The migration of millionaires to Switzerland is witnessing a notable surge, cementing the country’s reputation as a premier destination for the wealthy. Known as a tax haven for the rich, Switzerland has resisted implementing higher taxes that would affect its affluent residents, further solidifying its appeal in global millionaire migration trends. The recent rejection of a proposed national tax on large inheritances highlights Switzerland’s commitment to maintaining its favorable tax policies, which continue to attract high-net-worth individuals seeking effective wealth management solutions. Prominent figures in the banking sector, such as EFG International AG’s CEO Giorgio Pradelli, assert that Switzerland will remain unparalleled as a financial center for the elite. With a robust economy and strategic tax advantages, it’s no wonder that wealth continues to flow into this Alpine nation, making it a sanctuary for millionaires around the world.

Switzerland has long been recognized as a sanctuary for the wealthy, offering a combination of political stability, strong privacy laws, and attractive financial services. The ongoing trend of affluent individuals relocating to this European haven reflects a broader shift in wealth concentration, often referred to as elite migration. As countries compete to create more favorable environments for billionaires, Switzerland’s enduring appeal lies in its reputation as a low-tax jurisdiction, coupled with its renowned wealth management capabilities. This influx of high-net-worth individuals not only reshapes the demographic landscape but also underscores the significance of the Swiss financial sector in global economies. Ultimately, the dynamics of millionaire relocation continue to make Switzerland a focal point in discussions surrounding economic prosperity and wealth distribution.

Switzerland: The Ultimate Tax Haven for Millionaires

Switzerland has long been regarded as a premier destination for the affluent, particularly due to its favorable tax policies that continue to attract a large number of high-net-worth individuals. The recent rejection of a proposed tax on inheritances exceeding 50 million francs underscores Switzerland’s commitment to maintaining its appeal as a tax haven for the rich. By upholding its low tax rates and prioritizing wealth management, Switzerland nurtures an environment where millionaires can not only preserve but also grow their assets without the burden of excessive taxation.

In addition to its favorable tax policies, the country boasts a robust financial center that offers a range of services tailored to the unique needs of the wealthy. Financial institutions in Switzerland provide world-class wealth management services, focusing on asset protection and investment opportunities. This emphasis on personalized banking solutions further solidifies Switzerland’s status as the go-to locale for millionaires looking to maximize their wealth while enjoying quality of life and political stability.

Millionaire Migration Trends: Why Switzerland Remains a Top Choice

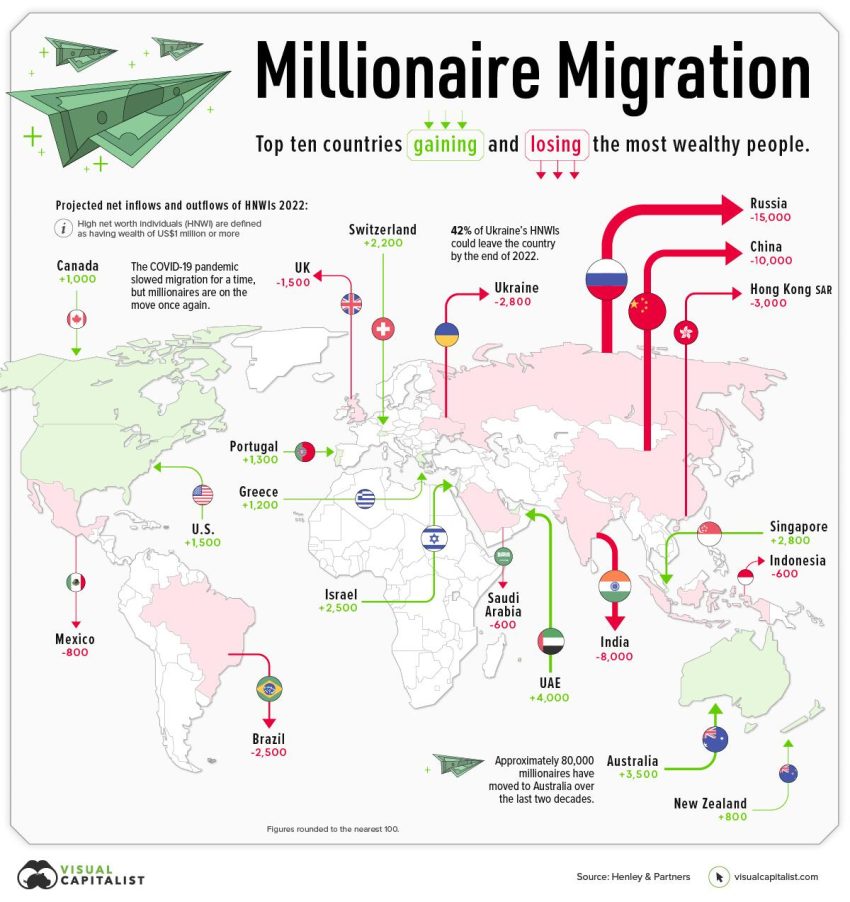

The migration of millionaires has become a significant trend in recent years, driven by factors such as tax advantages, lifestyle choices, and investment opportunities. According to studies, Switzerland has consistently ranked near the top as a favored destination for millionaires seeking refuge from increasing tax burdens in their home countries. As more affluent individuals look for countries with stable economies and a high standard of living, Switzerland’s unique blend of financial incentives and quality of life continues to make it an attractive option.

Recent reports indicate that despite the increasing competition from emerging tax havens like the United Arab Emirates and established centers like the United States, Switzerland remains in the mix as a prime location for millionaire migration. The presence of a highly skilled workforce, coupled with a safe business environment, ensures that newcomers can integrate quickly and benefit from local resources. This migration trend highlights a broader global shift towards strategic relocation in pursuit of favorable financial landscapes.

The Influence of Switzerland’s Financial Center on Global Wealth Management

Switzerland’s financial center is often recognized for its stability and reliability, which greatly influences global wealth management strategies. Wealth management firms in Switzerland cater to an elite clientele, employing sophisticated strategies that protect and grow wealth across generations. The country’s regulatory environment is designed to foster transparency and security, making it an ideal setting for investors who want to safeguard their assets while exploring options in international markets.

Furthermore, the concentration of financial expertise and innovative investment solutions available in Switzerland positions it as a leader in the wealth management arena. Private banks and financial institutions provide tailored advice that addresses the specific needs of millionaires. Their focus on sustainable investments and philanthropic initiatives resonates with clients looking to make a positive impact while securing their financial future.

Switzerland’s Competitive Edge in Attracting Millionaires

Despite the challenges posed by competing nations, Switzerland continues to showcase a competitive edge in attracting millionaires. Key factors such as its high quality of life, exceptional healthcare system, and excellent education opportunities for children serve as strong incentives for wealthy individuals and their families. These features create not only a desirable living environment but also an assurance that their loved ones will enjoy a prosperous upbringing in a stable society.

Additionally, Switzerland’s efficient public transport, exquisite landscapes, and cultural heritage contribute to an appealing lifestyle that many millionaires crave. Compared to countries with aggressive taxation policies, Switzerland’s more measured approach allows residents to maintain their wealth while enjoying all the privileges of comfortable living. These advantages play a crucial role in reinforcing Switzerland’s place among the preferred destinations for millionaire migration.

The Role of Political Stability in Switzerland’s Wealth Attraction

Switzerland’s unique political stability significantly influences its appeal as a sanctuary for the wealthy. The country operates under a long-standing tradition of neutrality, which not only protects it from international conflicts but also creates a predictable environment for investments. Millionaires are drawn to this stability as it underscores a secure backdrop against which they can plan their financial futures, further enhancing Switzerland’s allure as a tax haven for the rich.

Moreover, the stability provided by the Swiss political system offers assurances to investors that their rights will be protected over the long term. This confidence in a stable legal framework ensures that families can accumulate and pass on their wealth through generations. Consequently, the political landscape in Switzerland plays a pivotal role in its capacity to attract and retain high-net-worth individuals from around the globe.

Switzerland’s Reaction to Global Wealth Distribution Trends

In light of global wealth distribution trends which have seen significant wealth concentration among the richest, Switzerland remains keenly aware of its responsibilities and the implications of its tax policies. The country’s decision to reject an inheritance tax on the wealthy reflects its attempt to balance social equity with the need to attract and retain millionaires. By doing so, Switzerland acknowledges the importance of maintaining the incentives that draw wealthy individuals to its shores, thus continuing to solidify its status as an international financial hub.

This proactive approach signals to potential migrants that Switzerland is not just a tax haven, but also a place that allows for the possibility of contributing positively to society. By fostering an environment where wealth can be amassed without excessive governmental interference while also participating in societal growth, Switzerland stands to reinforce its reputation among wealthy migrants looking for places with ethical investment opportunities.

Tax Policy and Its Impact on Millionaire Migration in Switzerland

Switzerland’s tax policy plays a crucial role in influencing millionaire migration dynamics. With certain cantons offering attractive tax incentives, wealthy individuals find Switzerland to be an appealing destination compared to other countries that impose higher tax burdens on wealth. Despite global pressures for more equitable wealth distribution, the policy adjustments that favor the affluent ensure that Switzerland retains its status as a premier choice for rich migrants seeking fiscal advantages.

Moreover, the flexibility within Switzerland’s tax framework allows for personalization and optimization of tax strategies, further captivating potential migrants. As Switzerland continues to uphold its tradition of favorable taxation for millionaires, it positions itself as an enduring sanctuary for the wealthy, emphasizing its commitment to providing a unique financial landscape that other nations struggle to match.

The Future of Millionaire Migration to Switzerland

Looking ahead, the future of millionaire migration to Switzerland appears promising. With the ongoing trends indicating an increase in wealthy individuals relocating to favorable tax environments, Swiss cities are likely to continue attracting affluent newcomers. This influx will be driven not only by Switzerland’s long-established reputation as a tax haven but also by its high standard of living and robust safety measures that cater to affluent lifestyles.

As the global economy evolves and competition among countries for attracting wealth intensifies, Switzerland’s unique blend of privacy, security, and wealth management expertise will likely keep it in the minds of millionaires seeking to relocate. With projections estimating continued growth in millionaire populations worldwide, Switzerland’s capacity to adapt and innovate will be crucial to maintaining its position at the forefront of global wealth migration.

Frequently Asked Questions

What attracts millionaires to migrate to Switzerland?

Switzerland is widely regarded as a premier wealth management hub and a tax haven for the rich. Its favorable tax policies, robust financial center, and political stability make it an appealing destination for millionaires seeking both safety and opportunity. The recent decision to dismiss a proposed national tax on inheritances further reinforces Switzerland’s attractiveness to wealthy individuals looking to invest and reside in a favorable environment.

How does Switzerland’s tax policy impact millionaire migration trends?

Switzerland’s tax policy is designed to be attractive for high net worth individuals, contributing significantly to millionaire migration trends. By maintaining a low tax environment and rejecting higher taxes aimed at the ultra-rich, Switzerland continues to solidify its status as a primary destination for millionaires from around the globe.

Is Switzerland still the top location for millionaires despite increasing competition?

Yes, Switzerland maintains its position as the top choice for millionaires migrating globally, despite competition from other countries. According to experts, its status as a leading wealth management center and favorable tax policies ensure it remains a preferred destination for affluent individuals even as billionaire havens in the Middle East and Asia rise.

What are the benefits of wealth management in Switzerland?

Wealth management in Switzerland offers numerous benefits including personalized financial services, strong privacy laws, and a stable economic environment. These factors, combined with its reputation as a financial center, attract wealthy individuals and contribute to the ongoing trend of millionaire migration to the country.

Why is Switzerland considered a tax haven for the rich?

Switzerland is considered a tax haven for the rich due to its low tax rates, absence of inheritance taxes, and favorable living conditions that attract high net worth individuals. The country’s tax policies facilitate wealth preservation and growth, making it a compelling option for millionaires seeking to relocate.

Which regions contribute most to millionaire migration to Switzerland?

Countries like the United Kingdom and Scandinavia contribute significantly to millionaire migration to Switzerland. As these regions face rising tax rates, many affluent individuals seek the advantages of Switzerland’s wealth management services and favorable tax policies, leading to an influx of new residents.

How is the Swiss financial center adapting to global trends in millionaire migration?

The Swiss financial center is adapting to global trends by enhancing its wealth management services and maintaining an environment conducive to attracting affluent individuals. Initiatives to bolster financial stability while offering competitive tax advantages are key strategies ensuring Switzerland remains a sought-after destination for millionaires.

What recent developments have influenced Switzerland’s status as a migration haven for millionaires?

Recent developments such as the rejection of a new tax on inheritances significantly influenced Switzerland’s status as a migration haven for millionaires. This decision reflects the country’s commitment to maintaining an appealing economic environment, thereby attracting even more high net worth individuals seeking to migrate.

| Key Point | Details |

|---|---|

| Switzerland’s Tax Policy | Rejected a tax on inheritances/gifts over 50 million francs (about $62 million), reinforcing its appeal to the wealthy. |

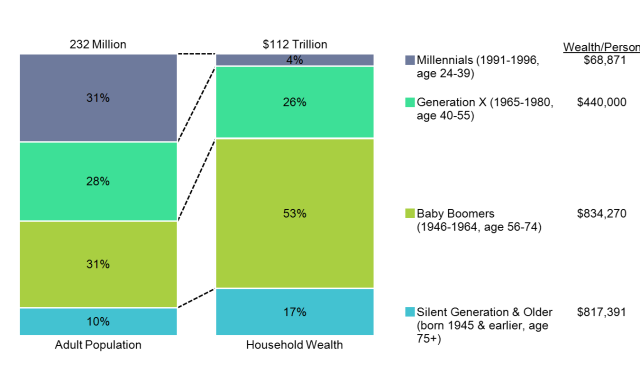

| Wealthy Population | Approximately 2,500 individuals affected by the proposed tax, significant wealth concentrated among the top 300 residents with a total worth of 850 billion francs. |

| Millionaire Ratio | Ranks first globally with about 145 millionaires per 1,000 adults, indicating that one in seven Swiss adults is a millionaire. |

| Competition from Other Nations | Increasing competition from the UAE, USA, and Italy for wealthy migrants. UAE tops the list owing to its zero income tax. |

| Future Projections | The migration of millionaires is expected to rise, with projections of 162,000 relocations globally by 2026. |

| Inflow from Regions | Increased arrivals from Scandinavia and the UK, driven in part by tax increases in Britain. |

Summary

Switzerland millionaires migration is set to continue as Switzerland solidifies its reputation as a sanctuary for the wealthy. The recent rejection of a tax aimed at the ultra-rich highlights the country’s commitment to maintaining an attractive environment for affluent individuals. Amid rising global competition, especially from the UAE and the US, Switzerland remains a top contender for millionaires seeking favorable conditions. Its robust financial sector, coupled with a high density of millionaires and favorable tax policies, ensures that it will continue to welcome an influx of wealthy migrants in the coming years.