Spain wealth tax, a pivotal part of the country’s fiscal landscape, plays a crucial role in wealth distribution and regional funding. This tax, encompassing both statewide and local regulations, is instrumental in addressing the wealth inequality faced by many economies. With the rise of Spain billionaires tax and its emphasis on taxing large fortunes, the debate surrounding wealth taxes in Spain has gained momentum among policymakers and the public alike. The introduction of the solidarity tax Spain further demonstrates the government’s commitment to generating revenue from high-net-worth individuals, especially in the post-pandemic recovery phase. However, discussions about the impact of wealth tax on investment and economic mobility continue to stir opinions across various sectors.

The taxation of personal fortunes in Spain has become a significant point of contention, especially as it relates to rich residents and expatriates. Known informally as the solidarity tax, this wealth levy is designed to ensure that affluent individuals contribute fairly to society. By examining the implications of Spain’s tax policies on real estate investments and wealthy individuals, it’s clear that the structure aims to balance economic interests with social responsibilities. This approach mirrors similar strategies seen in regions with wealth taxes, pushing for shared prosperity while attempting to curb excessive wealth concentration. As the country navigates the complexities of these financial regulations, understanding the nuances of these taxes becomes essential for stakeholders across the economic spectrum.

The Impact of Wealth Taxes in Spain

Wealth taxes in Spain, particularly the solidarity tax, have drawn considerable attention for their role in shaping the financial landscape of the nation. Introduced initially as a response to the fiscal challenges post-2011, the solidarity tax targets individuals with substantial assets, beginning at a net wealth threshold of €3 million. This progressive tax structure, which rises to 3.5% for fortunes exceeding €10 million, serves not only as a means of raising much-needed revenue for public services but also aims to address inequalities in wealth distribution. As a result, the tax has successfully generated billions, bolstering local budgets and funding critical services such as healthcare and education.

Despite fears of a mass exodus among the wealthy, the statistics paint a different picture. The number of billionaires in Spain has actually increased since the tax’s introduction, suggesting that the wealthiest individuals have opted to adapt rather than abandon their roots. This demonstrates how effective tax strategies, like Spain’s wealth tax, can operate without driving away affluent residents, providing a potential model for other nations considering similar measures.

Understanding Spain’s Billionaires Tax

The Spain billionaires tax reflects a growing trend across Europe where governments seek to impose levies on the ultra-wealthy to mitigate economic disparities exacerbated by global crises. This tax is seen as a statement against the increasing concentration of wealth, operating on the premise that those who possess immense riches should contribute their fair share to societal welfare, especially during times of need. The implementation of this tax has been strategic, prioritizing revenue collection while simultaneously attempting to protect essential public services.

Critics argue that such taxes could deter investment or encourage rich individuals to relocate to more tax-friendly environments. However, the case of Spain illustrates that wealthier citizens, like Amancio Ortega, often choose to remain and reinvest their fortunes locally despite the taxes. This suggests that a well-structured wealth tax can coexist with the interests of billionaires, especially if the tax’s revenues are earmarked for beneficial social programs that enhance community well-being and infrastructure.

Solidarity Tax: A Progressive Move for Equity

The solidarity tax in Spain has emerged as a progressive measure aiming to ensure a more equitable distribution of wealth. Implemented after the pandemic, this tax targets individuals with significant net worth, providing exemptions for primary residences and lower caps for combined income and wealth taxes. As Spanish society grapples with the challenges of wealth inequality, the solidarity tax is positioned as a necessary tool to provide essential public services and foster equitable resource allocation among citizens.

Since its inception, the tax has proven effective, generating considerable revenues and demonstrating that the wealthy can contribute to the collective good without sacrificing their investments or efforts. The ongoing debate surrounding the tax underscores the necessity for a balance between encouraging investment and ensuring fair taxation, which ultimately cultivates a sustainable and inclusive economic environment.

Real Estate and Wealth Taxes in Spain

Spain’s real estate market has been significantly influenced by the country’s wealth tax policies. Many of Spain’s most affluent individuals have invested heavily in property, leading to increased demand and rapidly rising prices, especially in major urban centers like Madrid and Barcelona. The wealth tax, which encompasses global assets, has encouraged many to invest in real estate to secure their wealth against taxation, thereby transforming it into a tangible asset.

However, the strategic implementation of this tax also raises concerns regarding housing affordability for average citizens. As wealthy individuals continue to drive up property prices, local governments must navigate the complex relationship between attracting investment and addressing the need for affordable housing. Policymakers are thus tasked with ensuring that wealth taxes contribute to community betterment rather than exacerbating existing inequalities in the real estate market.

Long-Term Effects of the Wealth Tax

The long-term effects of wealth taxes, particularly Spain’s solidarity tax, on the socioeconomic landscape remain to be fully understood. While they serve to generate substantial revenues for public services, there are concerns about potential disincentives for entrepreneurship and large-scale investments. As the landscape of wealth taxation evolves, it will be crucial to monitor its implications on business growth and the broader economy.

Furthermore, the success of Spain’s wealth tax could set a precedent for other nations contemplating similar measures. Learning from Spain’s approach may help countries design tax systems that enhance public welfare while maintaining an attractive environment for investment. The ongoing dialogue around the consequences of wealth taxation highlights the need for fiscal policies that address inequality without stifling economic innovation or mobility.

The Debate Surrounding Wealth Tax Revenue Allocation

A key aspect of the discussion about wealth taxes in Spain revolves around how tax revenues are allocated at regional and national levels. Since its reintroduction, the solidarity tax has been instrumental in funding local services and projects that have direct impacts on citizens’ lives, such as healthcare and education. This allocation system not only provides a financial safety net during challenging economic times but also reinforces the importance of wealth taxes as a means of ensuring community support.

However, the equitable distribution of these funds remains critically important. Policymakers must ensure that the revenue generated from wealth taxes benefits all layers of society and not just the affluent. By promoting transparent and effective usage of tax revenue, Spain can maintain public confidence in the system and encourage more residents to support or comply with existing tax frameworks.

Challenges in Implementing Wealth Taxes

Implementing wealth taxes, like Spain’s solidarity tax, isn’t without its challenges. One significant issue is the valuation of assets, particularly for individuals with non-liquid assets like real estate or investments in private companies. Determining the true market value can be contentious and complex, leading to disputes and ensuring compliance from those subject to the tax.

Furthermore, there is the risk of tax avoidance strategies where high-net-worth individuals may seek loopholes or setting up complex financial structures to minimize their taxable wealth. Addressing these challenges requires a robust framework of regulations and oversight, ensuring that wealth taxes can function effectively while upholding their intended purpose of redistributing wealth fairly.

Comparative Analysis: Wealth Taxes Across Europe

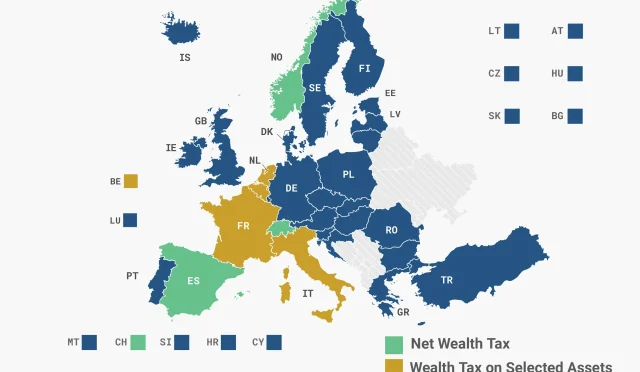

Looking across Europe, Spain’s wealth tax is part of a diminishing trend where such levies have become less common in recent decades. Compared to neighboring countries, where inheritance taxes or capital gains taxes often replace wealth taxation, Spain’s approach stands out as one of the few remaining models that actively seeks to tax wealth itself. This divergence offers insight into various European countries’ fiscal strategies and public policy priorities.

Examining how wealth taxes are structured and enforced in different regions can yield valuable lessons for policymakers considering similar measures in their own countries. Whether it’s through progressive tax rates or ensuring fair allocation of funds, Spain provides a unique case study in navigating the complexities of wealth taxation in a way that promotes equity without stifling economic growth.

Strategies for Future Wealth Tax Reforms

As Spain continues to adapt its wealth tax policies, exploring innovative strategies for reform will be crucial. Future reforms could focus on streamlining asset valuation processes, reducing administrative burdens for both taxpayers and the tax authorities. Simplifying the compliance process can enhance taxpayer morale and reduce the temptation to evade or minimize wealth tax obligations.

Moreover, public awareness campaigns highlighting the direct benefits of wealth taxes could foster broader acceptance and support. By clarifying how revenues are employed, such as funding education, infrastructure, and healthcare, Spain can ensure that debates around wealth taxation remain constructive and less focused on the notion of penalizing the rich. Such strategies can help craft a fairer tax system that is supported by all segments of society.

Frequently Asked Questions

What is Spain’s wealth tax and how does it function?

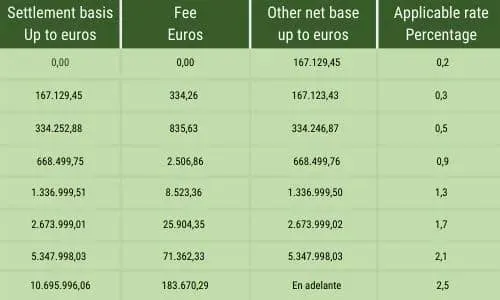

Spain’s wealth tax, established in 1978, is an annual tax levied on individuals based on their net wealth. It is applicable to worldwide assets and starts at a rate of 1.7% for net wealth exceeding €3 million, increasing to 3.5% for individuals with assets over €10 million. There are exemptions for the first €700,000 of wealth and €300,000 for a primary residence.

What is the solidarity tax in Spain and who does it affect?

The solidarity tax in Spain is a specific wealth tax introduced to ensure equitable regional revenue collection from large fortunes. It targets individuals with significant net wealth, activating at €3 million, with the intent to assist public spending, particularly after the pandemic. It affects high-net-worth individuals and aims to distribute wealth more evenly across Spain.

How do wealth taxes in Spain impact property prices?

Wealth taxes in Spain can lead to higher property prices due to increased demand from wealthy individuals looking to invest in real estate before tax deductions apply. For example, when wealthy individuals relocate to avoid taxation or when regions lower their wealth tax rates, property values can rise significantly due to increased competition among high-net-worth individuals.

Has the introduction of wealth and solidarity taxes in Spain driven away billionaires?

Contrary to initial fears, the implementation of wealth taxes and the solidarity tax in Spain has not resulted in a mass exodus of billionaires. Instead, the number of billionaires in Spain increased from 26 in 2021 to 34 in 2023, indicating that many wealthy individuals remain, even amidst tax pressures.

What criticisms are associated with the impact of wealth taxes in Spain?

Critics argue that wealth taxes can discourage investment and economic growth by imposing financial burdens on high-net-worth individuals. Others contend that while they aim to promote a fair distribution of wealth, they may lead to increased costs of living and property prices, ultimately impacting the broader economy.

How do Spain’s wealth taxes compare to similar taxes in other countries?

Spain is one of the few European nations still enforcing a wealth tax, alongside Norway and Switzerland. Unlike other countries where wealth is taxed upon transactions (like capital gains and inheritance), Spain’s model is unique in applying an annual tax based on total net assets, which could influence other nations contemplating similar tax structures.

What role does the government play in managing revenue from Spain’s wealth tax?

The revenue generated from Spain’s wealth tax is critical for regional governments, with the intention to support local public services. The solidarity tax aims to centralize some of this revenue to ensure equitable distribution, especially in areas experiencing financial strain, following the COVID-19 pandemic.

What factors should individuals consider regarding Spain’s wealth and solidarity taxes?

Individuals with significant net wealth should consider the current tax obligations under Spain’s wealth tax and solidarity tax, the exemptions available, and the economic impact of these taxes on their investments. Consulting financial advisors for strategic planning is advisable to navigate potential tax liabilities effectively.

| Aspect | Details |

|---|---|

| Wealth Tax Background | Spain has implemented a wealth tax since 1978, aimed at ensuring the wealthy contribute to public finances. |

| Recent Developments | In 2023, Spain introduced a solidarity tax for wealthy individuals, starting at 1.7% for those with net wealth above €3 million. |

| Impact on Wealthy | The anticipated mass exodus of billionaires did not occur; instead, the number of billionaires increased from 26 in 2021 to 34. |

| Regional Variations | Some regions have lowered or eliminated wealth tax rates to boost investment, prompting discussions on equitable revenue distribution. |

| Social Implications | The solidarity tax promotes wealth distribution and attempts to minimize the power imbalance created by wealth concentration. |

Summary

Spain wealth tax is a crucial aspect of the country’s revenue system, uniquely balancing wealth contributions while retaining affluent residents. Initiated in 1978, the tax aims to ensure the wealthy contribute fairly to public finances, especially following economic crises. Despite initial fears of losing wealthy residents to lower-tax regions or countries, the tax has so far been effective in maintaining Spain’s billionaire population and generating significant revenue. As Spain continues to adapt its wealth tax policies, it provides a vital case study for other nations contemplating similar fiscal strategies.

#SpainWealthTax #Billionaires #EconomicPolicy #TaxReform #GlobalFinance