Wealth inequality in the UK has reached alarming levels, revealing stark disparities in financial stability among the population. According to a recent report by the Resolution Foundation, it would take the average earner a staggering 52 years of earnings to amass the wealth of the top 10%. This growing wealth gap underscores the challenges of wealth distribution in Britain, especially when considering that it previously took just 38 years before the financial crisis to reach this threshold. The analysis further illustrates how wealth mobility has stagnated, as individuals born into lower wealth brackets often struggle to ascend the socioeconomic ladder. As the UK grapples with these economic disparities, understanding the implications of this wealth divide becomes essential for fostering a more equitable society.

The issue of wealth disparity in Britain has gained increasing attention, particularly in light of recent economic analyses. The financial contrast between the affluent and the average citizen has prompted discussions on economic fairness and justice. This growing divide is characterized by the unequal distribution of assets among various demographics, revealing the persistent barriers to wealth mobility. Reports from influential think tanks highlight the systemic issues that maintain these inequalities, suggesting a need for innovative policies to close the wealth gap across the nation. As the discourse around UK economic disparities evolves, it becomes crucial to address the root causes contributing to this entrenched issue.

Understanding Wealth Inequality in the UK

Wealth inequality in the UK has reached staggering levels, with reports from the Resolution Foundation indicating that the average worker now needs 52 years of earnings to match the wealth of the top 10%. This figure highlights the growing wealth gap in the UK, as it used to require only 38 years of median earnings prior to the financial crisis of 2008. This shift in wealth distribution in Britain raises concerns about financial mobility, where individuals find it increasingly difficult to ascend the economic ladder.

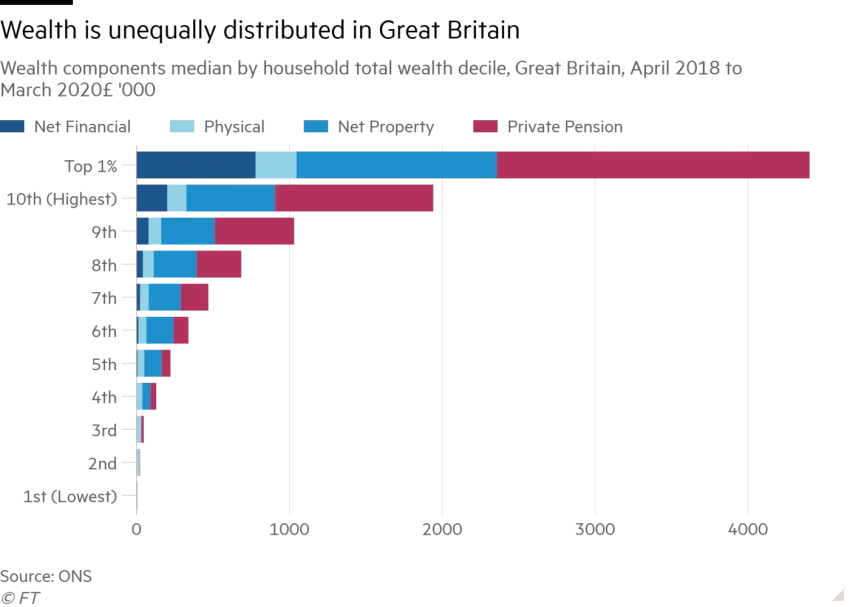

The statistical analysis from the Office for National Statistics sheds light on the persistence of wealth disparities, particularly emphasizing that those from wealthier backgrounds are likely to remain affluent while those in lower economic strata often stay impoverished. The findings underscore the need for policy interventions to address these wealth discrepancies, as the length of time it takes for an average individual to reach significant wealth has drastically increased.

The Impact of COVID-19 on Wealth Distribution in Britain

The COVID-19 pandemic significantly impacted wealth distribution in Britain, exacerbating existing economic disparities. While the taxpayer-backed furlough scheme temporarily supported millions of workers, it did little to bridge the wealth gap. Data from the Resolution Foundation reveals that lower-income households only saw a marginal increase in their liquid savings during the pandemic, contrasting sharply with wealthier families who enjoyed substantial savings growth.

This situation illustrates the deepening divisions in wealth mobility in the UK. The richest families accrued the most benefits, highlighting how financial crises tend to widen the wealth gap rather than reduce it. The facts indicate that while some households saved significantly during lockdowns, those with less income barely made any progress, stressing the critical need for equitable financial policies.

Regional Wealth Disparities Across the UK

Wealth distribution in Britain is not uniform, with stark regional disparities emerging between the north and south of England. As reported, the average wealth in south-east England reached £290,000, contrasting with only £110,000 in the north-east. Such differences in property prices and economic opportunities underscore the regional economic disparities that exist in the UK.

The concentration of wealth in certain areas fuels ongoing discussions about resource allocation and investment in neglected regions. Addressing these regional wealth gaps is vital for fostering economic balance and ensuring that residents in disadvantaged areas also have access to wealth-building opportunities. The widening wealth gap, driven by increasing property values and passive gains, underscores the necessity for responsible policy-making.

Wealth Mobility Challenges in the UK

Wealth mobility in the UK faces significant challenges, particularly due to the entrenched interests of rich households. The Resolution Foundation’s analysis highlighted how the dynamics of wealth mobility reflect a broader trend: those who start wealthier tend to stay wealthy, while the opposite is true for individuals beginning their economic journey with fewer resources. This stagnation hinders social mobility and reinforces socioeconomic divides.

In practical terms, this low level of wealth mobility means that families in lower quintiles miss out on opportunities that could enhance their financial standing. The report indicates that without significant policy changes focused on enhancing access to financial resources and investments for underprivileged communities, the trends of wealth retention by the affluent will prevail, perpetuating class divisions in the UK.

Passive Wealth Gains and Their Consequences

The increase in wealth inequality in the UK has largely been attributed to passive wealth gains, primarily through rising property prices and fluctuating pension valuations. These gains disproportionately favor older, asset-holding households, contributing significantly to the widening wealth gap observed in recent years. As house prices continue to soar, younger individuals find themselves increasingly priced out of the market, limiting their ability to build wealth.

This reliance on passive gains rather than active income generation creates a precarious economic situation for younger generations, further entrenching financial instability. Without active measures to mitigate the factors driving passive wealth concentration, the overall economic landscape will continue to skew towards the affluent, leading to greater financial insecurity among younger and low-income populations.

The Role of Policy in Addressing Wealth Disparities

Policy intervention is critical in addressing the growing issues of wealth inequality in the UK. The Resolution Foundation’s report calls for applications of strategic reforms that aim to redistribute wealth more equitably, especially in the face of continued disparity exacerbated by factors such as passive income growth and regional wealth imbalances. Proactive measures could include investment in education, better access to affordable housing, and incentives for wealth-building in less affluent communities.

Moreover, it is essential for policymakers to prioritize wealth distribution in Britain to foster a more equitable society. By focusing on inclusive economic growth, there is potential to dilute the effects of the wealth gap and create environments where all individuals can thrive financially. Effective policies could help enhance wealth mobility, ultimately leading to a more balanced wealth distribution.

The Evolving Landscape of Wealth Distribution in Britain

The landscape of wealth distribution in Britain is evolving, with shifting economic conditions continually affecting the wealth gap and wealth mobility dynamics. As observed in the recent trends, wealth concentration has become more pronounced since 2010, driven by mechanisms that lead to financial gains for certain populations. It is essential to understand these evolving trends to formulate effective responses to the ongoing challenges of wealth inequality.

Monitoring how factors such as economic growth, housing market trends, and changes in taxation impact wealth distribution will be pivotal for policymakers. Recognizing the rapidly changing economic environment allows for adaptive responses to combat wealth gaps, ensuring that the benefits of economic activities are more evenly shared across different demographics, thereby promoting wealth equity.

Perceptions of Wealth Inequality and Public Response

Public perception plays a vital role in shaping the dialogue around wealth inequality in the UK. The overwhelming sentiment regarding the widening wealth gap suggests a growing discontent among the population, which poses challenges for policymakers. As awareness of wealth distribution in Britain increases, pressure mounts for reforms to address economic disparities and provide relief for those feeling the strain.

Community engagement and public discourse are essential in tackling perceptions of wealth inequality. Encouraging conversations about fairness and economic justice can galvanize collective action and highlight effective pathways for reform. A sustained focus on wealth inequality can inspire solidarity among varying socioeconomic groups, promoting a unified response to advocate for systemic change.

The Intergenerational Wealth Divide in the UK

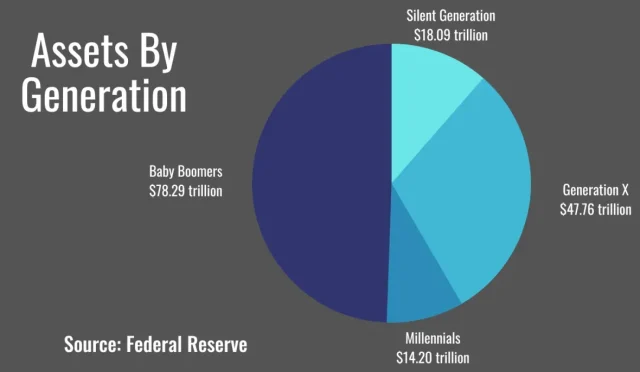

The intergenerational wealth divide in the UK is becoming increasingly pronounced, particularly as financial advantages compound over time for wealthier households. According to the Resolution Foundation’s findings, the gap in average wealth between younger and older generations has more than doubled in real terms from 2006-08 to 2020-22. This trend illustrates how advantages in wealth are inherited, further entrenching socioeconomic divisions.

The consequences of this divide extend beyond mere financial metrics and infiltrate social mobility dynamics, hampering opportunities for younger individuals. Cultivating approaches that disrupt these intergenerational cycles of wealth accumulation is urgent and could potentially play a significant role in creating a more equitable society, where opportunities for upward mobility are accessible to all, irrespective of their starting point.

Frequently Asked Questions

What is the current state of wealth inequality in the UK according to the Resolution Foundation report?

The latest Resolution Foundation report reveals that wealth inequality in the UK is significant, with the average worker needing 52 years’ worth of earnings to achieve the wealth of the richest 10%. This reflects a widening disparity since the 2006-08 period, where it required only 38 years.

How does the wealth gap in the UK affect economic mobility?

Wealth mobility in the UK is low, meaning that individuals born into wealth typically remain wealthy, while those from poorer backgrounds often stay poor. The Resolution Foundation highlights that the wealth gap has resulted in a noticeable lack of economic mobility.

What are the main drivers contributing to the widening wealth distribution in Britain?

The widening wealth distribution in Britain has been primarily driven by passive gains, such as rising property values and pension fluctuations, which have benefitted older, wealthier households, exacerbating wealth inequality in the UK.

How does regional disparity influence wealth inequality in the UK?

Regional disparities significantly influence wealth inequality in the UK; for instance, average wealth in southeast England reached £290,000 in 2020-22, compared to just £110,000 in the northeast. Such differences highlight how location impacts wealth distribution in Britain.

What statistics illustrate the changes in wealth inequality since 2010 in the UK?

Since 2010, the Resolution Foundation reports that wealth inequality in the UK has increased notably, with the wealth gap between individuals in their early 30s and early 60s more than doubling, growing from £135,000 to £310,000 in real terms.

How did the Covid-19 pandemic impact wealth distribution in the UK?

During the pandemic, wealth distribution in the UK varied greatly among income groups; while typical families in the lowest-income quintile saw savings increase by only £80, those in the highest quintile experienced a growth of £4,200. This stark contrast highlights ongoing wealth inequality.

What does the Resolution Foundation say about the proportion of total wealth held by the richest households?

The Resolution Foundation indicates that while absolute wealth inequality has grown, the proportion of total wealth in the UK held by the richest households has remained stable since the 1980s, signaling complex dynamics in wealth distribution.

What are the implications of the wealth mobility issues highlighted in the report on future generations?

The low wealth mobility in the UK suggests that future generations may face persistent economic disparities. As wealth tends to concentrate among those already affluent, it poses challenges for equity and opportunities for the less wealthy.

Can individual savings influence wealth mobility in the UK?

Individual savings have a limited impact on wealth mobility in the UK, especially for lower-income families. Despite opportunities to save during the pandemic, average increases in liquid savings were markedly lower for the low-income groups compared to higher-income families.

What role do housing prices play in wealth inequality in the UK?

Housing prices play a significant role in wealth inequality in the UK, as rising property values primarily benefit older property owners, thereby widening the wealth gap and perpetuating the cycle of intergenerational wealth disparities.

| Key Point | Details |

|---|---|

| Wealth Gap Duration | Average earners need 52 years of earnings to match the wealth of the richest 10% as of 2020-22. |

| Historical Comparison | In 2006-08, it took 38 years of earnings to reach the same wealth level. |

| Disparity in Wealth | The wealth gap increased from £1 million in 2006-08 to £1.3 million in 2020-22. |

| Wealth Mobility | Low wealth mobility implies that those starting wealthy remain wealthy and vice versa. |

| Relative Wealth Inequality | Proportion of total wealth held by the richest has been stable since the 1980s despite the growing wealth gap. |

| Passive Wealth Gains | Widening gap since 2010 attributed to rising house prices and pension fluctuations. |

| Intergenerational Wealth Divide | Average wealth gap between early 30s and early 60s grew from £135,000 to £310,000. |

| Regional Disparities | Average wealth in south-east England is £290,000, while in the north-east it is £110,000. |

| Pandemic Savings | Lower-income families saved just £80 during the pandemic, whereas high-income families saved £4,200. |

Summary

Wealth inequality in the UK has reached alarming levels, with recent research indicating that it would take an average earner 52 years to amass the same wealth as the top 10%. This widening gap highlights not only the escalating disparity in wealth but also the challenges faced by lower-income households in achieving financial stability. The data clearly illustrates that while the richest continue to benefit disproportionately from economic growth and asset accumulation, the average worker struggles to keep pace, reinforcing systemic inequalities that threaten social mobility.