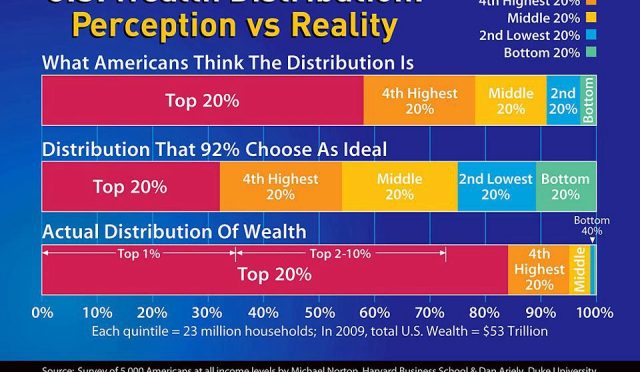

Wealth inequality has become a defining issue in America, with a staggering contrast between the ultra-rich and the rest of the population. Recent findings indicate that the billionaire wealth has skyrocketed by nearly $700 billion since Donald Trump’s presidency began, highlighting the role of the Trump tax cuts in deepening this divide. According to an Oxfam report, this surge in wealth serves as a stark reminder of the growing income disparity that undermines the foundations of a fair society. While America’s richest bask in unprecedented fortunes, more than 40% of Americans are classified as poor or low-income, a statistic that paints a grim picture of economic inequity. The ongoing erosion of financial stability for working families underscores the urgent need to confront wealth inequality and implement reforms that promote a more equitable distribution of resources.

The phenomenon of economic disparity, often referred to as wealth gap or financial inequality, continues to challenge the very fabric of society. This discrepancy has been largely driven by systemic policy decisions favoring the affluent, leaving millions in precarious financial situations. Recent insights have illustrated how America’s wealthiest individuals, bolstered by favorable legislation and tax policies, are accumulating assets at an alarming rate. Such trends not only perpetuate a cycle of privilege but also threaten the stability and well-being of working-class families. Addressing these critical issues requires a comprehensive understanding of the forces that sustain such levels of imbalance in wealth distribution.

The Surge of Billionaire Wealth in the Trump Era

The recent Oxfam report highlights a staggering increase in billionaire wealth, specifically noting that the top 10 richest individuals in the United States saw their combined fortune swell by almost $700 billion since Donald Trump assumed office. This sharp rise in wealth accumulation among America’s richest is emblematic of a broader pattern where policy changes favor the ultra-wealthy over the labor force that powers the economy. While those at the peak of the earning ladder flourish, ordinary families are left grappling with an increasingly challenging economic landscape.

Under Trump’s tax cuts, which significantly benefitted corporations and high-income earners, the divide deepened, demonstrating a concerted effort to elevate the affluent. The adverse repercussions of this policy have been profoundly felt among low-income households, who, according to Oxfam, struggle with escalating costs of living while their wealth stagnates. This trend lays bare the disparities and exacerbates the socio-economic divides that plague the nation.

Wealth Inequality: A National Crisis

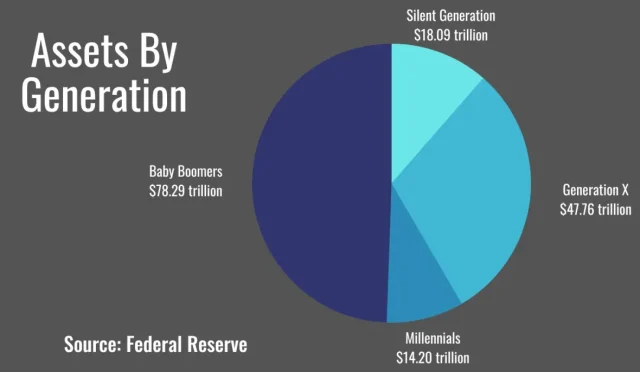

Wealth inequality has reached unprecedented levels in the United States, revealing a stark contrast between the haves and have-nots. As per Oxfam’s findings, the wealth accumulated by the wealthiest 0.1% continues to increase, now controlling an astonishing 12.6% of all US assets. This troubling statistic reinforces the growing disconnect between the rich and the working class, who are finding it increasingly difficult to meet basic needs such as housing, healthcare, and education.

This economic disparity is mirrored in political decisions made by the Trump administration, which critics argue have systematically favored billionaires and large corporations. Oxfam expresses concern that not only are the financial resources in the hands of a few, but the power dynamics are shifting unilaterally towards the wealthy, creating an environment of inequality that is hard to reverse without concrete structural changes.

Impact of Tax Cuts on Income Disparity

The Trump tax cuts have been instrumental in widening the gap of income disparity in the nation. Intended to stimulate growth, these tax reforms primarily benefited high-income earners and corporations, resulting in a further concentration of wealth among America’s richest. Research shows that during this period, the least wealthy households in the top 1% gained nearly 1,000 times more wealth than those in the bottom quintile, underscoring the policy’s detrimental effects on economic equity.

As these tax cuts remain in place, the ramifications are felt most acutely by low-income and working families who are struggling to maintain financial stability. The substantial benefits enjoyed by the wealthiest Americans starkly contrast with the challenges faced by those in the lower income brackets, highlighting an urgent need to reassess tax policies to foster a more equitable economic environment.

Oxfam’s Call for Economic Reform

In light of the alarming findings presented in its latest report, Oxfam America advocates for a transformative agenda aimed at rebalancing power and wealth in the United States. The organization suggests implementing a wealth tax targeting the ultra-wealthy, coupled with provisions for a universal childcare system, higher minimum wages, and a broader child tax credit. These reforms are essential components designed to dismantle the entrenched systems sustaining income inequality.

Furthermore, Oxfam emphasizes the need for robust antitrust policies to dismantle corporate monopolies that stifle competition and widen the economic gap. Such initiatives are critical for ensuring that economic growth benefits a broader segment of the population, rather than perpetuating a cycle of wealth accumulation at the top. Only through these combined efforts can we hope to reverse the damaging trend of wealth disparity that has characterized the current American economic landscape.

The Role of Political Power in Wealth Distribution

The intertwining of political influence and wealth accumulation is a core element in the narrative surrounding America’s economic inequality. As we observe through the lens of the Oxfam report, the alignment between political decisions and billionaire interests has steered economic policies toward exacerbating existing disparities. The Trump administration’s measures, from tax cuts favoring the wealthy to various regulatory rollbacks, illustrate how political power can be wielded to benefit a narrow segment of the population.

This phenomenon raises important questions about the democratic process and equity in policy-making. With billionaires exerting unprecedented influence over legislation and spending, the interests of everyday Americans often take a backseat, leading to an erosion of public trust in government. Therefore, advocating for reforms that increase accountability and transparency in political financing becomes imperative as part of the broader struggle for economic justice.

Food Insecurity Amidst Growing Wealth Disparities

The juxtaposition of soaring billionaire wealth and the harsh realities faced by low-income families is starkly evident in the growing food insecurity crisis across the nation. According to Oxfam, millions of households rely on federal nutrition assistance programs that are under threat due to political maneuvering by the Trump administration and its supporters. This situation poses grave implications for the well-being of vulnerable populations who are already struggling to make ends meet.

As legislation is poised to grant massive tax breaks to the wealthy, the impact on social services has been severe. Food assistance programs could be further diminished, exacerbating the challenges faced by those in poverty. Addressing food insecurity requires a commitment to reforming policies that have been disproportionately designed to favor the rich, thus ensuring that support systems for low-income families are adequately funded and accessible.

The Importance of Social Safety Nets

In times of escalating wealth inequality, the foundations of a strong social safety net become increasingly critical. Oxfam articulates that reforming the social safety net is essential to providing security and dignity to low-income families facing economic distress. Investments in robust healthcare, childcare, and housing programs are fundamental to creating a balanced and fair society that upholds the values of equity and community.

With proposals for expansions to social programs, the need for comprehensive policy changes is evident. Enhancing the safety net will not only provide immediate relief for struggling families but also foster long-term economic stability. Addressing these needs through thoughtful reforms can simultaneously bolster economic growth while dismantling the systemic barriers that hinder opportunity for so many.

Strategies to Combat Corporate Monopolies

Addressing corporate monopolies is vital for mitigating wealth inequality and promoting fair economic competition in the United States. Oxfam advocates for a dynamic antitrust approach that dismantles monopolistic structures, thus ensuring that markets remain competitive and accessible to all. The concentration of corporate power represents a significant threat to economic fairness and innovation, as it stifles smaller businesses and disproportionately benefits the wealthiest.

By implementing stricter antitrust measures, the government can encourage fairer market practices that uplift communities and empower consumers. Creating an environment where small businesses can thrive is crucial to redistributing wealth more equitably among the population. The fight against corporate monopolies is not just about economic fairness; it’s about restoring democracy and ensuring that all individuals have a stake in the nation’s economic future.

Rethinking Wealth Distribution Policies

The ongoing economic disparity calls for a conscientious reevaluation of wealth distribution policies in the United States. The Oxfam report outlines the critical need for policies that actively counteract the trend of upward redistribution—where wealth continually shifts towards a small elite at the expense of the general population. Such reflection and recalibration are not merely reactive; they also pave the way for a more just and sustainable economic model.

Policymakers are urged to take an inclusive approach to reform, focusing on tax reforms that benefit all citizens rather than a privileged few. Implementing progressive taxation, which places a greater burden on the wealthiest individuals while providing relief to the lower earners, could fund vital social services that combat inequality. By embracing fair wealth distribution policies, the nation can work toward reconciling the gaps created by decades of inequitable economic practices.

Frequently Asked Questions

How does billionaire wealth contribute to wealth inequality in America?

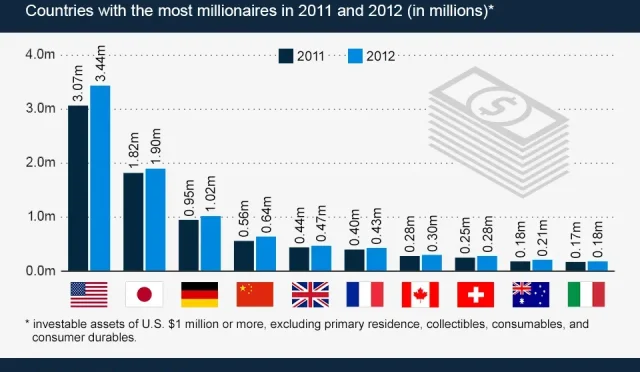

Billionaire wealth contributes significantly to wealth inequality in America by allowing a tiny fraction of the population to amass vast fortunes, which contrasts sharply with the majority of Americans. Recent reports highlight that between 1989 and 2022, the least wealthy households in the top 1% gained nearly 987 times more wealth than the wealthiest households in the bottom 20%.

What does the Oxfam report reveal about income disparity in the US?

The Oxfam report, ‘Unequal: The Rise of a New American Oligarchy’, reveals alarming trends regarding income disparity in the US. It underscores that wealth is increasingly concentrated among the richest, with the wealthiest 0.1% expected to hold 12.6% of total US assets by 2025, exacerbating the divide between billionaires and the working class.

How did Trump’s tax cuts affect wealth inequality?

Trump’s tax cuts played a crucial role in worsening wealth inequality. The administration’s policies are reported to have disproportionately benefited the wealthy, contributing to a significant increase in billionaire wealth while limiting assistance for low-income households. This dynamic has reinforced a system that favors the richest, amplifying the already stark income disparity.

What steps does Oxfam suggest to address wealth inequality in America?

To combat wealth inequality, Oxfam recommends implementing a wealth tax on billionaires, raising corporate tax rates, expanding child tax credits, enforcing strict antitrust policies to dismantle monopolies, guaranteeing federal jobs, and increasing the minimum wage. These actions are intended to rebalance economic power and support working families.

What are the long-term effects of wealth inequality on American society?

The long-term effects of wealth inequality on American society include a decline in social mobility, increased poverty rates, and heightened tensions between economic classes. As billionaire wealth continues to grow, a growing segment of the population, over 40%, is classified as low-income, limiting their access to essential resources and undermining social cohesion.

| Key Point | Details |

|---|---|

| Wealth Increase of Top 10 Individuals | Since Trump took office for a second term, the wealth of the 10 richest Americans increased by nearly $700 billion. |

| Historical Wealth Disparity | From 1989-2022, the least wealthy in the top 1% gained 987 times more than the wealthiest in the bottom 20%. |

| Poverty Rate | 40% of the US population was classified as poor or low-income as of last year, as noted in the Oxfam report. |

| Inequality Reach by 2025 | The wealthiest 0.1% expected to own 12.6% of total US assets, the highest recorded level. |

| Impact of Trump Administration Policies | The administration’s policies have accelerated wealth distribution to the upper class, harming working families. |

| Call for Policy Reforms | Oxfam suggests a wealth tax, higher corporate tax rates, expanded child tax credits, and other reforms to combat inequality. |

Summary

Wealth inequality has reached alarming levels in the United States, exacerbated by policies from administrations that prioritize the wealthy. Recent reports indicate that the richest among us continue to thrive while many struggle just to meet basic needs. The solutions outlined—including comprehensive tax reform and enhanced social safety nets—are crucial to addressing this deep-rooted issue and fostering a more equitable economy.