Wealth Tax in Britain: Why It Faces Major Opposition

The discussion surrounding wealth tax in Britain has gained renewed vigour as key Labour figures advocate for its potential implementation. Despite past hesitations, influential politicians like Neil Kinnock and Eluned Morgan are now vocal supporters, challenging the traditional opposition to such a levy. Critics argue against the economic impact of a wealth tax, pointing out that it could drive affluent individuals to relocate and complicate tax administration further. Recent discourse highlights notable wealth tax arguments, including the call for a fairer distribution of financial burdens among the population. Historically, the UK has grappled with wealth taxation proposals, and lawmakers are under increasing scrutiny regarding their ability to confront this contentious issue.

The debate over imposing a tax on accumulated wealth in the UK reflects a growing concern about fairness and economic equity. With discussions around a Labour-affiliated asset levy gaining traction, public sentiment is shifting as figures within the party advocate for fiscal reforms that target the affluent. This alternative taxation approach raises questions about the effectiveness and administration of such policies, echoing similar proposals examined throughout the UK wealth tax history. Proponents believe that taxing assets could address growing inequalities, while detractors warn of potential adverse consequences and complexities in enforcement. As both sides present their cases, the implications of these proposals continue to resonate across economic discussions in Britain.

Understanding the Wealth Tax Debate in Britain

The wealth tax debate in Britain has gained significant traction recently, especially among Labour party advocates. Influential figures like Neil Kinnock and Eluned Morgan have emphasized the necessity of introducing a tax on wealth as a means to address the deepening economic inequalities in the UK. The proposal typically entails a 2% levy on individual assets exceeding £10 million, which could potentially generate billions in revenue and redistribute wealth to support public services and social programs. However, this idea does not come without substantial controversy and complexity.

Opponents argue that such taxes may drive wealth out of the country, causing high-net-worth individuals to relocate their assets or even themselves to jurisdictions with more favorable tax regimes. They assert that simply increasing taxes on the affluent could poison the investment atmosphere, deter entrepreneurship, and ultimately undermine economic growth. This tension between the need for revenue and the risk of capital flight remains a central theme in discussions surrounding the proposed wealth tax.

Labour’s Wealth Tax Proposal and Public Sentiment

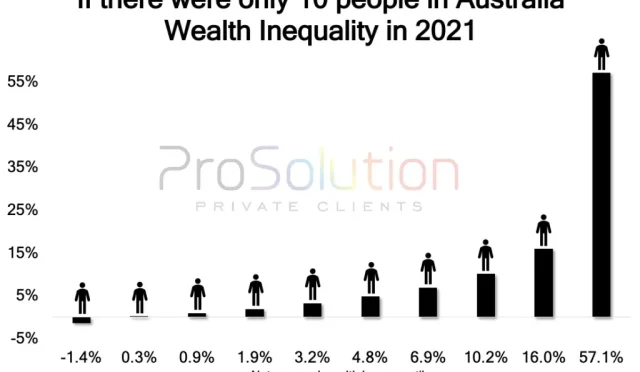

Labour’s proposal for a wealth tax seems to reflect a growing public sentiment that seeks to tackle the wealth inequality that pervades British society. As the wealth of the top 1% surges, many citizens argue that it is only fair that those with substantial assets contribute more towards the common good. Public opinion polls suggest a majority of people support some form of wealth taxation as a means to finance essential services such as healthcare and education. Proponents of the Labour proposal believe it could remedy economic injustices and help those in dire need.

Nevertheless, there is considerable pushback, fueled by fears of how such a tax would be implemented. Critics cite the impracticality of accurately assessing and taxing assets, particularly those like family businesses and personal property. Moreover, testimonies from other countries that have tried similar wealth taxes, such as France and Germany, highlight the administrative burdens and potential negative effects on economic activity. The Labour party’s unclear stance on the wealth tax continues to confuse constituents, exacerbating divisions over this abordable issue.

The Economic Impact of a Wealth Tax in the UK

The economic implications of introducing a wealth tax in the UK can be profound, influencing both individual behavior and overall economic health. Advocates point to studies suggesting that a wealth tax could collect around £24 billion annually, funds which could then be reinvested into public services and infrastructure. This could enhance quality of life and economic stability for lower-income citizens, ideally leading to a more balanced socio-economic landscape. However, this optimistic view is partnered with apprehensions regarding how such a tax might actually play out in a slowing economy.

Sceptics argue that the imposition of a wealth tax could inadvertently disincentivize saving and investment, a crucial pillar in economic growth. High taxation on wealth can lead to distortions in economic behavior; as individuals find ways to evade taxes or adjust their investment strategies to minimize tax burdens. Experts warn that if capital is consistently chased away or kept inactive due to high taxes, long-term economic growth could stagnate, thereby reducing the very revenue streams that the government hopes to cultivate.

Historical Perspectives on Wealth Tax in the UK

Historically, the concept of a wealth tax in the United Kingdom has been fraught with challenges and opposition. Past attempts to implement such a tax, such as the proposals by previous Labour governments, have often concluded in failure due to concerns about feasibility and compliance. Denis Healey, former Chancellor, noted decades ago that the administrative costs and complexity associated with administering a wealth tax would outweigh the potential benefits. This legacy of skepticism continues to inform current debates and illustrates the difficulties faced when discussing taxation on wealth.

Moreover, looking at the historical context reveals that many countries have retreated from wealth taxes, particularly after observing negative outcomes related to capital flight and compliance issues. In the UK, the notion of fairness in the tax system remains a core argument against wealth taxes, as many voters remember past struggles with similar proposals. Understanding this historical perspective is essential when considering contemporary discussions surrounding wealth taxes and what lessons have been learned from previous attempts.

Counterarguments Against Introducing a Wealth Tax

Counterarguments against the introduction of a wealth tax in Britain are numerous, with critics emphasizing that such taxation could ultimately serve to punish success rather than encourage growth. Many believe that the wealthy contribute to the economy not only through direct taxation but also through investments that create jobs and stimulate innovation. By targeting wealth, governments risk reducing these contributions, with the potential for long-term negative impacts on the economy and employment.

Additionally, there are concerns about how equitably a wealth tax would be applied, especially when issues of fairness come into play. The differentiation between earned income and accumulated wealth can complicate perceptions of what is fair. Many advocate for a system that encourages wealth creation and safeguarding the incentive to invest rather than penalizing it. This debate also ties into broader themes of economic policy, where the focus could ideally shift towards enhancing growth through constructive tax reforms instead of restructuring existing frameworks.

The Logistical Challenges of Implementing a Wealth Tax

Implementing a wealth tax brings with it a plethora of logistical challenges that would require careful planning and consideration. First and foremost, the issue of accurately assessing the value of diverse assets presents a significant hurdle. Individuals would need to declare properties, shares, and other valuable assets, and assessing their worth accurately poses an administrative nightmare, especially with fluctuating market values. How to handle unconventional assets, such as artwork or collectibles, would further complicate the situation and potentially alienate those who might otherwise support the tax.

Moreover, ensuring compliance amongst taxpayers and effectively auditing declarations would require a considerably expanded tax administration infrastructure, leading to questions regarding its feasibility and cost efficiency. Critics argue that previous experiences in other nations highlight the impracticality of wealth taxes, as historical data indicates that wealthy individuals often locate loopholes, resulting in compliance rates below what is necessary for sustainability. Thus, while the idea of a wealth tax may resonate with calls for fairness and economic equity, the realities of implementation could present insurmountable obstacles.

Political Implications of the Wealth Tax Discussion

The political landscape surrounding the discussion of a wealth tax is notably charged, with parties and stakeholders positioning themselves based on public sentiment and economic philosophy. For Labour, advocating for a wealth tax could solidify their stance as champions of social justice and equitable wealth distribution, appealing to their core electorate. However, the lack of a firm commitment from Labour leaders may reflect the underlying tensions within the party regarding economic strategy and electoral viability.

On the flip side, Conservative leaders capitalize on the uncertainties surrounding the wealth tax to reinforce arguments for economic pragmatism and the risks associated with increased taxation. This discourse plays into broader narratives about economic recovery and growth, emphasizing the need to create an environment conducive to investment rather than imposing additional burdens. Thus, the political implications of the wealth tax discussions extend beyond economics, intertwining with issues of identity, trust in leadership, and visions for the future of the UK.

Public Opinion and the Future of Wealth Tax Proposals

Public opinion on wealth tax proposals in the UK reflects a critical intersection of socio-economic concerns and national identity. Many citizens increasingly recognize the significance of addressing income and wealth inequality, leading to a growing acceptance of the idea that high-net-worth individuals should contribute more through a wealth tax. Surveys indicate that a considerable portion of the population expresses frustration with the disproportionate wealth distribution and is supportive of utilizing a wealth tax as a corrective mechanism.

Nevertheless, this enthusiasm is met with skepticism on how such a tax would ultimately shape economic conditions. The fear of losing affluent residents or stunting growth persists, casting uncertainty over the future viability of such taxation frameworks. As political leaders navigate these complexities, the conversation around wealth tax in Britain may evolve significantly in the coming years, influenced by economic conditions, public sentiment, and shifts in party alignments that will determine the direction of fiscal policy in the UK.

Comparative Analysis of Wealth Taxes Globally

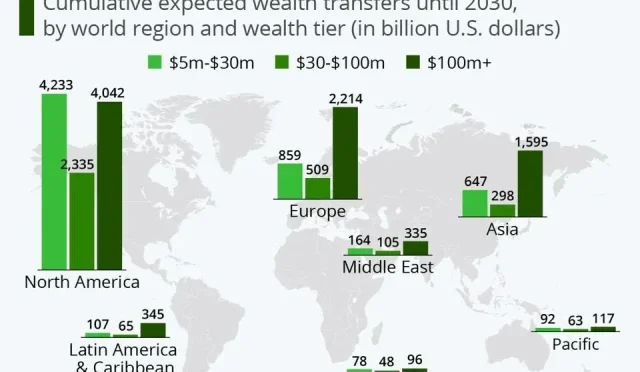

When examining the wealth tax debate, it is insightful to compare the UK’s current discussions with those from other countries that have implemented or repealed similar taxes. In countries like France and Norway, wealth taxes have faced significant backlash and have often been scaled back or abolished due to limited revenue generation and the adverse effects on wealthy individuals and businesses. Their experiences serve as cautionary tales, illustrating the potential pitfalls of wealth taxation and prompting a reevaluation of similar proposals within the UK context.

The comparative analysis reveals varying outcomes based on each nation’s economic structure, tax policies, and cultural attitudes towards wealth. As proponents of a UK wealth tax push for reform, understanding how wealth taxes have been accepted or rejected in other contexts can provide valuable lessons. If the UK decides to venture down the path of introducing a wealth tax, it would benefit greatly from these international experiences to devise a more structurally sound and publicly accepted approach.

Frequently Asked Questions

What are the main arguments for and against a wealth tax in Britain?

The arguments for a wealth tax in Britain revolve around fairness and economic equity, suggesting that those with greater wealth should contribute more to society. Proponents argue that it could address income inequality and raise significant revenue. However, arguments against it highlight practical challenges, historical failures in comparable nations, and potential negative impacts on investment and economic growth. Critics warn it could drive wealth overseas and create administratively burdensome systems.

How does the Labour wealth tax proposal address wealth inequality in the UK?

The Labour wealth tax proposal aims to address wealth inequality by suggesting a 2% levy on assets over £10 million, targeting wealth accumulation among the richest. Supporters argue it could generate up to £24 billion, which could be reinvested into public services. However, critics contend that taxing wealth could disproportionately affect individuals worth less than £10 million and complicate tax administration.

What has been the historical response to wealth tax proposals in the UK?

Historically, wealth tax proposals in the UK have faced significant resistance. Previous attempts to implement a wealth tax were deemed impractical, with past Labour governments concluding they would be costly and ineffective. Countries like France and Germany have largely abandoned similar taxes, citing inefficiencies and wealth flight, which raises concerns about the viability of a UK wealth tax.

What are the economic implications of implementing a wealth tax in Britain?

Economically, implementing a wealth tax in Britain raises concerns about disincentivizing savings and investments. Tax experts warn that substantial effective tax rates could demotivate individuals from building wealth, leading to decreased economic productivity. Additionally, there is fear that such a tax could drive wealthy individuals abroad, potentially harming the UK economy.

What challenges would a wealth tax face in terms of administration in the UK?

A wealth tax would face significant administrative challenges, including the need for accurate asset valuations and comprehensive assessments of individuals’ holdings. This would require extensive resources from HMRC to monitor and audit compliance. Questions around defining taxable assets, such as personal belongings or business equity, could complicate the process further, making efficient tax collection problematic.

How does public opinion influence the discussion around wealth tax in Britain?

Public opinion plays a crucial role in the discussion around wealth tax in Britain. While some factions within the Labour Party advocate for it, many constituents and working class individuals remain skeptical about its fairness and implementation. Concerns about potential impacts on ‘working people’ and the historical aversion to wealth taxes contribute to a cautious political atmosphere surrounding this issue.

What types of assets would be impacted by a UK wealth tax?

A UK wealth tax would primarily target high-value assets, including residential properties, stocks, bonds, and valuable personal items like art. Assets exceeding £10 million would be subject to a proposed 2% levy. However, the taxation of primary residences is politically sensitive and could be contentious, as many homeowners may resist additional taxation on their family homes.

What are the potential outcomes if a wealth tax is implemented in Britain?

If a wealth tax is implemented in Britain, potential outcomes could include increased revenue allocation towards public services, which supporters claim might benefit the wider population. Conversely, it could lead to increased tax evasion among the wealthy or incentivize them to relocate abroad, ultimately reducing the expected fiscal gains. Economic disincentives could also suppress investment and savings, impacting long-term growth.

Is there a precedent for how a wealth tax might be structured in the UK?

While there is no direct precedent for a UK wealth tax, proposals indicate a structure similar to a 2% levy on assets over £10 million. Various forms of wealth taxation exist globally, with countries like Norway and Switzerland having implemented similar taxes, albeit with varying degrees of success. The UK would need to consider these international examples while adapting to its unique economic and political landscape.

| Key Points |

|---|

| Wealth tax in Britain could lead to capital flight as the wealthy move their assets abroad. |

| The Labour party, once against a wealth tax, now sees some members calling for one, raising the prospect of change. |

| The proposed wealth tax would be a 2% levy on wealth over £10 million. |

| Chancellor’s response to wealth tax proposals is vague, maintaining ambiguity and avoiding outright denial. |

| Proponents argue it would address income inequality and provide valuable revenue without imposing burdens on the poor. |

| Opponents cite failed wealth taxes in other countries and the potential for evasion as reasons against implementing it. |

| Practical challenges include accurately valuing assets and enforcing compliance with tax laws. |

| Wealth tax could disincentivize savings and investment, potentially leading to economic stagnation. |

Summary

The discussion surrounding wealth tax in Britain highlights a complex interplay of political ambitions and economic realities. While advocates see it as a means to promote fairness and address income inequality, the historical precedents and practical challenges raise significant concerns. As the debate continues, it remains crucial for policymakers to carefully weigh the implications of a wealth tax in Britain, considering both its potential benefits and drawbacks.

#WealthTax #UKPolitics #TaxReformDebate #EconomicJustice #BritishEconomy