Trump Stock Accounts: Investing Early for Financial Success

The concept of Trump stock accounts represents a bold vision for the financial future of American citizens, particularly for newborns. Spearheaded by former President Donald Trump, this initiative aims to establish stock accounts that grant every baby a head start in investing, beginning with an initial deposit of $1,000. Advocates argue that such a program could play a crucial role in closing the widening wealth gap, echoing principles espoused by investment legends like Warren Buffett. By fostering financial literacy from a young age and tapping into the power of compounding interest, these accounts could set the stage for meaningful wealth accumulation for generations to come. Ultimately, the Trump stock accounts could reshape the landscape of investing, making an inclusive push towards economic prosperity and providing a safety net for future families.

Introducing an innovative financial initiative, the proposed stock accounts championed by Donald Trump seek to initiate investing habits from infancy. Branded as an opportunity for financial empowerment, these accounts are designed to give newborn citizens an advantageous start in the world of investments, mirroring Warren Buffett’s advice on the importance of early investing. This concept not only aims to encourage wealth-building practices among young Americans but also addresses broader issues such as the wealth gap and financial literacy. Furthermore, it embodies the principles of compounding interest, which demonstrates how even modest investments can grow exponentially over time. With such forward-thinking strategies, investing for newborns could become a cornerstone of financial education and an empowering tool for securing a prosperous future.

The Vision Behind Trump’s Stock Accounts

President Donald Trump’s proposal to provide every American newborn with a stock account, starting with an initial deposit of $1,000, aims to initiate financial literacy early in life. This initiative is grounded in the belief that by giving children financial assets from birth, they can experience the benefits of compounded interest—concepts often emphasized by investing luminaries like Warren Buffett. President Trump has described this initiative as part of his broader vision for growing the economy and reducing the wealth gap in the United States. The notion is that every child, regardless of their family’s financial background, deserves a chance at wealth creation through the power of investing.

This move not only seeks to close the wealth gap but also aims to foster a culture of saving and investing from a young age. With the assistance of government-backed accounts, children will be encouraged to learn about the stock market and the importance of financial literacy. As children manage these Trump Accounts, they will have the opportunity to make decisions on investment, which could empower them and promote a generation that is more financially savvy. Such an approach aligns with Warren Buffett’s philosophy of starting investment education early, showcasing how crucial financial literacy is in navigating the complexities of wealth.

Warren Buffett’s Endorsement of Early Investing

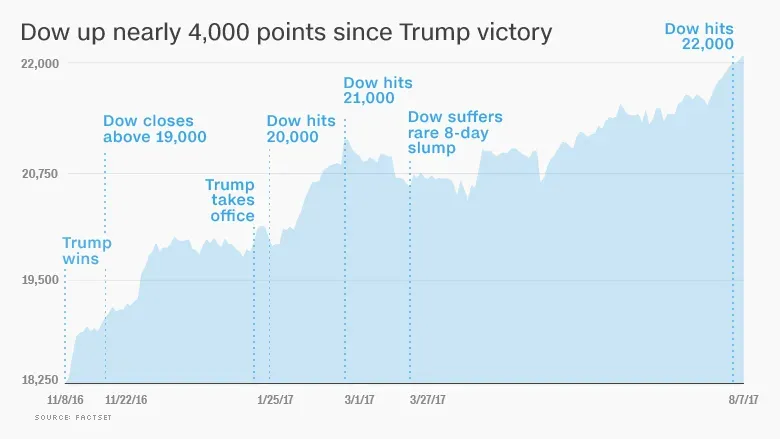

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has long endorsed the idea of investing early and often. His philosophy highlights that investing in a diversified portfolio of low-cost index funds creates a solid foundation for wealth accumulation. Trump’s proposal for newborn stock accounts resonates with Buffett’s advice that the earlier you start investing, the more you can capitalize on the effects of compounding interest. Buffett has likened compound interest to a snowball that accumulates more snow as it rolls down a hill, emphasizing the importance of starting young to maximize this effect.

In a world where the wealth gap continues to challenge economic equality, Buffett believes that every child should have a stake in the financial markets. He has stressed that small, consistent investments over the long term can transform modest beginnings into substantial wealth. The Trump Accounts could enable countless children to benefit from market growth, encouraging a new generation to incorporate investing into their life plans. By fostering early investment habits, the hope is to cultivate financially literate citizens who can contribute positively to the economy.

Compounding Interest as a Wealth Building Tool

Compounding interest is often referred to as the ‘eighth wonder of the world,’ and for good reason—it can turn even a modest initial investment into significant wealth over time. By implementing Trump’s stock accounts for newborns, there is a tremendous opportunity to leverage this financial principle from the outset of life. Historical examples show that a young person starting with a mere $1,000 could see their investment blossom into substantial savings by consistently contributing and letting the power of compounding work in their favor. Investing early, as Warren Buffett advises, means fewer years left for the investment to thrive, thereby maximizing returns.

This incentive towards compounding creates a more accessible pathway to wealth for all children, particularly in a society where financial advantages are often pre-defined by one’s economic background. With the right educational tools and structured environments to cultivate healthy financial habits, children can learn the art of investing for long-term gains. The premise is that allowing every American newborn to have a head start in investment could play a pivotal role in bridging the wealth divide, fostering an economically balanced future.

Challenges of Implementing Trump Accounts

While the concept of Trump stock accounts is innovative, there are inherent challenges that could affect its potential impact on reducing the wealth gap. As outlined in recent discussions, children from lower-income families might face constraints in maximizing their investment even if they receive the initial $1,000. While the government will facilitate the creation of tax-deferred accounts, the ability of families to contribute the maximum $5,000 annually could vary dramatically based on their financial situation. This discrepancy creates an unequal landscape where wealthier families might leverage the program more effectively.

Additionally, access to other financial resources and investments plays a substantial role in determining a child’s future financial success. Children from affluent backgrounds already have a host of benefits such as diverse savings accounts, extensive education resources, and familial financial support that would complement their investment portfolio. Hence, while Trump’s initiative is a significant step towards fostering early investment and financial literacy, auxiliary measures may be necessary to ensure equitable benefits across socio-economic lines.

Long-term Implications of Financial Literacy

The long-term implications of promoting financial literacy through initiatives like Trump’s stock accounts could be profound. By encouraging children to invest and understand financial concepts from an early age, there is an opportunity to cultivate a nation of financially astute adults who can navigate the complexities of personal finance with confidence. Compounding interest and informed investing strategies learned early on can lead to more responsible financial behaviors in adulthood, resulting in an overall healthier economy and lifestyle for future generations.

Moreover, increased financial literacy can reduce reliance on loans and credit, encouraging savings and wise investment instead. If children grasp these concepts early and can apply them throughout their lives, we may witness a gradual but transformative change in how Americans view money, savings, and investment. As such, alongside the Trump Accounts initiative, comprehensive financial education programs will be essential to reinforce these lessons and maximize the benefits of lifelong investing.

How The Initiative Addresses Wealth Inequality

The initiative proposed by Trump to establish stock accounts for newborns directly addresses wealth inequality by providing all American children, regardless of their parent’s financial situation, access to capital markets. This ensures that every child starts off with an investment that can grow over time, which is particularly vital in a society where economic advantages are often inherited rather than earned. If every child is given equal footing in terms of access to investments, it stands to reason that over time, the wealth gap could narrow, allowing for a more equitable distribution of financial opportunities.

However, the initiative alone may not suffice to remedy deep-rooted socio-economic challenges. Wealth accumulation is often compounded by access to education, healthcare, and other resources that affluent families naturally possess. While providing stock accounts is a progressive step, complementary policies addressing these additional challenges—such as improved educational facilities or savings incentives—could further amplify the initiative’s positive impact in reducing the wealth gap.

The Role of Corporate Partnerships in Financial Education

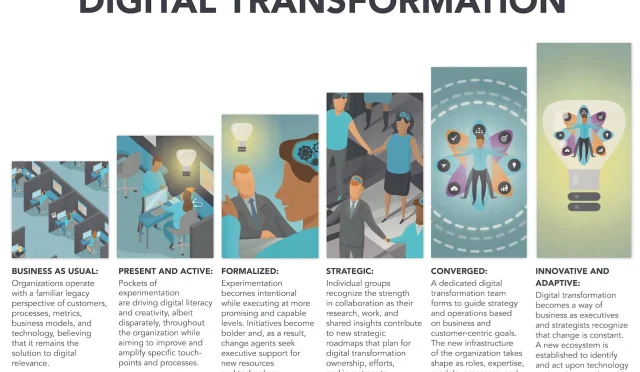

The White House’s collaboration with major corporations like Goldman Sachs and Robinhood highlights the importance of corporate involvement in promoting financial literacy. These partnerships can provide the technological infrastructure and capital needed to successfully launch and administer the Trump stock accounts initiative. Such collaborations can also extend their expertise and resources into communities to provide educational programs that teach financial literacy, which is crucial for making the most out of investments.

Corporations have a vested interest in creating financially literate consumers who can participate in the economy effectively. By proactively engaging in initiatives that inspire prudent financial behaviors, they help to create a well-informed public that understands the importance of investing. This relationship with corporate America not only supports the immediate goals of the Trump Accounts initiative but also builds a foundation for long-term financial stability and success across diverse populations.

Potential Economic Outcomes of Baby Bonds

The economic outcomes of initiatives resembling the proposed Trump stock accounts could be transformative. If each American newborn is given a stake in the economy through their investment accounts, it stimulates financial participation from an early age, nurturing a new generation of investors. As these individuals grow, they will understand investing as a means of achieving personal and financial goals, potentially leading to a more robust economy fueled by informed, engaged citizens committed to financial success.

Furthermore, if successful, such programs could usher in a wave of similar initiatives aimed at empowering younger generations financially. The idea could gain traction among policymakers, encouraging them to explore additional methods of increasing financial inclusivity. This shift could ultimately lead to more equitable economic opportunities and facilitate further discussions around systemic reforms aimed at closing the wealth gap in America.

The Future of Financial Programs for Young Americans

The proposal for Trump stock accounts marks a pivotal point in the discourse surrounding financial programs for young Americans. As policymakers and advocates push for innovative strategies to eradicate financial inequality, future programs may mirror this framework, seeking to educate and empower children from a young age. Anticipated advancements in financial technology could also play a crucial role in how these accounts are managed, potentially offering various investment strategies and educational resources integrated into their platforms.

Looking ahead, the success of this initiative will depend on a combination of political will, public support, and strategic partnerships that enhance financial literacy. It’s crucial that discussions surrounding such funding continue to evolve, addressing the nuances of wealth inequality while fostering an environment that encourages saving and investment from a young age. The implications of a well-structured financial education program could redefine how future generations approach wealth, investment, and economic stability.

Frequently Asked Questions

What are Trump stock accounts and how do they work?

Trump stock accounts refer to a proposed program to provide every American newborn with a tax-deferred investment account, starting with an initial $1,000 deposit. Under this initiative, guardians can contribute up to $5,000 annually, allowing the funds to be invested in broad U.S. index funds. Withdrawals are prohibited until the child reaches 18, promoting long-term wealth accumulation through the power of compounding interest.

How does the Trump stock account initiative align with Warren Buffett’s investment philosophy?

Warren Buffett advocates for starting early in investing, particularly in low-cost index funds. The Trump stock accounts concept mirrors this philosophy by providing newborns a head start in the market, allowing for compounding growth over multiple decades, which is essential for building substantial wealth.

Can Trump stock accounts help close the wealth gap in America?

While Trump stock accounts aim to provide every newborn with a financial stake in the market, they may only partially close the wealth gap. Wealthier families can contribute more to these accounts and have greater access to opportunities that enhance financial literacy, potentially giving them an advantage over lower-income families.

What role does financial literacy play in the success of Trump stock accounts?

Financial literacy is crucial for maximizing the potential of Trump stock accounts. Guardians who are educated about investing can better manage the accounts, utilize the benefits of compounding interest, and make informed decisions that could enhance long-term wealth accumulation for their children.

How significant is compounding interest in building wealth through Trump stock accounts?

Compounding interest is a key component of wealth building through Trump stock accounts. Even a modest initial investment can grow exponentially over time if left to compound, emphasizing the importance of starting to invest early, as advocated by Warren Buffett.

What are the potential challenges of the Trump stock accounts for low-income families?

The primary challenge for low-income families in utilizing Trump stock accounts is the annual contribution limit of $5,000. While the initial $1,000 offers a starting point, maintaining the maximum contribution might be difficult, limiting their children’s ability to benefit fully from compound growth compared to children from wealthier backgrounds.

What kinds of investments will be allowed in Trump stock accounts?

Trump stock accounts are designed to invest predominantly in broad U.S. index funds that minimize fees and avoid leverage, ensuring long-term financial stability and the continuation of compounding growth without the risks associated with high-volatility investments.

How can investing for newborns through Trump stock accounts impact future generations?

Investing for newborns through Trump stock accounts can significantly impact future generations by instilling an early understanding of and participation in the financial markets. This early start, driven by compounding interest, can generate substantial wealth, fostering a new culture of financial literacy and investment.

What is the timeline for implementing Trump stock accounts?

If the proposal for Trump stock accounts is approved, it is intended to apply to every American newborn born between January 1, 2025, and December 31, 2028, starting them off with an initial investment. The initiative is currently under review in the Senate following approval from the House of Representatives.

How did Trump stock accounts gain support from prominent executives?

Trump stock accounts have garnered backing from various CEOs from major corporations such as Dell, Goldman Sachs, and Uber, who participated in discussions highlighting the importance of compounding investments for future generations, contributing to a positive narrative surrounding financial education and wealth creation.

| Key Point | Details |

|---|---|

| Trump Stock Accounts Proposal | Every American newborn to receive a $1,000 stock account. |

| Investment Strategy | Investments will be in low-fee, broad U.S. index funds, promoting long-term wealth. |

| Eligibility | Accounts available for newborns from January 1, 2025, to December 31, 2028. |

| Future Management | Guardians will manage accounts, with annual deposits up to $5,000 allowed. |

| Withdrawal Policy | Withdrawals permitted only after the child turns 18, account terminates at 31. |

| Potential Impact on Wealth Inequality | Could reduce wealth gap, but wealthier families might still benefit more. |

| Warren Buffett’s Views | Buffett supports early investing and believes compounding is key to wealth. |

Summary

Trump stock accounts represent an ambitious effort to democratize investing in America. By providing every newborn with a financial start, this initiative aims to cultivate financial literacy and long-term wealth through the power of compounding returns. While the proposal is a bold step towards addressing wealth inequality, it remains imperative to consider the existing advantages of affluent families. Nevertheless, facilitating early investment may prove beneficial for many and align with the timeless investment strategies espoused by financial luminaries like Warren Buffett.

#TrumpStocks #EarlyInvesting #FinancialSuccess #StockMarketTips #InvestmentStrategy