Ultra-high-net-worth individuals are reshaping markets and investment flows as a small share of people control a surprising amount of wealth. UHNW wealth now accounts for a disproportionate slice of asset growth, underscoring the broader global wealth gap that persists even at the top. The concentration of money in the hands of this elite fuels luxury brands growth and shapes consumer behavior across high-end segments. For policymakers and investors, this wealth concentration signals opportunities and risks tucked inside a shifting economic landscape. By mid-2025, more than 500,000 Ultra-high-net-worth individuals held substantial investable assets, illustrating how the top tier stands apart from the rest.

Beyond the headline term, observers describe the core group as the world’s wealthiest elites or top-tier investors who steer markets with their capital and taste. This cohort, often labeled high-net-worth individuals or UHNW wealth holders, exemplifies the real-world effects of wealth concentration on luxury demand and asset choices. LSI-friendly framing also points to a broader socioeconomic pattern—the global wealth gap and income polarization that concentrate opportunity and risk in a small circle. As luxury brands seek growth, their strategies increasingly aim at the premium segment while considering geographic clusters where extreme affluence remains most pronounced. Together, these signals help explain why wealthy consumers continue to drive growth in premium goods and why policymakers watch shifts in wealth distribution.

Ultra-high-net-worth (UHNW) and the concentration of wealth

Ultra-high-net-worth individuals, defined as people with at least $30 million in investable assets, form the core of the world’s super wealthy. By mid-2025, the world’s ultra-high-net-worth (UHNW) group had grown to about 1% of the global millionaire population, according to Altrata. This same cohort now holds a significant share of wealth within the ultra-rich, with about 32% of UHNW wealth concentrated in the leading tier of this group.

This concentration highlights a broader global wealth gap even among the affluent. The wealthy are not evenly distributed, and wealth concentration remains a defining feature of the ultra-wealthy landscape, underscoring persistent disparities within the ranks of the ultra-rich and contributing to ongoing discussions about inequality.

UHNW wealth share and population size

The ultra-high-net-worth segment represents roughly 1% of the global millionaire population as of mid-2025, reflecting rapid growth at the very top of the wealth pyramid. Within this group, the top tier accounts for a substantial portion of millionaire wealth, underscoring how a small elite captures a large share of assets.

This pattern reinforces the global wealth gap (global wealth gap) and illustrates how wealth concentration persists even among the wealthiest. For marketers, policymakers, and financial professionals, the distribution of UHNW wealth remains a critical indicator of economic topography and market resilience.

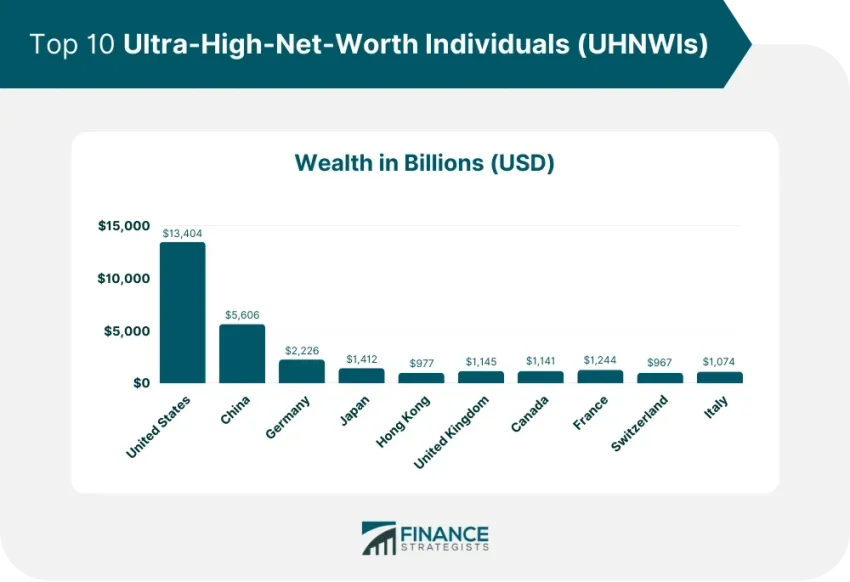

Geography of UHNW wealth: North America dominates in size and scale

North America’s UHNW population is the largest regional cluster, accounting for about 41% of the ultra-high-net-worth population and holding roughly $24 trillion in wealth. This geographic dominance illustrates how regional wealth centers concentrate global UHNW assets.

Within this geography, major cities emerge as hubs. New York is home to the largest share of these super wealthy individuals, followed by Hong Kong and Los Angeles, signaling how metropolitan centers drive UHNW wealth accumulation and investment activity.

Top UHNW cities and the urban footprint of wealth

The urban footprint of the ultra-wealthy is heavily concentrated in a handful of cities, with 7 of the top 10 cities where the richest people live in the United States. This urban concentration highlights how city ecosystems support UHNW wealth through finance, entrepreneurship, and high-end services.

A fifth of the global ultra-wealthy live in these top 10 cities, underscoring how metropolitan areas serve as global focal points for UHNW wealth and related luxury market dynamics.

Wealth concentration and the K-shaped recovery in the U.S.

The concentration of wealth within the top 1% of earners mirrors the broader wealth gap and aligns with the current K-shaped recovery in the U.S. economy, where different parts of the population recover at different paces. This pattern concentrates purchasing power at the very top.

MOODY’s data show that the top 10% of earners now account for about half of consumer spending, which obscures the spending behaviors of middle- and lower-income households and reinforces the salience of UHNW trends for retailers and luxury brands.

The ultra-wealthy and luxury brands growth

The ultra wealthy accounted for over 20% of consumer spending on luxury goods in 2024, spending about $290 billion—roughly 1% of U.S. GDP. This level of UHNW consumption exerts outsized influence on growth trajectories within the luxury sector and establishes luxury brands growth as a key priority for high-end marketers.

With the overall luxury consumer base declining after a decade of growth, the ultra-high-net-worth segment has become increasingly critical to luxury brands’ expansion plans. Brands aiming to sustain growth increasingly tailor offerings to UHNW wealth and spending preferences, reinforcing the link between UHNW wealth and luxury sector performance.

Wealth effect and the investable assets of UHNW

The wealth effect from rising stock and home prices contributes to the perception that the richest are getting richer, reinforcing confidence and spending in luxury and other asset-heavy sectors. This mood effect helps sustain the appetite for high-end goods and services among UHNW individuals.

Across the globe, the UHNW class controls about $30 trillion of investable assets, roughly 10% of investable global assets. This scale underpins investment, philanthropy, and capital allocation decisions that ripple through markets and impact luxury and financial services.

General luxury consumers vs UHNW: shifting market dynamics

The general luxury consumer base is declining after a decade of growth, making the ultra-wealthy increasingly critical to luxury brands’ growth (luxury brands growth). This shift reframes how brands design products, price strategies, and create experiences to appeal to UHNW wealth and spending patterns.

As the landscape shifts, marketers are adjusting segmentation and targeting to capture the distinct demands of UHNW wealth, while maintaining engagement with the broader luxury audience. The emphasis on UHNW spend signals a longer-term pivot in luxury retail, experiences, and financial services.

Urban concentration of UHNW wealth and city-led growth

A fifth of the global ultra-wealthy live in the top ten cities, highlighting how urban ecosystems concentrate UHNW wealth and influence local economies. This urban concentration supports advanced services, luxury retail, and investment activity centered in major metros.

New York, Hong Kong, and Los Angeles anchor this geographic footprint, illustrating how premier cities drive wealth creation and distribution for UHNW individuals, while attracting luxury brands, banks, and asset managers seeking access to top-tier clients.

U.S. dominance in UHNW cities and regional market effects

Seven of the top ten cities with the richest residents are in the United States, underscoring the U.S.’s central role in UHNW wealth distribution. This concentration shapes regional markets, investment patterns, and the competitive landscape for luxury services.

North America’s share of the UHNW population and wealth informs regional dynamics across markets, influencing everything from real estate demand to high-end hospitality and financial services catering to UHNW wealth.

Corporate strategies and markets shaped by UHNW demand

The wealth gap among the rich informs corporate strategies, with financial services and consumer brands tailoring products and memberships to attract UHNW customers. For example, credit card companies have introduced increasingly expensive annual memberships and exclusive perks to appeal to ultra-wealthy clients.

Airlines and other service providers also tailor offerings for wealthier travelers, illustrating how UHNW demand shapes pricing, packaging, and service levels across luxury-focused sectors. This alignment with UHNW wealth reinforces the strategic importance of ultra-wealth segments in market planning.

Conclusion: UHNW wealth as a driver of luxury growth and global wealth dynamics

The rise of ultra-high-net-worth individuals and the concentration of wealth are shaping a new normal for luxury brands, wealth management, and market behavior. The factors of UHNW wealth, global wealth gap, and wealth concentration help explain current spending patterns and investment flows.

Understanding these dynamics is essential for creating SEO-rich content that resonates with audiences interested in UHNW wealth, luxury brands growth, and the broader implications of the global wealth gap. This knowledge supports informed analysis, targeted marketing, and effective decision-making in high-end markets.

Frequently Asked Questions

What defines ultra-high-net-worth individuals (UHNW) and how many are there globally?

UHNW refers to individuals with at least $30 million in investable assets. By mid-2025 there were more than 500,000 UHNW individuals—about 1% of the global millionaire population—who together hold roughly 32% of ultra-rich wealth.

How does UHNW wealth relate to the global wealth gap?

The wealth gap remains pronounced at the very top. The UHNW group accounts for about 32% of ultra-rich wealth while representing only 1% of the population, illustrating a high concentration of wealth and a broader K-shaped recovery in the economy.

Where are UHNW individuals most concentrated geographically?

North America hosts about 41% of the UHNW population, with roughly $24 trillion in wealth. New York is the largest city for the ultra-wealthy, followed by Hong Kong and Los Angeles; seven of the top 10 cities are in the U.S., and around 20% of the global ultra-wealthy live in those top cities.

How does UHNW wealth influence luxury brands growth?

The ultra-wealthy accounted for more than 20% of luxury goods spending in 2024, totaling about $290 billion. This spend is a major driver of luxury brands’ growth, even as the broader luxury consumer base contracts.

What is the scale of UHNW investable assets?

The UHNW class holds about $30 trillion in investable assets, roughly 10% of investable global assets, underscoring their influence on capital markets and asset allocation.

What does wealth concentration mean for consumer spending and the broader economy?

The top 10% of earners now account for about half of consumer spending, highlighting how wealth concentration shapes macro demand and market trends, including luxury and premium sectors.

What is the wealth effect and how does it relate to UHNW?

The wealth effect describes rising stock and home prices making people feel wealthier. For the ultra-wealthy, this perception can boost confidence, investments, and high-end consumption.

How are companies tailoring products and services for UHNW individuals?

Businesses are focusing on exclusive experiences and premium memberships, with credit card issuers and airlines offering high-end programs aimed at UHNW clients. Personalization and privacy are key features.

What does this mean for policymakers and markets facing UHNW wealth concentration?

Wealth concentration and the global wealth gap influence investment flows, luxury demand, and market resilience during a K-shaped recovery. This context informs macro policy and strategic decisions for firms.

Which regions and cities are central hubs for ultra-high-net-worth individuals?

North America leads with about 41% of the UHNW population and around $24 trillion in wealth, making it a core hub for ultra-high-net-worth individuals and related economic activity.

| Key Point | Data / Details | Implications / Notes |

|---|---|---|

| Population share | Ultra-high-net-worth individuals (≥$30M) make up about 1% of the global millionaire population by mid-2025; the count is more than 500,000. | Concentration persists within the wealthy; signals ongoing wealth dynamics at the top. |

| Wealth share | This group holds about 32% of wealth among the ultra-rich; they are ~1% of the wealth population but account for over a third of millionaire wealth. | Highlights within-wealth inequality and the growing dominance of the very richest. |

| Number of UHNWI | More than 500,000 by mid-2025. | Large cohort with outsized influence on markets and brands. |

| Geographic concentration | North America accounts for about 41% of the UHNWI population with roughly $24 trillion in wealth. | Regionally dominant markets; implications for policy, investment, and assets. |

| Top cities | New York is the leading city; followed by Hong Kong and Los Angeles. 7 of the top 10 cities are in the U.S.; a fifth of global ultra-wealthy live in these top 10 cities. | Urban hubs drive access to growth, services, and luxury brands. |

| Wealth and spending dynamics | Top 10% earners make about 50% of consumer spending (Moody’s). | Wealth concentration fuels demand signals and market polarization. |

| Luxury goods impact | UHNWI accounted for >20% of luxury goods spending in 2024; about $290B, ~1% of U.S. GDP. | Ultra-wealth influence is critical for luxury brands and product development. |

| Investable assets | The ultra-high-net-worth class has about $30 trillion in investable assets, roughly 10% of global investable assets. | Significant capital market influence and portfolio diversification considerations. |

| Wealth effect | Rising stock and home prices help the richest feel even wealthier. | Supports continued spending and asset accumulation dynamics among the top tier. |

Summary

Ultra-high-net-worth individuals are navigating a rapidly evolving wealth landscape shaped by concentration, opportunity, and risk. The base content shows a small but powerful cohort—about 1% of the global millionaire population—now controls roughly 32% of wealth, with more than 500,000 people by mid-2025. Geography matters: North America accounts for about 41% of the UHNWI population and roughly $24 trillion in wealth, led by New York, with Hong Kong and Los Angeles close behind. The top 10 cities host seven UHNWI hubs, and a fifth of the global ultra-wealthy live in these top 10 cities. As wealth concentrates at the very top, spending dynamics favor the richest: the top 10% earners account for about half of consumer spending according to Moody’s. Corporations are adapting with premium memberships and services tailored to affluent travelers. The ultra-wealthy account for over 20% of luxury goods spending in 2024, amounting to about $290 billion, roughly 1% of US GDP. The wealth effect from rising stock and home prices continues to buoy perceptions of wealth. The ultra-high-net-worth class holds about $30 trillion in investable assets, about 10% of global investable assets, underscoring their influence on markets and brands. For Ultra-high-net-worth individuals and the brands serving them, the takeaway is clear: targeted growth, resilient diversification, and bespoke experiences are essential to maintain leadership amid a widening wealth gap.