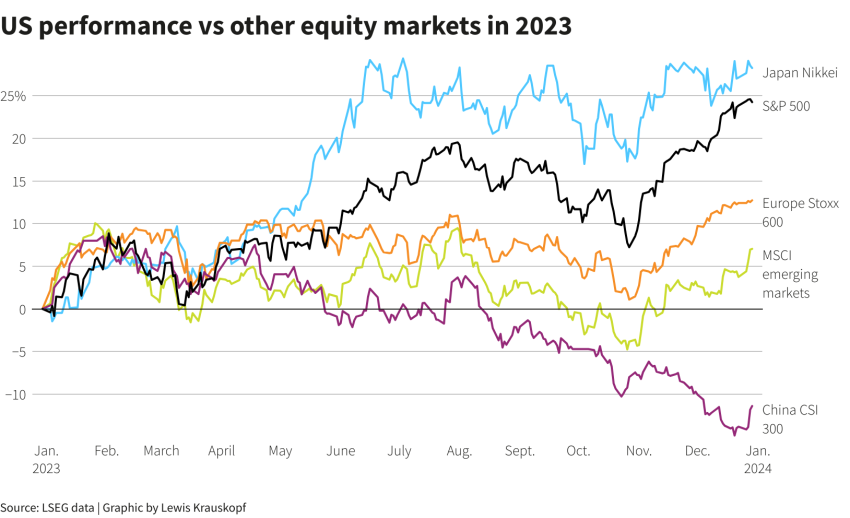

U.S. stock market performance has become a focal point of investor attention as volatility continues to shape trading strategies in 2023. On Monday, the markets finished modestly lower, driven by anxiety over AI trade volatility and shifting expectations surrounding Federal Reserve interest rates through 2026. With the Dow Jones, S&P 500, and Nasdaq Composite all closing down, traders are exercising caution ahead of critical economic data releases this week. The sentiment reflects a broader trend in stock market news where investors are increasingly reluctant to make significant moves without clearer indicators from the upcoming reports. As the landscape remains unpredictable, the dialogue around how economic shifts impact stock valuations and trends in technology stocks intensifies.

The recent fluctuations in the American equities market highlight how investors are navigating turbulent waters, particularly amid discussions around AI-driven stocks and their subsequent volatility. Following a notable dip in major indexes, analysts and traders alike are focusing on the leadership dynamics within sectors, questioning which stocks will sustain momentum. As key economic indicators are set to be released, the anticipation is palpable—essentially, understanding the undercurrents that influence stock performance has never been more critical. The Nasdaq, in particular, showcases the tension between rising interest rates and market expectations as traders adapt to a rapidly evolving financial landscape. Exploring these dimensions will shed light on the broader implications for investment strategies in both technology and traditional sectors.

Current Trends in U.S. Stock Market Performance

The current trends in U.S. stock market performance are reflecting a complex interplay of investor sentiment and macroeconomic indicators. After a modest decline on Monday, the Dow Jones Industrial Average ended slightly lower, illustrating a cautious attitude among traders as they sift through lingering volatility tied to AI-driven trades. This uncertainty has been fueled by fluctuating expectations of Federal Reserve interest rates, leaving many investors hesitating to make bold moves in the stock market. Observers note this trend is not just about numbers; it encapsulates a broader sentiment where traders are acutely aware of how sensitive the market can be to changes in economic indicators.

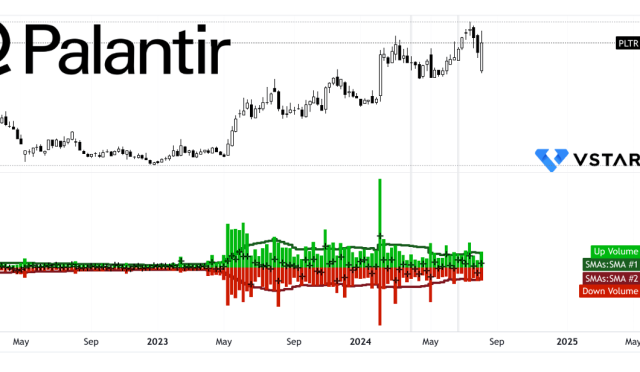

Furthermore, the Nasdaq Composite’s struggles signal a significant trend divergence among tech stocks, particularly those associated with artificial intelligence. With high-profile companies like ServiceNow facing scrutiny over acquisition talks, market players are left questioning the sustainability of rapid AI investments. As we look ahead to an influx of upcoming economic data releases, including critical jobs reports and inflation readings, the market’s path will largely depend on how these indicators influence trader sentiment in the short term.

Understanding AI Trade Volatility in the Market

AI trade volatility has emerged as a primary driver of market fluctuations, as evidenced by recent events. The surging interest in AI has led to a flurry of investments in tech sectors; however, this enthusiasm comes with its own set of risks. Market participants are now experiencing a wave of anxiety linked to the actual returns on investment in the AI space. Companies such as Oracle and Broadcom have raised questions about profitability timelines, resulting in a reevaluation of AI-linked stock valuations. This type of trade volatility is a main contributor to the overall movements of the Nasdaq, which has displayed heightened sensitivity to these developments.

Investors are now more cautious than ever, often adopting a ‘wait-and-see’ approach while the market consolidates. Since AI’s promise is paired with uncertainty regarding corporate profits, this trade volatility creates a tricky landscape for traders seeking clear signals. As economic data related to employment and inflation surfaces, there is a palpable tension as investors simultaneously battle excitement for new tech advancements and skepticism about their immediate financial returns.

The Impact of Federal Reserve Interest Rates on Stock Market Dynamics

The influence of Federal Reserve interest rates remains a cornerstone of stock market performance. Recent speculations about the future path of interest rates have led to mixed feelings among investors. On one hand, the prospect of lower interest rates could stimulate economic activity; on the other hand, any sign of tightening monetary policy may compel investors to offload equities in anticipation of reduced liquidity. It is this delicate balance that creates volatility not only across the stock market but particularly within the tech sector reliant on cheap capital.

As the Fed communicates its strategies, traders are clinging to every word and economic data release, knowing that these factors can substantially shift market directions. With long-term yields rising even against the backdrop of rate cuts, equity valuations are under pressure. The tension arising from these dynamics means that stock market performance is not just a reflection of corporate earnings but is increasingly intertwined with monetary policy assessments, making it critical for traders to stay informed and agile.

Analyzing Economic Data Releases and Their Market Repercussions

The upcoming economic data releases are poised to shape stock market sentiment in a profound way. Following delays due to a government shutdown, the markets are flush with a backlog of critical information that includes unemployment rates and inflation figures. With investors eager to ascertain the health of the labor market, the anticipated twice-staggered reports from October and November are being closely monitored for hints of economic resilience or weakness. Expectations hovering around job growth and inflation will have definitive implications for stock valuations and market confidence.

As these data points unfold, correlations are bound to emerge between investor reactions and the metrics reported. A surprisingly low job creation figure might induce fears of recession, leading to a pullback in stocks, whereas stronger-than-anticipated figures could bolster shares by reinforcing the notion of economic stability. This creates a compelling narrative: that economic data does not just inform the investment landscape but actively shapes it, underscoring the necessity for investors to remain vigilant as new figures are released.

Sector Performance and Leadership Rotation in the Market

Sector performance analyses offer deep insights into the leadership rotation currently observed in the U.S. stock market. Recently, defensive sectors, particularly healthcare, have resumed prominence, reflecting a tactical shift among investors wary of tech-centric volatility. This rotation is indicative of a search for stability amid growing anxiety regarding tech stock dependability, particularly those participating in the AI boom. The divergence in performance illustrates how traders respond selectively to evolving narratives in the market.

Considering the context of declining crude oil prices—impacting energy sectors—the leadership steering the market dynamics is paramount. This underscores a broader trend where market leaders do not necessarily lead in unison but rather highlight shifts as investors adjust their strategies based on perceived risks and opportunities. Understanding these sector rotations allows investors to reevaluate their portfolios continuously, aligning their investments with the prevailing dynamics driven by both economic indicators and corporate news.

Navigating Individual Stock Volatility in Major Indices

Individual stock volatility has become increasingly pronounced amid broader index fluctuations, presenting a mixed blessing for traders. For example, while stocks like Tesla show resilience following favorable developments, others—such as iRobot—quickly face severe downturns, underscoring the precarious nature of stock-specific movements. These stark contrasts highlight that the larger broadcast of market trends can often overshadow specific stock performance, complicating investment decisions.

With analysts closely observing high-profile companies to gauge sector health, investor sentiment often tilts rapidly based on corporate news rather than overall market trends. This disjointed nature of individual performance adds a layer of complexity to trading strategies, as investors must navigate both the macroeconomic indicators and the micro-level shocks that may suddenly impact stock prices. Therefore, recognizing the volatility within individual stocks while considering index movements is crucial for effective market navigation.

Evaluating Macroeconomic Indicators and Market Stability

Macroeconomic indicators serve as essential barometers for market stability, guiding investor expectations and stock performance alike. Rising long-dated yields, fiscal concerns, and inflation fears compose a trifecta that influences investment behavior significantly. As the Federal Reserve continues to make rate adjustments in response to these indicators, market participants find themselves constantly reassessing the implications for stock valuations and economic growth expectations.

As these macro forces evolve, they play a vital role in the perceived risks associated with equities. Investors are seeking reassurance from economic data that could prevent excessive volatility. Consequently, as indicators like job growth and inflation trends become front and center, market stability hinges upon their outcomes, prompting a chess-like strategy among traders as they weigh potential scenarios against macro factors.

The Role of Commodities in Stock Market Performance

Commodities are significantly intertwined with stock market performance, often acting as both leading and lagging indicators of economic health. The recent softness in crude oil prices, for instance, has impacted energy sector performance, reflecting a much broader concern about future demand and economic activity. As these commodity prices fluctuate, they invariably influence investor sentiment across related stocks, creating a feedback loop that may bolster or hinder market stability.

Moreover, commodities like gold can act as safe havens when volatility rises in the stock market. With current gold prices remaining elevated, it underscores investor concerns regarding inflation and economic uncertainty. As commodities react to geopolitical events and macroeconomic conditions, their performance can provide critical insights into expected trends within stock markets. This relationship highlights the necessity for investors to keep a keen eye on commodity movements in their broader analysis.

Implications of Cross-Asset Movements on Market Dynamics

Cross-asset performance adds another layer of complexity to understanding stock market dynamics. Observing correlations between equities, currencies, and cryptocurrencies allows investors to glean insights into market sentiment at large. For instance, the recent decline of the dollar and the ongoing losses in Bitcoin can indicate a broader risk-off mentality among traders, often resulting in shifts towards traditionally safer investment avenues.

This interconnected movement across asset classes suggests that traders must adopt a holistic view when considering their strategies. By analyzing how changes in one market can impact others—such as how a weaker dollar may affect export-driven stocks—investors can better position themselves to respond to rapidly evolving market conditions. The dynamic nature of cross-asset movements and their implications suggest a pathway for traders to navigate volatility more astutely.

Frequently Asked Questions

What factors contributed to the recent U.S. stock market performance?

The recent U.S. stock market performance has been influenced by several key factors, including heightened sensitivity to AI trade volatility, shifting expectations for Federal Reserve interest rates, and the release of crucial economic data. On a recent trading day, the Dow Jones, S&P 500, and Nasdaq Composite all experienced slight declines as investors navigated these complexities, reflecting a cautious mood among traders.

How do Federal Reserve interest rates impact U.S. stock market performance?

Federal Reserve interest rates play a critical role in U.S. stock market performance by affecting borrowing costs for companies and consumers. Lower interest rates typically stimulate economic growth, encouraging investment and spending, which can boost stock prices. In contrast, rising rates can increase costs and dampen economic activity, ultimately leading to declines in stock market performance.

What is the significance of the Nasdaq Composite in U.S. stock market performance?

The Nasdaq Composite is significant in U.S. stock market performance as it serves as a barometer for tech-heavy stocks, many of which are involved in the AI trade. Movements in the Nasdaq often reflect the performance of major tech companies, influencing investor sentiment and market trends. Recently, its performance has been impacted by market fatigue over AI stocks and valuation concerns, reflecting broader trends in investor behavior.

How do economic data releases affect U.S. stock market performance?

Economic data releases directly affect U.S. stock market performance by providing insights into the health of the economy. Reports on job growth, inflation, and consumer spending can influence investor expectations about future economic conditions and Federal Reserve policies. For instance, delayed data releases recently added uncertainty to market dynamics, leading to cautious trading as investors awaited key employment and inflation numbers.

What is the relationship between AI trade volatility and U.S. stock market performance?

AI trade volatility has a strong relationship with U.S. stock market performance, particularly due to the significant investments in AI technologies by leading tech companies. As companies announce new AI projects or financial results that impact their earnings, stock prices can experience rapid fluctuations, reflecting investor sentiment regarding the viability and profitability of AI-related spending. Recent downturns in AI-linked stocks have contributed to overall stock market performance challenges.

| Index | Closing Value | Change (Points) | Change (%) |

|---|---|---|---|

| Dow Jones Industrial Average | 48,416.74 | -41.31 | -0.09% |

| S&P 500 | 6,816.49 | -10.92 | -0.16% |

| Nasdaq Composite | 23,062.96 | -132.21 | -0.57% |

| Russell 2000 | 2,533.64 | N/A | -0.70% |

Summary

U.S. stock market performance on Monday reflected a complex landscape of investor sentiment heavily influenced by AI-related equities and volatility in interest rate expectations. The day ended with modest declines across major indices, particularly the Nasdaq Composite, as traders navigated nervousness surrounding upcoming economic data. With a heavy calendar of delayed reports looming, including crucial jobs and inflation data, investors are proceeding with caution, reflecting an overarching uncertainty in market leadership and sector dynamics.