In recent debates surrounding economic reform, the conversation about wealth tax has emerged as a vital strategy for addressing income inequality in the UK. Union leader Paul Nowak has voiced strong support for implementing a wealth tax, particularly as Labour draws closer to its autumn budget. He argues that introducing a modest wealth tax can support working class families and fulfill Labour’s investment plans promised during the election. With an astounding 68% of the public in favor of this tax on the wealthiest citizens, it’s clear that there’s a growing consensus for change in the financial landscape. As economic challenges mount, the call for fair taxation that includes a wealth tax has never been more pressing, echoing the sentiments of those seeking an equitable solution to support the working class and strengthen public services.

The discourse around taxing accumulated wealth, specifically through measures like a wealth tax, highlights a crucial aspect of modern fiscal policy. This strategy not only aims to redistribute resources but also seeks to enhance public infrastructure and social services, thereby benefiting the average citizen. As stakeholders for economic justice rally behind alternatives such as the reform of capital gains tax and new taxation on financial institutions, a united front emerges. The leadership of figures like Paul Nowak plays a significant role in shaping the narrative around these policies, emphasizing the need for working-class support. Understanding these alternative terms enables us to grasp the wider implications of proposed fiscal initiatives and the urgency for economically progressive reforms.

The Case for Wealth Tax in the UK

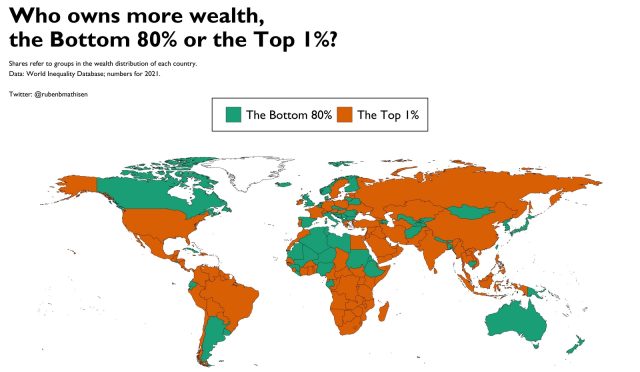

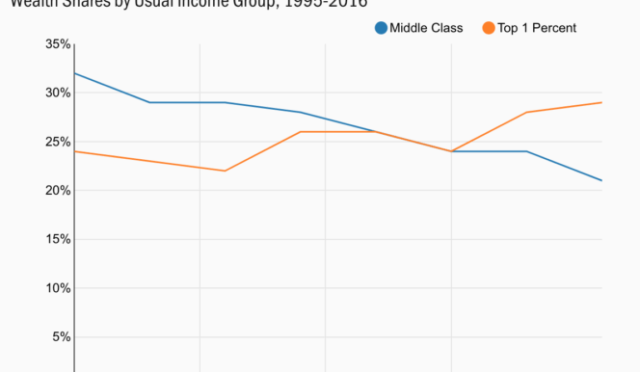

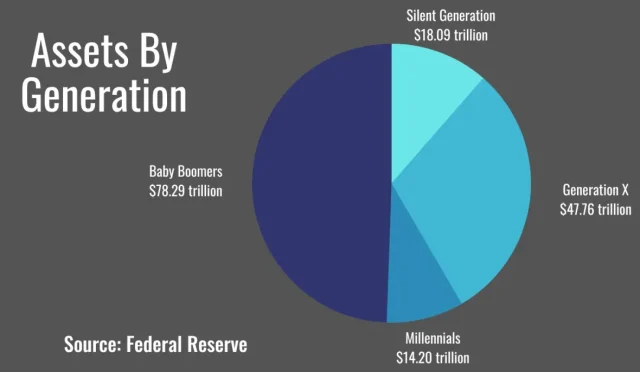

A wealth tax, particularly in the context of the UK, has gained significant traction among the public and economists alike. According to a recent TUC-commissioned poll, there is a growing consensus that individuals with assets exceeding £10 million should contribute a fair share to the economy. This growing popularity, particularly among Labour voters who are currently swaying towards Reform, reflects a demand for systemic change in the tax structure that prioritizes fairness and equity. Wealth taxes emerged as a necessary tool, not only to address the disparity between the wealthy and the working class but also to generate substantial revenue – estimated at £36 billion annually – that could be reinvested into public services and social infrastructure crucial for the working class.

Implementing a wealth tax aligns with Labour’s investment plans and progressive reforms aimed at nurturing the economy while uplifting the working population. Economic justice principles suggest that those who have accrued significant wealth during a period of economic strain owe a duty to contribute to the collective recovery. By taxing wealth, the government would not only address inequality but also regain public trust, demonstrating a commitment to supporting working people who have endured the burden of austerity and cost-of-living crises. Thus, the call for wealth tax is not merely about revenue but is part of a larger narrative surrounding economic reform aimed at restoring dignity and rights to the working class.

Economic Reform Challenges Facing Working Class

The ongoing economic reform discussions in the UK primarily revolve around addressing the pressures faced by the working class. Union leaders like Paul Nowak emphasize the need for systemic change, arguing that traditional tax structures disproportionately burden the working population while allowing the wealthy to leverage loopholes. The urgency for economic reform is underscored by the rising cost of living, stagnating wages, and shrinking public services, all of which push the working class further into financial hardship. If the current government fails to act decisively, they risk alienating core voters who feel abandoned by the political process.

Moreover, the challenge posed by right-wing populists, such as Farage’s Reform party, creates an environment where the working class may feel tempted to seek alternative representation. Nowak’s reflections highlight that true economic reform must resonate with the needs and aspirations of everyday workers. This includes advocating for fair taxation, improved employment rights, and expanded social services. By embracing leftist economic populism, Labour can effectively counteract the allure of opposition parties and galvanize support among disenchanted voters, re-establishing the narrative around accountability and commitment to economic justice.

Role of Labour in Economic Reform

As discussions on economic reform continue, Labour’s role remains pivotal in shaping a narrative that prioritizes working people. Paul Nowak asserts that it is essential for Labour to ‘stay the course’ on investment plans, highlighting that deviating from leftist policies would only serve to embolden the opposition. By leaning into economic reform that genuinely improves the lives of the working class, Labour can distinguish itself from opportunistic narratives that often misuse concerns surrounding economic hardship for electoral gain. The emphasis should be on tangible improvements, such as introducing wealth taxes that reflect the contributions of the affluent.

Labour’s potential to enact change is fortified by public support for reforms, as recent surveys indicate widespread backing for wealth taxes and increased taxation on high-earners. This provides Labour with a powerful mandate to push forward with ambitious investment plans that rejuvenate public services while also addressing wealth inequality. With Paul Nowak vocal on the ethics of taxation, Labour can strengthen its stance by promising real action on economic justice, thereby ensuring that they are the party advocating for the working class amidst the shifting political landscape.

Public Sentiment on Taxation and Economic Fairness

Recent polling data reveals a robust public sentiment favoring increased taxation on wealth, which could play a crucial role in shaping policy decisions in the near future. As evidenced by the TUC’s findings that 68% of respondents support a wealth tax for the ultra-wealthy, there is an undeniable public appetite for change that underscores economic fairness. This trend in popular opinion suggests that the electorate is ready to engage in meaningful discourse about the tax system, shifting away from the notion that taxing wealth is detrimental to growth.

Moreover, the support for equitable tax measures is particularly pronounced among Labour’s voter base, indicating a clear pathway for the party to reclaim its narrative around economic justice. By pushing for reforms that emphasize fair taxation, Labour can align itself with the majority opinion while simultaneously countering the rhetoric of political opportunists. The public is in favor of measures that redistribute wealth and provide funding for essential services, which can lead to a reinvigoration of community and public welfare initiatives that are crucial for the working class.

Addressing Economic Inequality through Tax Policy

Addressing economic inequality is essential for building a cohesive society that supports all individuals, particularly those within the working class. The imbalance seen in the current tax structure, which heavily favors income from work and tends to overlook wealth accumulation, is a source of frustration for many. Initiatives such as implementing a wealth tax would help rectify these disparities, ensuring that the tax system functions as a means of supporting not just economic growth, but also social responsibility. By taxing wealth fairly, the government could generate substantial funding for social programs that directly benefit working families.

Furthermore, discussions surrounding capital gains taxes and other wealth-related taxes play a vital role in the broader conversation about economic reform. By aligning these tax policies with the Labour commitment to enhancing services and providing for the public good, the government can create a fairer economic landscape. Emphasizing the redistribution of wealth through responsible tax legislation can help shield public services from cuts, rescue families from economic strain, and ultimately mark a shift towards a more equitable economic environment. Labour has the opportunity to lead the charge towards this much-needed reform.

Union Advocacy for Tax Reform

Union leaders, particularly those like Paul Nowak, have been at the forefront of advocating for significant changes to the tax system in the UK. Their push for wealth taxes, along with increased scrutiny of capital gains and corporate taxes, is rooted in the belief that the working class must receive adequate representation and support. Unions have consistently represented the voices of working people, highlighting the need for reform that not only addresses economic disparities but also fights against the tide of rising populism led by figures that do not genuinely represent the interests of those they claim to support.

The support from unions highlights the importance of collective bargaining and advocacy, particularly in a time when economic climates are uncertain. By leveraging public support for wealth taxes and stronger tax policies on the affluent, unions can exert pressure on political entities to enact reform that prioritizes the working class. This creates a powerful intersection between union strength and public alignment on economic issues, setting the stage for transformative changes that can redefine the relationship between taxation and social equity.

The Political Landscape and Working Class Representation

The political landscape in the UK is rapidly evolving, particularly as the working class seeks representation that aligns with their needs and aspirations. Figures like Paul Nowak emphasize this shift as both a challenge and an opportunity for the Labour Party to reaffirm its commitment to the working class. The rise of populist figures such as Nigel Farage poses an indirect threat to Labour’s voter base if the party fails to address the genuine concerns of the electorate, particularly regarding taxation and economic justice. Labour must articulate a clear vision that resonates with working-class citizens, demonstrating tangible support to counteract radical right-wing narratives.

Furthermore, positioning itself as a genuine advocate for the working class will require Labour to adopt bold policies centered around wealth and corporate taxation, as well as investment in public services. Strengthening the narrative around supporting the economically disadvantaged not only enhances the party’s platform but also works to protect its voter base from falling prey to populist propaganda. By addressing the socio-economic challenges head-on and embracing progressive tax policies, Labour can reclaim its status as a protector of working people’s rights and empower communities to rally around these reforms.

Future Prospects for Economic Reform

Looking ahead, the prospects for economic reform in the UK depend heavily on the political will to embrace progressive taxation and uplift the working class through policy change. As the public’s appetite for wealth taxes and enhanced corporate taxation continues to grow, it presents a unique opportunity for Labour to innovate its platform and electoral strategy. The potential to generate significant revenue through these reforms stands to not only improve public services but also restore faith in the political establishment’s ability to act in the interest of the people.

Union leaders like Nowak remain hopeful that by prioritizing economic fairness, Labour can gradually shift the public narrative and reclaim core voters disillusioned by right-wing populism. The urgency to act cannot be overstated; Labour’s ability to navigate this economic landscape successfully hinges on their commitment to equity in taxation. Engaging the public in meaningful discussions around taxation and investment will be critical as they prepare for future electoral battles, positioning economic reform as a central tenet of Labour’s agenda.

Frequently Asked Questions

What is a wealth tax and how does it work in the UK?

A wealth tax is a levy imposed on the value of an individual’s assets, rather than income. In the UK, proposals for a wealth tax suggest targeting those with assets exceeding £10 million. The aim is to create a fairer tax system, as indicated by Paul Nowak from the TUC, to ensure that wealthier individuals contribute their fair share towards public services and economic reform.

Why is there a push for a wealth tax in the UK?

There is a growing call for a wealth tax in the UK to address economic inequalities and to generate additional revenue for public services. Paul Nowak emphasizes that such measures could raise an estimated £36 billion annually, which could significantly aid working people during a cost-of-living crisis.

How would a wealth tax benefit the working class in the UK?

Implementing a wealth tax could benefit the working class by increasing funding for public services and social programs. As advocated by Paul Nowak, this tax aims to redistribute wealth more fairly and ensure those with greater financial means contribute more, easing the burden on low and middle-income households.

What are the economic reform proposals associated with wealth taxes in the UK?

Economic reform proposals, including the introduction of a wealth tax, suggest a multi-faceted approach to taxation. These include raising capital gains tax rates to match income tax, increasing taxes on gambling companies, and introducing a windfall tax on bank profits, collectively aimed at generating significant revenue while supporting working class needs.

How does public sentiment in the UK reflect support for a wealth tax?

Recent polls indicates a strong public support for a wealth tax, with 68% of respondents favoring a 2% annual levy on high-value assets. This is especially true among Labour voters, illustrating a demand for equitable tax reforms that prioritize the needs of working people and combat political opportunities from parties like Reform UK.

What role does Paul Nowak see for Labour regarding wealth tax?

Paul Nowak urges Labour to embrace the introduction of a wealth tax as part of its autumn budget, asserting that this would fulfill campaign promises and counteract threats from other political entities. He believes it would resonate with public sentiment for change and economic equity, demonstrating true support for the working class.

What impact could a wealth tax have on the future of public services in the UK?

Implementing a wealth tax could provide crucial funding for public services, which are currently under strain. As suggested by Paul Nowak, revenues generated could help alleviate issues in healthcare, education, and social support systems, ultimately benefiting the broader UK population.

Is the wealth tax proposal linked to the broader economic agenda of the Labour party?

Yes, the wealth tax proposal is part of a broader economic agenda by the Labour party focused on investment in public services, raising living standards, and ensuring that the tax system is equitable, especially for the working class. It aligns with Labour’s vision for economic reform as discussed by leaders like Paul Nowak.

What challenges might a wealth tax face in implementation in the UK?

Challenges in implementing a wealth tax in the UK may include political resistance, particularly from right-leaning parties and individuals who oppose increased taxation. Additionally, there may be concerns regarding the practical assessment of wealth and potential capital flight among the wealthy.

How could a wealth tax influence the relationship between political parties and the working class in the UK?

A wealth tax could reshape the relationship between political parties and the working class by offering genuine reform that addresses economic disparities. As Paul Nowak highlights, it would signal that Labour prioritizes the interests of working people, contrasting sharply with the policies of opportunistic parties like Reform UK.

| Key Point | Details |

|---|---|

| Wealth Tax Advocacy | Paul Nowak, General Secretary of TUC, urges for wealth taxes in the autumn budget to assist working people and combat Reform’s influence. |

| Political Strategy | Emphasizes left-wing economic populism and challenges Nigel Farage’s political opportunism towards working class. |

| Public Support | Polling shows 68% favor a 2% annual wealth tax on assets over £10 million; support rises among Labour voters. |

| Potential Revenue | Wealth taxes could generate £36 billion annually; proposals for other tax increases indicate broader support for fiscal reforms. |

| Call to Action | Nowak calls for steadfast government support for working people, highlighting economic inequality and the need for fair taxation. |

Summary

Wealth tax is emerging as a crucial solution for enhancing the economic well-being of working people. The call for a wealth tax reflects a growing consensus that individuals with significant assets should contribute fairly to society. As highlighted by union leader Paul Nowak, embracing wealth taxes can not only generate substantial revenue but also demonstrate a commitment to addressing economic inequalities exacerbated by the cost-of-living crisis. By implementing such measures, the government can reaffirm its dedication to improving public services and the rights of workers, ultimately fostering a more equitable society.