Wealth tax has emerged as a hot topic in recent political debates, especially in the context of addressing growing inequality in Britain. Advocates argue that a tax on the super-rich would not only contribute to public funds but also foster a fairer society by redistributing wealth. For example, recent budget proposals have included discussions around imposing a wealth tax in the UK to support vital services like education and healthcare. Critics, however, see this measure as simplistic and insufficient to tackle the underlying issues of economic disparity. Ultimately, the conversation surrounding wealth tax highlights the need for a serious evaluation of how wealth is shared and allocated in our society.

When discussing the taxation of affluent individuals, terms like ‘asset taxation’ or ‘levy on the wealthy’ often come to the forefront. This discourse is crucial as it revolves around measures designed to address economic disparities and ensure a more equitable distribution of resources. The notion of taxing the high-net-worth individuals aims to supplement government revenues while simultaneously challenging the ingrained inequalities that persist in contemporary society. Such proposals resonate with movements advocating for greater fiscal justice and resource allocation, spurring essential discussions about financial reforms in the UK. As the political landscape evolves, the call for a more structured approach to taxing wealth continues to gain traction, reflecting a broader yearning for social justice.

Understanding the Wealth Tax Debate in the UK

The wealth tax has emerged as a contentious topic in the UK, echoing calls for a fairer taxation system which places greater accountability on the super-rich. Current discussions revolve around the notion of taxing assets, with proponents arguing that such a measure could help fund essential public services like schools and hospitals. Even as some argue that a 1% annual levy on individuals with assets over £10 million is a viable solution, skeptics question its effectiveness, pointing out the need for a more robust and sweeping approach to tackle the inequalities that have been exacerbated by decades of wealth concentration.

Critics of the proposed wealth tax emphasize the oversimplification of the issue, suggesting that it may merely serve as a political façade rather than a genuine attempt at restructuring the economy. The fundamental problem of inequality in Britain requires not just a tax on the wealthy, but a broad reconsideration of tax policies and corporate responsibilities to ensure a balanced redistribution of wealth. The calls for a wealth tax must be grounded in a comprehensive approach that looks beyond quick fixes and seeks lasting solutions to the systemic issues of wealth distribution.

The Impact of Wealth Tax on Inequality in Britain

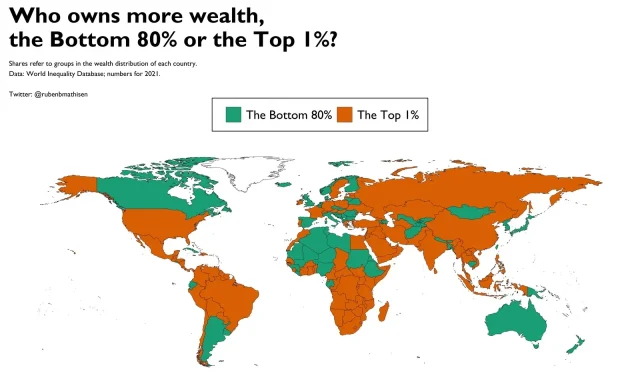

Addressing inequality in Britain is increasingly viewed as a pressing political necessity, and advocates believe that a wealth tax could play a pivotal role in this effort. Supporters contend that taxing high-net-worth individuals would potentially generate significant revenue that could be reinvested into healthcare, education, and social services, thereby contributing to a fairer society. With economic disparity widening, there is a growing consensus that the wealthy must contribute more, reflecting public sentiment advocating for greater equity in the taxation system.

However, while the wealth tax might seem like a straightforward solution, experts warn against taking such measures in isolation. The reality is far more complex, as simply imposing a tax may not address the root causes of inequality. Many argue that meaningful change would require a comprehensive set of policies that involves labor reforms, strengthening workers’ rights, and addressing corporate accountability. Tackling the pervasive issue of inequality in Britain necessitates a multifaceted approach, with wealth tax being just one aspect of a larger reform agenda.

Budget Proposals and the Future of Taxation

As the UK government prepares to unveil its budget proposals, the discourse surrounding taxation becomes increasingly heated. The anticipated budget is not just a financial plan but a reflection of governmental priorities and political ideologies. While some factions within the government advocate for mild adjustments to existing tax structures, others push for more radical measures like the wealth tax. These competing narratives underscore the political divisions that complicate discussions on effective wealth redistribution.

The question remains whether the forthcoming budget will genuinely address the inadequacies of current tax policies or simply offer a veneer of change. The wealth tax, despite its popularity among certain political circles, faces significant hurdles in garnering full-fledged support necessary for implementation. As the government grapples with pressing fiscal challenges and public expectations, the true test will be its ability to devise solutions that not only promise immediate relief but also lay the foundation for a more equitable future.

The Arguments For and Against the Wealth Tax

Support for a wealth tax often hinges on the moral argument that those who have benefited the most from the economy should contribute proportionally to the society from which their wealth is derived. Advocates frame their arguments within a context of fairness and social responsibility, underscoring the idea that significant wealth concentration serves to distort democratic processes and perpetuate economic inequality. This perspective suggests that the wealth tax could be an instrument of change, compelling the richest in society to share a more significant burden in funding public resources.

Conversely, opponents of the wealth tax argue that imposing such levies could drive wealthy individuals out of the country or stifle investment, ultimately undermining economic growth. They propose that rather than establishing new taxes, governments should focus on reforming existing tax mechanisms to optimize revenue without discouraging entrepreneurship and innovation. The debate thus reflects deeper ideological divides regarding the role of taxation in promoting social equity versus fostering economic dynamism.

Rethinking Redistribution: Beyond Wealth Tax

While a wealth tax garners attention as a potential vehicle for redistribution, many emphasize the need for a more comprehensive approach to economic reform. As proposed by various political leaders, an effective redistribution strategy would involve not just taxing the rich, but also fundamentally altering the existing power structures that perpetuate inequality. Measures such as expanded access to affordable housing, comprehensive healthcare reforms, and enhanced workers’ rights could contribute significantly to leveling the playing field.

Supporters of a more holistic approach argue that focusing solely on taxing wealth might obscure the underlying structural issues that contribute to disparity in society. By prioritizing inclusive economic policies that empower marginalized communities and provide paths for upward mobility, the conversation surrounding wealth tax becomes part of a larger narrative aimed at systemic change. This perspective encourages policymakers to envision a future where economic equity is achieved through broad reforms rather than isolated tax initiatives.

Lessons from International Wealth Tax Models

Looking beyond the UK, various countries have experimented with wealth taxes, offering valuable lessons that could inform domestic policy discussions. Nations such as France and Spain have implemented wealth taxes with varying degrees of success, and analyzing their outcomes provides insights into the potential advantages as well as pitfalls of such measures. Through these examples, British policymakers can examine the implications of wealth taxation on revenue generation and economic behavior, tailoring their approach to minimize adverse effects while maximizing social benefits.

These international examples highlight the importance of crafting policies that are both effective and politically sustainable. The differing outcomes underscore that a wealth tax must be implemented thoughtfully, considering local economic conditions and societal attitudes. As British politicians engage with the idea of a wealth tax, it is critical to learn from these global instances, ensuring that any future proposals are designed to achieve their intended goals without creating unintended consequences.

Public Perception of Wealth Tax Policies

Public sentiment plays a crucial role in shaping policies around wealth taxes, as popular support or opposition can significantly impact political feasibility. Recent surveys indicate a mixed but leaning positive perception of wealth taxes, especially among younger voters who are more attuned to issues of inequality. However, translating this support into actionable policy requires addressing concerns about fairness and the potential impact on the economy.

Engaging the public in conversations about wealth taxes is essential for building consensus and understanding the broader goals of redistribution. This involves not only elucidating how wealth tax revenue would be spent but also making a compelling case for why such measures are necessary in the current context. By fostering inclusive dialogues, policymakers can ensure that policies are reflective of collective values and aspirations for a more equitable society.

Economic Viability of Wealth Taxes

The economic viability of implementing a wealth tax has been scrutinized, particularly regarding its impact on investment flows and wealth creation. Critics argue that high taxes on wealth could disincentivize investment, potentially leading to capital flight as the wealthy seek more favorable tax environments abroad. However, advocates counter that a well-structured wealth tax could effectively redistribute resources without negative repercussions for the economy, as long as it is accompanied by robust measures to stimulate growth.

Consideration of the broader economic context is crucial when discussing the implementation of a wealth tax. If designed thoughtfully, a wealth tax can be part of a revitalized economic model that prioritizes sustainability and inclusivity. This approach involves balancing the need for increased revenue with the imperative of fostering an environment conducive to growth, innovation, and social prosperity.

The Role of Political Parties in Wealth Tax Advocacy

The role of political parties in shaping the narrative around wealth taxes is fundamental, as they often serve as the primary platforms for policy articulation. In the UK, various parties are aligning themselves with wealth tax proposals, yet the effectiveness of such advocacy largely depends on the clarity and sincerity of their messaging. Political factions must navigate the complexities of voter expectations while presenting coherent plans that resonate with the public’s desire for economic equity.

Moreover, political unity and collaboration shared across party lines could enhance the credibility of wealth tax initiatives. Bridging divides to form a cohesive front advocating for meaningful change would not only strengthen the political will behind wealth tax policies but could forge broader alliances aimed at addressing systemic economic issues. The challenge lies in fostering genuine dialogue that prioritizes the welfare of society over partisan advantage.

Frequently Asked Questions

What is a wealth tax and how would it affect the UK economy?

A wealth tax is a tax imposed on the value of assets owned by individuals, typically targeting the super-rich. In the UK, proposals for a wealth tax have emerged as part of budget discussions, aiming to address inequality in Britain by generating revenue for public services like healthcare and education. However, some critics argue that the impacts may not be transformative and could lead to minimal fiscal improvement.

How would a wealth tax help in redistributing wealth in the UK?

Proponents of a wealth tax claim that taxing the affluent can help redistribute wealth in the UK, providing vital funds for public services and reducing economic inequalities. By imposing a tax on assets over a certain threshold, the government could generate resources for initiatives that benefit lower-income citizens. Critics, however, argue that broader reforms are needed beyond just a wealth tax to effectively tackle systemic inequalities.

What are the budget proposals related to a wealth tax in the UK?

Recent budget proposals have included discussions about implementing a 1% wealth tax on assets exceeding £10 million, as suggested by the Green Party. This would aim to raise an estimated £10 billion annually. However, critics suggest that such measures could merely represent a facade, lacking the depth needed to address deeper economic disparities.

What are the potential criticisms of implementing a wealth tax in the UK?

Critics of a wealth tax argue it may not effectively address the systemic inequalities in Britain and could potentially be seen as a superficial solution, merely tapping into populist sentiment without substantial impact. They suggest that simply adjusting existing taxation on the wealthy may yield similar revenue without the complexities of a new tax framework.

How does a wealth tax fit into the broader conversation about inequality in Britain?

The discussion of a wealth tax is part of a larger debate about inequality in Britain, focusing on how to finance public services fairly. Advocates argue that a wealth tax would target the super-rich, contributing to a more equitable distribution of resources. However, some experts believe addressing inequality requires comprehensive reforms to labor and economic policies, not just a wealth tax.

What is the relationship between a wealth tax and economic growth in the UK?

While a wealth tax aims to redistribute wealth, critics assert it might not significantly boost economic growth in the UK. The focus should be on comprehensive reforms that enhance productivity and enable more people to participate in economic benefits, rather than relying on wealth taxes as a primary means of fiscal improvement.

Can a wealth tax truly reduce economic inequality in Britain?

Proponents of a wealth tax argue that it can contribute to reducing economic inequality by directly taxing the assets of the super-rich and reallocating those funds towards public services. However, significant skepticism exists regarding its effectiveness, with many arguing that a wealth tax alone won’t resolve the broader issues of economic disparity and that systemic changes are required.

What alternatives to a wealth tax exist for addressing inequality in Britain?

Alternatives to a wealth tax include reforming existing income and capital gains taxation, enhancing social housing provisions, and implementing labor laws that empower workers. These measures could promote greater equity in resource distribution without the complexities of a new wealth tax framework.

| Key Point | Description |

|---|---|

| Proposed Wealth Tax | Aimed at the wealthy with a proposed 1% tax on assets over £10 million. |

| Skepticism Towards Implementation | Critics argue that the 1% tax is insincere and lacks real impact. |

| Historical Context | The Wealth Tax Commission suggested a one-off tax could raise £260 billion, which is a more significant approach than current proposals. |

| Political Divide | There are mixed opinions from Labour and Green Party leaders regarding the effectiveness of a wealth tax. |

| Need for Comprehensive Change | Experts emphasize that deeper systemic changes are necessary to address wealth inequality effectively. |

Summary

Wealth tax discussions highlight the critical need for addressing inequality in the UK. Advocates propose a 1% levy on the wealthy, yet the genuine impacts and sincerity of such measures are questioned. Effective solutions require more than superficial taxes; they demand comprehensive structural reforms to ensure fair distribution of resources. Addressing wealth inequality is not just about taxing the rich, but fundamentally reforming the systems that maintain disparity.