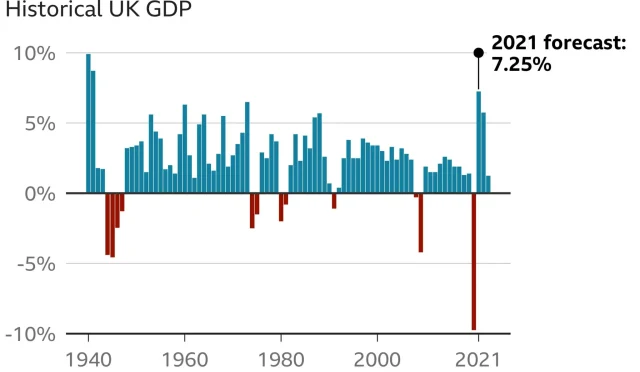

The discussion surrounding a UK wealth tax has gained significant traction as the government grapples with the challenges of tax reform amidst a tightening fiscal landscape. As pressure mounts to raise substantial revenue, estimates suggest that Chancellor Rachel Reeves may need between £20bn and £50bn just to meet routine spending demands. Advocates argue that a targeted wealth tax could effectively tap into the vast reserves held by the wealthiest individuals, enhancing equity in the UK taxation policy. However, the implications of such a wealth tax raise concerns about its feasibility, particularly in terms of asset tracking and the unpredictable behavior of affluent taxpayers. Moreover, the intricate landscape of capital gains tax and inheritance tax complicates the pathway to implementing a straightforward wealth tax, sparking a broader debate on the future of UK tax reform.

Introducing a tax specifically aimed at the affluent in the UK, often referred to as a wealth levy or asset-based tax, has emerged as a focal point of fiscal policy debates. The implications of this proposed tax extend beyond mere revenue generation; they encompass broader discussions about social equity and economic dynamics. As lawmakers explore the potential of modifying existing taxes, such as inheritance duty and capital gains assessment, the overarching goal remains clear: to create a more balanced taxation system. While proponents of a wealth levy point to international examples, critics question their effectiveness and sustainability within the UK’s unique economic framework. Ultimately, determining the future landscape of UK taxation will require a careful evaluation of the complexities surrounding both current assets and the wealthy individuals who hold them.

Understanding the Implications of a UK Wealth Tax

The introduction of a wealth tax in the UK brings with it a myriad of implications that extend beyond just the financial impact. For one, the political landscape surrounding wealth taxes is complex and fraught with debates about the fairness and effectiveness of such measures. Advocates for a wealth tax argue it could help balance the fiscal deficit, while detractors warn that it could deter investment and drive high-income individuals out of the country. This places pressure on policymakers to carefully assess the potential risks and rewards associated with implementing a new tax structure.

Moreover, the calculations involved in implementing a wealth tax are complicated by the lack of accurate data. As officials strive to quantify the wealth held by individuals, especially the ultra-wealthy, any potential tax could be miscalculated or poorly administered without reliable figures. This adds layers of complexity to the discussion, as it intertwines with other aspects of UK tax reform, such as capital gains tax and inheritance tax, which could potentially be reformed instead of introducing a new wealth tax.

The Challenges of Implementing a Wealth Tax

Implementing a wealth tax in the UK faces significant challenges, not least of which is the identification and valuation of assets. With the suspension of crucial economic surveys, the government struggles to determine who falls within the millionaire and billionaire brackets accurately. This lack of data creates a significant hurdle, as policymakers rely on sound statistical evidence to design effective and fair tax policies. The absence of reliable reporting can lead to public mistrust and political backlash against new tax measures.

Furthermore, there exists a philosophical debate within the government regarding the taxation of wealth versus capital. Some Treasury insiders suggest that a more effective strategy may involve reforming existing taxes, such as inheritance and capital gains taxes, rather than introduing a wealth tax. This view aligns with concerns that a wealth tax could stifle investment, which is crucial for economic growth. The challenge, therefore, lies not only in the tax’s financial viability but also in its ability to align with broader economic goals and principles.

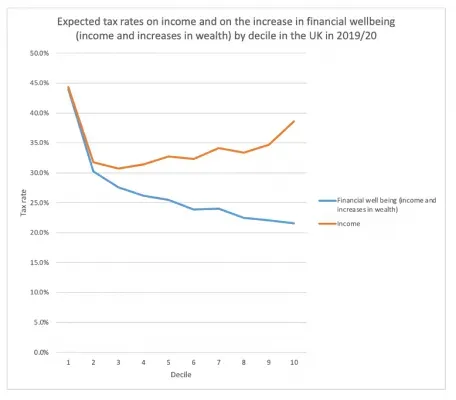

Reforms in Inheritance and Capital Gains Taxation

Recent discussions surrounding reforms to inheritance tax (IHT) and capital gains tax (CGT) indicate a shifting landscape in UK taxation policy. These reforms are critical as they offer existing avenues to increase tax revenue without imposing a new wealth tax. For example, aligning CGT rates more closely with income tax rates could level the playing field, ensuring that high earners contribute fairly to the tax system without the complexities of a new regime. Furthermore, easing the rules around gifting in IHT can encourage wealth distribution beyond direct familial ties, tackling issues of intergenerational wealth concentration.

Incorporating adjustments to IHT and CGT could also serve as a politically savvy move for the government. It may help to placate backbenchers calling for more substantial changes while demonstrating a commitment to fair taxation practices. As political pressure mounts, the government could leverage these reforms to address public demands for fiscal responsibility without resorting to a politically sensitive wealth tax, thereby appealing to a broader spectrum of the electorate.

Political Pressure and the Wealth Tax Debate

The discussion of a wealth tax in the UK is not solely about the financial implications; it is also a reflection of political ideologies within the government. As pressure mounts from various factions of the Labour party to adopt iconic wealth taxes akin to those implemented in other countries, political leaders must tread carefully. On one hand, there is a desire to satisfy left-leaning constituents who see wealth taxes as crucial for economic restructuring. On the other hand, treasury officials caution against the potential pitfalls associated with such measures.

This tension often leads to a dichotomy in strategies, with some advocating for immediate action on progressive tax policies while others call for a more gradual approach focused on amending existing taxation methods. The challenge lies in balancing these competing pressures while ensuring that any changes promote sustainable economic growth. Should the fiscal outlook worsen, the government may be compelled to reconsider its stance, ultimately impacting the viability of a strategy centred around a wealth tax.

The Case for Modernising Existing Tax Systems

Rather than adopting a new wealth tax, some economists and political leaders are advocating for a modernisation of existing tax frameworks. By adjusting capital gains and inheritance tax structures, the government could tap into greater revenue without the complexities and potential backlash associated with a wealth tax. Additionally, reforming these areas could alleviate the pressure felt by certain demographics, such as farmers who traditionally oppose changes to IHT.

This approach suggests a focus on refining the existing taxation system as opposed to expanding it unnecessarily. For instance, by harmonising the capital gains tax with income tax, the government not only simplifies tax liabilities for wealthy individuals but also reassures the general public that tax policy is fairer and more equitable. Such reforms are not only pragmatic but could help build public trust in tax systems amidst rising economic inequality.

International Comparisons in Wealth Taxation

Examining international cases of wealth taxes provides valuable lessons for the UK. Nations like Spain and Switzerland have enacted such taxes but also faced significant challenges, including numerous exemptions that limit revenue generation. Critics argue that these examples illustrate why a wealth tax may not be suitable for the UK’s economic environment, where existing taxes like IHT and CGT are already in play. Moreover, these countries have adjusted their tax policies over the years, often moving away from wealth taxes when faced with similar issues of compliance and effectiveness.

The allure of international precedents can lead to a misinterpretation of their potential success in the UK context. Rather than adopting these measures outright, Treasury officials argue for a comprehensive analysis of the actual benefits and drawbacks of wealth taxes seen abroad. By focusing on uniquely UK-centric solutions—like reforming inheritance and capital gains taxes—there may be more political and public support, ultimately leading to a more coherent and effective taxation policy.

Public Perception and Wealth Tax Legitimacy

Public perception plays a critical role in the legitimacy of any proposed wealth tax, impacting both support for it and likely compliance rates. The idea of taxing wealth can resonate positively among the populace, especially as discussions around income inequality continue to rise. However, this perception can shift dramatically based on how effectively the government communicates the purpose and intended use of such taxes. If citizens believe a wealth tax will fund vital public services and infrastructure, support may increase.

Conversely, if the public views a wealth tax as a punitive measure targeting successful individuals, support could diminish rapidly. Thus, transparency in how these proposed taxes are framed and their expected impact on society is crucial. Engaging in open dialogues about tax implications and emphasizing fairness can help mitigate opposition, especially among those with more entrenched views against such measures.

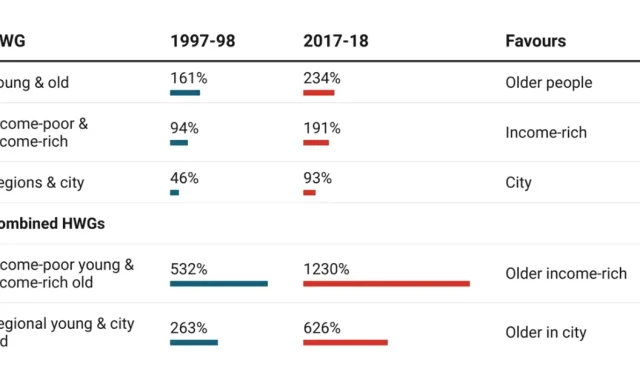

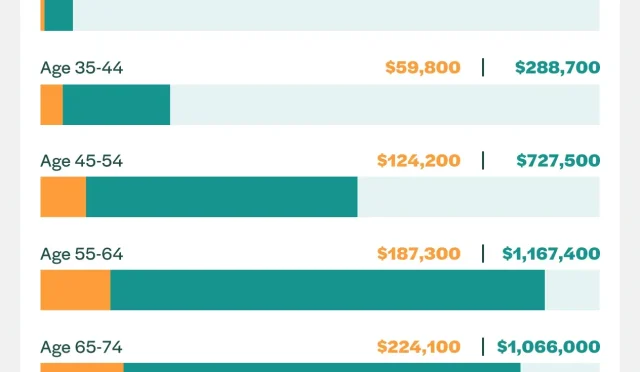

Strategizing Against Wealth Consolidation

Wealth consolidation poses a considerable challenge for policymakers, as the rich continue to accumulate assets and capital, potentially leading to growing economic disparities. To counteract this, a wealth tax or adaptations to current tax systems could aim to reduce the advantages enjoyed by the ultra-wealthy, encouraging a redistribution of wealth throughout society. This approach could generate considerable revenue while addressing social criticisms regarding inequality.

However, the government must carefully consider the implications of such measures, including the possibility of capital flight, where wealthy individuals relocate to avoid higher taxes. To maintain stability, it is essential to strike a balance between fair taxation and incentivizing investment. Thus, while the conversation around wealth taxes continues, focusing on strategic reforms to existing tax systems may offer a preferable route towards addressing wealth consolidation without deterring economic growth.

The Road Ahead: Balancing Taxation and Economic Growth

Looking ahead, the UK’s approach to wealth taxation must balance fiscal responsibility with the need for economic growth. Policymakers are increasingly aware that excessive taxation can hinder investment and entrepreneurship, potentially leading to diminished returns. Therefore, the road ahead may require refining existing tax mechanisms, such as enhancing the efficiency of IHT and CGT, rather than pursuing a headline wealth tax that carries significant political risk.

Engaging diverse stakeholders and exploring alternative tax models—not just at home, but in the broader context of global tax systems—could yield innovative solutions. With public opinion and political dynamics continually shifting, the government must remain adaptable, prepared to innovate, and focused on creating a tax environment that fosters growth while ensuring fairness and equity across all levels of society.

Frequently Asked Questions

What are the current implications of a wealth tax in the UK?

The implications of a UK wealth tax revolve around its potential ability to generate significant revenue, especially in the context of balancing spending against tax revenue. However, the effectiveness of imposing a wealth tax is complicated by challenges in accurately assessing the wealth of individuals, particularly due to inadequate data on asset locations and ownership.

How does the proposed wealth tax relate to UK tax reform?

The proposed wealth tax is intertwined with UK tax reform as it raises questions about how best to tax wealth without stifling investment. Some policymakers argue for a wealth tax to address income and capital disparities, while others suggest refining existing taxes like capital gains tax (CGT) and inheritance tax (IHT) to better target wealth.

What is the relationship between capital gains tax and a wealth tax in the UK?

Capital gains tax (CGT) may serve as a more politically viable alternative to a direct wealth tax, as it applies to profits made from asset sales. Discussions surrounding CGT often focus on aligning its rates more closely with income tax, which some argue would enhance fairness in the UK taxation policy without instituting a controversial wealth tax.

How does inheritance tax impact discussions about a wealth tax in the UK?

Inheritance tax (IHT) plays a crucial role in the discourse on wealth tax as it represents a significant existing tax on wealth transfer. Lawmakers are considering reforms to IHT, reflecting a broader strategy of taxing wealth without introducing a standalone wealth tax, which could face significant political resistance.

What challenges does the UK face in implementing a wealth tax?

The UK faces various challenges in implementing a wealth tax, including a lack of reliable data on wealth distribution and asset locations, potential political resistance, and economic arguments suggesting that high taxes on capital might deter investment. These factors complicate the debate on whether a wealth tax is the right path forward.

Are there any successful international precedents for wealth taxes that the UK could consider?

While some countries like Spain and Switzerland have implemented wealth taxes, their effectiveness and the challenges they face raise skepticism. Officials like Rachel Reeves argue that the UK’s existing wealth taxes, such as IHT and CGT, are more effective and that lessons from foreign tax systems may not easily translate to the UK context.

What alternative strategies are suggested for taxing wealth in the UK?

Alternatives to a wealth tax in the UK include reforming existing taxes like CGT to align it with income tax rates, adjusting inheritance tax rules, and improving the efficiency of current taxation policies aimed at wealthy individuals. These suggestions focus on leveraging existing systems to avoid the complications of introducing a new wealth tax.

How does the UK government plan to respond to demands for wealth taxation?

The UK government is likely to reflect on the pressure for wealth taxation by exploring adjustments to current tax frameworks, such as enhancing inheritance tax and capital gains tax, rather than swiftly adopting a new wealth tax. This gradual approach aims to balance fiscal needs and political feasibility.

| Key Points |

|---|

| The UK is under pressure to explore wealth taxes to raise substantial funds, with estimates ranging from £20bn to £50bn. |

| Existing tax mechanisms may be more politically viable but require careful adjustments rather than new taxes. |

| Issues arise from poor data collection on wealth, complicating the implementation of new tax policies. |

| The Treasury is influenced by historical economic ideologies which may hinder progressive tax reforms. |

| There is a debate on whether increasing wealth taxes could ultimately stimulate economic growth. |

| Some government insiders suggest reforms to existing taxes like inheritance tax and capital gains tax are preferable. |

| International examples of wealth taxes face scrutiny and provide mixed results in terms of efficacy. |

| Political dynamics within the Labour party are pushing towards potential headline wealth tax measures. |

| Challenges remain, especially regarding party unity on tax reforms amid economic uncertainties. |

Summary

The topic of UK wealth tax raises significant debate regarding the most effective means of increasing revenue. With the urgent need to bridge considerable fiscal gaps, discussions revolve around whether implementing a headline wealth tax or refining existing tax mechanisms will yield better outcomes. Political dynamics complicate progress as party factions advocate for varied approaches, underscoring the necessity for thoughtful consideration in fiscal policy amidst pressing economic demands.

#UKWealthTax #EconomicPolicy #TaxSolutions #FinanceInsights #WealthManagement