Trajan Wealth is a prominent registered investment advisor (RIA) based in Scottsdale, Arizona, managing approximately $2.5 billion in client assets. Renowned for its sophisticated wealth management services, Trajan Wealth caters to individuals at varying wealth tiers, from the mass affluent to high-net-worth investors. The firm is dedicated to delivering a comprehensive investment strategy that incorporates private equity investments, retirement planning, and personalized financial services. By merging tailored solutions with a holistic view of client needs, Trajan Wealth ensures that each client is equipped to navigate the complexities of their financial journey. This commitment to exceptional service positions Trajan Wealth as a leader in high-net-worth investment services, where every financial goal is a priority.

Trajan Wealth stands out as a distinguished player in the financial advisory landscape, offering an extensive range of asset management solutions tailored to a diverse clientele. This firm specializes in sophisticated financial planning methodologies, helping clients manage their investment portfolios while prioritizing retirement outcomes. By focusing on private equity opportunities and strategically allocated investment choices, Trajan Wealth elevates the wealth management experience for its clients. With an emphasis on personalized service, they proficiently handle the multifaceted needs of high-net-worth individuals and families. As such, Trajan Wealth exemplifies a modern approach to achieving financial security and growth.

Understanding Trajan Wealth’s Comprehensive Wealth Management Strategy

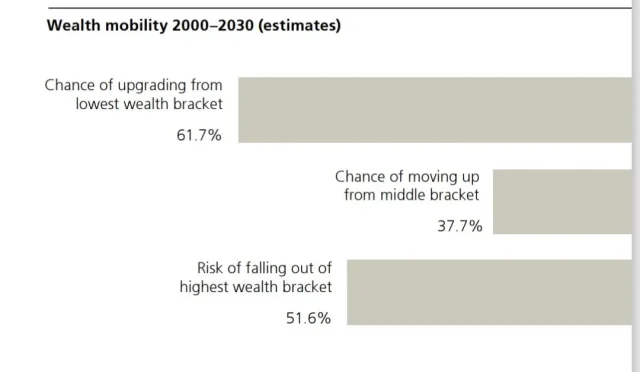

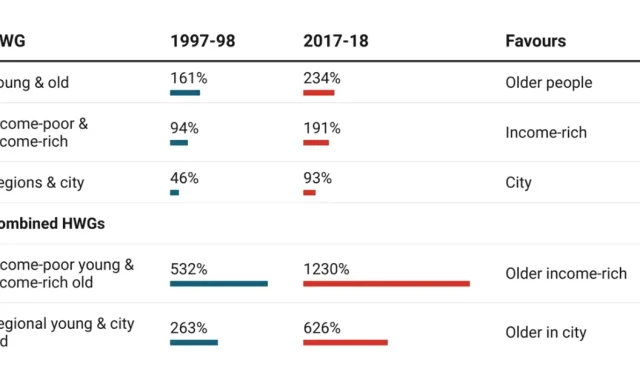

Trajan Wealth, with its $2.5 billion in assets, exemplifies a robust wealth management strategy crafted to cater to varying tiers of the wealth spectrum. The firm identifies its clients as falling into three main segments: the mass affluent, high-net-worth, and ultra-high-net-worth individuals. This stratification allows Trajan Wealth to tailor its services, ensuring that both conservative and aggressive investment approaches can be applied depending on the client’s financial situation and aspirations. With services spanning from investment management to estate planning, Trajan Wealth positions itself as a one-stop solution for all wealth management needs.

In today’s complex financial landscape, organizations like Trajan Wealth recognize the importance of a comprehensive strategy. Their approach is not solely about wealth accumulation but encompasses maintaining and protecting that wealth through retirement planning and risk management. By integrating various services under one roof, Trajan Wealth enhances the client experience, ultimately fostering long-lasting relationships and delivering personalized service that echoes throughout their diverse offerings.

Private Equity Investments and Trajan Wealth’s Allocation Strategy

At Trajan Wealth, private equity investments are central to their diversified allocation strategy. By selecting specific opportunities for clients to participate as limited partners in private equity funds, Trajan Wealth ensures that due diligence is meticulously performed, thereby minimizing investment risks and maximizing potential returns. Unlike traditional fund-of-funds approaches that can obscure potential profitability with additional fees, Trajan favors a hands-on investment style, targeting boutique firms that operate within the upper middle-market. This focus has historically allowed their clients to experience superior returns compared to larger competitors.

Trajan Wealth’s investment strategy includes a broad spectrum of alternative investments, which not only enhances portfolio diversification but also aims to provide crisis alpha through managed futures products. This proactive stance is critical as economic conditions fluctuate, allowing the firm to pivot strategically based on market dynamics. Their approach to constructing private equity portfolios reflects a commitment to meeting the evolving financial goals of their accredited clients while maintaining a careful balance of risk and reward.

Retirement Planning Tailored for High-Net-Worth Individuals

Retirement planning is a crucial aspect of wealth management, particularly for high-net-worth individuals who describe a life of unique financial complexities. Trajan Wealth recognizes that these clients often demand tailored solutions that align with their long-term financial goals, which is why they offer personalized retirement strategies. This planning includes various financial vehicles, ensuring clients have multiple streams of income during retirement—critical for sustaining their lifestyles without depleting their wealth.

In addition to traditional retirement planning, Trajan Wealth also considers each client’s risk tolerance and liquidity needs, adapting their strategies accordingly. This personalized approach allows for comprehensive discussions about anticipated expenses, potential healthcare costs, and lifestyle choices beyond retirement. By offering such detailed planning, Trajan Wealth empowers clients with the knowledge and confidence necessary for making informed decisions regarding their financial futures.

The Role of Asset Allocation in Wealth Management

Asset allocation serves as the cornerstone of effective wealth management, crucial for balancing risk, security, and growth across a client’s portfolio. Clients at Trajan Wealth benefit from custom-tailored asset allocation models that reflect individual risk profiles and market conditions. Whether clients prefer an aggressive allocation focused on high-growth stocks or a conservative model with a fixed-income emphasis, Trajan Wealth’s experts are adept at employing various investment vehicles to optimize returns and safeguard against volatility.

Regular reassessment of asset allocations is a proactive measure that Trajan Wealth uses to maintain alignment with the client’s financial goals and market conditions. As David Busch explained, their team reviews individual portfolios quarterly, taking into account not only investment performance but also changes in clients’ financial circumstances. This dynamic strategy ensures that clients can adapt to the ever-changing market landscape, maintaining a focus on long-term financial success.

Estate Planning: An Integral Service for Wealth Preservation

Estate planning is a vital aspect of Trajan Wealth’s comprehensive service offering, particularly for high-net-worth individuals concerned about preserving their wealth for future generations. Effective estate planning goes beyond mere wealth transfer; it encompasses strategies that minimize tax liabilities and protect assets from unforeseen challenges. Trajan Wealth incorporates tailored solutions into their estate planning process, ensuring that clients’ wishes are honored while maximizing the value of their estate.

The firm emphasizes the importance of communication between clients and their estate planning advisors. Trajan Wealth fosters discussions that cover essential topics, including wills, trusts, and other estate planning tools. By doing so, they not only help clients navigate complex legal frameworks but also facilitate sincere conversations about family legacies and intentions. This comprehensive approach fosters a greater peace of mind for clients, knowing their wealth management strategy thoughtfully includes the future of their family’s financial legacy.

Why Choose Trajan Wealth for High-Net-Worth Investment Services?

Choosing the right wealth management firm is crucial for high-net-worth individuals, and Trajan Wealth stands out for its commitment to personalized service and strategic investment management. With extensive experience navigating complex financial landscapes, Trajan Wealth offers tailored high-net-worth investment services that align with individual goals. Their collaborative approach, informed by deep market insights, empowers clients to make informed decisions that resonate with their financial aspirations.

Moreover, with a comprehensive understanding of both traditional and alternative investments, including private equity and fixed-income strategies, Trajan Wealth equips clients with the tools necessary to navigate diverse investment opportunities. This responsive and flexible approach reflects a dedication to adapting strategies in alignment with market conditions and clients’ evolving needs, reinforcing Trajan Wealth’s reputation as a premier choice for sophisticated investors seeking dedicated wealth management guidance.

Navigating the Complexities of Tax Planning with Trajan Wealth

Tax planning is an often-overlooked area in wealth management that plays a significant role in enhancing clients’ financial outcomes. At Trajan Wealth, tax efficiency strategies are integrated into their overall wealth management framework, aimed at maximizing clients’ investment returns while minimizing tax burdens. By leveraging a variety of tax strategies, including capital gains management and tax-loss harvesting, the firm helps ensure that clients can preserve more of their wealth.

The importance of proactive tax planning cannot be understated, especially as tax laws evolve and personal circumstances change. Trajan Wealth’s team works closely with clients to assess their unique tax situations, identifying potential benefits from tax-saving strategies. This integration of tax planning with broader financial goals reinforces the firm’s commitment to delivering comprehensive wealth management services that address the multifaceted needs of their clientele.

Addressing the Growing Trend of Alternative Investments

As investor sentiment shifts towards alternative investments, Trajan Wealth recognizes this trend and incorporates alternatives into its comprehensive wealth management approach. Private equity, real estate, and managed futures are part of their investment offerings, providing clients with opportunities to diversify their portfolios and potentially enhance returns. This growing interest in alternatives speaks to a broader search for non-traditional assets that can perform independently of standard market movements.

Trajan Wealth’s expertise in exploring and selecting alternative investment opportunities means clients receive personalized advice on their suitability based on individual risk profiles and investment horizons. Their chosen strategies aim to balance the inherent risks of alternative assets while capturing growth potential that can lead to superior portfolio performance. As more investors seek to navigate market volatility, Trajan Wealth ensures its clients are well-positioned to take advantage of alternative investment avenues.

Staying Ahead with Future Trends in Wealth Management

The wealth management landscape continues to evolve rapidly, and Trajan Wealth’s foresight in anticipating future trends is a testament to its commitment to client success. By integrating technology and adopting innovative strategies, Trajan Wealth positions itself at the forefront of the financial advisory space. The firm is attentive to emerging themes, such as ESG (Environmental, Social, and Governance) investing, which has garnered significant client interest and aligns with ethical investing practices.

Moreover, Trajan Wealth embraces macroeconomic trends that influence investment opportunities, fluctuating interest rates, and the evolving tech landscape. By staying informed and adaptive, Trajan Wealth ensures that its investment strategies remain responsive to these external factors, ultimately benefitting clients. The firm’s proactive stance signifies its dedication to not only preserving wealth but also growing it sustainably and strategically in alignment with future trends.

Frequently Asked Questions

What is Trajan Wealth’s investment strategy for high-net-worth clients?

Trajan Wealth’s investment strategy for high-net-worth clients focuses on personalized asset allocation that includes a mix of traditional and alternative investments. This includes private equity investments where clients can engage as limited partners in handpicked funds. The firm also emphasizes managing risk through thorough due diligence and maintaining a balanced portfolio that accommodates clients’ specific financial goals and time horizons.

How does Trajan Wealth support retirement planning for mass affluent clients?

Trajan Wealth provides comprehensive retirement planning services tailored to mass affluent clients—those with $500,000 to $1 million in assets. This includes developing personalized investment strategies that consider their current and future cash flow needs, enabling them to optimally manage their retirement assets and ensure financial security in their retirement years.

What type of wealth management services does Trajan Wealth offer?

Trajan Wealth offers a one-stop-shop for wealth management, providing an array of services including investment management, estate planning, tax planning, retirement planning, and insurance services. This ensures that clients across the wealth spectrum have access to comprehensive financial solutions to meet their diverse needs.

How does Trajan Wealth approach private equity investments?

Trajan Wealth adopts a selective approach towards private equity investments, favoring direct engagement as limited partners in specific funds rather than fund-of-funds strategies. This method allows Trajan Wealth to conduct thorough due diligence on each investment opportunity, ensuring that clients invest in high-potential boutique firms that align with their risk tolerance.

Does Trajan Wealth incorporate alternative investments in their strategies?

Yes, Trajan Wealth includes alternative investments in their strategies, such as managed futures and private equity, aimed at providing clients with diversified options to enhance their portfolios. This strategy is designed to offer potential crisis alpha and mitigate risks associated with traditional investments, depending on market conditions.

Is cryptocurrency part of Trajan Wealth’s investment offerings?

No, Trajan Wealth currently avoids cryptocurrency investments, considering them too speculative. While some interest in future ETF structures may arise, the firm prioritizes safeguarding clients’ assets and avoids high-risk investment products like cryptocurrency.

How frequently does Trajan Wealth reassess client allocations?

Trajan Wealth reassesses client allocations on a quarterly basis or as needed, depending on individual risk tolerance and life circumstances. This flexible assessment process ensures that each client’s investment strategy remains aligned with their financial objectives and changing market conditions.

What types of clients does Trajan Wealth serve?

Trajan Wealth serves a diverse clientele, ranging from mass affluent individuals with $500,000 to $1 million in assets to high-net-worth and ultra-high-net-worth investors. The firm’s tailored approach ensures all clients receive personalized wealth management and investment services.

How does Trajan Wealth handle cash reserves within client portfolios?

Trajan Wealth allocates a portion of cash reserves across model portfolios for operational needs, but keeps the allocation minimal. This approach ensures liquidity while maximizing investment opportunities for clients, balancing between safety and growth.

Does Trajan Wealth invest internationally, and if so, where?

Yes, Trajan Wealth invests in international markets, focusing on developed areas such as stable markets in Switzerland and potential growth markets like India. This strategic approach provides clients with diversified exposure to global investment opportunities.

| Key Point | Details |

|---|---|

| Client Segments | Mass affluent, high-net-worth, and ultra-high-net-worth investors. |

| Investment Strategy | Focus on a range of investment products, including traditional and managed equity models, private equity, and fixed income. |

| Risk Management | Delicate balancing of risk with private credit and equity, avoiding highly speculative investments like Bitcoin ETFs. |

| Personalized Client Review | Quarterly reviews of client portfolios based on individual risk tolerance and financial goals. |

| Returns Expectations | Private equity funds aim to outperform S&P 500 returns; caution with credit risks. |

Summary

Trajan Wealth is a leading financial firm adept at navigating the diverse needs of its clients across the wealth spectrum. With a solid foundation of comprehensive services, Trajan Wealth offers personalized investment strategies that balance risk and opportunity, positioning itself as a trusted partner in wealth management.