In recent years, wealth management deals have surged to the forefront of the financial landscape, driven by an increasing appetite from high-net-worth individuals seeking diverse investment opportunities. As the wealth management trends evolve, firms are strategically aligning themselves through mergers and acquisitions to cater to this affluent clientele, further fueled by the allure of private equity wealth management. The competitive nature of high net worth investing has prompted established wealth management firms to aggressively acquire smaller entities, resulting in a particularly vibrant M&A environment. This unprecedented consolidation wave marks a crucial shift in the industry, as companies strive to expand their reach and enhance their portfolio offerings. The evolving dynamics underscore the importance of adapting to market changes to effectively serve the burgeoning needs of wealthy investors.

The realm of financial advisory services is experiencing a revolutionary transformation, often encapsulated by the term “wealth management transactions.” As investors with significant capital become increasingly discerning, wealth managers are compelled to innovate and provide tailored solutions. Many wealth advisory firms are pivoting towards consolidations—commonly referred to as mergers and acquisitions in wealth advisory—to unify their resources and expertise. The rise of private equity investments in this sector reflects a broader trend towards securing robust capital flows and achieving economies of scale, which are essential for navigating the complex landscape of asset management. Collectively, these developments indicate a significant shift towards a more integrated and responsive approach to managing wealth.

Understanding Wealth Management Trends

The wealth management sector is undergoing significant transformation driven by evolving trends and demands from high-net-worth individuals. Rising investor appetite for personalized investment strategies and alternative assets is reshaping how wealth management firms operate. The trend toward private equity wealth management has intensified, with firms increasingly offering tailored solutions that align with the interests of affluent clients. This shift not only highlights the pressing need for innovative investment avenues but also the overarching influence of market dynamics in determining the offerings of wealth management firms.

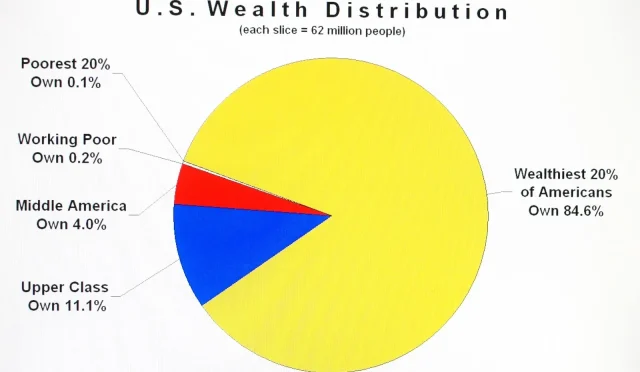

Moreover, in this landscape, a clear focus on wealth management trends is critical for advisors striving to capture and retain high-net-worth clients. With an estimated global wealth of $140 trillion among this demographic, understanding the nuances of their investment preferences is paramount. Trends such as public/private convergence have democratized access to private market opportunities, thus prompting wealth managers to refine their strategies to include diversified options that resonate with modern investor behaviors.

The Rise of Private Equity Wealth Management

Private equity has emerged as a vital component for wealth management firms seeking to enhance their offerings. As investments in private markets become more attractive, firms are continually reevaluating their strategies to include private equity deals in their portfolios. Many high-net-worth investors view these investments as a means to achieve superior returns compared to traditional asset classes. Consequently, we are witnessing a surge in private equity-backed wealth management deals that signify a long-term shift in investor behavior and expectations.

This trend is not without its challenges, as wealth management firms must navigate the complexities associated with private equity investments. Education and transparency are paramount, as investors require detailed insights into the risks and rewards of these alternatives. As more firms successfully integrate private equity into their service lines, they bolster their value proposition, fostering deeper relationships with clients and establishing themselves as trusted advisors capable of navigating today’s dynamic investment landscape.

Frequently Asked Questions

What are the current wealth management trends driving deals in the sector?

Current wealth management trends include a significant rise in private equity investments, a focus on catering to high net worth investing, and the consolidation of wealth management firms. These trends indicate a shift towards larger advisory platforms that can handle escalating demands for specialized services from affluent clients.

How are private equity firms influencing wealth management deals?

Private equity firms are investing heavily in the wealth management sector, leading to a surge in mergers and acquisitions (M&A). Their involvement has resulted in higher valuations for wealth management firms and an increase in the number of substantial deals as they seek to tap into the growing market of high net worth investors.

What role do wealth management firms play in the M&A landscape?

Wealth management firms are pivotal in the M&A landscape, driving a wave of consolidation as they seek to scale operations and enhance service offerings for high net worth clients. This activity reflects the industry’s response to a growing market of affluent investors looking for comprehensive investment solutions.

Why is size becoming increasingly important for wealth management firms?

Size matters in wealth management as larger firms are better positioned to meet the complex needs of high net worth investors. Bigger platforms can offer a broader range of services, benefit from economies of scale, and attract institutional investments, all of which enhance their competitiveness in the market.

How is the inflow of institutional investments impacting the wealth management space?

The inflow of institutional investments, particularly from sovereign wealth funds and private equity firms, is significantly impacting the wealth management space by driving up valuations and fostering a competitive environment. This trend encourages firms to consolidate and expand to meet the demand from wealthy clients.

What potential challenges do wealth management firms face amidst the current deal-making environment?

Wealth management firms are facing challenges such as a potential shortage of qualified advisors due to retirements, increased competition from emerging financial networks, and the need to expand their service offerings to attract and retain high net worth clients in a rapidly evolving landscape.

What are the projected future trends for M&A in wealth management?

The future of M&A in wealth management looks promising, with forecasts predicting continued high activity levels. As advisors retire and firms seek growth through collaborations and acquisitions, the market is expected to see a doubling of transaction volumes over the next decade.

| Key Points | Details |

|---|---|

| Rising Demand | Increasing interest from wealthy clients seeking alternatives drives growth in private markets. |

| M&A Activity | Wealth management firms are consolidating and acquiring smaller firms, supported by major financial giants. |

| Market Size | The wealth management sector is valued at approximately $140 trillion in private assets. |

| Future Expectations | Echelon Partners forecasts a record number of deals by 2025, with a projected growth in activity. |

| Valuation Trends | Valuations of wealth management platforms are rising due to increasing interest from private equity. |

Summary

Wealth management deals are currently witnessing an unprecedented surge fueled by rising investor demand for private market investments. As more affluent clients seek personalized investment opportunities, wealth management firms are strategically merging and acquiring to expand their capabilities and service offerings. This consolidation trend is supported by significant private equity investments, indicating a robust future for the sector. With projections pointing to record deal volumes in the coming years, firms must adapt to a rapidly evolving landscape where scalability, comprehensive service, and client relationships are paramount.