Wealth dynamics are reshaping the financial landscape of the United States, particularly influencing the upper middle class. As Nick Maggiulli highlights in his insightful book “The Wealth Ladder,” the contemporary economy is witnessing a unique transition, reflected in the shifting percentages of economic classes. The upper middle class has surged from a mere 7% in 1989 to nearly 18% today, thanks to various drivers, including economic upheavals like the pandemic. This notable growth presents both opportunities and challenges in wealth transfer and asset ownership, as affluent individuals compete for limited resources. Understanding wealth dynamics is crucial for navigating this ever-evolving financial terrain, especially as we approach the impending $124 trillion wealth transfer from the baby boomer generation to their descendants.

The term ‘economic progression’ encapsulates the evolving financial hierarchies that are emerging in our society. Particularly within the context of the upper middle tier, a demographic that has increasingly become prominent in wealth discussions, these dynamics influence not only how assets are accumulated and transferred but also how they are perceived. As noted by financial experts like Nick Maggiulli, the shifting landscape of economic classes reveals much about societal values and priorities. Furthermore, terms like ‘wealth stratification’ and ‘financial mobility’ resonate with those observing the transformations of the wealth ladder. An understanding of these nuanced concepts can provide deeper insights into both personal finance strategies and broader economic implications.

Understanding the Upper Middle Class in Today’s Economy

The upper middle class has become a focal point of discussion in recent economic analysis, particularly by Nick Maggiulli in his bestselling book “The Wealth Ladder.” This demographic, which now represents approximately 18% of the U.S. population, is characterized by significant financial resources, yet many individuals within this class still perceive themselves as less affluent compared to their wealthier counterparts. This contradiction creates a complex psychological dynamic, leading to a drive for continued economic advancement. As trends shift and the economic landscape changes rapidly, understanding the motivations and behaviors of the upper middle class is crucial for both individuals and policymakers.

Furthermore, the rise of this economic class has been accentuated by post-pandemic changes. Crowded venues and competitive housing markets illustrate the presence of individuals who are financially stable yet often face the scrutiny of high costs and economic uncertainties. As Maggiulli points out, the perception of wealth is shifting along with the distribution of assets, where upper middle-class families are increasingly drawn into the fray of wealth dynamics that define modern economic interactions.

Economic Impacts of the Great Wealth Transfer

Nick Maggiulli’s warnings about the upcoming Great Wealth Transfer, estimated to be around $124 trillion, highlight the imminent changes that will affect different economic classes. This monumental financial shift will see baby boomers passing down their wealth to younger generations, altering not just individual net worths but the entire landscape of economic classes. While this transfer has the potential to enhance the financial standing of many individuals, it also poses significant challenges, including heightened competition for jobs, resources, and market share among the newly affluent young adults.

Moreover, this transfer could lead to a distortion in wealth perception, where the emergent affluent class may struggle to adapt to their newfound financial status, similar to the upper middle class’s ongoing struggles. As wealth dynamics evolve, so do the behaviors surrounding real estate and investments. Many affluent individuals are now opting to rent rather than purchase property, driven by both flexibility and market conditions, and reflecting a broader trend that transcends mere economic class distinctions.

Navigating Wealth Dynamics in a Shifting Economy

Navigating the current economic environment requires a nuanced understanding of wealth dynamics, as highlighted by Nick Maggiulli’s analysis. Individuals today, particularly those in the upper middle class, must adapt their financial strategies in response to the changing landscape. The investment patterns are shifting, with wealth increasingly concentrated in stocks and ownership of businesses rather than traditional assets like real estate. This calls for a re-evaluation of how financial maturity is perceived across different strata of society.

Moreover, adaptability in financial planning is crucial now more than ever. Maggiulli advocates for individuals to reflect on their priorities beyond the mere acquisition of wealth. As economic classes shift, it’s essential to consider how personal goals align with broader economic trends. By fostering a mindset of continual learning and flexibility, individuals can navigate the complexities of modern finance, preparing themselves for the implications of both the Great Wealth Transfer and the evolving notion of wealth in America.

The Role of Perception in Wealth Classes

Perception plays a critical role in how individuals within the upper middle class view their financial situation and status. Despite being financially secured, many in this demographic often feel inadequate, especially when compared to wealthier individuals. This sentiment echoes Charlie Munger’s thoughts on happiness declining in correlation with financial prosperity, underscoring the psychological effects of wealth distribution and societal expectations. Understanding this perception is vital for unraveling the behaviors and decisions made by those in the upper middle class.

Moreover, this perception influences lifestyle choices, investment decisions, and even personal relationships. As families in this economic class compete for resources, the implications of wealth dynamics become evident. It drives the need for better financial literacy and a more comprehensive understanding of personal financial goals beyond societal standards. By addressing these perceptions, individuals can develop healthier attitudes towards their wealth and foster a more balanced approach to financial growth.

Shifts in Asset Composition Across Economic Classes

Nick Maggiulli’s insights into asset composition reveal key differences in how various economic classes allocate their resources. Wealthier individuals tend to focus on diverse investments including stocks and businesses, while those in lower economic classes may rely more heavily on real estate or savings accounts. As the landscape of wealth changes, understanding these differences is essential for both investors and future generations being introduced to the world of finance.

Moreover, as economic conditions evolve, so too does the approach individuals take towards asset allocation. The upper middle class, for example, is increasingly navigating these choices with a mindset that combines traditional wealth-building strategies with newer alternatives. This shift is indicative of a more sophisticated approach to personal finance, where aligning financial assets with long-term goals forms the crux of strategic planning in various economic contexts.

The Psychological Aspects of Wealth and Happiness

The interrelation between wealth, happiness, and personal fulfillment is a complex subject that requires careful consideration, particularly within the context of Nick Maggiulli’s findings. Many individuals in the upper middle class find themselves in a paradox where financial stability does not equate to perceived happiness. This emotional dissonance is prevalent among those who navigate wealth dynamics but often feel pressure to achieve more, reflecting a societal narrative that equates financial success with personal worth.

To address these challenges, a more holistic view of wealth must be adopted—one that includes mental and emotional wellness as components of financial health. As individuals assess their positions on the wealth ladder, reflecting on what truly brings them fulfillment beyond monetary wealth can lead to greater overall satisfaction. Engaging with financial education that emphasizes emotional intelligence may further empower families to find balance and contentment in their economic pursuits.

Housing Market Trends Amidst Economic Shifts

Current trends in the housing market reveal a significant change in the decision-making of upper middle-class families who are increasingly opting to rent rather than buy homes. This trend, highlighted in Maggiulli’s discussions, reflects broader economic pressures and shifting priorities for many high-income earners. Factors such as rising property prices, uncertainty in the economic climate, and increased demand for flexibility are contributing to this behavioral shift.

Additionally, renting allows individuals to maintain liquidity and invest their capital into other asset classes, aligning with the shifting asset compositions discussed by Maggiulli. This strategic choice emphasizes an adaptation to modern economic realities, where ownership is less prioritized in favor of investment flexibility. Understanding these market trends not only provides insights into current wealth dynamics but also prepares individuals for future financial planning.

Building Financial Strategies for the Future

As individuals and families navigate the complexities of wealth dynamics, building sound financial strategies becomes imperative. Nick Maggiulli’s emphasis on adaptability speaks to the necessity of re-evaluating concepts of wealth in light of changing economic circumstances. By proactively examining their positions on the wealth ladder, individuals can identify opportunities for growth that align with their personal values and financial goals.

Moreover, education about financial management can empower people to make informed decisions about investing, budgeting, and asset allocation. Recognizing that wealth is not static, but rather dynamic and influenced by numerous factors, encourages a mindset geared towards continuous learning and adaptation. Through this lens, individuals can create robust financial strategies that not only seek growth but also ensure long-term stability in an ever-evolving economy.

Frequently Asked Questions

What are the key insights from Nick Maggiulli’s perspective on wealth dynamics?

Nick Maggiulli, a prominent figure in wealth management, highlights the dynamic shifts in economic classes, particularly the rise of the upper middle class. His insights suggest that wealth dynamics are evolving, influenced by factors like the pandemic and a significant economic transformation in the United States.

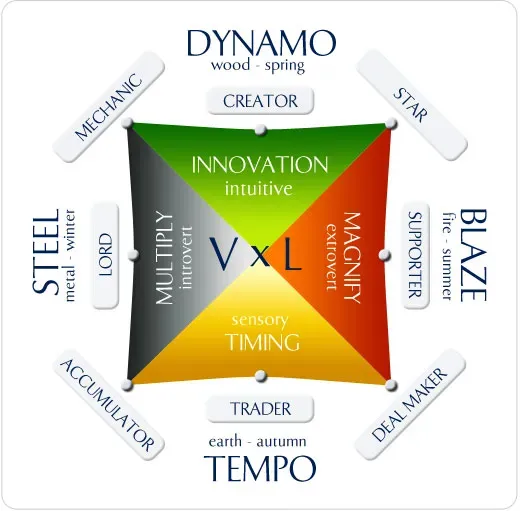

How does ‘The Wealth Ladder’ framework redefine wealth dynamics in America?

In ‘The Wealth Ladder,’ Nick Maggiulli categorizes wealth into six distinct levels, providing a clearer understanding of wealth dynamics. This framework illustrates the growth of the upper middle class, indicating a shift in wealth distribution and economic classes within society.

What factors contribute to the rising perception of wealth among the upper middle class according to Maggiulli?

According to Nick Maggiulli, the upper middle class has seen growth from 7% to 18% of the population since 1989. Factors like increased competition in housing markets and changing consumer behaviors reflect their complex relationship with wealth dynamics, despite their financial stability.

What is the upcoming Great Wealth Transfer and its implications for wealth dynamics?

The Great Wealth Transfer, estimated at $124 trillion, refers to the significant transfer of wealth from baby boomers to younger generations. Nick Maggiulli warns that this shift could impact wealth dynamics, complicating perceptions of economic classes as inherited wealth changes hands.

How do economic classes differ in their asset ownership according to wealth dynamics?

Nick Maggiulli emphasizes that economic classes prioritize different assets; the wealthy often hold stocks and businesses, while the upper middle class may find themselves uncertain with regard to home ownership. This distinction reflects the complex nature of wealth dynamics in today’s economy.

Why do many affluent individuals choose to rent rather than buy homes in the current market?

Maggiulli observes a trend among the affluent opting to rent instead of purchasing homes, citing today’s challenging housing market. This choice underscores the intricate wealth dynamics where even financially stable individuals prioritize flexibility and strategic financial planning.

What are the implications of happiness levels among the upper middle class as described by Charlie Munger?

Charlie Munger’s observation that happiness declines even as life improves resonates with Nick Maggiulli’s findings on wealth dynamics. Many in the upper middle class, despite achieving financial success, may feel pressure and competition that affect their overall happiness and perception of wealth.

How can individuals navigate the complexities of wealth dynamics as suggested by Maggiulli?

Nick Maggiulli advocates for adaptability in financial strategies as individuals assess their positions on the wealth ladder. By focusing on personal priorities beyond mere financial accumulation, individuals can better navigate the evolving landscape of wealth dynamics.

| Key Point | Details |

|---|---|

| Shift in Economic Classes | Nick Maggiulli highlights a notable change in the economic classes in the U.S., particularly affecting the upper middle class. |

| Rise of Upper Middle Class | The upper middle class (Level 4) has grown from 7% of the population in 1989 to approximately 18% today. |

| Impact on Economy | This growth has led to noticeable economic changes, such as increased competition in housing markets and crowded airport lounges. |

| Assets Held by Classes | Wealthy individuals often own businesses and stocks, contrasting with other classes who may primarily own real estate. |

| Great Wealth Transfer | The upcoming $124 trillion transfer from baby boomers to younger generations poses challenges to existing wealth dynamics. |

| Rental Preference | Many affluent people are choosing to rent rather than buy homes, reflecting a shift in current housing market dynamics. |

| Importance of Adaptability | Maggiulli advocates for adaptability in personal finance strategy as households navigate different levels of the wealth ladder. |

Summary

Wealth dynamics represent a crucial aspect of understanding the modern economy, as highlighted by Nick Maggiulli. His insights into the changing landscape of economic classes reveal that the upper middle class has seen significant growth, leading to various economic implications. As we navigate these shifts, it becomes increasingly important to reassess financial strategies and focus on adaptability in the face of evolving wealth dynamics.