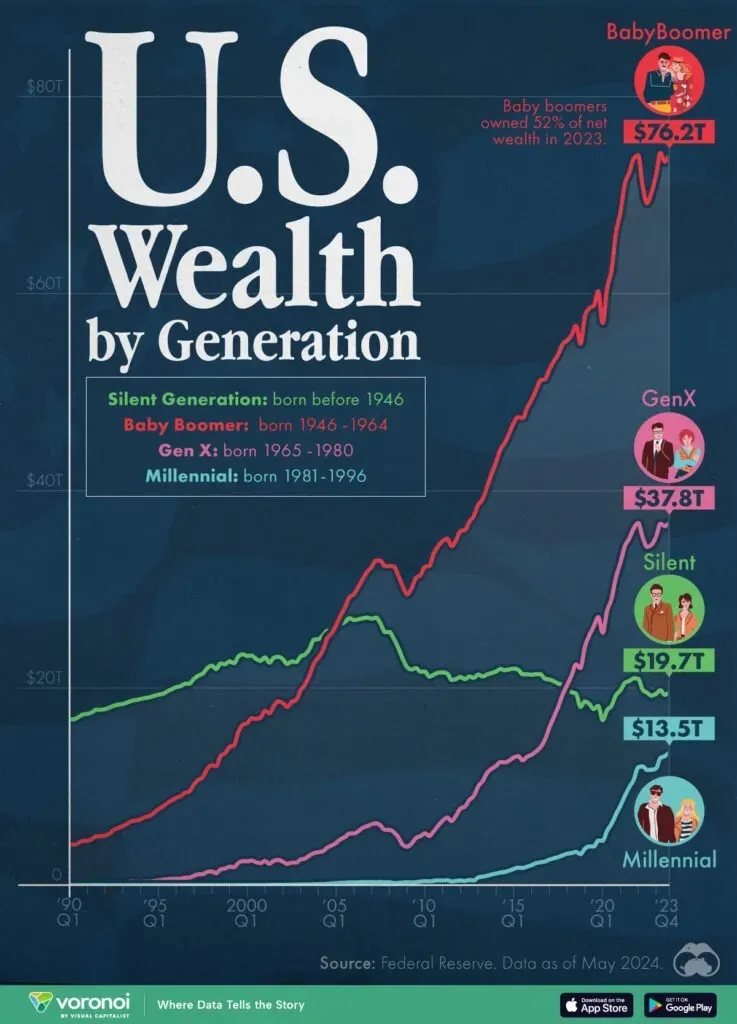

Wealth distribution by generation reveals a stark contrast in financial assets among different age groups in America. As we explore the trends through the lens of the Baby Boomers, Generation X, and even Millennials and Gen Z, it becomes evident just how significant the generational wealth gap has become. Baby Boomers currently hold an astounding $83.3 trillion, representing over half of the nation’s household wealth, while Millennials and Gen Z collectively possess only $17.1 trillion. This disparity not only highlights the wealth concentration among the elder generations but also raises concerns about the economic future of younger cohorts as they grapple with stagnating financial opportunities. Understanding these dynamics is crucial in addressing the challenges posed by wealth distribution by generation in today’s ever-evolving society.

Examining financial equity across age brackets sheds light on the evolving landscape of generational wealth. The financial legacies established by past cohorts, particularly the affluent Baby Boomers, starkly contrast with the limited assets held by younger generations, like Millennials and Gen Z. As we delve deeper into this socioeconomic phenomenon, we will uncover insights into the net worth of Generation X alongside the income fluctuations experienced by the Silent Generation. The narrative of wealth throughout these distinct groups illustrates an urgent need to address the imbalances that perpetuate economic inequalities. This discussion not only widens our understanding of wealth stratification but also emphasizes the pressing issues facing the financially diverse generations of today.

Understanding the Generational Wealth Gap

The generational wealth gap is a concerning issue that reveals stark disparities in asset ownership among different age groups. This gap affects the financial stability and growth potential of younger generations, particularly Millennials and Gen Z, who are currently inheriting a landscape of economic instability and growing debt. With Baby Boomers holding over $83 trillion in wealth, it’s evident that the historical context—a post-World War II economic boom—has favored this generation, leading to significant financial advantages that younger cohorts find challenging to replicate.

Moreover, the wealth distribution by generation highlights that Baby Boomers not only possess a vast majority of the nation’s assets, but also enjoy advantages such as higher earnings during key economic growth phases. In contrast, Gen X, while better off than Millennials and Gen Z, still lags behind in accumulating wealth, with a net worth largely influenced by fluctuating markets and rising living costs. The implications driven by this wealth gap could hinder economic mobility, making it crucial for policymakers to address these disparities and find pathways to redistribute wealth more equitably.

Baby Boomers and Their Financial Dominance

Baby Boomers typically showcase an archetype of financial success within the American society, possessing an average wealth of about $1 million per individual. This prominence in wealth can largely be attributed to their timing; entering the workforce during times of economic growth, they capitalized on expanding job opportunities and the booming real estate market of the late 20th century. As a group, Boomers have accumulated considerable financial assets, with about 29.3% of their wealth sitting in stocks and bonds, which has exponentially increased in value over the years.

Additionally, Baby Boomers benefit from homesteading and real estate investments, accounting for 23.3% of their wealth. These investments have flourished subsequent to the 2008 recession, propelling their financial status even further as property values rebounded. As they approach retirement, Boomers also influence inheritance trends, further enhancing their financial legacy and perpetuating wealth disparities with younger generations who may not have similar opportunities for wealth creation.

Generation X: Bridging the Wealth Divide

Generation X stands out in the wealth distribution landscape, positioned between the affluent Baby Boomers and the financially constrained Millennials. With over $42.6 trillion in wealth, Gen X embodies both resilience and challenges stemming from their financial journey. Facing stagnant wage growth and market volatility during their peak earning years, their net worth reflects both the struggles of securing financial stability and the burdens of caring for both aging parents and their children simultaneously, known as the ‘sandwich generation.’

Despite these hurdles, Gen X is credited with financial adaptability, often leveraging their experiences in navigating economic shifts. Many members of this generation have mobilized their financial assets into entrepreneurship and investments, creating business ventures that reflect their unique economic landscape. Thus, while they may not have accumulated wealth comparable to Boomers, they carve out a distinctly resilient financial identity that is crucial for mitigating the intergenerational wealth gap.

Millennials and Gen Z: Wealth Challenges and Opportunities

Millennials and Gen Z, collectively holding just $17.1 trillion in assets, represent a significant contrast in wealth distribution. Despite being the largest demographic cohort in the U.S., they face unprecedented financial challenges including skyrocketing student debt, housing affordability crises, and stagnant wages. Approximately 10.5% of total U.S. wealth, this figure underscores the daunting prospects younger generations face in accumulating substantial wealth compared to their predecessors. It reflects the societal shifts that prioritize education and housing, often leaving them indebted before they can even begin to invest in their financial futures.

On the flip side, Millennials show promising entrepreneurial tendencies, with about 10.8% of their total wealth derived from private business assets. This indicates a shift towards self-employment and innovative ventures as a means of wealth creation. As they navigate through economic volatility, their digital savviness positions them to reshape industries and financial landscapes, potentially setting the stage for a more equitable distribution of wealth in future generations. Understanding these dynamics will be vital for developing strategies aimed at closing the wealth gap.

The Silent Generation’s Economic Legacy

The Silent Generation, representing those born before 1946, holds a notable $20.1 trillion in wealth, primarily reflecting the values of savings and property ownership. With a significant portion of their assets tied up in real estate, this generation has experienced more stable and secure economic growth, setting a financial benchmark for overall asset accumulation. Their more conservative approaches to fiscal management have led to wealth preservation, positioning them as a key contributor to the overall wealth composition of older Americans.

Furthermore, the income sources for the Silent Generation predominantly include pensions and social security, offering them a steady financial foundation in retirement. However, the transition of their wealth to younger generations raises questions about the perpetuation of the wealth gap. Once this generation passes on their assets, strategies will need to be in place to ensure that the next generations can effectively leverage this inheritance, facilitating economic growth and equity rather than widening the generational wealth divide.

Economic Factors Influencing Wealth Distribution

Different economic factors have played a significant role in shaping the wealth distribution across generations. The shifts in market dynamics, such as the 2008 financial crisis, drastically influenced asset growth, particularly for Millennials and Gen Z, who entered the workforce during a challenging economic landscape. This context has made it difficult for them to achieve the same financial footing as earlier generations, especially Baby Boomers who reaped the benefits of a booming economy and favorable market conditions during their prime earning years.

Inflation and rising living costs further complicate wealth accumulation for younger generations, making home ownership and consistent savings challenging goals. Without robust support systems or significant changes in economic policy aimed at wealth redistribution, the gap is projected to widen. Addressing these economic disparities is crucial for fostering a more equitable future where wealth can be shared across generations.

Strategies for Closing the Generational Wealth Gap

To effectively close the generational wealth gap, comprehensive strategies must be established that facilitate financial literacy and access to resources for younger generations. Programs focusing on education about personal finance, investing, and savings can equip Millennials and Gen Z with tools to build financial independence. Additionally, policies that support affordable housing and student debt relief could significantly enhance their financial prospects, allowing them to invest more in their futures.

Moreover, fostering intergenerational dialogue around wealth sharing and economic opportunities can bridge the gap and create collaboration between generations. Baby Boomers, with their wealth, could offer mentorship or financial support to younger relatives embarking on their own business ventures. By cultivating an environment of shared knowledge and resources, a new paradigm of wealth distribution could emerge, benefiting both current holders of wealth and those striving for financial stability.

Wealth Distribution Policies and Their Impact

Wealth distribution policies play a critical role in shaping the economic landscape, particularly in addressing the disparities evident between generations. Legislation surrounding inheritance taxation, capital gains, and social safety nets are essential for maintaining equity among different age groups. Progressive approaches to taxation can alleviate some of the burdens experienced by younger generations while also ensuring that wealth concentration does not exacerbate economic divides.

Additionally, investment in programs that promote equitable access to education and healthcare can uplift underserved communities, fostering a more balanced wealth distribution. Policymakers must consider the long-term impacts of wealth distribution policies, ensuring that they not only aim to address immediate disparities but also create sustainable structures that allow for equal opportunities for wealth creation across generations.

The Future of Wealth Distribution in America

As we look to the future of wealth distribution in America, it is evident that generational dynamics will continue to evolve in response to economic pressures and societal changes. The data suggests that while Baby Boomers currently dominate wealth, their eventual transition will necessitate an adjustment period for younger generations who may encounter challenges in absorbing this wealth. Understanding demographic shifts and trends will be crucial for anticipating how asset distribution will transform in coming decades.

Moreover, innovative financial products and technology are reshaping how wealth can be accumulated and passed down. Digital currencies, impact investing, and other financial technologies offer new avenues for wealth creation, especially for Millennials and Gen Z. By embracing these innovations and advocating for fair policies, there’s potential for creating a more equitable economic landscape that mitigates the generational wealth gap and fosters prosperity for all.

Frequently Asked Questions

What is the current wealth distribution by generation in the U.S.?

In 2025, wealth distribution by generation reveals that Baby Boomers hold **$83.3 trillion**, making up **51%** of total U.S. household wealth. Generation X follows with **$42.6 trillion** (26.1%), while Millennials and Gen Z collectively hold **$17.1 trillion** (10.5%). This substantial generational wealth gap illustrates the financial challenges faced by younger generations in comparison to their older counterparts.

How does the generational wealth gap affect Millennials and Gen Z?

The generational wealth gap significantly impacts Millennials and Gen Z, who hold only **10.5%** of total U.S. wealth at **$17.1 trillion**. In contrast, Baby Boomers possess **over half** of all household wealth. This disparity reflects challenges in asset accumulation, as younger generations navigate economic hurdles such as rising student debt, expensive housing markets, and stagnant wages.

What are the primary sources of wealth for the Baby Boomer generation?

Baby Boomers, who average **$1 million** in wealth per person, primarily derive their wealth from financial assets (**29.3%**) and real estate net of debt (**23.3%**). Their advantageous timing during a stock market boom in their prime earning years has contributed significantly to their current wealth distribution.

What financial assets do Millennials possess compared to Gen X?

Millennials’ financial assets, totaling **$17.1 trillion**, are notably lower than Generation X’s **$42.6 trillion**. While Gen X benefits from greater wealth accumulation over time, Millennials are characterized by a higher percentage of private business assets (**10.8%**), highlighting their entrepreneurial tendencies despite facing a smaller overall wealth share.

What challenges are contributing to the lower net worth of Millennials compared to Baby Boomers?

Millennials face several challenges contributing to their lower net worth compared to Baby Boomers, including significant student loan debt, higher housing costs, and a tough job market. These factors have hindered their ability to accumulate wealth at the same rate as the Baby Boomer generation, exacerbating the already evident generational wealth gap.

What role does income play in the wealth distribution by generation?

Income plays a crucial role in wealth distribution by generation. Baby Boomers generally experienced robust income growth during their peak earning years, which helped them accumulate **$83.3 trillion** in wealth. In contrast, Generation X faced slower income growth amid economic downturns, influencing their current wealth position of **$42.6 trillion**, while Millennials grapple with stagnant wages and rising costs, leading to their **$17.1 trillion** in total wealth.

How does the Silent Generation’s wealth compare to younger generations?

The Silent Generation holds **$20.1 trillion**, accounting for **12.3%** of total U.S. wealth. Their wealth is significantly greater than that of Millennials and Gen Z, who together possess only **$17.1 trillion**. This highlights the growing generational wealth gap, with older generations accumulating wealth at a much higher rate than their younger counterparts.

| Generation | Birth years | Value of assets, net of mortgage debt (USD) | Share |

|---|---|---|---|

| Silent Generation | Before 1946 | $20.1T | 12.3% |

| Baby Boomers | 1946 to 1964 | $83.3T | 51.0% |

| Generation X | 1965 to 1980 | $42.6T | 26.1% |

| Millennials & Gen Z | 1981 or later | $17.1T | 10.5% |

Summary

Wealth distribution by generation reveals a stark contrast in financial assets held across different age cohorts in America. As of 2025, the Baby Boomer generation holds a commanding **$83.3 trillion**, making up **51%** of all U.S. household wealth, highlighting their predominance as the richest generation in history. Meanwhile, Generation X possesses **$42.6 trillion**, while Millennials and Gen Z collectively control a mere **$17.1 trillion**—only **10.5%** of total wealth despite being the largest population cohort. This generational wealth gap underscores the unique economic challenges that younger generations face as they strive for financial stability in an ever-evolving economic landscape.