Wealth Management for Millennials: Shifting Trends in 2025

Wealth management for millennials is rapidly evolving as the younger generation seeks more tailored and digital solutions for their financial futures. This shift comes in the wake of an unprecedented transfer of wealth, estimated at $100 trillion, from older generations to younger investors. Millennials and Gen Zers, often referred to as the next generation of investors, are dissatisfied with the traditional wealth management trends they have inherited, seeking innovative firms that align with their modern lifestyle. Digital wealth management, which emphasizes accessibility and user-friendly platforms, is becoming increasingly crucial for engaging these young millionaires. As advisors adapt their wealth transfer strategies to meet these demands, they must prioritize the unique preferences of this tech-savvy demographic.

The landscape of financial planning is shifting, with a notable emphasis on personalized investment and management solutions tailored for younger clients. Financial guidance, particularly aimed at the newly affluent and younger generations, is shifting towards an online-centric model that reflects their digital lifestyles. This emerging cohort of young learners and wealthy heirs is looking for not only traditional investment avenues but also innovative avenues such as cryptocurrencies and private equity. As wealth managers embrace these alternative investment opportunities, they can bridge the gap between conventional wealth strategies and the desires of today’s youthful clientele. By adopting a more engaging and educational approach, advisors stand to foster long-term relationships with the next generation of wealth holders.

The Rise of Next Generation Investors

Next generation investors are redefining wealth management dynamics by bringing fresh expectations and priorities to the forefront. According to a recent survey by Capgemini, an astonishing 81% of millennials and Gen Zers planning to inherit wealth are looking to replace their parents’ wealth management firms, primarily due to dissatisfaction with existing digital services. This generational shift necessitates a deep understanding of their individual preferences, as young millionaires prioritize personalized and innovative financial solutions.

As this generation gains financial acumen, they are influenced not only by their personal aspirations but also by changes in wealth management trends. The impending $100 trillion wealth transfer from baby boomers to younger investors signifies a monumental shift. Thus, wealth management firms must tailor their services to align with the interests of next-generation millionaires who are unafraid to embrace risk and expanding investment horizons.

Wealth Management for Millennials: Embracing Digital Solutions

Wealth management for millennials involves recognizing their inherent preference for digital interactions. Young investors are digital natives who increasingly demand seamless online platforms for managing their portfolios. Research indicates that two-thirds of millennials expect their wealth managers to offer advanced digital services, moving beyond traditional face-to-face interactions that baby boomers prefer. To engage this demographic, wealth management firms must provide comprehensive mobile apps that facilitate real-time trading and portfolio management.

Moreover, enhancing digital wealth management solutions is not merely a suggestion but a necessity. The capabilities of these platforms should allow millennials to access their financial information effortlessly, incentivizing them to interact more frequently with their advisors. By offering more intuitive tools for financial management decision-making, firms can cultivate lasting relationships with this demographic, ensuring they remain competitive as the wealth management landscape evolves.

New Investment Preferences: Beyond Traditional Assets

The investment preferences of young millionaires diverge significantly from those of older generations. While traditional stocks and bonds have long reigned supreme, younger investors are favoring more diverse opportunities, including cryptocurrencies, private equity, and alternative markets. A substantial 88% of millennials believe private equity plays a vital role in their investment strategies, emphasizing the need for wealth managers to expand their offerings to meet these shifting demands.

This trend is reflective of a broader wealth management strategy that recognizes the necessity of accommodating emerging asset classes. Wealth managers that fail to provide options in cryptocurrencies and other innovative investments risk alienating this future base of clients. As younger investors prioritize aggressive growth over mere wealth preservation, it is crucial for wealth management professionals to understand and integrate these new asset classes into their strategies.

Adapting to Risk: Millennials’ Investment Mindset

Young investors are characterized by a distinctive approach to risk, often taking bolder financial decisions compared to older generations. The Capgemini survey highlights that millennials and Gen Zers are willing to embrace higher-risk investments, viewing their longer time horizons as an advantage. This tendency is fueled by increased access to financial education and resources, allowing them to better understand and evaluate their risk-taking capabilities.

Moreover, wealth management firms must recognize and accommodate this risk appetite by offering tailored products that allow for speculation and innovation in investment strategies. By facilitating better access to high-risk investment opportunities, such as meme stocks and cryptocurrencies, wealth management professionals can align their services with the preferences of the next generation, ultimately leading to a more satisfied and engaged clientele.

Educational Needs: Breaking Down Financial Barriers

Effective wealth management involves not only providing services but also educating clients, especially the younger generations on financial matters. Despite a strong desire for financial education, many current programs are perceived as unengaging or overly complex. Young millionaires prefer accessible and relatable content that empowers them to manage their finances confidently while avoiding condescension inherent in existing educational resources.

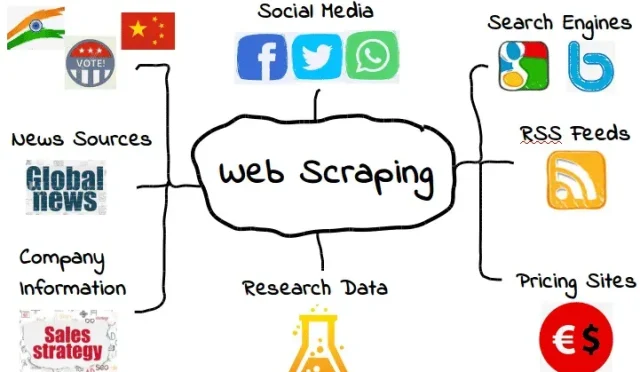

A successful approach involves simplifying financial concepts into digestible formats, utilizing modern mediums like podcasts and social media. This educational shift also helps bridge generational gaps, fostering trust and enhancing relationships between wealth managers and their younger clientele. Creating learning experiences that resonate with the lifestyle and values of next-generation investors can significantly elevate their engagement.

Personalized Services: Beyond Traditional Investment Advice

Today’s younger investors are in search of more than just straightforward investment advice; they desire a holistic approach that encompasses various lifestyle aspects. This includes essential services like estate planning, tax strategy, and philanthropic guidance tailored to fit their unique financial situations. The need for wealth management firms to adapt their offerings from mere investment products to comprehensive lifestyle services is evident.

Additionally, young clients are increasingly interested in personalized concierge services and expert advice on luxury purchases and wellness initiatives. By providing customized experiences that align with their lifestyle, wealth managers can enhance client satisfaction and loyalty. This evolving service model reflects the diverse priorities of young millionaires, demonstrating that wealth management must evolve to incorporate broader aspects of their lives.

Global Perspectives: Investing in Emerging Markets

The next generation of investors exhibits a notable inclination towards international diversification, reflecting their experiences and perceptions gained from global travel. As these young millionaires seek investment opportunities beyond their local markets, they show heightened interest in emerging wealth centers such as Singapore, the UAE, and Saudi Arabia. This trend underlines the importance of developing wealth management strategies that encompass global dynamics.

Wealth managers must embrace this global mindset to effectively service their clients. By offering insights into international opportunities and diversified investment pathways, firms can attract and retain next-generation investors. Moreover, educating clients on the risks and rewards of international investments can empower them to make informed decisions while providing a competitive edge to wealth management firms.

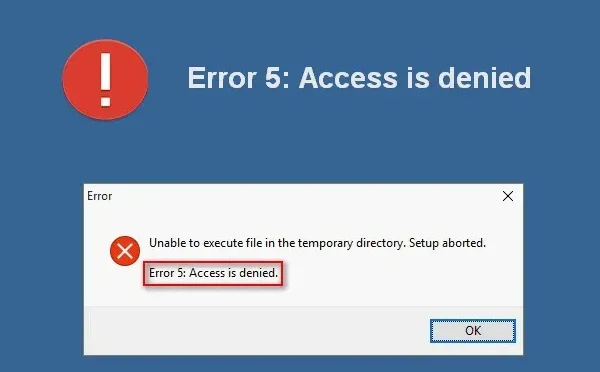

The Importance of Cybersecurity in Wealth Management

As wealth management firms adapt to the needs of millennials, the pressing concern for cybersecurity emerges. Young investors are increasingly aware of the risks associated with digital investments, prompting a demand for robust security measures to protect their assets. Wealth management firms, therefore, must prioritize cybersecurity protocols in their suite of services, establishing trust with their technologically savvy clientele.

Investing in advanced cybersecurity solutions not only safeguards client assets but also aligns with the expectations of the next generation who insists on secure transaction capabilities and data protection. Firms that proactively communicate their commitment to maintaining secure systems will build credibility and confidence among younger investors, ensuring long-term loyalty in an ever-evolving digital landscape.

The Role of Philanthropy in Wealth Management Among Young Millionaires

Philanthropy plays a significant role in the financial planning of young millionaires, as many prioritize social responsibility and giving back to their communities. This trend indicates a growing desire among young investors to align their investments with their values, particularly in supporting causes they are passionate about. Wealth management firms can leverage this inclination by facilitating opportunities for impactful giving and responsible investing.

By incorporating philanthropic strategies into their offerings, wealth managers can not only aid their clients in making a difference but also foster deep emotional connections. This improves client satisfaction and engagement, reinforcing the idea that wealth management is not just about financial gain but also about creating a legacy that resonates for generations. Understanding and adapting to these philanthropic interests will be essential for firms aiming to attract next-generation investors.

Frequently Asked Questions

What are the top wealth management trends for millennials?

Millennials are driving new wealth management trends, focusing on digital wealth management and personalized financial services. They seek investments beyond traditional stocks and bonds, including crypto and private equity, and prefer engaging through digital platforms rather than in-person meetings. Their priorities include risk-taking for aggressive growth, diversified international investments, and comprehensive lifestyle management services.

How are next generation investors changing the wealth management landscape?

Next generation investors, particularly millennials, are reshaping the wealth management industry by demanding more tailored services and effective digital offerings. With an expected wealth transfer of $100 trillion, these investors prioritize risk, alternative investment strategies, and meaningful engagement through technology. Financial firms that adapt to these changes are more likely to attract and retain young millionaires.

What services do young millionaires expect from wealth management firms?

Young millionaires expect wealth management firms to provide robust digital services, customized investment strategies, and comprehensive lifestyle assistance. They focus on advanced investment options, education on managing wealth, and concierge services that include luxury planning, health advice, and cybersecurity support, reflecting their prioritization of personalized and experiential services.

How can wealth managers appeal to millennials and Gen Z investors?

Wealth managers can appeal to millennials and Gen Z investors by enhancing their digital platforms, offering diverse investment options, and prioritizing education that is relatable and engaging. Firms should focus on creating meaningful relationships through social media and personalized communication, ensuring that they cater to the unique needs and preferences of next generation investors.

What impact does wealth transfer have on wealth management for millennials?

The impending $100 trillion wealth transfer is prompting millennials to reconsider traditional wealth management methods. They are likely to seek new advisors that align with their values, emphasizing digital access, innovative investment opportunities, and a focus on social impact, which indicates a significant shift in how wealth is managed and perceived among younger investors.

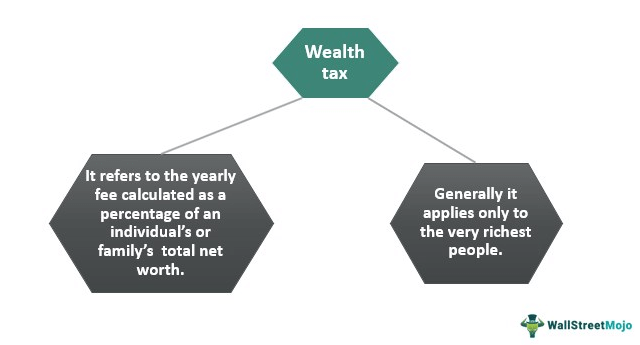

| Key Point | Explanation |

|---|---|

| Market Shift | 81% of wealthy inheritors plan to replace their parents’ wealth management firms as they express dissatisfaction with traditional services. |

| Wealth Transfer | A $100 trillion transition of wealth from baby boomers to millennials and Gen Z will reshape the wealth management landscape. |

| Risk Appetite | Younger investors favor riskier investments like cryptocurrencies, focusing on aggressive growth rather than wealth preservation. |

| Product Preferences | Next-gen investors are interested in diversified assets such as private equity and international opportunities rather than traditional stocks and bonds. |

| Digital Engagement | Young investors expect advanced digital offerings, seeking real-time access and interactive tools rather than traditional face-to-face meetings. |

| Educational Needs | Next-gen candidates desire simple, engaging financial education rather than conventional, complex presentations that fail to resonate. |

| Lifestyle Management | They require a range of services including estate planning, philanthropy advice, and luxury lifestyle guidance tailored to their unique needs. |

Summary

Wealth management for millennials is evolving rapidly as younger investors seek new advisory approaches. This generation’s dissatisfaction with existing services reveals a strong desire for innovative digital solutions and investment options that cater to their risk appetites and lifestyle preferences. With the impending transfer of substantial wealth from older generations, wealth management firms must adapt swiftly to engage and meet the expectations of millennial and Gen Z investors effectively.

#WealthManagement #MillennialWealth #2025FinanceTrends #GenYInvesting #FutureOfWealth