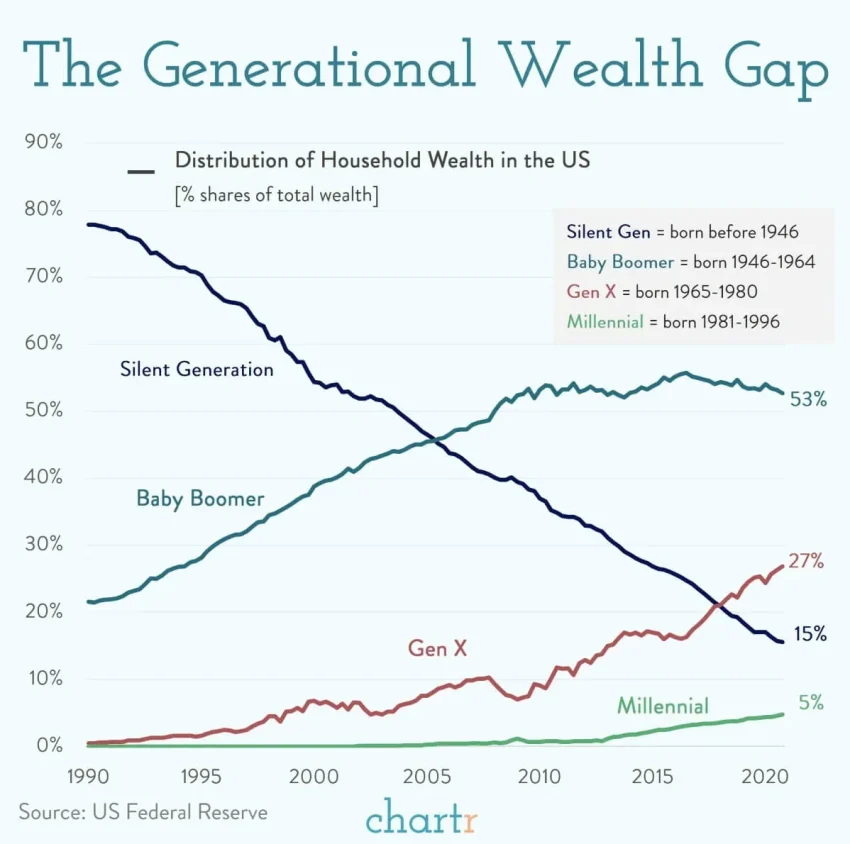

The wealth gap between generations has emerged as a pressing concern in America, highlighting an increasing disparity in financial resources between baby boomers and younger generations. With baby boomers reportedly holding an astonishing $82 trillion in wealth, their financial advantage over Generation X and millennials has never been clearer. This generational wealth divide encompasses not only the disparities in property ownership but also the vast differences in stock market investments, with boomers controlling a significant share of financial assets. As millennials struggle with homeownership, facing rising prices and severe competition in the real estate market, the implications of this wealth disparity are profound. This widening gap threatens the ability of younger individuals to accumulate generational wealth and secure their financial futures, emphasizing the need for urgent discussions on economic equity and support for younger homebuyers.

The generational wealth divide reflects the growing economic inequality whereby older adults, particularly baby boomers, disproportionately benefit from accrued assets and investments, leaving younger generations at a disadvantage. This stark contrast in financial standing has led to a significant generational wealth gap, where millennials are increasingly marginalized in the real estate market. As boomers choose to retain their properties amidst rising home values, the challenges for millennials in achieving homeownership and financial stability are compounded. Furthermore, the wealth disparity is not limited to real estate; it extends to stock ownership and investment opportunities, which are essential for building long-term wealth. Evaluating these generational trends sheds light on the critical implications for future financial landscapes and the pressing need for policy reforms that aim to bridge this divide.

The Generational Wealth Divide: An Overview

The generational wealth divide continues to widen as older Americans effectively consolidate their financial power. Baby boomers, in particular, have accumulated a significant amount of wealth, largely driven by sound investments in the real estate market over decades. Comparatively, millennials are grappling with the burden of hefty student loans and rising rental prices, which impede their ability to save for homeownership. This has led to a stark contrast in financial stability, wherein the older generation enjoys the benefits of their long-term investments, while younger individuals struggle to achieve even the basics of economic independence.

The consequences of this wealth disparity are profound, impacting not just individual families but the economy at large. With baby boomers controlling a large percentage of property and financial assets, young adults find themselves navigating a contracting market where opportunities for homeownership are dwindling. This dynamic exacerbates the wealth gap, making it increasingly difficult for millennials and Generation Z to pursue financial dreams that were more attainable for previous generations. As the older demographics cling to their wealth and assets, the barriers to entry for younger generations continue to rise.

Boomers and Real Estate Market Trends

As baby boomers preserve their real estate holdings, market trends are significantly shifting, impacting millennial entry into the housing market. Recent statistics show that boomers are opting to age in place, which translates to fewer homes becoming available for younger buyers seeking to purchase properties. This trend, combined with economic factors such as low inventory and increasing demand, has driven prices up, further complicating the prospect of homeownership for millennials. They are left competing against seasoned investors and older family members who possess more resources.

Additionally, boomers have benefitted immensely from appreciating home values, which has contributed to their substantial net worth of over $82 trillion. In contrast, millennials often find themselves priced out of homeownership as they earn less and encounter soaring property prices in urban areas. The real estate market, as shaped by boomers’ choices, has become a challenging landscape for younger generations to navigate, forcing many to reconsider their aspirations towards homeownership.

Wealth Gap Between Generations: The Facts and Figures**

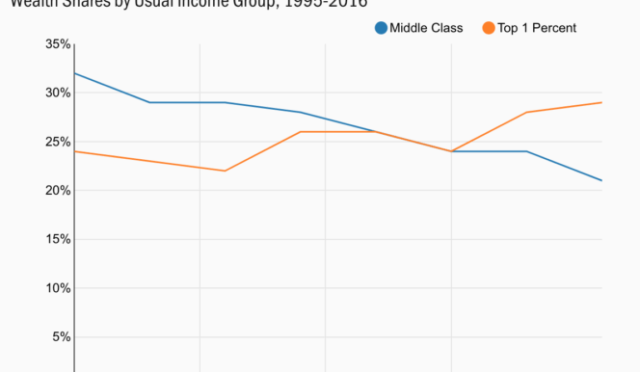

The wealth gap between generations is startling, with baby boomers possessing financial resources that dwarf those of millennials. With baby boomers holding approximately four times the wealth of millennials, according to the latest data, this disparity paints a bleak picture for younger generations. Factors such as the rising cost of living, inadequate wage growth, and limited opportunities in a competitive job market have left millennials at a disadvantage, unable to build the same wealth that previous generations have accumulated.

Recent findings show that from the early 1980s to 2022, the wealth of those aged 75 and older has significantly increased, while millennials, who face the highest debt-to-income ratios, continue to struggle just to maintain the status quo. This growing disparity raises critical questions about the future of financial mobility in the U.S. economy and whether younger generations can catch up or if they will remain with a limited wealth trajectory due to the structural shifts favoring the older demographics.

Challenges of Homeownership for Millennials

Millennials are facing unprecedented challenges in their pursuit of homeownership. The combination of escalating property prices and relatively stagnant wages has created a significant barrier for this tech-savvy generation, who are often burdened with student debt. The generational differences in homeownership rates highlight a concerning trend: while baby boomers have enjoyed the benefits of favorable market conditions over the last few decades, millennials have found themselves in a paradox, where traditional pathways to wealth accumulation are increasingly out of reach.

The importance of homeownership cannot be understated, as it represents both a financial investment and a major life milestone. However, with the current real estate market trends showing a scarcity of available homes and rising prices, many young adults are left leasing apartments instead of investing in property. As boomers hold onto their homes longer, this pattern not only limits supply in the market but also perpetuates the growing wealth gap that has become a defining characteristic of generational economic differences.

Real Estate Investments: A Boomer Stronghold

The landscape of real estate investments in America has become predominantly controlled by the baby boomer generation. With seasoned experience, they hold over 54% of the stock market shares, substantially contributing to their wealth and influencing market stability. Their extensive investments in real estate have allowed them to leverage property values effectively, further compounding their financial advantage over younger generations. For millennials, who are still in the process of building their asset portfolios, this has created an uneven playing field.

The implications of this boomer stronghold in real estate are far-reaching. As these older Americans cherish their investments, the younger generation’s ability to enter the housing market becomes increasingly jeopardized. Not only do millennials face the rapid rise in property prices as boomers retain ownership, but they also contend with the potential for economic instability when boomers decide to divest their holdings. This situation creates uncertainty for the future, as millennials navigate a market dominated by the financial strategies and assets of the boomers.

Millennials and the Burden of Debt

In addition to the prevailing challenges in securing homeownership, the millennial generation bears a substantial burden of debt—most notably, student loans. This massive financial load complicates their ability to save for a down payment while simultaneously managing daily expenses. With limited funds, many young adults find themselves in a cycle of renting rather than owning, perpetuating the dynamic of generational wealth divide. In fact, studies indicate that high debt levels among millennials correlate with their delayed entry into the housing market.

As millennials remain tethered to debt, the socio-economic implications are severe. The struggle for financial independence becomes an insurmountable hurdle, preventing many from achieving traditional markers of adult success, such as homeownership. The debt that millennials carry affects their behavioral choices in the market, making them increasingly risk-averse when it comes to real estate investments compared to baby boomers who enjoy assets that appreciate with time. Thus, the cycle of wealth for younger generations remains increasingly difficult to break.

The Impact of Economic Conditions on Wealth Inequity

Economic conditions have played a crucial role in exacerbating the wealth inequities between generations. The historical context of the baby boomer’s financial growth stemmed from a thriving post-war economy, leading to sound investments in real estate and equities. Millennial prospects, however, face headwinds not seen by earlier generations, such as the economic fallout from the Great Recession, which profoundly affected job markets and access to credit for young buyers. These intertwined economic realities highlight the difficulties millennials encounter in building generational wealth.

Moreover, diminishing opportunities for accessible homeownership due to skyrocketing home prices have forced many millennials to rethink their long-term financial goals. As economic instability looms, with inflation and rising interest rates potentially impeding income growth, the challenges facing younger generations may only intensify. Without substantial policy changes to address the wealth gap and foster greater economic mobility, millennials may find the road to economic prosperity increasingly blocked.

Policy Implications for Bridging the Wealth Gap

Addressing the wealth gap between generations requires strategic policy approaches aimed at facilitating homeownership for millennials and subsequent generations. Legislative measures such as affordable housing initiatives, enhanced access to first-time homebuyer programs, and student debt relief could alleviate some pressure on younger demographics. Importantly, policymakers need to recognize the implications of the current wealth disparities and take actionable steps to level the playing field for aspiring homeowners among millennials and Gen Z.

Promoting economic opportunities through financial literacy programs and investment in housing infrastructure would not only support millennials but serve to bolster the overall economy. By fostering an environment that encourages savings and responsible investments among young adults, society can chip away at the generational wealth divide and create a sustainable pathway toward wealth accumulation that benefits all demographics. Bridging this gap will require collaboration across governmental and private sectors, aimed at crafting solutions that address the unique challenges faced by younger generations.

Future Considerations for Generational Wealth

Understanding the future considerations for generational wealth requires a comprehensive look at not only financial strategies but also the broader socio-economic landscape. As boomers age, their eventual transition of wealth—whether through inheritance, estate planning, or financial gifts—will shape the next generations’ financial realities. It is critical to address both the benefits and complexities of these transitions to ensure they promote equity rather than exacerbate existing disparities.

Moreover, the evolving perceptions of wealth and economic participation will influence the approach that younger generations take toward investing and home ownership. Millennials and Gen Z are more inclined towards alternative investment opportunities such as sustainable assets, given their concern for social responsibility. As these younger generations inherit wealth from boomers, it will be vital to harness this economic potential not just for personal gain but for long-term societal benefit, thus paving the way for a more equitable financial future.

Frequently Asked Questions

What is the current wealth gap between generations in America?

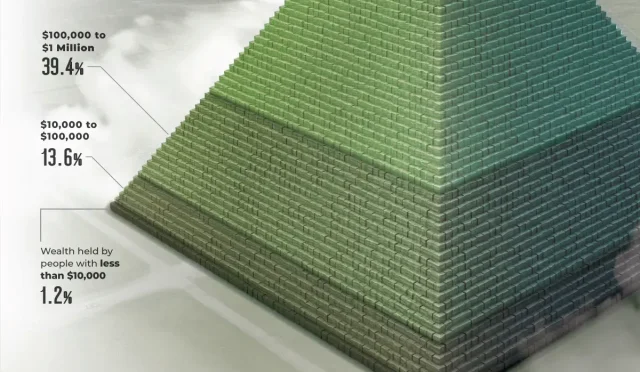

The wealth gap between generations in America is significant, with baby boomers holding approximately $82 trillion in wealth, which is over twice as much as Generation X’s $42 trillion and four times that of millennials’ $16 trillion. This disparity is largely due to baby boomers’ greater homeownership rates and stock market investments, which have increased since the 1980s.

How does baby boomers’ wealth contribute to the generational wealth divide?

Baby boomers contribute to the generational wealth divide by retaining substantial assets, including property and investments. This generation owns about 54% of stocks valued over $25 trillion, while millennials only hold 8.2% of the market. Their wealth accumulation, supported by long-term investments and home equity, further distances them from younger generations, making it harder for millennials and Gen Z to achieve similar financial stability.

Why are millennials struggling with home ownership amid the wealth disparity?

Millennials are struggling with home ownership due to rising home prices, limited market supply, and high levels of mortgage debt. As baby boomers choose to remain in their homes, the available housing for younger buyers diminishes, aggravating the wealth disparity between generations. Consequently, millennials are facing obstacles that prevent them from entering the real estate market and building wealth.

What impact do real estate market trends have on the generational wealth divide?

Current real estate market trends are negatively impacting younger generations by restricting their ability to purchase homes. With fewer homes available for sale and baby boomers opting to stay in larger properties, millennials encounter increased competition and higher prices. This trend exacerbates the wealth gap, as fewer opportunities for home ownership hinder millennials’ chances of accumulating generational wealth.

How does the homeownership rate affect wealth accumulation for millennials?

The homeownership rate is crucial for wealth accumulation, especially for millennials. Currently, millennials own homes at a rate similar to that of 1983, yet this still lags behind older generations. As baby boomers maintain high homeownership rates, millennials face increased challenges in acquiring property, which limits their potential for wealth growth and contributes to the widening wealth gap between generations.

Why is the wealth gap between generations expected to continue widening?

The wealth gap between generations is expected to continue widening due to several factors: baby boomers’ strong control over stocks and real estate, their reluctance to sell homes, and the increasing financial burdens on younger generations, including student loans and rising living costs. These elements create an environment where older generations can accumulate wealth while younger individuals face significant barriers.

What can be done to bridge the wealth gap between generations?

To bridge the wealth gap between generations, strategic policies are needed, such as enhancing access to affordable housing for millennials, addressing student debt issues, and promoting financial literacy programs. Additionally, creating incentives for baby boomers to downsize or sell their homes can help increase housing supply and contribute to a more equitable intergenerational wealth distribution.

| Generation | Wealth ($ Trillions) | Homeownership Rate | Stock Ownership Percentage |

|---|---|---|---|

| Baby Boomers | 82 | High (significantly above 65%) | 54 |

| Generation X | 42 | N/A | N/A |

| Millennials | 16 | Comparable to 1983 | 8.2 |

| Generation Z | N/A | 0.3 | N/A |

Summary

The wealth gap between generations has become a defining issue in today’s economy. As older generations, particularly baby boomers, accumulate wealth at an unprecedented rate, millennials and Generation Z face increasing hurdles in building their own wealth. With baby boomers holding a staggering $82 trillion and controlling a significant portion of stocks and real estate, younger generations struggle with rising mortgage debts and a contracting housing market. This growing disparity highlights the urgent need for solutions to bridge the wealth gap between generations, ensuring economic opportunities for all.