The landscape of wealth management trends is evolving rapidly, propelled by rising demand from affluent investors and innovative financial strategies. As high-net-worth clients seek more personalized and alternative investment opportunities, various firms in the sector are adapting their services to meet these complex needs. This shift is notably fueled by significant private capital investments, leading to increased mergers and acquisitions (M&A) in wealth management, which highlights a significant consolidation trend. Wealth management firms are under pressure to enhance their offerings as the competition for managing substantial pools of capital grows fiercer. This dynamic has created a vibrant financial advisory market, where adaptability and expertise are essential for success.

Recent developments in the financial advisory landscape reveal a compelling narrative of transformation and consolidation among investment firms. The surge of interest from affluent clientele has prompted wealth advisory companies to evolve their service offerings to encompass a wider range of financial solutions. High-net-worth investors are increasingly drawn to alternative investments, significantly impacting the mergers and acquisitions (M&A) activity within the sector. This ongoing wealth management consolidation is not only changing the competitive dynamics of the industry but also reshaping the financial advisory market to better serve sophisticated investors. As private capital continues to flow into this space, the traditional paradigms of wealth management are being redefined, creating exciting opportunities for both advisors and their clients.

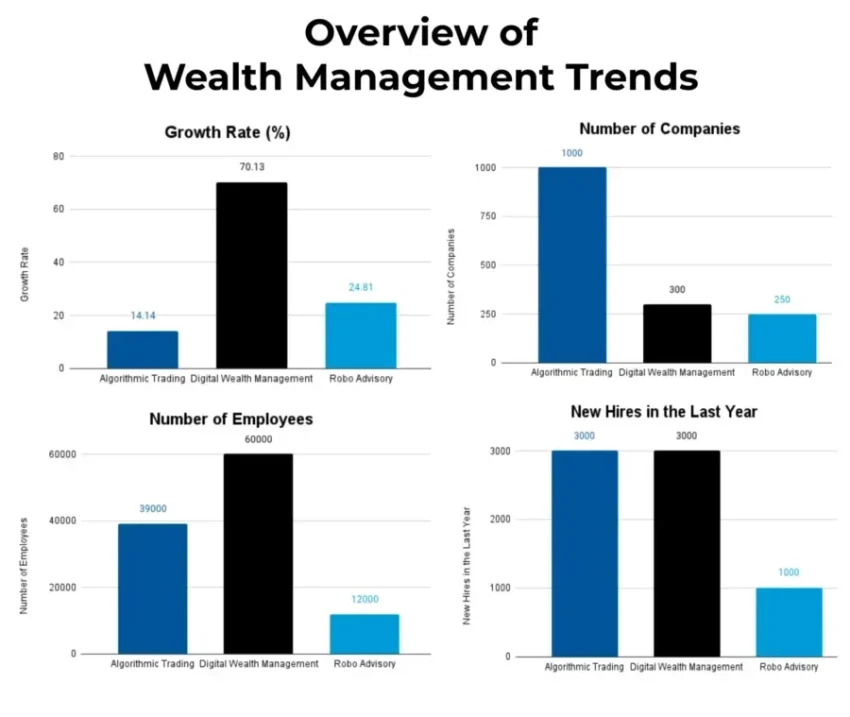

Current Trends in Wealth Management

The landscape of the wealth management industry is rapidly transforming as the demand for specialized financial services surges. Wealth management trends indicate a notable shift towards private capital interactions, facilitating a consolidation pathway among major players. Key firms are responding by adopting innovative strategies designed to cater to the preferences of high-net-worth investors. As investors seek personalized investment avenues, wealth management firms are increasingly capitalizing on opportunities within this lucrative market.

Moreover, the ongoing mergers and acquisitions (M&A) in wealth management serve as a testament to the rising confidence among private equity firms and institutional investors. With the market projected to experience heightened activity, the financial-advisory sector is poised for an unprecedented level of consolidation. This is largely attributed to the growing asset bases of these firms and their ability to leverage private capital to acquire smaller advisory services, thereby expanding their reach and service offerings.

The Role of Private Capital in Wealth Management

As the demand for sophisticated investment solutions escalates, private capital is becoming a driving force in reshaping the wealth management landscape. Private equity firms are pouring substantial investments into wealth management companies, eager to tap into the vast pool of assets held by high-net-worth individuals. This influx of capital is enabling firms to scale operations rapidly while enhancing the breadth of services offered to clients.

Furthermore, the strategic alignment between private capital and wealth management firms is paving the way for innovative financing models. Many of these firms are actively seeking avenues to differentiate themselves, leading to the creation of unique product offerings tailored to the diverse needs of high-net-worth investors. As firms partner with private equity investors, they can provide enhanced solutions, including alternative investment opportunities that attract sophisticated clients.

Impact of M&A on Wealth Management Consolidation

The trend of mergers and acquisitions in wealth management reflects a broader effort to consolidate resources and capabilities within the industry. As a result, the financial advisory market is witnessing the emergence of larger firms equipped to handle complex financial demands. This consolidation not only increases efficiency but also strengthens the collective bargaining power of these firms, allowing them to negotiate better terms and deliver enhanced value to clients.

In 2025 alone, the wealth management sector is predicted to experience record levels of M&A activity. With forecasts estimating hundreds of transactions primarily fueled by private equity interest, the consolidation trend is seen as a necessary evolution in response to the impending shortage of advisers due to retirements. Consequently, firms are recognizing the importance of strategic partnerships and acquisitions to remain competitive and meet the evolving needs of their high-net-worth clientele.

Meeting the Demands of High-Net-Worth Investors

High-net-worth investors are at the forefront of today’s wealth management dynamics, navigating an increasingly complex financial landscape. As their investment needs become more sophisticated, they are increasingly drawn to firms that offer comprehensive services tailored to their unique requirements. Wealth management firms that embrace this paradigm shift are integrating a variety of specialized services, including estate planning and alternative investments, to satisfy the demands of discerning clients.

Additionally, the consolidation within the industry means that clients can expect one-stop solutions for all their financial needs. Firms that have successfully merged or acquired others are in a prime position to provide a diverse range of services under one roof, enhancing customer experience and fostering deeper relationships. This strategic pivot aligns with the expectations of high-net-worth investors, who seek personalized attention and bespoke financial strategies.

Emerging Investment Opportunities in Wealth Management

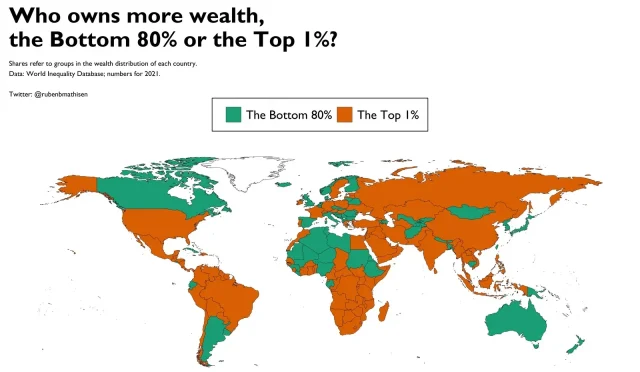

With the convergence of public and private markets, a wealth of investment opportunities is sprouting, driven largely by the burgeoning base of high-net-worth individuals. Wealth managers are increasingly exploring alternative investment strategies that go beyond traditional equities and fixed income, appealing to clients who are seeking greater diversification and potentially higher returns. This shift reflects an evolving investment ideology whereby wealth holders are encouraged to engage in private capital investments.

Moreover, this inclination towards alternative investments is prompting many wealth management firms to boost their operational capabilities. By offering innovative solutions that give clients access to private equity, venture capital, and hedge funds, these firms are tapping into an underrepresented segment of the wealth management space. As they adapt to this trend, firms will not only enhance their service model but also attract a broader clientele of high-net-worth investors looking for unique avenues to grow their wealth.

The Significance of Scaling in Advisory Services

As showcased by the expansion of mega-advisory platforms, size has become a significant factor in wealth management success. Larger firms can leverage their scale to enhance service delivery, access superior technology, and provide comprehensive financial solutions that smaller firms may struggle to match. This trend toward scaling is indicative of the competitive pressures within the wealth management sector, as firms seek to create a lasting impact in a crowded marketplace.

Additionally, the trend toward consolidation reinforces the importance of scale in the advisory services sector. Firms that can bring together expertise from various specialties can better meet the complex needs of sophisticated investors. By unifying multiple capabilities under a larger institutional umbrella, wealth managers are positioning themselves as one-stop solutions, readily addressing diverse client demands across the financial landscape.

Valuation Trends in Wealth Management

Valuations within the wealth management industry are seeing a significant uptick, reflecting the high demand for advisory services amid a growing client base of high-net-worth investors. The influx of private capital has driven these valuations upwards, placing a premium on platforms that demonstrate robust revenue growth and profitable business models. Investors are recognizing the potential of wealth management firms to deliver strong returns, thus justifying elevated valuation metrics.

Moreover, as competition intensifies, firms are also increasingly recognizing the importance of maintaining sustainable growth strategies. By focusing on delivering consistent, high-quality service, wealth managers enhance their attractiveness to potential investors and acquirers alike. This dynamic underscores not only the rising intrinsic value of these firms but also the integral role of effective management in navigating market uncertainties and future growth prospects.

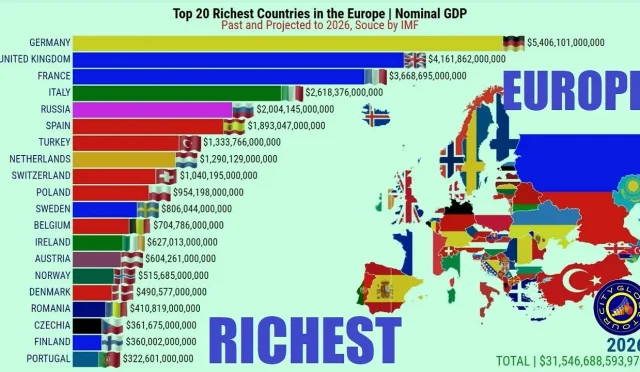

Sovereign Wealth Funds and Their Influence

Sovereign wealth funds are emerging as pivotal players within the wealth management sphere, investing heavily in established advisory firms. Their entry into the sector signifies increased interest from institutional investors, underpinning the belief in the sector’s long-term sustainability. By acquiring stakes in prominent financial management firms, these sovereign investors are paving the way for enhanced stabilizing forces amidst market fluctuations.

Additionally, the involvement of sovereign wealth funds can streamline access to capital for wealth management firms, enabling them to accelerate growth initiatives and widen their service offerings. Such partnerships not only bring considerable financial backing but also strategic insight into global investment trends, positioning these firms favorably in a competitive landscape.

Navigating Today’s Competitive Landscape

In today’s fast-evolving financial landscape, wealth management firms must continuously adapt to a host of competition from both traditional financial institutions and tech-driven disruptors. The race to attract high-net-worth clients necessitates innovative approaches, including personalized financial planning and advanced investment technology. Firms that effectively utilize cutting-edge solutions can distinguish themselves in a saturated market, better meeting the expectations of affluent investors.

Moreover, strategic positioning through mergers or partnerships with established private equity firms can provide wealth managers with a competitive edge. By focusing on collaboration, firms can tap into the expertise and resources needed to thrive while navigating complexities within the financial advisory market. Ultimately, successful wealth management firms will be those that embrace adaptability and foresight in addressing the aspirations of high-net-worth clients.

Frequently Asked Questions

What are the latest wealth management trends influencing private capital investment?

The latest wealth management trends, particularly the surge in private capital investments, center around increased consolidation in the financial advisory market. Wealth management firms are actively merging to cater to the growing number of high-net-worth investors, demonstrating a strong focus on large-scale acquisitions driven by private equity (PE) firms and sovereign wealth investors.

How is M&A activity shaping the future of the wealth management industry?

M&A activity is significantly shaping the future of the wealth management industry by creating larger, more diversified advisory platforms. The trend indicates a consolidation cycle where firms are acquiring smaller companies to enhance services, accommodate high-net-worth investors, and leverage innovative investment opportunities, particularly in private capital markets.

Why are high-net-worth investors driving consolidation in wealth management?

High-net-worth investors are driving consolidation in wealth management due to their increasing demand for comprehensive financial services, including access to alternative investments and specialized advisory offerings. As wealth-management firms respond to this demand, they engage in strategic mergers and acquisitions to build robust partnerships and deliver tailored solutions.

What role does private capital play in the current financial advisory market?

Private capital plays a crucial role in the current financial advisory market, fueling a rapid acquisition wave among wealth management firms. This influx of funding from private equity and sovereign wealth firms enables these companies to expand their offerings and scale to meet the complex needs of high-net-worth clients, ultimately transforming the advisory landscape.

What does wealth management consolidation mean for the future of financial advisory services?

Wealth management consolidation signals a future where financial advisory services become more integrated and comprehensive. As firms merge, the focus shifts toward providing specialized services under one roof for high-net-worth investors, enhancing client experiences and addressing the growing complexity of wealth management in an evolving economic environment.

How are wealth management trends impacting valuations in the financial sector?

Wealth management trends are significantly impacting valuations in the financial sector, as heightened competition and increased PE investment drive up valuations of advisory platforms. With strong growth profiles and a high percentage of recurring revenue, firms in the wealth management space are achieving elevated EBITDA multiples, reflecting investor confidence amidst a wave of consolidation.

What are the emerging trends in financial advisory services for high-net-worth investors?

Emerging trends in financial advisory services for high-net-worth investors include an increased focus on personalized, holistic wealth management strategies. As firms consolidate, there is a shift towards offering alternative investments, trust administration, and estate planning services, catering to the diverse financial needs of affluent clients.

How is the retirement of financial advisers affecting wealth management trends?

The impending retirement of financial advisers is accelerating wealth management trends towards consolidation, as many firms seek to integrate new talent and retain clients. This trend is prompting existing firms to acquire others or partner with larger entities to optimize their operations and ensure continuity of service for high-net-worth investors.

What does the term ‘public-private convergence’ mean in the context of wealth management?

In the context of wealth management, ‘public-private convergence’ refers to the growing trend where individual investors are increasingly exploring private markets for investment opportunities. This shift is prompting wealth management firms to adapt their offerings to include private capital solutions, addressing the preferences of high-net-worth clients seeking diverse investment strategies.

Why is size becoming a crucial factor in the wealth management industry?

Size is becoming a crucial factor in the wealth management industry as larger advisory firms can offer a wider array of services and investment options to high-net-worth clients. Through consolidation, firms aim to increase their assets under management (AUM), which enhances their competitiveness and ability to invest in innovative solutions for affluent investors.

| Key Point | Details |

|---|---|

| Booming Wealth-Management Sector | The wealth-management sector is experiencing a surge in mergers and acquisitions, driven by private equity and sovereign wealth firms. |

| Focus on High-Net-Worth Clients | Wealth management firms are competing to attract high-net-worth individuals, with global private assets estimated at $140 trillion. |

| Public-Private Convergence | Rising demand for alternative investments among wealthy clients is shifting individual investors into private markets. |

| Consolidation Trends | There is a notable trend of consolidation within the industry, with record amounts of deals forecasted for the coming years. |

| Size of Advisory Platforms | Investors are increasingly targeting larger advisory firms to improve growth, reflecting a trend towards creating mega-advisory platforms. |

| Innovative Services for Clients | Firms are combining services to cater to the complex needs of high and ultra-high-net-worth clients. |

| Rising Valuations | Valuations in wealth management remain elevated with strong organic growth and profitability driving investor interest. |

| Increased Competition | Competition is fierce among wealth managers to retain top advisors and attract new clients through lucrative offers. |

| Global Investment Trends | Sovereign wealth funds are increasingly investing in wealth management firms, reflecting global confidence in the sector. |

Summary

Wealth management trends are indicating a significant transformation in the financial-advisory industry as private equity and sovereign wealth firms aggressively pursue mergers and acquisitions. This consolidation is driven by the surging demand among high-net-worth clients for innovative investment solutions and comprehensive financial services. As a result, the sector is not only expanding in size but also evolving to meet the diverse needs of its affluent clientele, marking a notable shift in how wealth management firms operate in today’s dynamic economic landscape.