Wealth inequality is a pressing issue that characterizes much of today’s economic landscape, particularly in the United States, where the stark divide between the wealthy and the poor continues to widen. Despite being one of the richest nations globally, America grapples with alarming statistics regarding wealth distribution; nearly two-thirds of private wealth is held by just 10% of the population. This concentration leaves an alarming percentage of Americans facing financial stress, struggling to afford basic necessities or plan for retirement. The effects of this wealth disparity are steep, prompting discussions about potential solutions like Universal Basic Income or wealth redistribution effects that prioritize poverty reduction programs. Addressing wealth inequality is crucial not only for economic stability but also for fostering a fair society where everyone can thrive.

Economic disparity, often referred to as income inequality, highlights the significant gap between the affluent and the less fortunate in society, particularly in nations like the USA. This phenomenon manifests in various forms, including unequal access to financial resources, where a small elite holds the majority of private assets while the rest face daunting challenges. The implications of such clinical economic divides are profound, generating discussions around alternative solutions such as Universal Basic Income and poverty alleviation initiatives. As we explore wealth distribution trends and their impacts, it becomes clear that addressing these disparities is essential for promoting a balanced economic environment and ensuring that even the underprivileged can enjoy a semblance of financial security.

Understanding America’s Wealth Inequality

America’s wealth inequality is a significant issue that continues to affect millions. The disproportionate distribution of wealth, heavily favoring the top 10% of earners, has led to a societal divide where financial stress is the norm for many. Despite the staggering total of $160.35 trillion in privately held wealth, the fact that the wealthiest individuals control nearly two-thirds of this amount reveals a troubling disparity. The staggering figures illustrate that while some Americans enjoy extreme financial comfort, a substantial portion of the population struggles to meet everyday expenses, emphasizing the urgent need for wealth redistribution.

The implications of wealth inequality extend beyond mere economics; they impact social cohesion and individual well-being. Many who fall into the lower spectrum of wealth experience stress related to financial insecurity, with alarming statistics indicating that over half of Americans fret about the rising costs of living. Such economic pressures often thwart opportunities for upward mobility, leading to a vicious cycle of poverty that is difficult to escape. Even with robust wealth creation in America, the consequences of unequal distribution create substantial barriers to financial stability for too many.

The Reality of Financial Stress in the USA

Despite being one of the wealthiest nations in the world, many Americans experience considerable financial stress. Reports show that a staggering 68% of Americans lack sufficient savings for retirement, and many struggle to cope with day-to-day expenses. This financial hardship can be attributed to several factors, including the rising cost of living and increasing debt burdens among the populace. The gaps in wealth distribution exacerbate these conditions, as a small fraction of the population retains a vast amount of resources, leaving the rest to shoulder economic pressures.

Financial stress is not just a temporary condition; it has long-standing implications for mental health and community well-being. Often, individuals facing financial instability may forgo necessary medical treatments, skip meals, or face tough choices regarding education and childcare. As stress levels rise, the likelihood of further financial problems also increases, creating a self-perpetuating cycle. Understanding the scope of financial stress is crucial to fostering effective support systems and poverty reduction programs to enhance the living conditions of the American populace.

Exploring Solutions: Poverty Reduction Programs

Poverty reduction programs play a vital role in addressing the wealth inequality prevalent in the United States. Government initiatives, such as the expansion of the Child Tax Credit during the COVID-19 pandemic, not only provided immediate financial relief but also led to a marked reduction in child poverty. With the poverty rate hitting a record low, these targeted financial support programs illustrate the potential effectiveness of government intervention in alleviating economic strain for vulnerable populations.

Implementing systematic poverty reduction strategies can yield substantial benefits, uplifting entire communities from the cycle of poverty. By investing in comprehensive initiatives that provide skills training, job placement, and access to affordable healthcare, the potential for long-term economic improvement dramatically increases. Moreover, promoting financial literacy enhances individuals’ ability to manage their resources better and engage with available poverty reduction programs effectively.

The Promise of Universal Basic Income

Universal Basic Income (UBI) has emerged as a potential solution to combat poverty and wealth inequality in the U.S. by providing citizens with a consistent and unconditional financial payment. This concept has garnered attention as experiments across various locations have shown promising results, including improved health and higher life satisfaction among recipients. By offering a safety net, UBI can empower individuals to pursue employment opportunities that align with their interests rather than merely surviving day to day.

Additionally, implementing UBI could lead to broader societal benefits, such as increased consumer spending that boosts local economies. Critics argue that UBI may disincentivize work; however, early evidence indicates that recipients often use their UBI payments to invest in education or start small businesses. This paradigm shift towards individual empowerment and financial security is essential for easing the pressure of wealth inequality and creating a more balanced economy.

The Challenges of Wealth Redistribution

The idea of radically redistributing wealth in America seems appealing, especially in light of the glaring inequality experienced by so many. However, the challenges associated with such an endeavor are monumental. A forced redistribution of privately held wealth would not only disrupt the economy but may also lead to unprecedented inflation levels. With many people suddenly receiving substantial amounts of money, the demand for goods and services could outpace supply, leading to price surges that ultimately erode the initial benefits of wealth redistribution.

Moreover, historical precedents suggest that any extreme redistribution effort would be unsustainable in the long run. Skilled individuals with wealth-generating abilities would likely rise to the top once again, creating a cycle that mirrors the original inequality. Without structural changes to the economic system addressing the root causes of wealth disparity, the outcomes of an aggressive redistribution policy would likely mirror the current state of affairs in just a few generations.

Philanthropy’s Role in Wealth Distribution

Philanthropy plays a crucial role in addressing wealth inequality by redirecting a portion of private wealth towards social good. High-profile billionaires, including Bill Gates and Warren Buffett, have committed to donating the majority of their fortunes, demonstrating how personal wealth can be a powerful tool for maatschappelijke change. While philanthropy is not a comprehensive solution to wealth distribution, it offers immediate relief and opportunities for vulnerable communities through targeted initiatives and social programs.

However, relying solely on philanthropy can be problematic. It can mask the systemic issues contributing to wealth inequality and perpetuate the mentality that solving poverty is the responsibility of the wealthy. Sustainable change requires collective action, including comprehensive policy reforms that focus on wealth redistribution effects, ensuring that the focus balances both charity and structural change within the economy.

Addressing Systemic Issues in Capitalism

To effectively tackle wealth inequality, it is essential to address the systemic issues entrenched in capitalism. The capitalist framework often prioritizes profit above social equity, leading to policies that disproportionately benefit the wealthy. Encouraging corporate responsibility and implementing regulations that promote fair wages, job security, and access to essential services can help level the playing field. Adopting reforms that increase tax contributions from the wealthiest individuals and corporations is critical to fostering a more equitable distribution of resources.

Additionally, rethinking the fundamentals of wealth generation and distribution can yield innovative strategies for poverty alleviation. Such measures might include investing in community-owned enterprises that contribute to local economies while providing employment opportunities. A multifaceted approach that embraces both policy reform and community investment can create a framework for reducing wealth disparity and ensuring that economic progress benefits all members of society.

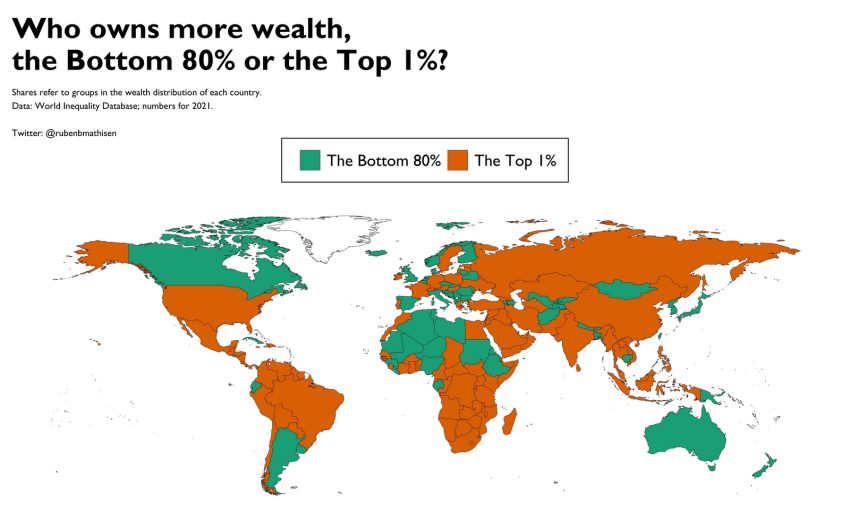

Learning from Other Countries: Global Perspectives

By analyzing wealth distribution and poverty alleviation strategies from other nations, the U.S. can draw valuable insights for tackling its challenges. Several countries with progressive economic policies have successfully reduced poverty rates through comprehensive social safety nets and targeted investments in education and health care. These examples demonstrate that investments in human capital, combined with effective wealth distribution mechanisms, yield positive outcomes for society as a whole.

Moreover, exploring alternative economic models, such as cooperatives and social enterprises, provides an avenue for addressing wealth inequality without resorting to extreme measures. These models promote democratic ownership and equitable profit-sharing, ensuring that wealth generated within communities remains within those communities. Adopting best practices from around the globe can inspire innovative solutions tailored to the unique economic landscape of the United States.

The Future of Wealth Equality in America

Envisioning a more equitable future requires open dialogue and collaborative efforts from various stakeholders, including government officials, corporate leaders, and community activists. As awareness of wealth inequality rises, advocacy for systemic changes and effective poverty reduction programs will grow stronger. The conversation surrounding wealth redistribution must prioritize not only the fair distribution of resources but also the enhancement of opportunities and structures that allow everyone to thrive.

Ultimately, tackling wealth inequality in America is a complex challenge demanding a collective response. By leveraging the strengths of both the public and private sectors, investing in robust social programs, and fostering a culture of corporate responsibility, we can pave the way for a more equitable future. While perfect equality may remain an elusive goal, striving toward it will undoubtedly lead to meaningful improvements in the lives of countless individuals, fostering a healthier society.

Frequently Asked Questions

What is the current state of wealth inequality in America?

Wealth inequality in America is characterized by a significant concentration of wealth among the top 10% of individuals, who control nearly two-thirds of the nation’s private wealth. Despite the United States having the highest total wealth globally, many Americans face financial stress due to this unequal distribution.

How does America’s wealth distribution affect poverty levels?

The uneven wealth distribution in America exacerbates poverty levels, as a large proportion of the population struggles to meet basic living expenses. Government programs aimed at poverty reduction, such as stimulus checks during the COVID-19 pandemic, have demonstrated the potential to lower poverty rates significantly.

What are some effective poverty reduction programs related to wealth inequality?

Effective poverty reduction programs that address wealth inequality include government stimulus initiatives, the expansion of the Child Tax Credit, and the implementation of Universal Basic Income (UBI). These programs have shown promising results in lifting individuals out of poverty and improving overall well-being.

Can Universal Basic Income help address wealth inequality in the US?

Universal Basic Income (UBI) has the potential to help address wealth inequality by providing citizens with guaranteed financial support. Experiments with UBI in various locations have indicated increases in health, life satisfaction, and employment, suggesting it could be a viable strategy for reducing financial disparities.

What are the potential consequences of extreme wealth redistribution in America?

Extreme wealth redistribution in America could lead to significant economic disruption and inflation due to the sudden influx of wealth among individuals. While the idea of equal wealth distribution is appealing, the logistical, ethical, and economic ramifications make it a complex and potentially impractical solution to wealth inequality.

How has financial stress impacted Americans amid growing wealth inequality?

Financial stress in the United States remains high despite its overall wealth due to the stark wealth inequality. Many Americans report struggles to afford living costs, prepare for retirement, and manage debt, highlighting the gap between wealth accumulation and the financial realities faced by most.

What role do philanthropists play in addressing wealth inequality?

Philanthropists play a significant role in addressing wealth inequality by donating portions of their wealth to various charitable causes. High-profile figures like Bill Gates and Warren Buffett have committed to donating their fortunes, demonstrating the potential impact of philanthropy on alleviating poverty and reducing wealth disparities.

| Key Point | Explanation |

|---|---|

| Wealth Inequality in America | America has significant wealth inequality, with 68% of citizens unable to retire, and 56% struggling with living expenses. |

| Concentration of Wealth | The top 10% of individuals own nearly two-thirds of America’s wealth, illustrating stark economic divides. |

| Hypothetical Wealth Redistribution | Even if wealth distribution were equal, every American would receive around $471,465, which could drastically change lives. |

| Economic Upheaval Risks | Radical redistribution could lead to economic chaos, inflation, and a return to old wealth hierarchies. |

| Successful Poverty Reduction Programs | Government interventions, such as stimulus programs and UBI, have shown potential in reducing poverty rates. |

| Philanthropy’s Role | Many billionaires participate in philanthropy, pledging to donate large portions of their wealth to social causes. |

| Need for Targeted Solutions | Addressing wealth inequality requires focused efforts rather than drastic wealth redistribution. |

Summary

Wealth inequality remains a pressing issue in America, where a significant portion of the population struggles to achieve financial stability despite the nation’s vast wealth. With critical insights into the distribution of wealth among citizens and the challenges associated with radical redistribution, it is evident that addressing this inequality is essential for promoting financial security and social stability. By exploring targeted poverty reduction initiatives, such as government programs and philanthropy, we can work towards a more equitable economic landscape.