UK Millionaires Migration 2025: A Record Wealth Exodus

In 2025, the UK Millionaires Migration phenomenon is poised to reach dramatic heights as a staggering 16,500 high-net-worth individuals (HNWIs) are anticipated to leave the country. This mass movement marks the largest wealth flight seen in recent years, showcasing the changing landscape of global migration trends that favor more investor-friendly destinations. As economic policies tighten, many affluent individuals are seeking alternatives that offer greater stability and opportunity abroad. The implications of this millionaire outflow extend beyond mere numbers; they signal potential shifts in the UK’s economic health and competitiveness on the global stage. With the increasing trend of high-net-worth individuals relocating, understanding the economic impact of this migration is essential for grasping the future of wealth in the UK and beyond.

In the context of the UK Millionaires Migration trend in 2025, a significant shift among affluent individuals relocating internationally is unfolding. Often referred to as the ‘wealth exodus,’ this development underscores the broader dynamics of millionaire outflows as high-income earners seek better tax regimes and living conditions. As economic conditions in traditional strongholds falter, wealth flight has become a pressing topic of concern, raising questions about the long-term viability of financial landscapes like the UK. Related global migration trends highlight the growing appeal of countries that provide favorable environments for prosperity, illustrating how economic impacts resonate on an international scale. Ultimately, this migration trend not only reveals personal choices of the wealthy but also reflects broader economic realities shaping the future of wealth across nations.

The Phenomenon of UK Millionaires Migration 2025

In 2025, the phenomenon of UK millionaires migration is expected to reach unprecedented levels, with 16,500 high-net-worth individuals (HNWIs) leaving the country—a stark indication of a broader trend termed ‘wealth flight’. This historical outflow, as forecasted by the Henley Private Wealth Migration Report, significantly surpasses the loss recorded by previous years and other countries, highlighting a critical shift in the global migration landscape for the affluent. The driving factors for this migration are multifaceted, encompassing increasing taxes, changing political climates, and the pursuit of more favorable environments for wealth preservation.

This migration trend indicates not just a response to immediate financial incentives but underscores a deeper sentiment among ultra-wealthy individuals regarding long-term stability and opportunity. Many wealthy Britons are looking toward jurisdictions that offer favourable tax regimes and enhanced lifestyle options, such as the UAE, Monaco, and Malta. This significant shift emphasizes how strategic wealth migration can fundamentally alter economic dynamics, reflecting the changing perceptions of economic security on both a national and global scale.

Understanding Wealth Flight: Causes and Consequences

Wealth flight refers to the migratory trend of high-net-worth individuals seeking more favorable living conditions and fiscal environments. In light of recent tax reforms and economic pressures, the UK is witnessing an alarming rate of millionaire outflow. Changes such as increased capital gains taxes and inheritance duties have instigated a growing sentiment of disenchantment among affluent residents, prompting many to seek alternative locations that better suit their needs for wealth preservation and lifestyle advantages.

The consequences of this wealth flight extend beyond individual financial losses; they pose a significant economic challenge for the UK. High-net-worth individuals contribute substantially to the economy through investments, job creation, and tax revenues. Their departure not only diminishes immediate financial inflows but may also affect long-term economic competitiveness. Furthermore, the loss of the wealthy demographic may lead to a reputational decline of the UK as a prime destination for business and investment, ushering in broader implications for the country’s socioeconomic fabric.

Global Migration Trends: The Rise of New Wealth Hubs

As traditional strongholds for wealth, such as the UK and parts of Western Europe, face declining appeal, new global migration trends are emerging that highlight the rise of alternative wealth hubs. Countries like the UAE, Switzerland, and Portugal are benefitting from significant inflows of departing millionaires from the UK and other nations. Attractive tax regimes, robust economic opportunities, and desirable lifestyles make these regions attractive for high-net-worth individuals seeking both personal and financial refuge.

Emerging markets are also gaining traction; countries like Montenegro and Malta have seen exponential growth in their millionaire populations due to favorable investment migration programs. This shift illustrates a broader demographic change in where high-net-worth individuals choose to reside, fundamentally altering the landscape of global wealth distribution and prompting a re-evaluation of where economic power centers are likely to be established in the future.

Economic Impact of High-Net-Worth Migration

The economic impact of high-net-worth migration is profound and multifaceted. For countries gaining wealthy migrants, the influx typically leads to increased investment, heightened economic activity, and boost in local real estate markets. Wealthy individuals tend to spend significantly on luxury goods and services, enhance the consumer market, and inject much-needed capital into local economies, stimulating growth. The UAE’s capital, for example, is seeing a substantial increase in its millionaire population, which is expected to yield positive effects on its already flourishing economy.

Conversely, countries experiencing outflows face daunting challenges as the departure of wealthy residents can lead to a loss of capital, diminished economic confidence, and potential stagnation in fiscal growth. The UK’s anticipated net loss of 16,500 millionaires in 2025 highlights serious long-term concerns for the economy. Maintaining competitiveness becomes increasingly challenging, possibly resulting in further economic disparity within the nation as affluent individuals seek stability and opportunity abroad.

Lifestyle Factors Influencing Wealth Migration

Lifestyle choices significantly influence wealthy individuals’ decisions to migrate. Many high-net-worth individuals seek locations that not only provide tax advantages but also align with their lifestyle aspirations, offering vibrant cultures, excellent educational institutions, safety, and quality of life. Countries like Italy and Portugal are increasingly seen as desirable due to their rich heritage, pleasant climates, and welcoming environments that cater to affluent individuals and families.

Moreover, the appeal of lifestyle factors is complemented by the availability of expat communities, which provide a sense of belonging and support for newly relocated individuals. The growing trend of remote work has further facilitated this phenomenon, allowing affluent workers the flexibility to choose their residence based on quality of life rather than proximity to their workplace. This shift points to a changing narrative about wealth and relocation—one that increasingly values personal satisfaction and global opportunities over the limitations imposed by traditional geographic borders.

The Role of Citizenship by Investment Programs

Citizenship by investment programs have emerged as crucial tools in attracting wealthy migrants and countering wealth flight. Countries like Malta and Portugal, with their structured programs encouraging foreign investment, provide clear pathways for high-net-worth individuals to obtain residency and citizenship in exchange for economic contributions. Such programs serve not only as an incentive for the wealthy but also as mechanisms for governments to bolster their economies amidst the challenges of migration.

These initiatives can lead to a sustained inflow of capital and talent, helping new citizens integrate into their adopted countries and contribute to local communities. As the UK suffers notable losses in its millionaire population, citizenship by investment programs in other territories may serve as a pragmatic model for rejuvenating economies and enhancing appeal for global investors, showcasing how proactive policies can attract wealth and stimulate growth.

Monitoring the Shifts in Wealth Geography

Monitoring shifts in wealth geography is essential for understanding the broader economic implications of millionaire migration. Professional firms like Henley & Partners are instrumental in analyzing these trends, providing valuable insights into the evolving landscape of global wealth movement. As countries reassess their policies and strategies to attract or retain millionaires, accurate data on migration trends is vital for informing decisions at both the governmental and investment levels.

Understanding where wealth is moving allows nations to develop targeted strategies that not only compete with emerging wealth hubs but also address the underlying reasons for outflows. Additionally, tracking these shifts helps investors and businesses identify emerging opportunities in growing markets, proving that the dynamics of wealth migration are crucial not just for policymakers but for economic planning and investment strategies globally.

Implications of Brexit on UK Wealth Migration

Since the Brexit vote in 2016, the UK’s appeal as a destination for wealthy individuals has dramatically changed. The anticipated outflow of 16,500 millionaires in 2025 further emphasizes the challenges the UK faces in retaining its affluent population. Factors such as economic uncertainty, regulatory changes, and global perception have contributed to the diminishing attractiveness of the UK for high-net-worth individuals, ushering in a new era marked by the term ‘WEXIT’ as wealthy individuals exit in search of more favorable environments.

Furthermore, the implications of Brexit extend beyond immediate millionaire losses. It raises concerns about the long-term impact on the UK’s economic landscape. As high-net-worth individuals relocate to more stable and prosperous jurisdictions, the UK risks losing not just financial capital but also vital skills and economic contributors, perpetuating a cycle of decline. Addressing these issues through well-considered policy adjustments may help the UK regain its standing as a magnet for investment and wealth.

Key Takeaways from the Henley Wealth Migration Report 2025

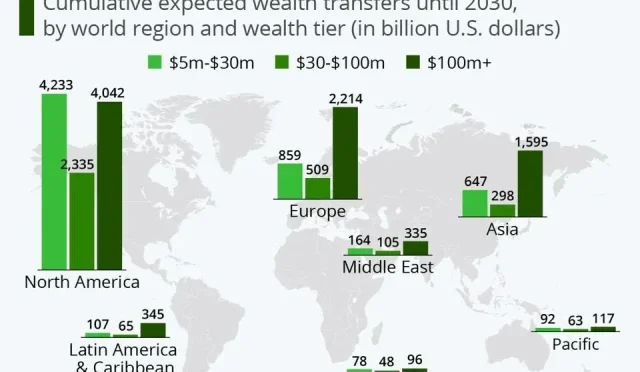

The Henley Wealth Migration Report 2025 provides crucial insights into the trends influencing millionaire relocation across the globe. The staggering projection of over 142,000 millionaires relocating internationally underscores the ongoing transformation of wealth geography. Focused attention on the economic implications of these shifts reveals a vibrant discussion about tax policies, investment opportunities, and the role of lifestyle in determining migration choices.

The report serves as a key resource for understanding not just the motivations behind millionaire outflows but the broader economic landscape that is shaping these decisions. By highlighting countries that are both losing and gaining wealthy migrants, it fosters awareness among policymakers and stakeholders about necessary adaptations to global challenges and market demands, shaping the future trajectory of global wealth distribution.

Frequently Asked Questions

What factors are driving UK Millionaires Migration 2025?

The UK Millionaires Migration 2025 is primarily influenced by recent sweeping tax reforms, increasing capital gains and inheritance taxes, and a growing perception among high-net-worth individuals (HNWIs) that more favorable opportunities, stability, and freedom are available in other countries. This wealth flight is indicative of significant global migration trends, especially as the UK anticipates a loss of approximately 16,500 millionaires.

How does the UK compare to other countries in terms of millionaire outflow in 2025?

In 2025, the UK is expected to lead the world in millionaire outflow, with a net loss of 16,500 high-net-worth individuals (HNWIs). This figure starkly contrasts with China, projected to see a loss of 7,800 millionaires. This substantial migration trend illustrates a broader economic impact on the UK’s status as a wealth hub.

What are the top destinations for UK millionaires relocating in 2025?

UK millionaires migrating in 2025 are primarily relocating to tax-friendly jurisdictions such as the UAE, Monaco, and Malta, as well as lifestyle-centric countries like Italy, Portugal, and Greece. The UAE, in particular, is set to attract a remarkable net inflow of 9,800 relocating millionaires.

What economic impacts could the UK face due to the estimated millionaire outflow in 2025?

The economic impact of the UK Millionaires Migration 2025 could be profound, affecting tax revenues, real estate markets, and overall economic growth. With a significant loss of high-net-worth individuals, the UK’s appeal as a global investment destination may diminish, leading to longer-term consequences for economic competitiveness.

Are there specific trends among other European countries regarding millionaire migration in 2025?

Yes, in 2025, several major European countries are also expected to experience net outflows of high-net-worth individuals. France, Spain, and Germany are seeing decreases in resident millionaires, with significant numbers relocating to emerging wealth hubs in Southern Europe, like Switzerland and Portugal, indicating a shift in wealth distribution across the continent.

How does the concept of ‘wealth flight’ relate to the UK Millionaires Migration 2025?

Wealth flight is a term that describes the exodus of high-net-worth individuals from one country to another, often due to unfavorable economic conditions, taxation, or instability. In the context of UK Millionaires Migration 2025, this phenomenon reflects the broader trend of HNWIs seeking better opportunities and more favorable investment climates overseas.

What role does the UAE play in the UK Millionaires Migration 2025?

The UAE plays a prominent role in the UK Millionaires Migration 2025 as it is projected to be the top destination for relocating millionaires. The region’s favorable tax regulations, luxurious lifestyle, and robust economic environment are key factors attracting high-net-worth individuals from the UK.

How is the UK positioning itself in response to high-net-worth individuals leaving in 2025?

In light of the UK Millionaires Migration 2025, policymakers may need to evaluate current tax structures and investment incentives to enhance the country’s appeal. The significant outflow of HNWIs could prompt discussions on mitigating measures to retain wealth and stimulate economic growth.

What are the long-term implications of UK Millionaires Migration 2025 on global migration trends?

The UK Millionaires Migration 2025 signifies a pivotal shift in global migration trends, potentially leading other countries to reconsider their tax and investment policies. As the UK becomes a net exporter of millionaires, it may influence broader patterns of wealth distribution and migration, impacting economic competitiveness on a global scale.

What demographic of individuals is most affected by the UK Millionaires Migration 2025?

The UK Millionaires Migration 2025 primarily affects high-net-worth individuals (HNWIs), including successful entrepreneurs, business executives, and affluent families, all of whom are seeking more favorable living conditions and investment opportunities abroad.

| Country/Region | Projected Millionaire Migration 2025 | Net Outflow / Inflow | Comments |

|---|---|---|---|

| UK | –16,500 | Outflow | Largest outflow of millionaires globally, driven by tax reforms. |

Summary

UK Millionaires Migration 2025 highlights a significant trend as the United Kingdom is experiencing an unprecedented outflow of high-net-worth individuals in 2025. This migration wave, driven by factors such as tax increases and the search for better opportunities and stability, underscores the shifting competitive landscape for wealthy individuals. The implications for the UK’s economy and investment climate are profound, prompting a call for new strategies to attract and retain affluent residents amidst this global migration of millionaires.

#UKWealth #MillionaireMigration #WealthExodus2025 #GlobalFinance #UKEconomy