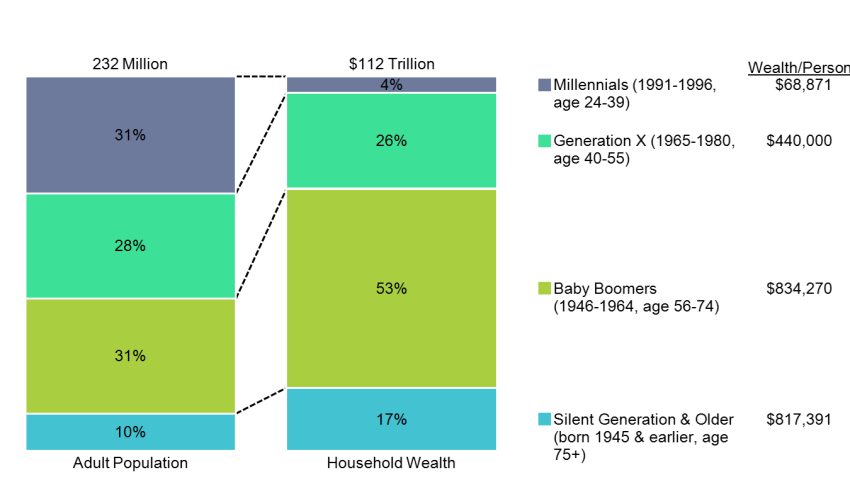

Wealth distribution generations present a striking contrast between the financial landscapes of baby boomers, millennials, and Gen Z. The latest data reveals that baby boomers control nearly one-third of America’s wealth, a staggering $85 trillion, which dwarfs the current assets held by millennials at around $18 trillion and Gen Z’s even more modest $6 trillion. As baby boomers reap the benefits of rising home values and stock investments, millennials struggle with student debt and stagnant wages, while Gen Z faces unique financial challenges, such as limited job opportunities due to technological changes. This generational wealth divide highlights the urgent need for discussions about equitable wealth transfer, particularly as we approach the anticipated wealth transfer of 2025, estimated at $124 trillion. Understanding household wealth statistics across generations is crucial for addressing these disparities and creating a more inclusive financial future.

The generational gap in financial assets is undeniably vast, showcasing the differences in wealth accumulation over time. The aging population, particularly those in the baby boomer cohort, holds a dominating share of household finances, leaving subsequent generations, like millennials and Gen Z, grappling with economic uncertainties. These younger groups encounter various fiscal challenges, from soaring student debt to skyrocketing housing prices, which highlight the disparity in wealth acquisition processes. As we prepare for the forthcoming wealth inheritance that many expect to emerge around 2025, it becomes essential to examine how these trends affect future financial stability. A more detailed look into generational wealth shifts offers valuable insights into the fading prospects for younger Americans.

Understanding Baby Boomers’ Wealth Dominance

Baby boomers currently dominate the wealth landscape in the United States, controlling nearly one-third of the nation’s household wealth. This significant wealth accumulation can be attributed to several economic factors that favored their generation, particularly during their prime earning years. With more than $85 trillion in assets, baby boomers have benefited from a combination of rising home values and a booming stock market, primarily during the late 20th century. While they were entering the housing market, inflation made real estate a lucrative investment, resulting in substantial increases in equity over the years.

In stark contrast, both millennials and Generation Z face a growing disparity in wealth. Millennials, holding about $18 trillion, find themselves significantly behind their baby boomer counterparts, struggling with high student debts and stagnating wages. Meanwhile, Gen Z, who only amassed about $6 trillion, faces unique economic challenges, ranging from job scarcity due to advancements in technology like AI, to a housing market that remains largely inaccessible. As Edward Wolff succinctly put it, the massive wealth ownership by baby boomers has left less opportunity for younger generations to accumulate wealth.

Wealth Distribution Across Generations

The current wealth distribution illustrates a widening gap between generations, primarily between baby boomers and their younger counterparts. This stark divide is a critical indicator of underlying socioeconomic issues, manifesting in the difficulty millennials and Gen Z experience as they attempt to build wealth. Factors influencing this distribution include high living costs, student loan debt burdens, and an inflated housing market, which make it increasingly challenging for younger generations to purchase homes and invest in their financial futures.

As the economy evolves, many individuals wonder about the effects of this wealth gap on future generations. The anticipated wealth transfer by 2025, which is projected to amount to an astonishing $124 trillion, could substantially alter the landscape for millennials and Gen Z. However, reliance on this transfer as a primary means of wealth acquisition could be precarious. Experts assert that while the Great Wealth Transfer may offer some financial relief, it is crucial for younger generations to remain proactive about their financial planning and investing habits.

The Great Wealth Transfer and Its Impact

As baby boomers age, the prospect of the Great Wealth Transfer looms large on the economic horizon. This transfer will potentially redistribute a staggering $124 trillion from the older generation to millennials and Gen Z. This scenario presents both a unique opportunity and a challenge. While many younger individuals may stand to inherit significant assets, the timing and amount of wealth received are uncertain, with estimates varying widely.

Financial experts highlight that, while waiting for this transfer can be tempting, millennials and Gen Z should engage in building their wealth through diligent savings and investments. Taking proactive steps now will provide independence and stability rather than relying solely on inheritance for future financial security. The narrative around wealth transfer emphasizes the necessity for tangible financial planning, ensuring that this wealth adds to their financial progress instead of being a delayed opportunity.

Financial Challenges Faced by Generation Z

Generation Z is navigating a complex financial landscape characterized by considerable challenges. Entering into adulthood during a time of high student loan debt and inflation, many Zoomers are grappling with economic realities that starkly differ from those of previous generations. The high cost of living, paired with unstable job markets due to technological advancements, has constrained their ability to accumulate wealth and achieve financial independence.

In addition, the rising costs associated with housing have made it increasingly difficult for Gen Z to enter the real estate market. With significant barriers to homeownership – including inflated home values and daunting mortgage rates – many young adults find themselves delaying home purchases and settling for less favorable economic conditions. These financial hurdles create a challenging environment for Gen Z, as they work to carve out a prosperous future amidst heightened economic pressure.

Millennials vs. Baby Boomers: A Wealth Comparison

When drawing comparisons between millennials and baby boomers, it becomes clear that the two demographics experience wealth in vastly different ways. Baby boomers, benefiting from a stronger economy during their formative years, have been able to accumulate and retain wealth at an impressive scale, contrasting sharply with the struggles millennials face today. With around $18 trillion in assets, millennials are often saddled with the burden of student debt, which significantly impacts their ability to save and invest.

This wealth disparity emphasizes the economic challenges millennials have compared to their parents. While baby boomers could easily capitalize on rising home values and favorable investment conditions, millennials currently grapple with a wealth gap that inhibits their financial mobility and stability. As they strive for financial independence, understanding this comparison underscores the necessity for proactive money management strategies for millennials aiming to bridge the wealth divide.

Household Wealth Statistics and Their Implications

Recent household wealth statistics reveal a pressing economic narrative in the United States, showcasing that baby boomers hold an overwhelming share of the wealth. Data indicates that older Americans own more than 31% of the nation’s wealth, which highlights the growing economic inequality across generational lines. As wealth remains concentrated within the aging population, younger generations face significant barriers to wealth acquisition, limiting their opportunities for financial growth.

These statistics are particularly alarming when considering the broader implications for the economy. As baby boomers approach retirement, their significant consumption patterns may shift, potentially impacting economic growth. For younger groups, the challenge remains to adapt to this landscape, strategizing their financial future in an environment where access to wealth seems increasingly out of reach. The responsibility lies within focusing on financial education and literacy to combat these disparities in household wealth statistics.

Impacts of Technology on Wealth Accumulation

The rapid technological advancements in recent years have drastically altered the landscape of wealth accumulation for younger generations. Automation and artificial intelligence have disrupted traditional job markets, impacting both millennials and Gen Z’s income potential. Many younger workers are facing the hardships of finding suitable entry-level positions due to increased competition and fewer opportunities, resulting in stagnated wage growth that is a departure from the economic traditionalism that benefited their predecessors.

The impact of technology extends beyond job markets; it also shapes how young people interact with investing. Resources like online trading platforms have made stock investment more accessible, yet the knowledge gap concerning effective financial strategies persists. Without guidance in navigating these new technologies, younger generations may find themselves ill-prepared to take full advantage of market opportunities, further exacerbating the existing wealth gap in America.

A Proactive Approach to Financial Health

As younger generations face economic inequities perpetuated by older cohorts’ wealth dominance, taking a proactive approach to financial health has never been more critical. Developing sound financial habits early on can assist in navigating obstacles such as debt, lack of savings, and challenges in wealth accumulation. Establishing budgets, saving consistently, and exploring diverse investment avenues can empower millennials and Gen Z to counter the wealth gap.

Additionally, financial literacy education is vital in cultivating informed decision-makers who can actively contribute to their future wealth. By equipping themselves with the necessary knowledge and skills, younger generations can build stronger foundations in money management and investment strategies. Engaging in financial planning early can help mitigate the effects of socioeconomic disparities, enabling these generations to claim their share of financial success.

Strategies for Future Wealth Building

In an effort to secure a more favorable financial future, both millennials and Gen Z need to focus on developing effective wealth-building strategies. This includes diversifying their investment portfolios, understanding various investment vehicles, and exploring options beyond traditional savings accounts. With the rising tide of digital financial solutions, engaging in alternative investments can provide younger generations with the edge needed to grow their wealth over time.

Moreover, enhancing financial literacy through educational resources and workshops can inspire confident decision-making. Initiating conversations about finances among peers, families, and financial advisors can also foster a supportive environment conducive to wealth-building efforts. By actively pursuing these strategies, younger generations can work towards diminishing the wealth gap and creating a more equitable financial landscape.

Frequently Asked Questions

What impact does the baby boomers wealth have on millennials wealth comparison?

The wealth held by baby boomers greatly affects millennials, as the former holds over $85 trillion, while millennials only possess around $18 trillion. This vast disparity highlights the challenges millennials face in wealth accumulation, making their wealth comparison to baby boomers starkly unfavorable.

How does Gen Z financial challenges relate to baby boomers wealth distribution?

Gen Z faces significant financial challenges, including high student debt and limited job opportunities, contrasting with baby boomers who have accumulated substantial wealth. The wealth distribution heavily favors baby boomers, leaving Gen Z with merely $6 trillion as they struggle to build financial independence amid rising costs.

What is the expected wealth transfer in 2025 and its significance for millennials and Gen Z?

The wealth transfer expected in 2025 is projected to be around $124 trillion, which will significantly benefit millennials and Gen Z. This Great Wealth Transfer will allow younger generations to inherit substantial wealth, potentially alleviating some financial challenges they currently face.

What are the key household wealth statistics that reflect the wealth distribution among generations?

Recent household wealth statistics show baby boomers now control 31% of U.S. wealth compared to millennials with only 15%, while Gen Z holds a mere 6%. These statistics illustrate the stark wealth distribution across generations, with baby boomers overwhelmingly benefitting from economic conditions during their early adulthood.

How can millennials and Gen Z prepare for the upcoming wealth transfer attributed to baby boomers?

To prepare for the forthcoming wealth transfer from baby boomers, millennials and Gen Z should develop financial plans focusing on saving and investment strategies. This proactive approach is essential to ensure they can effectively manage any inheritance and accelerate their wealth growth.

| Generation | Wealth Share | Assets Owned | Percentage of Population | Economic Challenges |

|---|---|---|---|---|

| Baby Boomers | 31% of U.S. wealth | $85 trillion | 20% | Enjoyed significant home and stock value appreciation. |

| Millennials | ~20% of U.S. wealth | $18 trillion | 20% | Struggling with home ownership and economic stability. |

| Gen Z | ~6% of U.S. wealth | $6 trillion | 20% | Facing high debts and limited access to entry-level jobs. |

Summary

Wealth distribution generations reveal a stark contrast in financial success among different age cohorts, particularly evident in the substantial wealth accumulation by baby boomers. This generation’s strategic navigation through economic events has led them to dominate household wealth in the U.S. However, millennials and Gen Z face significant hurdles that hinder their wealth acquisition, despite some positive trends indicating improvement for the younger cohort. As the Great Wealth Transfer approaches, it is essential for Gen Z and millennials to develop proactive financial strategies rather than solely rely on inheritance to build their own wealth.