reflect this demand for transparency. The integration of technology continues to play a crucial role here, facilitating easier communication and more efficient transactions for clients, setting Singapore apart from its competitors who may not yet embrace this shift.

Private Wealth Asia: Navigating Generational Wealth

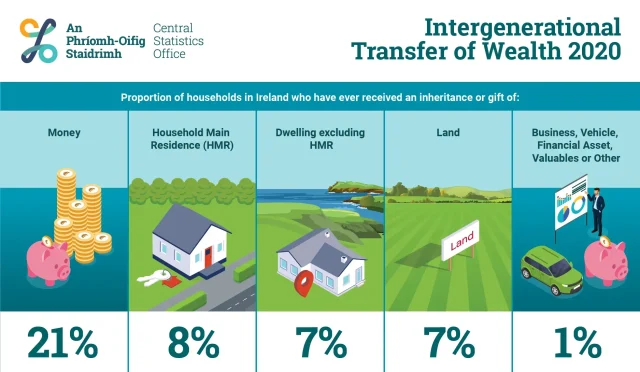

In the context of Private Wealth Asia, generational wealth transfer is a significant theme that reshapes the wealth management landscape. As trillions in assets are poised to change hands, wealthy families must address the challenge of continuity in preserving their values while adapting to younger generations’ more dynamic investment preferences. This transition emphasizes the importance of personalized relationships; younger clients often prioritize engagement with advisors who demonstrate genuine understanding and care for their unique goals.

Moreover, wealth management firms in Asia are beginning to recognize the need for fostering relationships with next-generation clients early on. The statistic that 90% of heirs do not retain their parent’s advisors highlights the urgency of establishing trust and credibility when dealing with younger investors. As generational wealth evolves, wealth management strategies must be rigorously updated to cater to the values of autonomy and responsible risk-taking, with firms bridging gaps through education and engagement to retain this crucial demographic.

Embracing AI in Finance: A Balanced Approach

Artificial intelligence (AI) promises considerable advancements in the wealth management arena, offering significant efficiencies and innovations. Financial companies are investing in AI technologies for operational workflows and client interaction enhancements, which highlight the potential benefits of data-driven decision-making. Nonetheless, many experts, including Urs Brutsch from HP Wealth Management, caution against over-reliance on algorithms, stressing that human judgment remains indispensable in portfolio management.

The prudent application of AI in finance should view it as an enhancer rather than a replacement for human expertise. While AI can streamline administrative tasks and uncover patterns across vast datasets, the human element remains vital in particularly nuanced investment decisions. Trust in professionals who can interpret the insights provided by AI technologies is crucial for clients, illustrating that a harmonious blend of human intuition and technological capability leads to more resilient wealth management strategies.

The Importance of Fee Transparency in Wealth Management

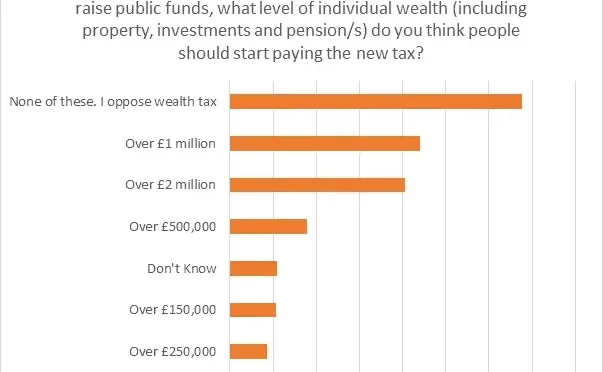

Fee transparency is an emerging trend reshaping repayment models in wealth management, responding to an increasingly discerning clientele. As more clients express concerns over how they are charged for services, firms are compelled to adapt their pricing structures. HP Wealth Management’s shift towards more transparent advisory fees illustrates this transition, revealing a broader industry move towards clarity and predictability in financial dealings. Enhanced fee transparency not only improves client relationships but also builds trust in a sector historically faced with skepticism regarding hidden charges.

Yet, cultural shifts in how fees are perceived can be slow. Many clients remain unaware of the ramifications of transactional pricing models, with traditional practices deeply rooted in the region. As awareness grows, firms must not only educate clients but also evolve internally to incentivize advisors based on client outcomes rather than transaction volumes. This evolution is pivotal in ensuring that wealth management firms align with contemporary expectations while also promoting fairness and accountability in client relationships.

Building Trust with Next-Generation Clients

In a landscape marked by transformation, building trust with the next generation of clients is paramount. Younger investors thoroughly seek relationships that offer not only financial guidance but also shared values and personal understanding. They inherently gravitate towards firms that offer a blend of personal touch and technological fluency, reflecting their comfort with digital platforms. Wealth managers must find ways to engage meaningfully while also embracing the technological evolution that accompanies new generational preferences.

Moreover, fostering these relationships requires a long-term perspective. The wealth management industry must acknowledge that genuine bonds form over time, through consistent interactions and personalized service. Building rapport with younger clients not only serves immediate business objectives but also ensures continuity in client relationships across generations. By prioritizing relationships over transactions, wealth managers position themselves to harness emotional intelligence in guiding future wealth transitions.

Resilience in Private Wealth Management Strategies

Despite the myriad of challenges facing private wealth management, resilience emerges as a vital theme for firms operating in Asia. Investors appreciate the value of long-term relationships, especially in climates that continue to be influenced by economic shifts and political climates. By emphasizing stability and trustworthiness, firms like HP Wealth Management establish a reputation that transcends current trends, affirming their commitment to providing consistent, valuable service.

Managing wealth is not merely about transactions or technology. It is about understanding client aspirations over decades, knowing when to adapt strategies, and remaining steadfast in delivering results that matter to wealth owners. Resilience therefore hinges on maintaining focus on personal relationships while integrating relevant innovations that support, rather than replace, the human element of financial services. In navigating the future of wealth management in Asia, firms that balance innovation with tradition are well poised to thrive.

The Role of Cultural Values in Wealth Management

Cultural values play a significant role in shaping wealth management practices across Asia, particularly in generational wealth dynamics. Wealthy families often prioritize legacy, honor, and family cohesion, driving their decision-making processes. As a result, wealth managers must possess cultural fluency, understanding the importance of family narratives and the weight given to emotional factors in financial decisions. This cultural awareness fosters stronger connections between advisors and clients, promoting loyalty within the wealth management relationship.

Moreover, integrating these cultural considerations into wealth management strategies equips firms to address the unique challenges of wealth transitions. Tailoring services to recognize traditional values while embracing modern financial practices allows firms to create comprehensive multidimensional strategies. By aligning their approaches with the cultural context of their clients, wealth managers in Asia can ensure the effective preservation and growth of wealth across changing generations.

Future Trends in Private Wealth Management

Looking forward, the private wealth management sector in Asia is poised for continued transformation influenced by emerging trends and evolving client expectations. As technology continues to reshape how services are delivered, firms must embrace a hybrid approach, combining digital convenience with high-touch human relationships. This multifaceted service model enables wealth managers to cater to the diverse preferences of their clients, ensuring adaptability in an ever-changing market landscape.

Additionally, there is an increasing recognition of the growing segment of socially responsible investments (SRI) and environmental, social, and governance (ESG) considerations in wealth management strategies. As clients become more aware of their impact on society and the environment, firms that promote sustainable investing practices will have a competitive advantage. By aligning investment opportunities with personal values, firms can deepen their connection with clients while contributing positively to societal goals.

Retaining Clients Through Education and Engagement

Engagement through education is becoming a key component in retaining clients in the wealth management landscape. With rapid changes in the financial markets and investment vehicles, clients crave knowledge that informs their decision-making processes. Providing educational resources, workshops, and one-on-one consultations allows firms to empower clients in understanding their wealth management strategies, increasing satisfaction and loyalty.

Furthermore, a well-informed client is likely to feel more confident in their financial decisions, which translates into long-term relationships with wealth managers. This educational engagement creates an opportunity for firms to differentiate themselves in a crowded marketplace. As wealth management evolves, enhancing client knowledge not only boosts retention rates but fosters a deeper community of informed investors who feel secure in their financial stewardship.

Frequently Asked Questions

What is Private Wealth Asia and how does it relate to wealth management?

Private Wealth Asia refers to the management of substantial assets for high-net-worth individuals in the Asian region, particularly in countries like Singapore. It encompasses fiduciary services, investment strategies, and financial planning tailored to preserve and grow generational wealth for clients.

How is Singapore positioned as a leader in wealth management within Private Wealth Asia?

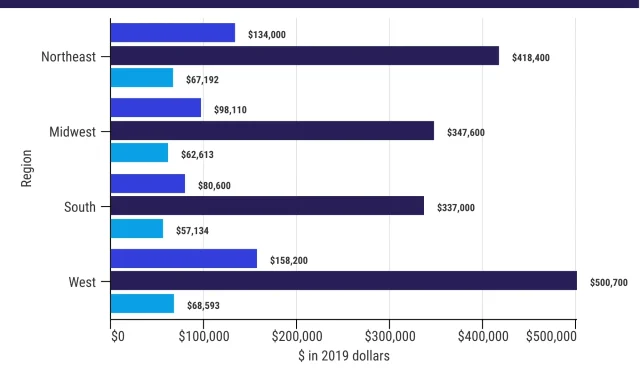

Singapore stands out in Private Wealth Asia due to its political stability, rule of law, and commitment to transparency in fees, making it an attractive hub for wealth management despite emerging competition from cities like Dubai and Hong Kong.

What challenges do wealth management firms face regarding talent in Singapore’s Private Wealth Asia sector?

The wealth management industry in Singapore is facing structural talent shortages, making it increasingly difficult to attract skilled client-facing professionals, which is crucial for sustaining growth in Private Wealth Asia.

How are generational wealth transfers impacting Private Wealth Asia?

As trillions in generational wealth are set to transfer in the coming years, wealth management firms must adapt their strategies to engage the next generation, emphasizing relationship-building and transparency to retain clients.

What role does AI play in Private Wealth Asia’s investment strategies?

While AI is considered a valuable tool for enhancing operational efficiency in Private Wealth Asia, firms like HP Wealth Management emphasize that human judgment remains critical in portfolio construction and investment decision-making.

Why is fee transparency important in the context of Private Wealth Asia?

Fee transparency is vital in Private Wealth Asia as it fosters trust and clarity between wealth managers and clients, helping clients understand the cost structures involved and encouraging a shift from transactional to fee-based advisory models.

How can understanding cultural dynamics improve outcomes in wealth management across Private Wealth Asia?

Understanding cultural dynamics allows wealth management firms to tailor their approaches in Private Wealth Asia, ensuring that they meet clients’ expectations regarding personal relationships and trust, which are often prioritized over purely transactional interactions.

What is the significance of maintaining long-term client relationships in Private Wealth Asia?

Maintaining long-term client relationships is crucial in Private Wealth Asia, as it drives investment consistency and fosters loyalty amidst generational wealth transfers, ensuring clients feel valued and understood over time.

How are private wealth firms adapting to the needs of the next generation in Asia?

Private wealth firms are adapting to the needs of the next generation by offering more tech-enabled services, prioritizing fee transparency, and building direct relationships early to align with younger clients’ values and expectations in Private Wealth Asia.

What are the key benefits of consulting with a wealth management firm like HP Wealth Management in Private Wealth Asia?

Consulting with a wealth management firm like HP Wealth Management in Private Wealth Asia offers personalized investment strategies, greater fee transparency, and a focus on preserving generational wealth through trusted advisor relationships.

| Key Point | Explanation |

|---|---|

| Talent Shortages | Structural issues in Singapore’s employment pass regime make it harder to attract qualified professionals. |

| Fee Transparency | Clients are becoming more cost-aware, leading to a slow shift towards transparency in fee structures. |

| Next-Gen Engagement | Younger clients value personal relationships and tech-enabled autonomy, indicating a trust issue. |

| Role of AI | AI is seen as a useful tool for efficiency, but human judgment remains essential for investment decisions. |

| Longevity in Relationships | Investment consistency is driven by the ongoing priority of wealth preservation across generations. |

Summary

Private Wealth Asia is witnessing a significant reinvention as it adapts to new challenges and opportunities in the wealth landscape. Recent discussions highlight the importance of stability in Singapore amid rising competition from other regions. Key insights reveal the critical balance between technology and personal relationships, especially in engaging the next generation of wealthy clients. While fee transparency evolves slowly, the emphasis on trust and client relationships marks the future of private wealth management in Asia.