The concept of the UK wealth timebomb has emerged as a critical issue, reflecting the deep and growing disparities in wealth distribution across the nation. As economic inequality escalates, the stark reality of wealth inequality in the UK becomes increasingly evident, with a significant portion of the population holding little or no net wealth. The discourse surrounding a potential wealth tax in the UK is gaining traction, as many citizens question the fairness of Britain’s current approach to wealth distribution. This urgent conversation is underscored by the growing recognition that taxing wealth is not just a fiscal responsibility but a moral one, especially amid rising social tensions. Addressing these disparities is not merely a matter of economic policy, but also one of social justice, requiring a reexamination of how wealth is accumulated and shared in British society.

The looming crisis of wealth disparity in the UK manifests as a time-sensitive challenge, prompting discussions about equitable wealth distribution and social responsibility among the affluent. Terms like economic inequality and wealth inequality have become central to understanding the fabric of modern Britain, where a wealth tax could serve as a potential remedy for the widening gaps in asset ownership. As Britain grapples with its wealth distribution issues, the debate highlights the need for a proactive response to ensure that wealth does not become a privilege reserved for a select few. The societal implications of this scenario call for urgent action, as public sentiment increasingly favors more equitable tax structures that can bridge the gap between the wealthy elite and the broader population. As such, the conversation surrounding the UK wealth timebomb is more than political rhetoric; it is a call to redefine how wealth is viewed and taxed in order to foster a fairer society.

Understanding the UK Wealth Timebomb

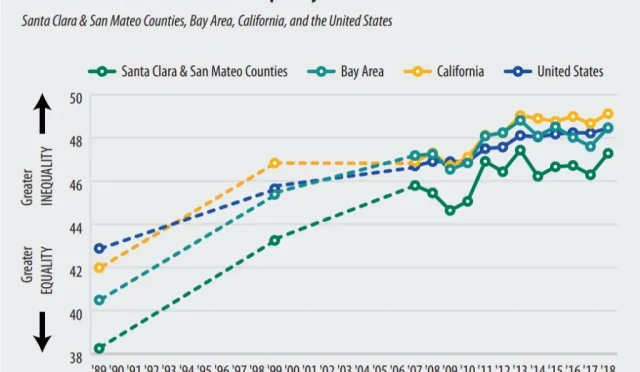

The term ‘wealth timebomb’ refers to the precarious state of wealth distribution in the UK, where a tiny percentage of the population holds a disproportionate share of national wealth. Recent studies indicate that the top 1% of earners control about 20% of all wealth in the UK, representing a stark shift since the early 20th century. This concentration of wealth not only aggravates economic inequality but also creates significant social strains, as the wealthiest citizens often become disconnected from the struggles faced by the majority. In the current landscape, there are increasing calls to address this imbalance through effective public policy and structural reforms.

The emergence of the wealth timebomb is further compounded by a growing sentiment that wealth accumulation should not involve social responsibility. Today, many wealthy individuals resist tax increases on the grounds that these violate their rights to private property. However, this perspective breeds resentment and division, undermining social cohesion. In light of historical precedents, there is a clear need to redefine the role of wealth in society, recognizing that those who benefit from economic prosperity owe a debt of responsibility to the populace. Without intervention, the wealth timebomb stands to exacerbate divisions, leading to greater unrest and conflict.

Wealth Inequality in the UK: A Growing Concern

Wealth inequality in the UK has reached alarming proportions, reflecting not only fiscal disparities but also structural barriers that prevent upward mobility. The Resolution Foundation reports that half of British families have no net wealth, a shocking figure that starkly illustrates the divide between the asset-rich and the wealthless. This disparity is particularly evident in the housing market, where skyrocketing prices have rendered homeownership unattainable for the younger generation. In regions like London, the wealth gap continues to widen, highlighting the need for urgent policy change to address these imbalances.

Despite the rising awareness of wealth inequality, proposed solutions often face significant pushback from those who believe increasing taxes on the affluent is an infringement on fundamental rights. However, it is critical to understand that wealth inequality not only harms those who are impoverished but poses a threat to the social fabric of the country. The voices of the marginalized grow louder in resentment against a system that locks them out of opportunities. Therefore, addressing wealth inequality should be seen less as a punitive measure and more as a necessary investment in the stability and future prosperity of the nation.

The Case for a Wealth Tax in the UK

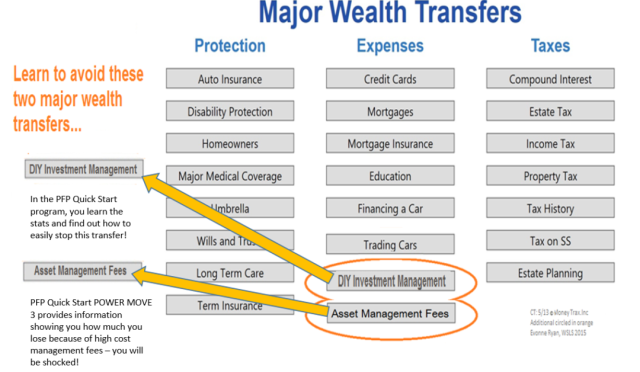

A wealth tax represents a viable solution to combat the UK’s growing economic disparities. Unlike income taxes, which primarily target earnings, a wealth tax would focus on the assets that individuals possess, effectively addressing the concerns surrounding wealth concentration in a fair manner. Advocates of a wealth tax argue that it can serve as a tool for redistributing resources more equitably and ensuring that those who have benefited most from society contribute fairly. By taxing accumulated wealth, it is possible to raise funds that can alleviate public services and welfare programs critically underfunded in recent years.

Critics of a wealth tax often cite concerns regarding potential capital flight and compliance issues, fearing that high-net-worth individuals would leave the UK or find loopholes to avoid taxation. However, evidence suggests that these fears may be exaggerated. Rather than fleeing, wealthy individuals have historically adapted to changes in tax structures. By setting a reasonable threshold for a wealth tax—above which individuals would start to pay—policymakers can encourage social responsibility among the richest while ensuring that ordinary citizens are not burdened. This approach not only generates substantial revenue but also fosters a sense of community and shared prosperity.

Exploring Class Inequality and Its Implications

Class inequality in the UK has been entrenched over generations and is now further amplified by economic policies that prioritize the wealthy over the working class. Sociologists have noted that the odds of children from working-class backgrounds achieving high-status jobs are increasingly low due to systemic barriers, affectionately termed the ‘class ceiling.’ This reality is only exacerbated by the current wealth concentration, which significantly limits opportunities for economic mobility. As a result, the idea of a fair and democratic society is called into question.

With this backdrop, it is undeniable that tackling class inequality is critical in addressing broader issues of economic disparity. Educational and training opportunities need to be more accessible, enabling those from lower socio-economic backgrounds to improve their prospects significantly. Furthermore, the interplay between wealth and status reinforces the notion that social mobility is often an elusive goal for many, leading to disillusionment with the political system. Only by prioritizing policies that widen access and reduce inequalities can any meaningful change be achieved in Britain’s socio-economic landscape.

The Cultural Responsibility of Wealth Holders

Throughout history, the wealthy in the UK have been viewed as custodians of not only their assets but also of social responsibilities towards the less fortunate. However, this cultural understanding has waned in recent decades, giving rise to a mentality that treats wealth as a strictly private good devoid of societal obligations. This shift in perspective has significant implications for public discourse around wealth taxation and responsibility, raising the question of whether current wealth holders recognize the benefits they derive from society.

In contrast to past expectations of noblesse oblige, where the rich actively contributed to societal well-being, modern attitudes often prioritize individual gain. This notion undermines the foundational belief that wealth should enable not only personal prosperity but also broader societal improvement. As public resentment towards inequality grows, the responsibility of the wealthy to contribute to the community becomes all the more urgent. Reviving discussions around the social contract linked to wealth ownership could foster a more collaborative future, where the rich recognize their potential role in mitigating social inequality.

Recognizing the Social Value of Wealth

Wealth has traditionally been viewed not only as a product of individual effort but also as a collective societal advantage. Reflecting on this perspective allows for a more meaningful understanding of wealth’s role in shaping communities and fostering shared prosperity. The disconnect between wealth creation and societal impact underlines the importance of recognizing that significant financial assets should serve a purpose beyond mere accumulation; they should contribute to the common good. In this context, wealth can be seen as a resource that, when shared responsibly, can engender a more balanced and harmonious society.

By embracing the idea of wealth as a social asset, wealth holders can lead the charge in bridging gaps and addressing inequalities. This vision calls for strategic investments in public initiatives, such as education, healthcare, and infrastructure, to nurture environments where collective growth occurs. By reframing wealth in terms of its social value, not only does it foster a sense of responsibility, but it also enhances community resilience. Ultimately, this shift could lay the groundwork for a more equitable society in which all citizens can thrive.

Historical Perspectives on Wealth Taxation

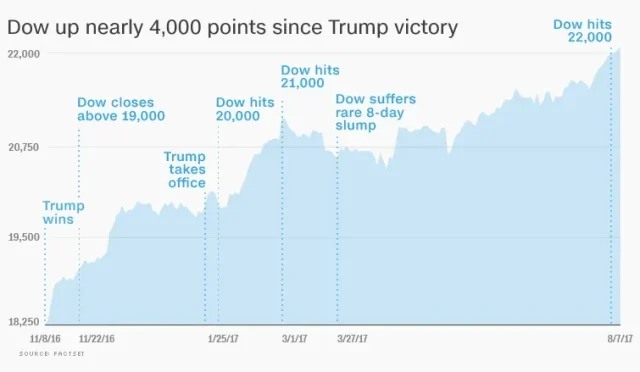

The history of wealth taxation in the UK reveals a shifting narrative around the moral implications of tax policy and collective well-being. From early methods of tax assessment during the Norman conquest to the progressive taxation policies of the 20th century, there is a long-standing tradition of acknowledging the need for wealth redistribution. These historical precedents provide critical insights into how present-day tax policies can be shaped to address contemporary issues. Importantly, they show that wealth taxation is not a novel concept but, rather, a return to ethical foundations that prioritize societal welfare.

As discussions around the implementation of a wealth tax continue to unfold, it is vital to look back at successful taxation strategies used throughout British history. Those policies were often designed not only to generate revenue but to address the inequalities of the time, thereby reinforcing a shared social commitment towards collective prosperity. Revisiting these historical examples can inspire a reimagined approach to wealth taxation, encouraging a more equitable system that seeks to restore balance and fairness to an increasingly unequal society.

Promoting Consistent and Fair Taxation Policies

Establishing a coherent and fair tax policy is essential in addressing the growing wealth disparity in the UK. The current system often creates inconsistencies that disproportionately benefit the wealthy while burdening the average citizen. Streamlining taxation frameworks, specifically those concerning wealth and capital returns, can help create a balanced approach to public finance that ensures fairness across economic classes. By aligning tax rates on capital income with those on earned income, policymakers can alleviate some of the public resentment and foster a more equitable tax environment.

Furthermore, comprehensive reforms should prioritize transparency and accountability within the tax system, empowering citizens to understand how their contributions support societal growth. Effective communication around the implications of tax policies can help demystify financial frameworks and encourage public dialogue regarding wealth obligations. In turn, these strategies may cultivate community support for progressive taxation that ultimately aims to rectify economic imbalances while fostering cooperation among diverse sectors of society.

Building a Future of Shared Prosperity

The ideal vision for the UK’s economic future involves creating a society where wealth is distributed equitably, enabling all citizens to thrive. This goal hinges on a commitment to dismantle existing inequalities and to cultivate a culture that recognizes the importance of shared wealth and collective responsibility. Implementing wealth taxes is just one avenue towards achieving this future, necessitating a broader cultural shift where the value of wealth transcends personal gain and is acknowledged as a shared resource.

Encouraging a conversation around the social implications of wealth can reshape the public narrative, empowering individuals from all walks of life to appreciate the collective nature of prosperity. By fostering this understanding, we can begin to dismantle the barriers that perpetuate economic inequality, creating opportunities for future generations. Ultimately, prioritizing a vision of shared prosperity is about reinforcing social responsibility, allowing Britain to move forward as a more equitable and cohesive society.

Frequently Asked Questions

What is the UK wealth timebomb and why is it a concern for wealth inequality in the UK?

The UK wealth timebomb refers to the growing disparity in wealth distribution, where a small percentage of the population holds the majority of wealth, exacerbating economic inequality. This issue is critical as it threatens social cohesion and the future prosperity of the nation.

How does wealth inequality in the UK relate to the ideas of a wealth tax?

Wealth inequality in the UK calls for the introduction of a wealth tax as a measure to redistribute wealth more equitably. Advocates argue that taxing the wealthiest individuals can help fund public services and address the disparities created by the concentration of wealth.

What historical context illuminates the UK’s current wealth distribution and the economic inequality faced today?

The current wealth distribution in the UK echoes patterns seen in the early 20th century, where wealth was highly concentrated among a few. Historical shifts, such as those observed during the welfare state’s establishment, inform today’s debates on economic inequality and the necessity for a wealth tax.

In what ways can taxing wealth responsibility be viewed as an ethical obligation in the UK?

Taxing wealth responsibility is seen as an ethical obligation because those with substantial wealth have benefited from societal structures and systems. Thus, contributing through taxes can enhance social welfare and support those less fortunate, reinforcing the idea of common wealth.

What are the implications of the UK’s wealth distribution trends for future generations?

The ongoing trends of wealth concentration in the UK suggest that future generations may face increased economic disparities, limiting their opportunities for social mobility and exacerbating issues of wealth inequality. This creates a pressing need for effective wealth taxation to mitigate these challenges.

How can the concept of Britain’s wealth distribution influence public policy and the need for a wealth tax?

Understanding Britain’s wealth distribution can influence public policy by highlighting the necessity of implementing a wealth tax aimed at reducing inequality and promoting sustainable economic growth. As wealth concentration rises, equitable tax policies can help redistribute resources more fairly.

What role does the public perception of wealth impact the debate around wealth tax in the UK?

Public perception of wealth significantly impacts the debate around wealth tax. Many view wealth as a private good with minimal social obligations, leading to resistance against proposals for increased taxation on the wealthy. Changing this perception is crucial for the acceptance of wealth taxation as a necessary social responsibility.

What evidence supports the need for wealth taxation as a solution to economic inequality in the UK?

Research from institutions like the Resolution Foundation indicates that wealth gains are increasingly concentrated among the wealthiest, with half of UK households possessing no net wealth. Implementing a wealth tax could alleviate these disparities and fund essential public services to support those in need.

| Key Points |

|---|

| Analysis of the UK’s wealth distribution and its implications for society. |

| Comparative historical context between the wealth concentration in the past and present. |

| Discussion of the challenges related to tax reforms and societal attitudes towards wealth. |

| Concerns about the increasing wealth inequality and its societal consequences. |

| Proposals for wealth taxation as a means to address social and economic imbalances. |

| Exploration of how the perception of wealth has shifted from being a collective resource to a private asset. |

Summary

The UK wealth timebomb is a critical issue that highlights the growing disparity in wealth distribution across society. As wealth becomes increasingly concentrated in the hands of a small elite, the consequences for social equality and economic stability are alarming. Historical perspectives illustrate that this concentration is not merely a recent phenomenon but part of a broader cycle that could lead to severe societal discord. To avert a disastrous future, there is an urgent need for thoughtful policy discussions around wealth taxation that acknowledge the societal responsibilities that come with substantial wealth. Addressing this issue with a focus on fairness and equity is essential to ensuring a more just and prosperous society for all.