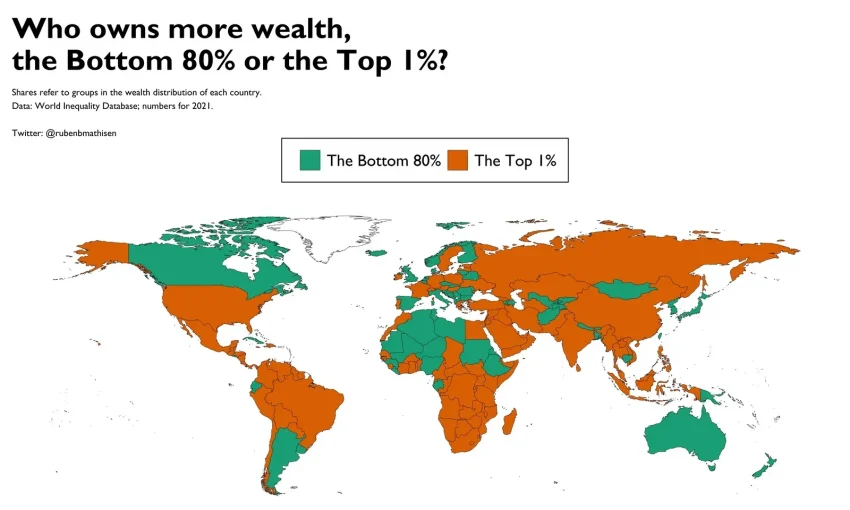

Wealth inequality has become a pressing global issue, manifesting starkly in the disparities seen across different nations. Recent studies reveal that the concentration of wealth among the richest individuals, notably millionaires, accounts for an alarming proportion of global assets. The Gini coefficient, a key metric for measuring wealth distribution, highlights the significant gaps in equity, with countries like Brazil, Russia, and South Africa leading in high inequality rankings. Despite some nations striving for better wealth distribution, overall global wealth equality decreased by 0.4% since the year 2000. As we examine these trends, it becomes evident that addressing wealth inequality is crucial for fostering equitable countries and ensuring sustainable economic growth for all.

The disparity in wealth among different socioeconomic groups, often referred to as economic inequality, presents a significant challenge on both local and global scales. This uneven distribution of assets has led to a growing divide, where a select few control an overwhelming share of personal wealth, while vast populations struggle to gain a foothold. Understanding the implications of this financial disparity requires us to look closely at metrics such as the Gini index, which provides insights into the extent of inequality within various regions. Moreover, countries that manage to cultivate a more balanced wealth structure tend to experience greater social stability and economic resilience. In this exploration of wealth dynamics, we will uncover how global wealth inequality affects societies and what measures can be implemented to promote a fairer economic landscape.

Understanding Global Wealth Inequality Trends

Global wealth inequality has become a pressing issue as we progress into 2025. The Gini coefficient, which measures wealth distribution, offers a numerical perspective on this disparity. A Gini coefficient of 0 indicates perfect equality, while a score of 1 signifies total inequality. Recent reports have shown that countries like Brazil and Russia continue to struggle with high coefficients, revealing a significant imbalance where a small fraction of the population controls a disproportionate amount of wealth. This growing divide highlights the urgent need for policies aimed at improving wealth distribution and addressing social inequalities.

Economic factors, including industrialization and the concentration of wealth among millionaires, play a significant role in shaping global wealth inequality. The UBS Global Wealth Report indicates that nearly half of the world’s wealth is owned by just a small percentage of millionaires, exacerbating socio-economic disparities. As we move forward, understanding these trends is crucial for crafting strategies that promote equitable economies and curtail the increasing gap between the wealthy and the underprivileged.

Countries With Extreme Wealth Inequality

In examining the nations with the highest levels of wealth inequality, Brazil, Russia, and South Africa stand out with Gini coefficients in the low 0.8s. This suggests that a small elite holds a majority of the nation’s wealth, while vast portions of these populations struggle economically. Such extreme wealth concentration not only limits access to resources for the lower-income segments but also curtails opportunities for social mobility, impacting overall national growth.

The ramifications of wealth inequality extend beyond economics into social stability and political realms. For instance, the stark income gaps seen in countries rich in natural resources, like Saudi Arabia and the UAE, raise concerns about equitable growth and governance. Addressing these disparities requires comprehensive reforms focusing on wealth distribution, social justice, and the establishment of strong institutions that promote inclusive development.

The Most Equitable Countries in Wealth Distribution

On the other end of the spectrum, countries like Slovakia, Belgium, and Qatar exemplify effective wealth distribution systems, reflected in their low Gini coefficients. Such nations often implement strong social safety nets and the promotion of policies aimed at fostering equality. Their relatively high rates of household savings further contribute to a more balanced economic environment where wealth is more evenly shared among citizens.

These equitable countries serve as models for how effective governance and policy design can lead to improved living standards and reduced wealth inequality. By prioritizing measures that enhance asset ownership and financial access among all socio-economic classes, these nations demonstrate that achieving a more balanced wealth distribution is possible, providing valuable lessons for countries grappling with high inequality.

The Slow Decline of Global Wealth Equality

Since the year 2000, global wealth equality has shown a concerning decline of 0.4%. This minor yet troubling shift underscores the increasing concentration of wealth among the richest households, further emphasizing the urgency of addressing wealth inequality on a global scale. With millionaires owning a substantial portion of total personal wealth, the need for economic reforms and initiatives to democratize wealth distribution is more evident than ever.

The data reveals that while progress has been made in some equitable countries, many others are falling behind. This decline in wealth equality calls for a multifaceted approach that encompasses education, equitable taxation, and social welfare programs aimed at redistributing resources. By taking proactive steps to mitigate these disparities, societies can work towards a future where economic opportunities are accessible to all.

The Role of Millionaires in Global Wealth Markets

Millionaires play a pivotal role in shaping global wealth markets and are often seen as both a boon and a bane to economic equality. As highlighted by the UBS report, this small percentage of individuals owns nearly half of the world’s personal wealth, leading to significant influence over market dynamics and investment trends. Their accumulation of assets often drives innovation and economic growth, but it also raises questions about the sustainability of wealth concentration.

Moreover, the presence of a large millionaire class can lead to increased economic polarization, as wealth thresholds rise and opportunities for the average citizen diminish. To achieve a truly equitable global economy, it’s essential to find a balance where the successes of millionaires can contribute positively to broader societal growth while also addressing the root causes of unequal wealth distribution. Effective policymaking is crucial to ensuring that wealth generated by millionaires benefits wider segments of the community and fosters inclusive growth.

Measuring Wealth Inequality with the Gini Coefficient

The Gini coefficient is a key metric for assessing income and wealth inequality, making it an essential tool for understanding socio-economic disparities across countries. This statistical measure indicates how evenly wealth is distributed among a population, with values closer to 0 representing greater equality. In contrast, higher values approaching 1 highlight significant disparities. Understanding the Gini coefficient allows policymakers and researchers to identify trends and areas that require urgent attention in the fight against wealth inequality.

As nations strive for improved economic policies, public awareness of the Gini coefficient’s implications can drive broader conversations about wealth distribution and social justice. By promoting transparency and discussion regarding these statistical measures, citizens can hold their governments accountable for ensuring improved wealth equity. This ultimately contributes to a society where individuals are empowered and have equal opportunities to succeed.

Investigating Wealth Distribution Dynamics

Wealth distribution not only reflects the economic capabilities of a nation but also serves as an indicator of social health and stability. In countries like India and the USA, the wealth distribution dynamics reveal significant disparities despite their strong economies. This situation reflects systemic issues that hinder equitable access to resources and opportunities. Such dynamics necessitate comprehensive analyses to inform effective policy response.

Understanding the patterns of wealth distribution is imperative for addressing the challenges posed by inequality. Through targeted research and appropriate policy initiatives, countries can work towards dismantling barriers that perpetuate wealth disparities. This will create a more inclusive economic landscape where opportunities are accessible to all, reducing the disparities that currently exist.

The Impact of Wealth Inequality on Society

Wealth inequality has profound implications for societal cohesion and stability. High levels of inequality often lead to resentment and social unrest among the marginalized populations. For instance, in regions of Brazil and Russia where wealth is highly concentrated, crime rates can spike as individuals struggle to make ends meet. Thus, addressing wealth inequality is not merely an economic issue; it’s a critical matter of social justice and harmony.

Furthermore, wealth inequality can hinder economic progression. When wealth is held in the hands of a few, innovation and entrepreneurship can stagnate as a significant portion of the population lacks access to necessary resources and capital. By working towards a more equitable distribution of wealth, societies can foster an environment conducive to growth, creativity, and overall economic health.

Future Prospects for Wealth Equality

As we look toward the future, the prospects for achieving wealth equality remain a subject of great importance. With growing awareness and discourse surrounding wealth inequality, there is potential for impactful changes through policy reforms and public engagement. Nations that prioritize equitable economic strategies are more likely to set a precedent that encourages inclusivity and shared prosperity.

Despite the obstacles, the push towards more equitable societies is gaining momentum. Grassroot movements and international collaborations are increasingly demanding action against wealth inequality, urging governments to explore innovative solutions that can facilitate more balanced wealth distribution. In the coming years, it will be essential to monitor progress in this area and continue advocating for economic justice on a global scale.

Frequently Asked Questions

What is the Gini coefficient, and how does it relate to global wealth inequality?

The Gini coefficient is a statistical measure used to represent wealth inequality within a population. It ranges from 0, indicating perfect equality, to 1, signifying maximum inequality. In the context of global wealth inequality, a higher Gini coefficient suggests a more uneven distribution of wealth among individuals and households within a country.

Which countries have the highest levels of wealth inequality based on the Gini coefficient?

Countries like Brazil, Russia, and South Africa exhibit some of the highest levels of wealth inequality, with Gini coefficients around 0.82. This indicates a significant wealth concentration among the richest, highlighting the stark contrast in wealth distribution among the rest of the population.

How has global wealth inequality changed since the year 2000?

Since 2000, global wealth inequality has slightly decreased by 0.4%. However, this minor decline is overshadowed by the increasing concentration of wealth among millionaires, who now own nearly half of the world’s total personal wealth, according to the UBS Global Wealth Report.

What factors contribute to equitable countries in terms of wealth distribution?

Equitable countries, such as Slovakia and Belgium, often showcase low Gini coefficients due to strong social safety nets, effective policies promoting asset ownership, and high household savings. These factors collectively work to foster a more inclusive and fair wealth distribution among their populations.

What does the rise in the number of millionaires mean for global wealth inequality?

The rise in the number of millionaires indicates a growing disparity in wealth allocation, particularly as these individuals hold nearly half of the world’s wealth. This concentration amongst millionaires often exacerbates global wealth inequality, with significant economic power resting in the hands of a few.

How does wealth inequality affect economic growth and development?

Wealth inequality can hinder economic growth by limiting access to resources and opportunities for a large segment of the population. When wealth is concentrated, it can lead to social unrest and reduced investment in public goods, ultimately stalling development and perpetuating cycles of poverty.

What is the relationship between wealth inequality and social policies in equitable countries?

In countries with equitable wealth distribution, strong social policies are typically in place that promote asset ownership, education, and healthcare access. These policies help to create an environment where wealth can be distributed more evenly, reducing the Gini coefficient and enhancing overall societal welfare.

How does visualizing global wealth inequality help in understanding economic issues?

Visualizing global wealth inequality, such as through the Gini coefficient, allows individuals and policymakers to better understand the disparities in wealth distribution. It highlights areas needing intervention and fosters informed discussions about economic policies aimed at achieving greater equity.

What lessons can be learned from the wealth distribution of countries like Slovakia and Belgium?

Countries like Slovakia and Belgium, which show low levels of wealth inequality, provide valuable lessons in implementing effective social policies and systems that promote equity. Their experiences underline the importance of strong safety nets and inclusive economic strategies in achieving a balanced wealth distribution.

Why is it important to monitor wealth inequality trends globally?

Monitoring wealth inequality trends is crucial for identifying economic disparities, formulating effective public policies, and ensuring sustainable economic growth. By understanding these trends, nations can work towards more equitable economic systems that benefit a broader segment of the population.

| Country | Gini Coefficient 2024 |

|---|---|

| 🇧🇷 Brazil | 0.82 |

| 🇷🇺 Russia | 0.82 |

| 🇿🇦 South Africa | 0.81 |

| 🇦🇪 United Arab Emirates | 0.81 |

| 🇸🇦 Saudi Arabia | 0.78 |

| 🇸🇪 Sweden | 0.75 |

| 🇺🇸 United States | 0.74 |

| 🇮🇳 India | 0.74 |

| 🇹🇷 Türkiye | 0.73 |

| 🇲🇽 Mexico | 0.72 |

| 🇸🇬 Singapore | 0.70 |

| 🇩🇪 Germany | 0.68 |

| 🇨🇭 Switzerland | 0.67 |

| 🇮🇱 Israel | 0.66 |

| 🇸🇰 Slovakia | 0.38 |

Summary

Wealth inequality continues to be a pressing global issue affecting economic stability and social justice. In the current analysis, Brazil, Russia, and South Africa are highlighted as the countries with the highest wealth inequality, exhibiting Gini coefficients indicating substantial asset concentration among the wealthiest segments of their populations. Conversely, nations such as Slovakia and Belgium have implemented effective policies that achieve more equitable wealth distribution. The overall decline in global wealth equality since the year 2000, coupled with millionaires holding nearly half of the world’s wealth, underscores the urgent need for discussions around economic reforms and wealth redistribution strategies to counteract growing disparities.