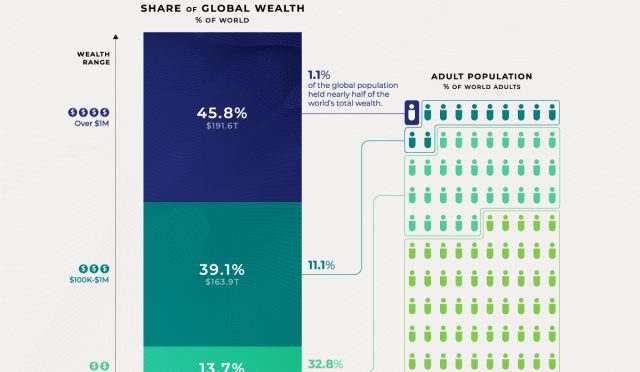

Wealth tax advocacy has gained traction in recent discussions about economic reform, especially as countries explore new means to address income inequality. Prominent figures, like Faiza Shaheen, are calling for a wealth tax; however, critics argue that taxing income from wealth may offer a more practical path forward. Reports such as the Taxing Wealth Report 2024 suggest robust alternatives, envisioning as much as £90bn in annual revenue from progressive tax policies. Innovative proposals, including those from the Green party, echo these sentiments by highlighting the potential of UK wealth tax proposals to reshape the financial landscape for the better. As debates intensify, understanding the complexities of taxing wealth—and the implications it holds for the affluent—becomes essential in the quest for equitable financial solutions.

The conversation surrounding taxation and equity led by advocates like Faiza Shaheen focuses on the notion of imposing a levy on accumulated wealth—often referred to as asset taxation. However, a growing contingent argues for a strategy centered on revenue generated from wealth income, paving a clearer and arguably more effective route to enhancing public funds. The Taxing Wealth Report 2024 provides insights into this shift, illuminating how progressive financieras can yield significant income through refined tax policies. Additionally, propositions from the Green party have emerged, suggesting mechanisms to harness this potential effectively, thereby reinforcing the debate’s relevance. As stakeholders engage with these financial frameworks, understanding their implications for societal wealth distribution becomes more critical than ever.

Understanding the Flaws in Wealth Tax Advocacy

The concept of a wealth tax, while appealing in theory, is fraught with complexities that make it a less viable solution than advocates like Faiza Shaheen suggest. One significant challenge is defining what constitutes ‘wealth’ and then accurately assessing it for every UK resident. This task would require extensive resources from HMRC and could lead to a myriad of complications in enforcement. Such difficulties reveal a fundamental flaw in the argument for a wealth tax—it is not merely an issue of funding but one of practicality and implementation.

Countries that have succeeded with wealth taxes often did so by keeping their systems simple or by implementing wealth taxes in conjunction with the removal or adjustment of other taxes. For instance, Norway and Switzerland have wealth taxes but do so in the context of eliminating inheritance taxes or adjusting capital gains taxes. Thus, to merely introduce a UK wealth tax without a comprehensive understanding of its implications risks a haphazard approach, ultimately providing little return and creating unnecessary complications.

Frequently Asked Questions

What are the key arguments for wealth tax advocacy in the UK?

Wealth tax advocacy in the UK focuses on directly taxing wealth to generate additional revenue. Proponents argue that a well-structured wealth tax could contribute significantly to public services and social equity. However, critics claim there are more effective methods, such as taxing income from wealth, which could yield substantial revenues without the complexities of wealth assessment.

How does taxing income from wealth compare to wealth tax proposals?

Taxing income from wealth is seen by many economists as a more practical approach than wealth tax proposals. This strategy encourages progressive tax policies that increase government revenue without the challenges of assessing individual wealth. Reports like the Taxing Wealth Report 2024 suggest that this method could generate around £90 billion annually, offering a clearer, more manageable solution to wealth taxation.

What are the Green party tax proposals related to wealth taxation?

The Green party tax proposals include various strategies that align with progressive tax policies, seeking to replace or enhance existing tax structures rather than introducing a direct wealth tax. Their manifesto for 2024 incorporates elements from the Taxing Wealth Report 2024, emphasizing the need to end tax subsidies to private pensions, which could further increase tax revenues by an estimated £50 billion.

Why do some advocate for rejecting the idea of a wealth tax in favor of income taxation?

Many advocates reject the wealth tax idea due to the complexities involved in defining and assessing wealth. Instead, they argue for taxing income from wealth, which can be more straightforward and yield significant revenue. This view is supported by empirical data from the Taxing Wealth Report 2024, which prioritizes practicality in tax policy.

What challenges does Faiza Shaheen’s wealth tax advocacy face?

Faiza Shaheen’s wealth tax advocacy faces criticism for lacking a clear implementation plan and for underestimating the complexities of wealth assessment. Critics emphasize that successful wealth taxes in other countries often replace other tax forms, and many have been rescinded due to inefficiencies, highlighting the need for innovative solutions rather than traditional wealth taxation.

How can the UK government increase tax yield without implementing a wealth tax?

The UK government could increase tax yield by focusing on progressive tax policies that tax income from wealth rather than wealth itself. As noted in the Taxing Wealth Report 2024, implementing recommendations like ending tax subsidies for private pensions could raise substantial revenue while promoting fairness and reducing reliance on wealth tax advocacy.

| Key Point | Details |

|---|---|

| Advocacy for Wealth Tax | Faiza Shaheen supports implementing a wealth tax but lacks a clear plan for its execution. |

| Complexity of Wealth Tax | Defining and calculating wealth for taxation is seen as complicated by critics. |

| Alternative Proposals | There are more practical options based on taxing income from wealth rather than the wealth itself. |

| Estimated Tax Yields | Proposals from Prof Richard Murphy could yield £90bn annually; additional measures could bring the total to £140bn. |

| Politcal Support | The Green party endorses some of these proposals, which could significantly impact wealth distribution. |

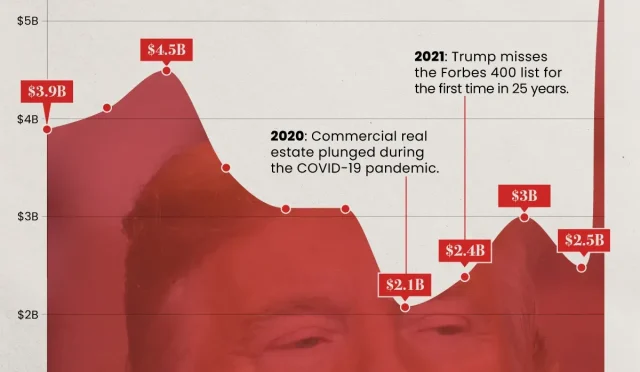

| International Context | Examples from Norway and Switzerland show wealth taxes have been used differently in other nations. |

| Performance of Wealth Taxes | Many countries that adopted wealth taxes eventually abolished them due to ineffectiveness. |

Summary

Wealth tax advocacy is a contentious issue in modern fiscal policy debates. While some propose a wealth tax as a solution, critics point out the complexity of implementation and offer practical alternatives that focus on taxing income derived from wealth. These alternative solutions highlight the potential for significant tax revenue without the complications associated with wealth taxation. As illustrated in recent proposals, addressing the taxation of wealth through more pragmatic measures could yield substantial benefits and may prove to be a more effective strategy for achieving equity in tax policy.