UK Economic Developments: Analyzing Inflation and Taxes

The ongoing UK economic developments are a topic of great interest as the country navigates the challenges posed by inflation and the consideration of wealth taxes. Recent spikes in UK inflation have led policymakers to reevaluate fiscal strategies to ensure sustained economic stability. Additionally, the geopolitical impacts on the economy cannot be ignored, with global events creating ripples in the UK market landscape. Wealth taxes in the UK have emerged as a contentious issue, sparking debates among industry leaders about their potential impact on both domestic and foreign investments. As the economic climate evolves, understanding these dynamics is crucial for stakeholders looking to adapt and thrive in a fluctuating global economic environment.

Recent shifts in economic strategies within the United Kingdom are crucial to grasping the broader implications of global market trends. This discussion delves into the pressing challenges and potential solutions as the nation addresses rising inflation rates and investigates the viability of implementing wealth taxation. The interplay of international events and their repercussions on local economic stability underscores the necessity for a robust response. Moreover, the exploration of fiscal policies and their ramifications provides valuable insights into how the UK can mitigate the effects of external economic pressures. Understanding these patterns is essential for anyone interested in the future of the UK economy and its resilience in uncertain times.

Understanding UK Economic Developments Amidst Global Trends

Recent UK economic developments have been significantly impacted by the evolving landscape of global economics. With inflation rates climbing alongside persistent geopolitical tensions, the UK finds itself at a crossroads. The response to inflation will determine the path towards economic recovery, as policymakers grapple with balancing growth and price stability. As UK inflation continues to rise, it puts pressure on households and businesses alike, forcing many to reevaluate their financial strategies.

The interplay between UK economic conditions and global trends cannot be overlooked. Factors such as market volatility, trade dynamics, and foreign investments are critically analyzed to understand how external forces influence the UK economy. Moreover, the impact of geopolitical developments on the UK market is particularly pronounced, with events abroad often causing ripples in domestic economic health. Keeping a close watch on these developments allows for better preparedness in formulating responsive economic strategies.

The Ripple Effect of Inflation on the UK Economy

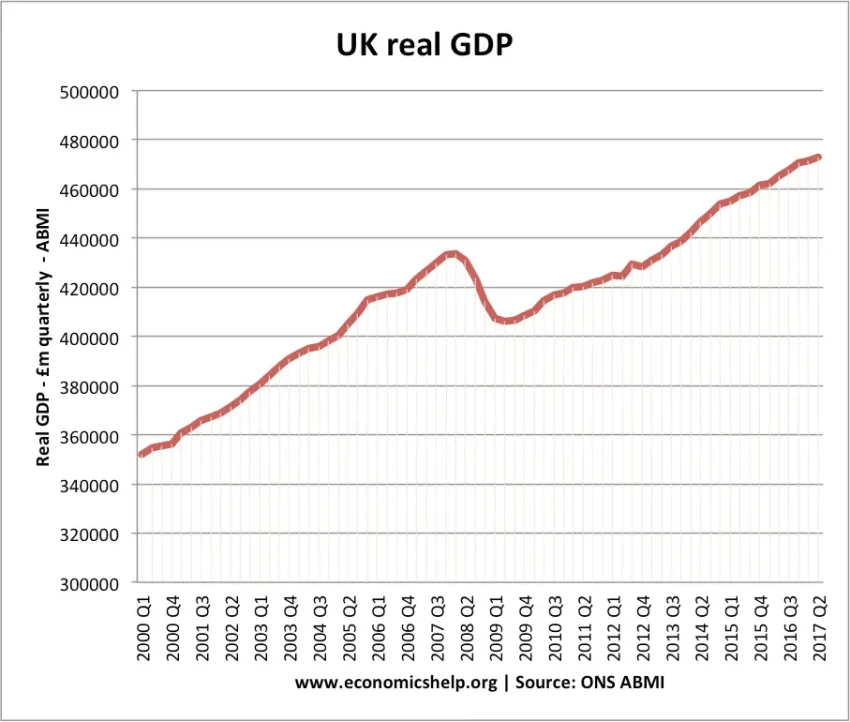

UK inflation has been a topic of urgent discussion, influencing everything from consumer spending to government policy. As inflation rises, the purchasing power of the average consumer diminishes, which can stifle economic growth. Businesses may face higher input costs, potentially leading to increased prices for goods and services, further perpetuating an inflationary cycle. Understanding this phenomenon is crucial, particularly in light of the recent data highlighting significant shifts in consumer behavior in response to inflation.

Moreover, the implications of rising inflation extend beyond the immediate economic landscape. It impacts interest rates, as central banks often adjust monetary policy to combat inflationary pressures. Investors are closely watching these developments, as the UK’s economic stability could swing dramatically based on government measures adopted in reaction to inflation trends. Thus, monitoring UK inflation is essential for understanding the broader economic context and potential future challenges.

The Increasing Discussion on Wealth Taxes in the UK

The concept of wealth taxes in the UK has gained traction as economic imbalances become more pronounced. As the cost of living continues to rise amid inflation, discussions around how to equitably distribute wealth are coming to the forefront. Proponents argue that wealth taxes could provide necessary funding for public services and economic recovery initiatives, particularly as the government seeks to address inequalities exacerbated by economic hardships.

However, the introduction of wealth taxes poses significant challenges and raises concerns among local and international investors. Industry leaders are apprehensive about the potential effects on investment flows into the UK market. Also, the diverse reactions from different sectors underscore the complexity of implementing such taxes. Thus, understanding the debate on wealth taxes is essential for grasping the broader implications for the UK economy and its attractiveness as an investment destination.

Geopolitical Impacts on the UK Economy and Market Stability

Geopolitical tensions are a formidable force shaping the economic landscape in the UK. Events such as trade wars, conflicts, and sanctions can create uncertainty, impacting investor confidence and market stability. The ongoing geopolitical conflicts, particularly involving major powers, have spillover effects on UK economic policies and strategies, prompting the government to adapt swiftly to maintain stability.

Furthermore, these geopolitical dynamics entail significant considerations for economic stability within the UK. As policymakers navigate these challenges, the need for strategic foresight becomes apparent. This ensures that the UK can withstand external shocks and maintain a thriving economy. Ultimately, understanding these geopolitical impacts is critical for comprehending the future trajectory of the UK economy and its role within the global economic framework.

The Role of Investors in Navigating Economic Uncertainty

Investors play a vital role in supporting and stabilizing the UK economy, particularly during periods of heightened economic uncertainty. As inflation rises and discussions around wealth taxes intensify, investors must adapt their strategies to navigate the changing landscape. Understanding market trends and governmental responses to these economic challenges is crucial for making informed investment decisions.

Moreover, the actions of domestic and international investors can significantly influence economic stability within the UK. A decline in investor confidence could lead to reduced capital inflow, exacerbating pre-existing economic vulnerabilities. Therefore, fostering a secure investment environment amid ongoing challenges is essential for maintaining the health and resilience of the UK economy.

Exploring the Connection Between Inflation and Economic Policies

Inflation has historically influenced economic policies worldwide, and the UK is no exception. The Bank of England’s monetary policy decisions, such as setting interest rates, are often influenced by prevailing inflation trends. As inflation persists, the implications for economic policy become increasingly complex, compelling the government to develop responsive measures.

Moreover, the relationship between inflation and economic policies is essential in determining long-term stability. Policymakers must balance the need to control inflation with the imperative to stimulate growth. An analysis of how different strategies impact the economy reveals critical insights into the balancing act required to support financial stability amidst inflationary pressures.

Navigating Economic Stability in Times of Crisis

Economic stability is crucial for the UK, particularly as global events create unpredictable challenges. From external economic shocks to internal policy responses, the government’s approach to maintaining stability is continually tested. A focus on adaptive policies can help mitigate risks associated with inflation and geopolitical tensions.

Moreover, a resilient economy is one that can absorb shocks and recover swiftly from crises. This has been particularly relevant in the face of post-pandemic recovery efforts and fluctuating global market conditions. Ensuring that the UK economy is equipped to withstand such challenges is key to sustaining long-term growth and prosperity.

The Interplay of Global Economics and Local Policies

Global economics inherently influences local policies within the UK, given its interconnectedness with other countries. Economic trends such as trade balances, currency fluctuations, and investment flows shape the decisions made by UK policymakers. As global economic conditions evolve, so too must the local responses to ensure alignment with international standards.

Additionally, aligning local economic policies with global trends is essential for attracting foreign investment and maintaining a competitive edge. The successful navigation of these complex dynamics demands a comprehensive understanding of both domestic needs and global pressures, which is vital for ensuring that the UK remains robust within the international economic landscape.

Future Outlook: UK Economic Strategies in a Changing World

The future outlook for the UK economy hinges on the strategies adopted to tackle the myriad challenges posed by inflation, wealth taxes, and global economic fluctuations. Policymakers must prioritize flexible strategies that allow for swift adjustments to changing circumstances. This adaptive approach is essential for bolstering economic stability and reassuring investors.

Furthermore, the effectiveness of these future strategies will determine the UK’s ability to navigate through uncertain times. As geopolitical tensions continue to shape the global economic outlook, the UK’s strategic responses will be critical in laying the groundwork for sustainable growth and maintaining economic resilience in a complex and ever-evolving world.

Frequently Asked Questions

What are the recent developments in UK inflation and how do they affect the economy?

Recent developments in UK inflation have shown significant fluctuations due to global economic pressures. The Bank of England has responded by adjusting interest rates to stabilize the economy. High inflation rates impact consumer purchasing power, savings, and investment, leading to broader implications for economic stability in the UK.

How are proposed wealth taxes in the UK influencing economic strategies?

Proposed wealth taxes in the UK have sparked debates among policymakers and industry leaders on their potential impact on investment and economic growth. These taxes aim to redistribute wealth to address social inequalities, but they may also deter foreign investments, influencing overall economic stability and market confidence.

What is the influence of global economics on UK economic developments?

Global economics significantly impacts UK economic developments, particularly through trade relationships and supply chain dynamics. Ongoing geopolitical tensions and market volatility can lead to sudden shifts in the UK economy, making it essential for policy adjustments to cope with these external economic pressures.

How do geopolitical impacts affect economic stability in the UK?

Geopolitical impacts, such as conflicts and trade disputes, pose risks to economic stability in the UK. These factors can disrupt supply chains, increase costs, and lead to inflationary pressures. The UK’s ability to navigate these challenges is crucial for maintaining a stable economic environment.

What are the implications of wealth taxes for international investors in the UK?

Wealth taxes in the UK may create apprehensions among international investors regarding the attractiveness of the UK market. While these taxes could fund essential public services, they also raise concerns about the long-term implications for returns on investment, potentially impacting foreign direct investment flows.

| Key Point | Details |

|---|---|

| Global Economic Developments | Focus on recent changes affecting the UK economy. |

| UK Responses to Inflation | Analyzes strategies employed by the UK government to combat rising inflation. |

| Wealth Tax Proposals | Explores potential implementation of wealth taxes and effects on investors. |

| Impact of Geopolitical Conflicts | Discusses how international tensions are affecting UK economic stability. |

| Market Volatility | Reviews the influence of global market changes on the UK economy. |

Summary

UK economic developments have recently been significantly influenced by global economic trends and external pressures. The examination of how inflation is being addressed and the proposed wealth taxes reflects the UK government’s response to various economic challenges. Furthermore, ongoing geopolitical conflicts and market fluctuations illustrate the interconnectedness of national economies with global events. As these factors continue to evolve, it is crucial for stakeholders to adapt and strategize to ensure long-term stability and growth.

#UKEconomy #InflationTrends #TaxPolicyUK #EconomicAnalysis #UKFinancialOutlook