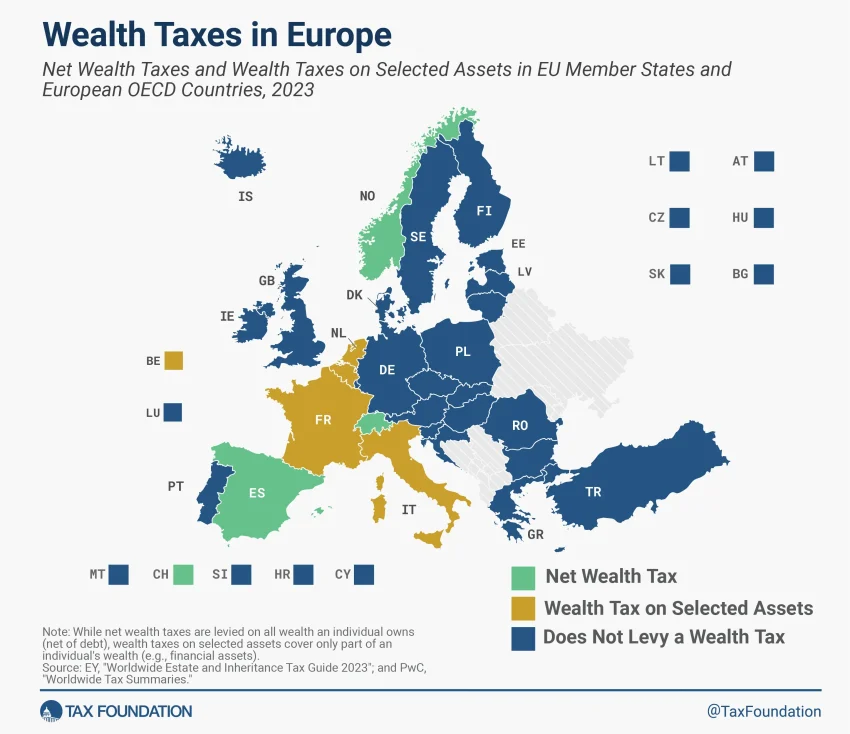

Wealth tax has emerged as a critical topic in discussions about economic justice and the widening wealth disparity seen in nations around the globe. Advocates argue that implementing a wealth tax on the ultra-rich could effectively challenge the growing inequality that undermines democratic institutions and economic stability. This tax would target those who hold an excessive share of the nation’s wealth, thus addressing the stark imbalances that favor the affluent at the expense of the working class. As proponents push for progressive taxation reforms, they highlight the necessity of such measures in order to fund public welfare and social services essential for mitigating income tax pressures on the lower and middle classes. Ultimately, the debate over wealth tax is not just about financial policy; it is a pivotal discourse on how societies address systemic inequality and pursue economic equity.

The notion of taxing extreme wealth is gaining traction as a vital strategy to combat socioeconomic inequities. By establishing a fiscal framework that holds the ultra-rich accountable for their wealth accumulation, societies can work towards addressing critical issues such as income disparity and social welfare funding. Such taxes, also referred to as net worth taxes or capital taxes, create a mechanism for wealth redistribution that targets the richest segments of the population while benefiting the broader community. In this ongoing discourse about economic stratification, the fight for greater financial accountability among the wealthiest is seen as a necessary step toward achieving a more equitable society and restoring faith in democratic governance. As the conversation around wealth taxation expands, its implications resonate across varied socioeconomic landscapes.

Understanding Wealth Tax: The Need for Economic Justice

The concept of wealth tax has gained significant traction in recent years as a potential solution to the escalating problem of economic inequality. Advocates argue that imposing a small percentage tax on the wealth of the ultra-rich could generate substantial revenue while addressing the widening gap between the wealthy and the less affluent. This resurgence of interest in wealth taxes comes at a time when many are questioning the fairness of existing tax systems, especially in light of the considerable concentration of wealth in the hands of a few, which raises concerns about economic justice.

However, it is crucial to consider whether a mere wealth tax is sufficient to rectify the deep-seated issues of inequality. While a wealth tax might provide a short-term financial boost for social programs, it may not fundamentally alter the structures that perpetuate wealth disparity. It is essential to remember that income tax reforms and broader fiscal policies must accompany wealth taxes to ensure a meaningful reduction in inequality. As economist Nancy Folbre points out, to effectively combat economic injustice, society might need to contemplate more radical solutions beyond incremental tax adjustments.

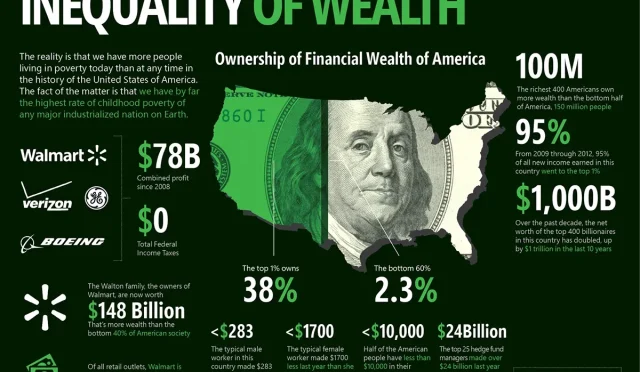

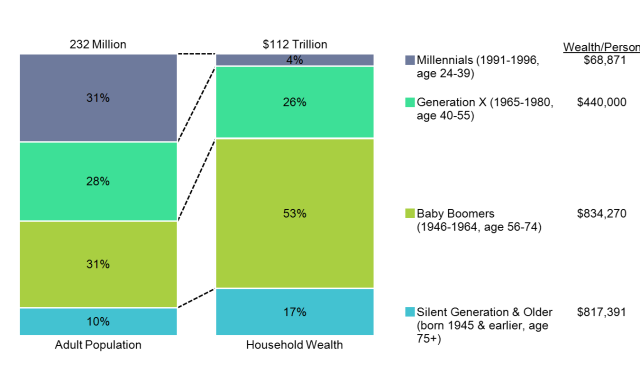

The Role of Ultra-Rich in Wealth Disparity

Wealth disparity has reached alarming levels, with the richest 1% owning an overwhelming share of global wealth. These ultra-rich individuals exert significant influence over political and economic systems, often resisting initiatives such as wealth taxes that could disrupt their financial dominance. This resistance illustrates a larger trend where the ultra-wealthy utilize their power to shape policies that protect their interests, effectively hindering efforts aimed at fostering economic equity. The debate surrounding wealth taxes is not just about fiscal policy; it is also a reflection of the broader power dynamics that characterize modern society.

The ultra-rich’s opposition to wealth taxes is often framed as a defense of innovation and economic growth, yet this narrative overlooks the reality that their wealth accumulation frequently comes at the expense of the working class. As income and wealth inequality continue to rise, it becomes increasingly clear that wealth taxes are not merely a topic of political discourse but a necessary tool for addressing systemic injustices. Policymakers must confront the vested interests of the ultra-rich to enact meaningful changes that promote a more equitable distribution of resources.

Strategies to Combat Income Inequality Through Taxation Methods

Frequently Asked Questions

What is a wealth tax and how does it relate to income tax?

A wealth tax is an annual tax on the net wealth owned by individuals or households, targeting those with substantial assets. Unlike income tax, which taxes earnings and profits, a wealth tax aims to address wealth disparity by directly taxing the ultra-rich, thereby potentially reducing inequality in society.

How might a wealth tax impact economic inequality?

A wealth tax could help slow the growth of inequality, particularly among the ultra-rich, by redistributing wealth and funding social programs. However, critics argue its effectiveness may be limited, as it might not significantly close the wealth gap created by the faster accumulation of resources by the richest individuals.

Why do some people oppose wealth taxes despite rising inequality?

Opposition to wealth taxes often stems from concerns that they may drive wealthy individuals to relocate, impacting local economies. Additionally, some view wealth taxes as a disincentive to investment and economic growth, arguing that they could exacerbate wealth disparity rather than alleviate it.

What are examples of wealth tax proposals in the U.S. and their objectives?

Proposals include the Billionaires Income Tax Act and local initiatives to impose taxes on billionaires in states like California. The objectives are to generate revenue to fund public services, combat economic injustice, and offset cuts to social programs for low- and middle-income families.

Can a wealth tax be seen as a tool for economic justice?

Yes, proponents argue that a wealth tax can promote economic justice by ensuring that the ultra-rich contribute fairly to society, helping to combat the systemic inequality that limits opportunities for lower-income individuals and families.

How does the concept of a wealth tax relate to the issue of social reproduction?

A wealth tax can indirectly support social reproduction by funding social safety nets and public services, which help sustain the wellbeing of lower-income families. This connection highlights the importance of redistributing resources to maintain social harmony and support the needs of the broader population.

What is the potential impact of a wealth tax on funding education and healthcare?

A wealth tax has the potential to significantly enhance funding for education and healthcare services by generating revenue to support these vital areas, thus helping to alleviate some of the burdens caused by economic disparities and ensuring better access for all.

How effective are wealth taxes at addressing the issue of wealth disparity?

While wealth taxes may help in reducing the rate at which wealth disparity grows, they may not be sufficient alone to eradicate wealth inequality entirely. They are often viewed as one component of a broader strategy needed to achieve economic justice.

| Key Points |

|---|

| Inequality is a major global issue, with the wealthiest 1% holding more wealth than 95% of humanity. |

| Wealth tax proposals, like a 2% tax, could be more symbolic than effective in reducing inequality. |

| The structure of the U.S. tax system has become less progressive over time, favoring the wealthy. |

| Despite calls for wealth taxes, political challenges and the ruling class’s influence hinder implementation. |

| Some proposals, such as California’s 5% tax, are aimed at addressing cuts to vital public services. |

| There is growing public support for wealth taxes, especially among those affected by funding cuts. |

Summary

Wealth tax proposals are gaining attention as a means to address rising inequality, but their effectiveness remains in question. While they could symbolize a shift towards a more equitable society, critics argue that they may only minimally impact the vast wealth gap. With the concentration of wealth in the hands of a few threatening social stability, the discussion on wealth tax underscores the urgent need for fiscal reform in addressing the needs of a broader population.