The latest US Stock Market Update reveals a challenging landscape for investors as the year draws to a close. Today at 11:59 a.m. ET, the S&P 500 and Dow Jones Industrial Average experienced a decline, with the S&P 500 down about 0.8% at 6,745.66. This downturn is largely attributed to a notable slide in AI stocks, raising concerns about their future profitability amidst rising oil prices, which gained traction following geopolitical tensions related to Venezuela. As market analysis unfolds, traders are now caught in a tug-of-war; the hope for a year-end rally is being tempered by inflationary pressures and a shaky tech sector. Investors are left weighing the implications of these dynamics on broader market performance and potential strategies heading into the new year.

In today’s financial climate, the update on the American equity markets sheds light on critical developments as we approach year-end. As of late morning, recent fluctuations in major benchmarks indicate a hesitant sentiment gripping Wall Street. With the S&P 500’s and Dow’s values retreating slightly, the market appears to be grappling with a pronounced setback in technology shares, specifically those associated with artificial intelligence. Meanwhile, energy stocks find themselves buoyed by climbing oil prices, stemming from geopolitical developments in Venezuela, which complicates the inflation narrative. The intricate interplay of these factors sets the stage for a pivotal period for investors, raising questions on sector resilience and strategic positioning.

US Stock Market Update: Analysis of Current Trends

As of late morning on December 17, 2025, the U.S. stock market displayed mixed signals with the S&P 500 and Dow Jones seeing declines amidst a notable drop in AI stocks. Currently, the S&P 500 is down roughly 0.8%, while the Dow is down about 0.15%. Investors are grappling with conflicting narratives: the hope for a seasonal ‘Santa rally’ is tempered by concerns over inflation and the performance of mega-cap tech stocks linked to AI. With investors actively assessing the sustainability of AI profits, the market remains in a delicate position, balancing optimism against underlying risks.

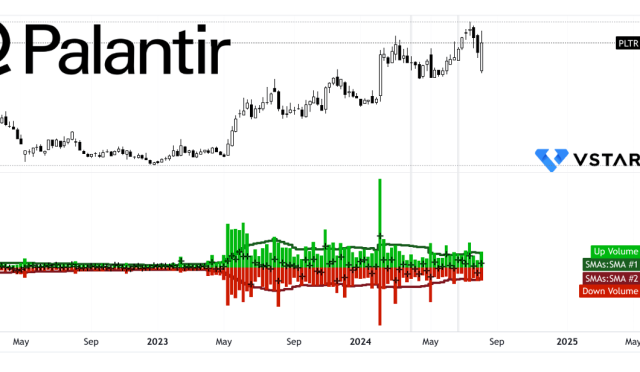

The current market dynamics illustrate a wider trend where stock values are being heavily influenced by a few tech giants, particularly those in the AI sector. Despite a majority of stocks rising, the significant losses from a handful of AI-related companies are overshadowing broader market gains. This concentration of risk raises questions about future profitability and market leadership. Illustrations of this phenomenon are seen with stocks like Nvidia and Oracle, where investor anxiety around valuations could lead to a market recalibration over the coming weeks.

Frequently Asked Questions

What are the latest US Stock Market Updates regarding S&P 500 performance?

As of 11:59 a.m. ET on December 17, 2025, the S&P 500 is down approximately 0.8%, currently sitting at around 6,745.66. Recent trading has shown a struggle as investors react to a pullback in AI stocks, while energy stocks are seeing a rebound due to rising oil prices.

Why are AI stocks dropping in the US Stock Market Update?

AI stocks have been experiencing a downturn as investors evaluate whether rapid AI spending can translate into quick profits. Concerns were heightened following news that major companies, like Oracle, are facing financing issues, which has led to a reevaluation of AI valuations.

How are recent oil prices impacting the US Stock Market Update?

Rising oil prices, driven by geopolitical tensions such as the Venezuelan blockade, are influencing the US Stock Market significantly. The increase in oil prices, which saw benchmark U.S. crude rise about 1.5% to around $56 a barrel, supports energy stocks but also raises inflation concerns.

What is the Dow Jones news affecting the US Stock Market today?

Today, the Dow Jones Industrial Average is down about 0.15% at approximately 48,039.78. The overall market sentiment reflects a tug-of-war as AI stocks decline, and while some energy shares gain ground, the overall index is struggling due to heavy selling in large tech stocks.

What market analysis can be drawn from the US Stock Market Update on December 17, 2025?

The current market analysis indicates a fragile balance between potential year-end rallies and investor anxiety due to AI stock performance and inflation concerns. The S&P 500’s drop, amid mostly rising stocks, suggests that large-cap tech decline is overshadowing broader market gains.

What should investors be aware of from the latest US Stock Market Updates?

Investors should be cautious, as the US Stock Market Update indicates a reliance on a few mega-cap tech stocks for market movement, amidst rising oil prices and inflation fears that could complicate monetary policy. Upcoming consumer inflation data will be crucial for market direction.

How do AI adoption rates affect the US Stock Market Update?

The US Stock Market Update highlights that only 17% of surveyed businesses report successful large-scale AI implementation, suggesting that investor skepticism regarding AI profitability timelines is influencing current market trends and the performance of tech stocks.

What are the expectations for the Dow Jones and S&P 500 going forward based on the latest updates?

Market forecasts suggest a more cautious outlook for the S&P 500 and Dow Jones, with modest year-end targets reflecting concerns about AI-driven valuations and rising inflation that could maintain higher interest rates into 2026.

| Index | Change (%) | Current Value |

|---|---|---|

| S&P 500 | -0.8% | 6,745.66 |

| Dow Jones Industrial Average | -0.15% | 48,039.78 |

| Nasdaq Composite | -1.25% | 22,821.50 |

Summary

In today’s US Stock Market Update, the market reflects a struggle as the S&P 500 and Dow see declines amidst a backdrop of AI stock fatigue. As of late morning on December 17, 2025, the S&P 500 is down 0.8% and the Nasdaq has slipped 1.25%, influenced by concerns over high valuations in technology stocks, particularly in the AI sector. The market’s volatility is exacerbated by rising oil prices following geopolitical tensions surrounding Venezuela, causing a mixed trading environment that investors are watching closely. Overall, the sentiment remains cautious as market participants hope for a year-end rally, but factors such as inflation and energy prices will be pivotal in determining the path forward.