Wealth Tax Impact: What It Means for Homeowners in the UK

The potential impact of a wealth tax is currently generating heated discussions among policymakers and homeowners alike. As Rachel Reeves navigates pressure from backbenchers to impose new taxes on the wealthy, attention is turning toward the implications for high-value homes. A proposed levy targeting rich property owners could affect approximately 150,000 homeowners whose estates boast valuations exceeding £2 million. This proposed wealth tax raises crucial questions about fairness, investment in UK property tax, and the overall burden on those who own luxury residences. Understanding the effects of this policy is vital for stakeholders in the real estate market and for individuals considering their financial futures.

Exploring the concept of a property levy aimed at affluent residents reveals significant insights into the ramifications for those holding high-value estates. This new imposition, often referred to as a homeowner’s tax, seeks to redistribute wealth through taxation on extravagant properties, specifically targeting those with homes valued over £2 million. Such financial policies stir debate on economic equity and the responsibilities of property owners within the UK. Moreover, as affluent individuals grapple with these potential changes, the conversation surrounding property ownership becomes increasingly relevant, emphasizing the need for a deeper understanding of these tax implications.

Understanding Wealth Tax in the UK

Wealth tax is a concept that has gained traction in the UK, especially among policymakers aiming to address wealth inequality. This tax targets individuals with substantial assets, typically affecting rich property owners who possess high-value homes. The idea is to levy a tax on the value of properties that exceed a certain threshold, for example, £2 million. Recent discussions have centered around how such a tax could provide additional financial resources for public services while also incentivizing investments in more modest housing.

Moreover, the implementation of a wealth tax in the UK could send ripples through the real estate market. Homeowners of expensive properties might reconsider their investments, potentially leading to a slowdown in the luxury housing sector. This proposed tax is particularly relevant in light of the recent calls by backbenchers for the government to increase taxation on the wealthy, highlighting a growing public sentiment for a fairer distribution of tax burdens.

Impact of Wealth Tax on Homeowners

The introduction of a wealth tax could significantly impact homeowners, particularly those with properties valued over £2 million. Approximately 150,000 individuals could find themselves liable for this tax, resulting in potential financial strain. Homeowners may need to reassess their financial strategies, which could include selling their high-value homes, downsizing, or even relocating to areas outside the UK where such taxes are not implemented. Such moves would catalyze a shift in the market, potentially affecting property values in expensive neighborhoods.

Additionally, the impact extends to homeowners’ choices and lifestyle. With a wealth tax in play, many may become increasingly cautious about investing in enhancements or renovations to their properties. The fear of additional tax liabilities could stifle growth in the housing market, as fewer homeowners opt to buy or upgrade expensive homes. As a result, the UK property tax landscape may transform, leading to a greater divide between affluent property owners and the middle-class homeowners.

The Relationship Between Wealth and UK Property Tax

Wealth and property taxes are intrinsically linked in the UK, especially with the introduction of a proposed wealth tax. For homeowners of high-value properties, their wealth is often tied to their real estate assets. The government identifies these properties as valuable sources of tax revenue, making them a clear target for new taxation measures. The alignment of property value with wealth is significant, as it can highlight disparities in economic status among citizens.

As the discussion around UK property tax continues, it becomes essential to consider how wealth tax might alter perceptions of home ownership. Many homeowners view their property as an investment, but imposing taxes on wealth could lead them to view their homes more as a liability. This perspective shift can affect how buyers engage with high-value homes and alter their long-term investment strategies.

Tax Strategies for High-Value Homeowners

High-value homeowners may need to devise new tax strategies in response to a potential wealth tax. This could include estate planning, such as forming trusts or considering the implications of transferring asset ownership. By proactively managing their assets, homeowners can minimize their exposure to wealth tax and preserve their wealth for future generations. Financial advisors may see an uptick in demand during these discussions, as affluent individuals seek guidance on navigating the complexities of tax implications.

Additionally, strategic property management could emerge as a key focal point. Homeowners might consider diversifying their real estate portfolios or investing in properties that fall below the wealth tax threshold. This approach could reduce their tax burden while still allowing them to engage with the property market. Staying ahead of tax trends and utilizing insights from financial experts becomes critical as the landscape of UK taxation evolves.

Public Perception of Wealth Tax on Property Owners

Public opinion plays a crucial role in shaping the future of wealth tax policy for property owners. The prospect of targeting the wealthy has garnered mixed reactions from the general populace, with some viewing it as a necessary step towards addressing income inequality, while others perceive it as punitive towards those who have succeeded financially. Homeowners facing a potential wealth tax may feel the brunt of societal scrutiny, leading to further debates about the fairness of tax policies.

Furthermore, as discussions around wealth tax gain momentum, it is crucial for policymakers to gauge public perception accurately. Engaging with community sentiments can help frame the narrative surrounding the tax. Maintaining a balance between the need for public revenue and the potential adverse reactions from affluent homeowners is essential for the implementation of any new tax policies.

Potential Revenue from Wealth Tax

A proposed wealth tax could generate substantial revenue for the UK government, particularly from the demographic of high-value homeowners. By targeting those with homes valued over £2 million, the government estimates significant financial resources could be tapped into this relatively small segment of the population. This revenue could be pivotal in funding essential public services, advancing social programs, and leveling the financial playing field.

However, the challenge lies in balancing the tax burden. While wealth tax could enhance public funds, the potential negative impact on property values and market dynamics must be considered. Policymakers need to ensure that the revenue generated does not come at the expense of the housing market’s vitality, which could offset the intended financial gains with broader economic repercussions.

Comparative Analysis of Wealth Tax Models

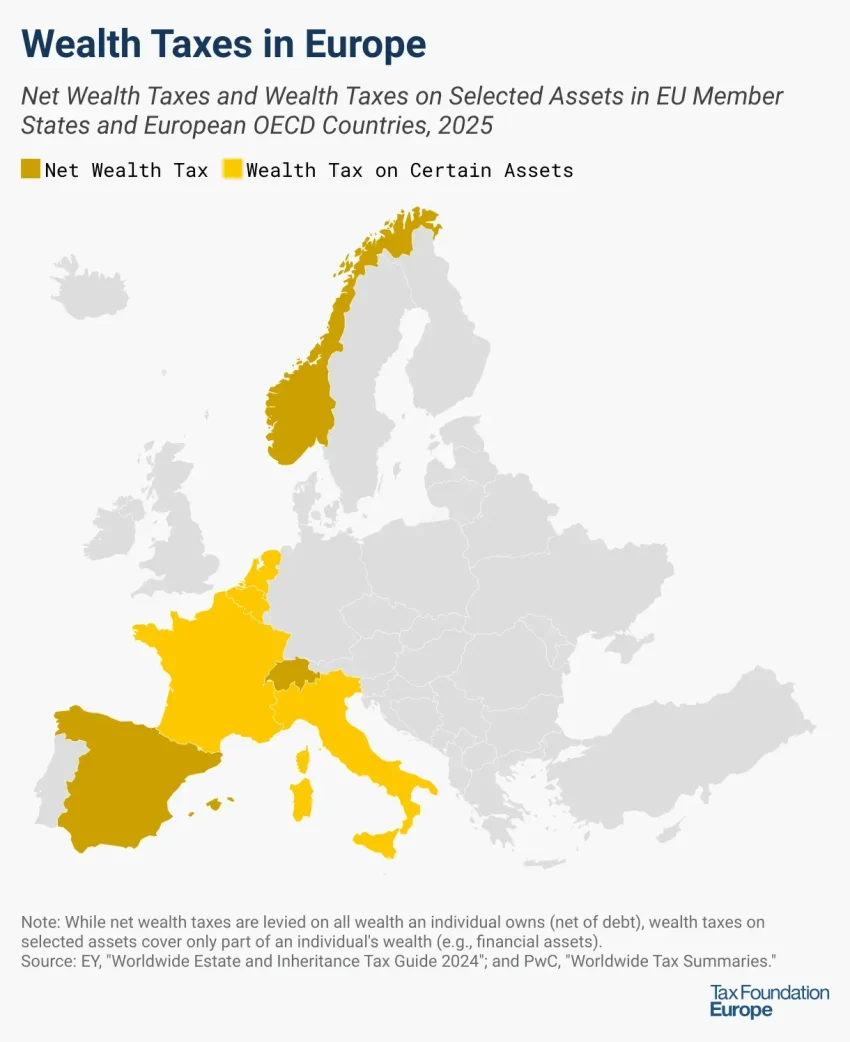

Across the globe, various countries have implemented wealth taxes with differing degrees of success. A comparative analysis of these models can provide insights for the UK as it contemplates its approach to taxing high-value homeowners. Nations like France and Spain have relied on wealth taxes to fund public services, yet their implementations have faced considerable resistance from affluent citizens, often leading to policy reversals.

Examining these international examples could help the UK identify effective strategies and potential pitfalls associated with wealth taxes. Understanding how other nations have navigated public sentiment and economic fallout will be crucial in shaping a fair and effective wealth tax framework that does not disincentivize investment in the property market.

Long-Term Implications of Wealth Tax

The long-term implications of introducing a wealth tax in the UK could transform the property market landscape. Over time, homeowners might adjust their investment strategies, leading to a shift in property ownership trends. With a growing number of high-value homes facing tax implications, the allure of investing in luxury properties may diminish, influencing market dynamics for both high-end and mid-range homes.

Moreover, as a wealth tax could deter foreign investment, the UK may need to be cautious about how the wealth tax framework is structured. It will be crucial to weigh the benefits of increased domestic revenue against the potential exodus of affluent property investors who may seek more favorable tax environments elsewhere. Long-term viability will hinge on the government’s ability to promote a balanced and attractive property market.

Navigating Changes in Homeowners Tax

With the prospect of a wealth tax looming, homeowners in the UK need to stay informed about potential changes to their tax obligations. Understanding the links between homeowners’ tax liabilities and the proposed wealth tax is vital for effective financial planning. Homeowners will need to adapt their financial strategies in response to any new tax policies, ensuring they are prepared for shifts in the tax landscape.

Moreover, the evolution of homeowners’ tax in the UK is likely to be influenced by the broader economic climate, as well as the political landscape surrounding taxation. Homeowners should stay engaged with ongoing discussions and consider how emerging trends may impact their property investments. Proactively addressing these changes will better position homeowners to navigate the complexities of the evolving tax ecosystem.

The Future of Wealth Tax and Property Ownership

The future of wealth tax and property ownership in the UK remains uncertain, but it is clear that the discussion will continue to evolve. As more voices join the conversation, the implications for homeowners, particularly those with high-value properties, will become increasingly critical. Developing a nuanced understanding of both wealth tax policy and its potential impacts on the property market will be essential for homeowners going forward.

In the long term, it is hoped that wealth tax can lead to fairer taxation models that do not dampen property investment enthusiasm. Encouraging a nuanced discussion about the need for equitable wealth distribution could facilitate more effective policy-making. Property owners must remain adaptable and informed, recognizing that the changes ahead could redefine the landscape of home ownership.

Frequently Asked Questions

What is the potential impact of a wealth tax on homeowners in the UK?

A proposed wealth tax could significantly impact UK homeowners, particularly those with properties valued over £2 million. It is estimated that around 150,000 homeowners would be affected, potentially leading to increased financial pressure on rich property owners.

How would a wealth tax affect owners of high-value homes?

Owners of high-value homes may face higher tax liabilities under a wealth tax, which targets those with substantial property investments. This could lead to increased costs for wealthy homeowners, influencing their financial decisions regarding property ownership and investment.

What are the implications of a UK property tax for affluent homeowners?

A UK property tax aimed at affluent homeowners could result in a recalibration of property market dynamics. Rich property owners may need to reassess their investments as increased taxes on high-value homes could diminish their overall property value and profitability.

Can homeowners be taxed based on the value of their properties?

Yes, under the proposed wealth tax model, homeowners could be taxed based on their property’s value. This pilot program primarily targets high-value homes, affecting those whose properties exceed £2 million, thereby increasing the tax burden on wealthy property owners.

What is the relationship between wealth tax and UK property ownership?

The relationship between wealth tax and UK property ownership highlights the financial implications for those who own high-value assets. Implementing a wealth tax could lead to greater tax responsibilities for homeowners, particularly affecting rich property owners in the current market.

| Key Point | Details |

|---|---|

| Wealth Tax Proposal | Proposed as a new tax on wealthy individuals, particularly aimed at homeowners. |

| Target Group | Approximately 150,000 homeowners with properties valued over £2 million. |

| Political Pressure | Rachel Reeves is facing calls from backbenchers to consider new taxes. |

| Potential Impact | The wealth tax could significantly affect the financial burden of wealthy citizens. |

Summary

The wealth tax impact has become a pivotal topic as proposed legislation seeks to levy taxes on expensive homes, particularly affecting homeowners with properties over £2 million. This initiative, led by Rachel Reeves amidst political pressures, aims to address concerns over wealth distribution and fiscal responsibility. As we analyze this potential tax, it’s essential to recognize that it could significantly alter the financial landscape for a considerable number of affluent homeowners.

#WealthTaxUK #HomeownershipImpact #UKEconomy #PropertyTaxDebate #FinancialPolicyUK