UK economy discussions are currently at the forefront of debates as experts analyze various aspects influencing financial stability. With UK inflation trends climbing, understanding the situation is crucial for both consumers and businesses alike. The UK government policies aimed at regulating the economy have sparked conversations about their effectiveness in combating rising costs. Additionally, future economic strategies are being considered to prevent recession fears from materializing in the marketplace. As businesses adapt to these shifting market conditions, the insights gained from these discussions become vital for formulating resilient approaches.

Conversations regarding the British financial landscape have intensified, reflecting several pressing concerns. With inflation rates on the rise, there is a growing focus on the impact of governmental decisions in this domain. Furthermore, strategic planning for economic stability is critical as apprehensions mount regarding a potential economic downturn. Companies operating in the UK are being urged to rethink their operational models in response to these unpredictable market conditions. Overall, this dialogue highlights the need for informed discussions on adapting to ever-changing economic realities.

Current UK Inflation Trends and Their Impact

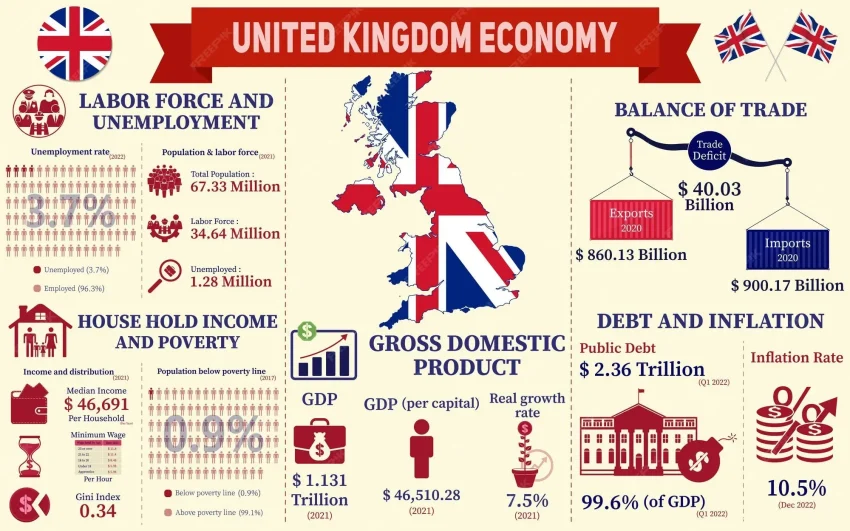

The ongoing discussions about the UK economy have prominently featured inflation trends, which have been subjected to intense scrutiny by policymakers and economists alike. As inflation rates continue to rise, the implications for consumers and businesses become increasingly pronounced. Experts suggest that the persistent increase in the cost of living directly affects household budgets, leading to altered spending habits and a re-evaluation of economic priorities. Additionally, the rising costs of goods and services are diminishing consumer confidence, contributing to an overall sense of uncertainty in the marketplace.

Inflation trends are a critical concern for the UK economy as they influence key decisions made by the government and financial institutions. The Bank of England has responded with adjustments to interest rates, aiming to combat inflation while fostering economic growth. This delicate balance is crucial in maintaining financial stability, and experts argue that without effective intervention, the UK risks entering a period of prolonged economic stagnation. The conversation around inflation is not merely about numbers, but about its ripple effects on employment, investments, and household economics.

UK Government Policies: Addressing Economic Challenges

The role of UK government policies in shaping economic outcomes has come under the spotlight as rising inflation and recession fears have emerged as pressing concerns. Recent government initiatives aim to mitigate the adverse effects of inflation by introducing measures designed to support both consumers and businesses. Policies such as tax reliefs and subsidies for essential goods have been discussed to ease the financial burden on households while encouraging businesses to innovate and adapt to the changing economic landscape.

In addition to immediate relief measures, there is a pressing need for long-term strategies that focus on sustainable economic growth. This includes investment in infrastructure, technological advancements, and education that can equip the workforce for future challenges. By examining past government interventions and their effectiveness during periods of high inflation, policymakers can better navigate the current climate, ensuring that future economic strategies are well-informed and resilient to market fluctuations.

Future Economic Strategies for the UK

Looking ahead, the formulation of future economic strategies is essential to ensure the UK can navigate the complexities of a rapidly changing global economy. Collaborations between government, industry leaders, and economists have sparked discussions on innovative approaches that incorporate emerging technologies and sustainable practices. These strategies aim to create a robust economic framework that can withstand shocks from inflationary pressures while adapting to consumer demands and market shifts.

Incorporating resilient practices into economic strategies is fundamental as businesses face increasing competition and operational challenges. The adoption of green technologies and digital transformations are pivotal as companies strive to enhance efficiency and responsiveness to market changes. Ensuring that future economic strategies are adaptable will not only benefit businesses but also foster an environment conducive to job creation and economic stability in the long term.

Navigating UK Recession Fears

As discussions surrounding the UK economy intensify, recession fears loom large over businesses and consumers alike. The prospect of a recession has sparked debates on the appropriate measures to adopt in anticipation of economic downturns. Experts warn that without proactive strategies, the UK may experience significant contraction, affecting employment rates and consumer confidence. This environment compels businesses to rethink their operational approaches and consider diversifying their offerings to mitigate potential risks.

Moreover, government policies play a crucial role in addressing recession fears. Initiatives aimed at stimulating growth through investment in key sectors can provide a cushion against downturns. It is essential for businesses to remain agile, adapting to the evolving economic landscape while reinforcing their resilience to external shocks. Ongoing dialogues focusing on preventative tactics and readiness will help sectors better prepare for any uncertainties that lie ahead, ensuring that the economy remains vibrant even amidst challenges.

Business Adaptation in the UK Economy

In the face of rising costs and inflation, businesses in the UK are compelled to adapt their strategies to thrive in a volatile economic environment. Those that implement dynamic approaches, such as optimizing supply chain management and enhancing customer engagement, are likely to fare better during turbulent times. Adapting to economic fluctuations not only requires innovation but also the ability to anticipate market trends and consumer preferences.

The adaptation process also involves leveraging technology to streamline operations and reduce costs. Businesses are increasingly turning to digital solutions to enhance efficiency and improve customer service, allowing them to respond swiftly to changing demands. By fostering a culture of agility and innovation, UK businesses can navigate economic uncertainties more effectively, ensuring their longevity and success in the ever-evolving market landscape.

Frequently Asked Questions

What are the current UK inflation trends affecting the economy?

Current UK inflation trends show a fluctuating rate due to various factors, including rising energy prices and supply chain issues. These inflation trends are impacting consumer purchasing power and driving discussions around the Bank of England’s response to stabilize the economy.

How do UK government policies influence the economy?

UK government policies directly influence the economy by shaping fiscal measures, taxation, and spending priorities. Recent initiatives aimed at combating inflation and supporting economic recovery are central to ongoing discussions about the UK economy’s direction.

What are the anticipated future economic strategies for the UK?

Future economic strategies for the UK include focusing on sustainable growth, innovation, and supporting businesses in adapting to a changing market. Experts emphasize the need for policies that address both inflation and potential recession fears while fostering resilience in the economy.

What are the implications of UK recession fears on business adaptation?

UK recession fears are prompting businesses to adapt by re-evaluating their strategies, reducing costs, and seeking new market opportunities. This adaptation is crucial for ensuring survival and competitiveness in an uncertain economic landscape.

How are businesses in the UK responding to rising costs linked to inflation?

Businesses in the UK are responding to rising costs linked to inflation by increasing prices, optimizing operations, and enhancing efficiency. These responses are essential for maintaining profitability amid the challenges posed by current UK inflation trends.

| Key Point | Details |

|---|---|

| Inflation Rates | Recent discussions highlight an increase in inflation rates, affecting both consumers and businesses. |

| Government Policies | Experts debate the effectiveness of current government policies in tackling inflation and supporting economic stability. |

| Future Strategies | Considerations for future economic strategies are essential as the economy faces potential recession fears. |

| Business Adaptation | Businesses are adapting to shifting market conditions due to rising costs and inflationary pressures. |

Summary

UK economy discussions are increasingly centered around the complexities of inflation and the responses from government policies. These discussions illuminate the multifaceted challenges that the UK economy currently faces, including the tangible impacts of rising inflation rates and government strategies to alleviate such pressures. As experts contribute their insights, it becomes clear that addressing these issues is critical for stabilizing the economy and ensuring that businesses can thrive in an ever-changing market landscape.