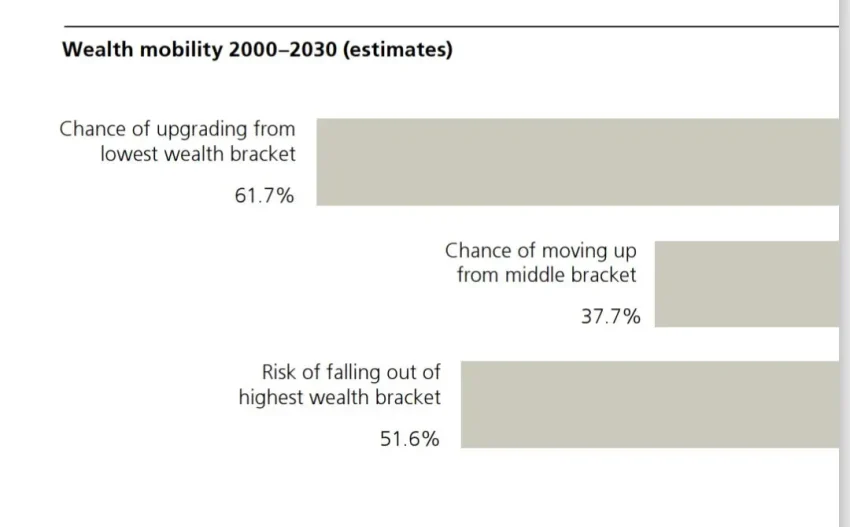

Wealth mobility is becoming increasingly elusive for Britain’s middle class, highlighting the stark reality of ongoing household wealth inequality. Recent studies reveal that while total wealth in the UK has soared—nearly 7.5 times the national income by 2022—the wealth gap continues to pose significant challenges for ordinary families attempting to climb the financial ladder. The overwhelming concentration of wealth among the richest 10%, who possess about half of the total household wealth, underscores the struggles that the middle class faces in achieving true economic mobility. As asset ownership in the UK becomes a distant dream for many, the disparity in wealth growth compared to stagnant wages deepens the socioeconomic divide. Consequently, the wealth gap in Britain illustrates a critical need for initiatives that promote equitable opportunities and financial growth for all families, fostering a more inclusive economic landscape.

The concept of wealth fluidity captures the dynamics of financial progression and regression experienced by various segments of society. This phenomenon underscores the varying degrees of economic advancement, particularly as it pertains to the struggles faced by the middle class despite rising asset values and overall household wealth. The increasing household wealth disparity highlights the obstacles that many individuals encounter as they strive for better financial standing. As the accumulation of assets becomes an increasingly distant goal, the chasm between the affluent and those striving for financial stability continues to expand. The shift in wealth distribution emphasizes the urgent need to address these pivotal economic challenges, ensuring that every individual has the opportunity to improve their financial situation.

Understanding Wealth Mobility in Britain

Wealth mobility refers to the ability of individuals or families to improve their financial status over time. In Britain, the concept of wealth mobility is particularly relevant as the economic landscape continues to evolve. Despite an overall increase in household wealth, the reality for many middle-class families tells a different story. Reports indicate that a significant portion of wealth is still concentrated among the wealthiest households, leaving many feeling stuck in their current financial situation. This stasis reflects the larger issue of the wealth gap in Britain, where large discrepancies exist between the richest and poorest in society.

Efforts to understand wealth mobility must consider how external factors, including economic policies and market conditions, play a role in shaping opportunities for different socioeconomic classes. As the data shows, climbing the financial ladder is becoming increasingly difficult for many Britons, particularly for younger generations who face barriers such as soaring property prices and stagnant wages. To foster genuine wealth mobility, it would require targeted strategies aimed at reducing wealth inequality, enhancing economic mobility, and accessing affordable housing.

The Wealth Gap and Its Impact on Middle-Class Struggles

The wealth gap in Britain significantly impacts the struggles of the middle class. As wealth distribution becomes more polarized, the middle class finds it increasingly challenging to maintain their financial stability. This shift highlights the growing disparity in asset ownership throughout the UK, where a small segment of the population holds a vast majority of the wealth. The report from the Resolution Foundation illustrates how this trend has persisted despite a general increase in national wealth.

The effects of this wealth gap extend beyond mere financial statistics. Middle-class families are now grappling with limited access to opportunities that could enable them to build wealth and secure their futures. The socio-economic challenges they face—such as higher living costs and reduced savings capacity—create a feedback loop that further entrenches them in their financial standings. As such, addressing middle-class struggles entails a multifaceted approach that promotes economic mobility and equitable asset distribution.

The Role of Asset Ownership in Economic Mobility

Asset ownership plays a critical role in determining an individual’s economic mobility. The disparity in household wealth is often exacerbated by differences in asset accumulation, with the rich leveraging their property and investments to generate further wealth. In the UK, where home ownership is a vital aspect of financial security, the difficulties facing those trying to enter the housing market only deepen the existing inequalities. Young families, in particular, find themselves at a disadvantage, facing rising property prices that outpace their earning potential.

For economic mobility to improve, greater emphasis must be placed on facilitating access to asset ownership. This includes creating policies that support affordable housing initiatives and financial education programs that empower individuals to invest wisely. As households begin to accumulate their own wealth, they are more likely to contribute to the wider economy and, ultimately, foster a more equal society where wealth mobility becomes a realistic goal for all.

Generational Wealth Disparities and Their Consequences

Generational wealth disparities have grown alarmingly in the UK, where younger generations are finding it increasingly challenging to catch up with their more affluent counterparts. The widening wealth gap between those in their 30s and those in their 60s is not merely a reflection of personal finance habits; it signifies structural shifts in the economy that prioritize inherited wealth and asset accumulation over meritocratic success. As older generations continue to benefit from high property values and pension schemes, the younger sector remains burdened by student loans and the precipitous rise in housing costs.

This generational divide poses profound challenges for societal cohesion and economic stability. As wealth mobility stagnates, frustration among younger generations grows, leading to feelings of disillusionment and disengagement from traditional economic pursuits. Addressing these disparities is paramount to ensuring economic vitality and fairness, requiring comprehensive reforms aimed at bolstering access to wealth-building opportunities for younger demographics.

Homeownership: A Key Element of Wealth Mobility

Homeownership remains one of the cornerstones of wealth accumulation in the UK. However, the path to homeownership has become increasingly obstructed due to soaring property prices and stagnant incomes, making it more difficult for the average family to secure a foothold on the property ladder. The current landscape highlights the reality that without owning property, the potential for wealth mobility becomes severely limited. According to the Resolution Foundation, policies must be implemented to make homeownership attainable again for the middle class.

Additionally, fostering a culture of affordable housing could counter the widening wealth gap by enabling lower and middle-income households to invest in assets instead of being priced out of the market. With accessible housing, families can build equity, which not only serves as a safety net but also empowers them to make investments that contribute to their long-term financial security. Thus, addressing homeownership barriers could be a transformative step towards enhancing wealth mobility throughout Britain.

The Impact of Economic Mobility on Society

Economic mobility—or the ability for individuals to move up the economic ladder—serves as a vital indicator of societal health. In contexts where wealth mobility is limited, such as in the UK, the broader social fabric may suffer from increased disenchantment and decreased overall wellbeing among residents. The perception that a fair chance at success is out of reach can lead to decreased productivity and heightened social tensions. As evidenced by the growing wealth gap, without substantial steps towards economic mobility, Britain risks permanent social divisions that would further entrench economic inequality.

Moreover, fostering economic mobility contributes to a more dynamic economy. When individuals feel empowered to pursue opportunities without the constraints imposed by wealth inequality, they are more likely to innovate and engage actively in the marketplace. A society that values and promotes economic mobility not only uplifts individuals but also propels collective economic growth, showcasing the interdependence between personal success and national prosperity.

Systemic Barriers to Wealth Mobility

Systemic barriers continue to hinder wealth mobility in Britain, perpetuating cycles of poverty and limiting opportunities for low- and middle-income families. These barriers can include limited access to high-quality education, discriminatory lending practices, and lack of resources for financial literacy. Collectively, these obstacles create an environment where social mobility becomes increasingly difficult to attain, leaving many people feeling trapped in their financial circumstances.

Recognizing and dismantling these systemic barriers is crucial to enhancing wealth mobility across the population. This requires a concerted effort from both government and private sectors to implement inclusive policies that promote equitable access to financial opportunities. Facilitating educational access, reforming lending practices, and providing strong support for wealth-building initiatives could dramatically shift the landscape, offering a more even playing field where all have a chance to succeed.

The Role of Policies in Shaping Wealth Distribution

Policy decisions play a fundamental role in shaping wealth distribution and, by extension, wealth mobility. In an economy where the wealth accrued from assets often outweighs earned income, tax policies, welfare programs, and housing regulations can have profound effects on who gets ahead and who gets left behind. Recent political discourse increasingly reflects the need to reevaluate policies that inadvertently perpetuate the wealth gap, emphasizing the need for comprehensive reform that prioritizes equitable wealth distribution.

Policies focused on securing affordable healthcare, advocating for fair taxation, and increasing wages for low-income earners can be instrumental in bridging the wealth gap. Long-term solutions must be crafted with a focus on sustainability and inclusivity, ensuring that as the economy grows, opportunities for wealth-building are shared across all segments of society, and not just the privileged few.

Bridging the Wealth Gap: A Path Forward

As the discussion surrounding wealth mobility and the wealth gap intensifies, it is crucial to identify concrete steps that can be taken to bridge these divides. Increasing the availability and accessibility of affordable housing, implementing progressive taxation that addresses wealth concentrations, and enacting robust support systems for education and job training can help bridge the wealth gap. These proposals are essential not only for reducing inequality but also for stimulating broader economic growth.

Moreover, fostering connections between businesses and communities can enhance economic mobility. Collaborating with local organizations to create apprenticeship programs and job opportunities can empower individuals with the skills needed to achieve financial stability. By building a comprehensive network of support, it becomes feasible to address the entrenched wealth inequality that currently hampers economic mobility and restricts access to a fair opportunity for success.

Frequently Asked Questions

What factors contribute to wealth mobility among Britain’s middle class?

Wealth mobility for Britain’s middle class is heavily influenced by factors such as asset ownership in the UK and household wealth inequality. The disparity in wealth accumulation, particularly with rising property prices and stagnant wages, has created barriers that make it increasingly difficult for middle earners to climb the financial ladder.

How does the wealth gap in Britain affect economic mobility?

The wealth gap in Britain significantly impacts economic mobility by making it harder for lower-income households to accumulate wealth. Reports indicate that the richest households own about half of the country’s wealth, resulting in limited opportunities for middle class struggles to improve their financial standing without substantial initial assets.

What role does asset ownership play in wealth mobility in the UK?

Asset ownership is critical to wealth mobility in the UK, as owning property or investments can create passive income and wealth increases. Those without assets face greater obstacles in bridging the wealth gap, making it essential for policies to support broader access to asset ownership to improve economic mobility.

Why is household wealth inequality a concern for future generations in Britain?

Household wealth inequality is a growing concern as it perpetuates a cycle where wealth concentration among the top 10% limits resources and opportunities for younger generations. This trend reinforces the generational wealth gap, hindering the ability of the middle class to gain financial traction in an increasingly competitive landscape.

How can the government improve wealth mobility for low and middle-income families?

To enhance wealth mobility for low and middle-income families, the government can focus on policies that facilitate affordable home ownership and expand retirement savings options. Addressing the wealth gap in Britain through smart economic policies can provide a pathway for families to increase their asset base and improve their overall economic condition.

| Key Point | Details |

|---|---|

| Wealth Increase vs. Inequality | Total household wealth in Britain has risen significantly, but wealth inequality has remained stable since the 1980s, with the wealthiest 10% holding a substantial portion of it. |

| Disparity in Wealth Accumulation | An average worker would need to save their entire earnings for 52 years to match the wealth of the richest 10%, highlighting the difficulty in climbing the wealth ladder. |

| Regional Differences | In London, the richest families hold 12 times the wealth of the median household, showcasing stark wealth disparities compared to other regions like the South East. |

| Impact of the Pandemic | The pandemic resulted in unequal wealth gains, with high-income families seeing more significant savings increases while low-income families struggled to save. |

| Generational Wealth Gap | The gap between the wealth of older individuals and younger generations has widened, making it harder for the younger population to accumulate wealth. |

| Policy Recommendations | The report suggests focusing on affordable homeownership and pension participation to help bridge the wealth gap. |

Summary

Wealth mobility is a pressing issue in Britain, where the stark divide between the rich and the middle class remains unaddressed. Despite a notable increase in total household wealth, economic systems favor the wealthy while leaving the middle class struggling to catch up. This ongoing challenge emphasizes the necessity for policies that support equitable wealth distribution, helping families to gain a foothold on the financial ladder and fostering a more dynamic economy.