Wealth Ladder: 6 Levels of Wealth to Financial Freedom

Understanding the Wealth Ladder is essential for anyone looking to elevate their financial status and achieve lasting financial independence. This innovative framework breaks down the levels of wealth into manageable rungs, making it easier to identify where you currently stand and the steps needed to advance. In this episode, we dive deep into the six distinct layers of wealth, each corresponding to specific net worth milestones that can help guide your wealth-building strategies. Learn how personal finance decisions, such as spending and investing, should evolve as you ascend the Wealth Ladder. By gauging your financial position through this lens, you can effectively work towards greater financial freedom and satisfaction.

Exploring the concept of the financial hierarchy reveals vital insights into the journey of wealth accumulation. Each segment within this structure represents varying degrees of monetary success and the actions necessary to capitalize on each stage. By focusing on wealth-building methodologies, individuals can refine their personal finance strategies tailored to their current economic standing. As you traverse this financial progression, recognizing the importance of net worth milestones becomes crucial in steering towards financial independence. Join us as we unpack these ideas, leading you through the essential steps for achieving your financial goals.

Understanding the Wealth Ladder: A Framework for Financial Growth

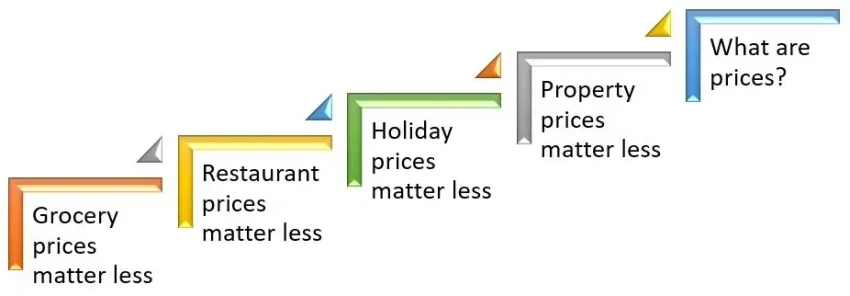

The Wealth Ladder concept provides a structured approach to financial progression, breaking down the complex world of personal finance into six digestible levels. This framework allows individuals to clearly recognize their current financial status while highlighting the specific actions needed to elevate their wealth. As you start to ascend the rungs of this ladder, you’ll notice your understanding of wealth-building strategies deepening, leading to more informed decisions about earning, spending, and investing.

Each level of the Wealth Ladder is marked by distinct net worth milestones, guiding you towards greater financial independence. By having goals tied to specific wealth levels, you can devise more effective personal finance tactics. For instance, beginners might focus on stabilizing their financial situation, while those on higher rungs can strategize on increasing their earning potential and optimizing wealth allocation to sustain their lifestyle.

The Six Levels of Wealth: What They Mean for You

Nick Maggiulli’s framework delineates the six levels of wealth, ranging from financial instability to significant financial independence. Understanding these levels is crucial for anyone on the journey to financial freedom. Many individuals struggle with where to begin—this model offers clarity and actionable steps tailored for each phase of their financial journey. From establishing a foundation of emergency funds to investing consistently, there are specific strategies that correlate with each level.

For example, those starting on the lower levels may find their primary focus should be on getting out of debt and creating a budget, while those achieving higher levels might concentrate on wealth accumulation through diverse investments. As you navigate the transitions between these levels, being aware of what strategies work best at each rung will help maximize your financial potential and move you towards your desired lifestyle and goals.

Financial Independence: The Ultimate Reward of the Wealth Ladder

Reaching financial independence is often the ultimate goal for many individuals, and it is prominently featured in the Wealth Ladder framework. Financial independence allows you to enjoy freedom in life choices without the constraints of financial worry. This state is characterized by having sufficient investment income to cover one’s lifestyle expenses, providing a cushion against unforeseen financial difficulties. With this goal in mind, the Wealth Ladder lays out a pathway to achieving this milestone through careful wealth-building strategies.

As you progress to higher levels of wealth, your focus naturally shifts from mere survival to thriving. This evolution leads to pursuing aspirations such as travel, leisure, and passions that were previously financially unattainable. The emphasis on smart spending, strategic investment, and understanding net worth milestones helps in navigating towards this sought-after independence. It transforms the approach from living paycheck to paycheck into a more abundant mindset, emphasizing long-term growth and sustained financial health.

Wealth-Building Strategies: Move Up the Financial Ladder

Implementing effective wealth-building strategies at each level of the Wealth Ladder is essential for achieving greater financial stability. Nick emphasizes that it’s not just about saving money, but rather about smart spending and investment. As you scale up the ladder, increasing your earning potential becomes a key strategy. This might mean seeking career advancement, side hustles, or even creating passive income streams that drive financial growth at higher levels.

Additionally, the strategies applied can differ greatly depending on your position on the ladder. For those at the starting rungs, fundamental practices such as budgeting and cutting unnecessary expenses are vital. Meanwhile, as individuals move up, strategies may focus more on mastering investments, real estate, or stock market participation. Understanding where you are can significantly enhance your ability to make strategic financial choices that align with your ultimate wealth goals.

The Importance of Net Worth Milestones in Personal Finance

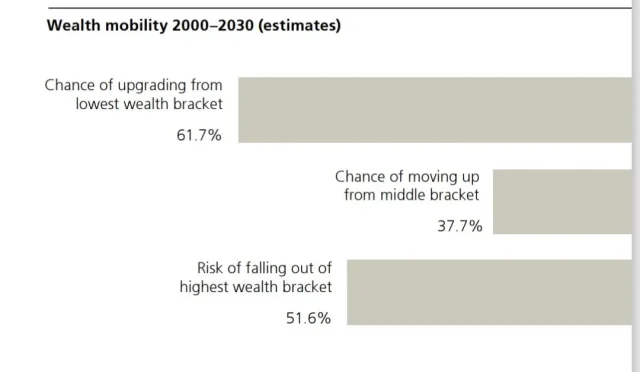

Net worth milestones serve as critical markers in the journey of personal finance, illustrating one’s progress along the Wealth Ladder. These milestones represent significant points in one’s financial life, such as having an emergency fund that covers six months of expenses or reaching the point where your investments yield enough income to cover living costs. Setting these milestones helps individuals stay focused and motivated as they track their financial progress.

Moreover, understanding your net worth is essential in governing financial decisions. It enables individuals to make informed choices about spending and investing, promoting a approach that prioritizes financial health rather than temporary income boosts. Engaging with these milestones can ultimately lead to a more empowered financial experience, allowing for better planning as individuals climb the Wealth Ladder towards their aspirations.

Aligning Spending and Income: A Rung-by-Rung Approach

One of the insightful discussions in the podcast centers around how spending decisions should be tied to net worth rather than income levels. This distinction is crucial in navigating the Wealth Ladder effectively. For instance, individuals with high incomes but low net worth might be living paycheck to paycheck, unable to practice financial independence. Learning to align spending with net worth ensures a healthier financial outlook and empowers individuals to make smarter financial decisions.

As individuals advance through various levels of wealth, it’s vital to refine their spending habits accordingly. At lower rungs, controlling spending to achieve necessary financial stability is key, while those at higher levels must shift their mindset toward investment-oriented spending. This realignment can lead to greater opportunities for wealth accumulation, ensuring that as you climb the ladder, your expenses do not outpace your ability to grow your finances.

The Role of Earning Potential in Wealth Accumulation

As highlighted in Nick Maggiulli’s discussion, increasing earning potential is pivotal as one progresses through the Wealth Ladder. While frugality can be an effective short-term strategy, relying solely on cutting expenses often limits financial growth. Instead, focusing on developing skills to improve career prospects, seeking promotions, or starting businesses can dramatically enhance wealth accumulation. The richer your earning potential, the easier it becomes to climb the financial ladder.

Additionally, prioritizing your compass towards earning opportunities fosters a mindset shift from merely surviving financially to thriving in wealth accumulation. The more you invest in yourself and your capacity to generate income, the more likely you will reach higher levels of financial independence. Ultimately, the power of maximizing earning potential cannot be understated and is a vital cog in the larger financial wheel that is the Wealth Ladder.

Practical Insights for Climbing the Wealth Ladder

Climbing the Wealth Ladder requires practical insights and actionable strategies, tailored for each rung you find yourself on. Many resources, like Nick’s blog and previous episodes, delve into detailed approaches for squeezing the most out of your finances. These insights cover everything from basic budgeting techniques for those at the lower levels to advanced investing strategies for those nearing financial independence, ensuring there’s a wealth of knowledge at your disposal.

Additionally, one should not underestimate the value of community and mentorship as you climb the wealth ladder. Engaging with financial advisors or joining financial education groups can enhance your understanding and provide support. As you embark on your wealth-building journey, finding a balance between self-education and seeking expertise will not only accelerate your progress but also reinforce your commitment to achieving long-term financial goals.

Moving Beyond Financial Instability: First Steps on the Ladder

The journey of wealth begins with awareness and action, particularly for those facing financial instability. The first steps to climb the Wealth Ladder involve creating a robust financial foundation. This can include budgeting meticulously, eliminating debts, and accruing an emergency fund. By addressing these fundamental areas, individuals can begin to shift their financial trajectory from struggling to saving.

As individuals stabilize their finances, they can then focus on increasing their net worth and gradually moving toward more complex wealth-building strategies. The initial steps taken to escape financial instability are critical for laying the groundwork for future progression up the ladder. The quest for securing financial independence begins with these essential actions, creating a pathway toward a brighter financial future.

Frequently Asked Questions

What are the different levels of wealth on the Wealth Ladder?

The Wealth Ladder consists of six distinct levels, each representing specific net worth milestones and financial freedoms. These levels help individuals understand where they stand financially, guide their wealth-building strategies, and provide a clearer path toward financial independence.

How can I achieve financial independence using the Wealth Ladder concept?

To achieve financial independence through the Wealth Ladder, you should identify your current wealth level and implement the appropriate financial strategies tailored for that rung. Focus on increasing your income, managing your spending based on your net worth, and investing wisely to climb the ladder towards greater financial freedom.

What wealth-building strategies should I use at each rung of the Wealth Ladder?

Each rung of the Wealth Ladder requires distinct wealth-building strategies. At lower levels, prioritize creating a budget and building an emergency fund. As you progress, focus on investment diversification, increasing earning potential, and ultimately reallocating wealth to enhance financial security and freedom.

How does my net worth influence my spending decisions according to the Wealth Ladder?

According to the Wealth Ladder framework, spending decisions should be based on your net worth rather than your income. As you grow your net worth, you can afford more freedom in your spending choices, which can lead to enhanced quality of life and experiences.

Why is increasing earning potential important as I climb the Wealth Ladder?

Increasing your earning potential becomes crucial as you climb the Wealth Ladder because higher income allows for more investments and savings, ultimately accelerating your journey to financial independence. It’s about building assets rather than simply cutting expenses.

What role do net worth milestones play in the Wealth Ladder?

Net worth milestones play a pivotal role in the Wealth Ladder as they mark significant achievements in your financial journey. Recognizing these milestones helps you gauge your progress and motivates you to advance to the next level of wealth and financial independence.

What is the significance of understanding personal finance in relation to the Wealth Ladder?

Understanding personal finance is essential for effectively navigating the Wealth Ladder. It equips you with the knowledge to make better decisions regarding budgeting, investing, and managing debt, all crucial to advancing toward higher levels of wealth and achieving financial freedom.

Can the Wealth Ladder framework be applied to anyone, regardless of their current financial situation?

Yes, the Wealth Ladder framework is designed to be applicable to anyone, regardless of their current financial situation. Whether you’re just starting your wealth-building journey or already on your path to financial independence, the Wealth Ladder offers insights and strategies that can help you progress.

| Wealth Level | Description | Key Strategies | Goals |

|---|---|---|---|

| Level 1: Financial Instability | Struggling to meet basic expenses and savings | Focus on budgeting and cutting unnecessary expenses | Achieve financial stability and create savings. |

| Level 2: Financial Security | Able to pay bills with some savings | Develop a robust savings plan | Build an emergency fund of at least 3-6 months of expenses |

| Level 3: Financial Freedom | Have enough savings to cover basic needs and wants | Invest consistently and diversify assets | Achieve certain lifestyle freedoms such as travel |

| Level 4: Financial Independence | Income from investments covers living expenses | Focus on wealth growth and passive income streams | Afford luxury experiences without financial worry |

| Level 5: Financial Abundance | Significant net worth with diverse investments | Strategic philanthropy and legacy planning | Achieve the ability to give back to the community |

| Level 6: Financial Legacy | Estate planning and wealth preservation | Educating the next generation about finances | Create a lasting impact through inheritance and philanthropy |

Summary

The Wealth Ladder offers a structured approach to understanding financial progress, allowing individuals to identify their current financial state and strategize effective steps to ascend to greater levels of wealth and financial independence. Each level of the Wealth Ladder emphasizes not just the accumulation of wealth but also the freedom and fulfillment that accompanies financial prudence and astute investment. By integrating practical strategies and personal finance fundamentals, the Wealth Ladder serves as a valuable guide for anyone seeking to enhance their financial capabilities and enjoy a prosperous life.