Wealth Tax in Wales: Mark Drakeford’s Call for Change

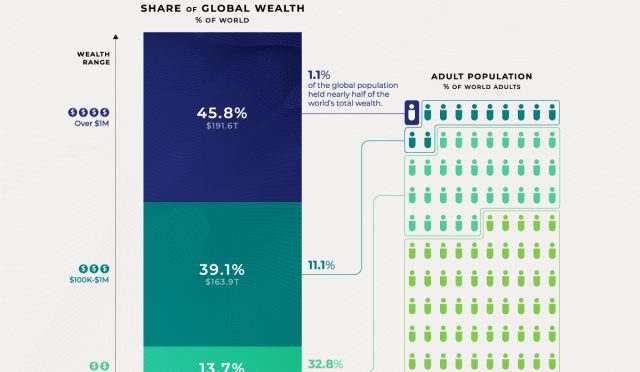

Wealth tax in Wales has emerged as a critical issue, igniting discussions around economic inequality and social justice. Former First Minister Mark Drakeford is advocating for a reform in taxation that targets the wealthiest individuals, arguing this could significantly address the widening gap between rich and poor in the region. Alongside this, he labeled the two-child benefit cap as a “moral imperative” that should be abolished to combat child poverty effectively. These calls resonate not only within the Labour party but also highlight larger concerns regarding Wales government policies aimed at reducing overall child poverty and fostering economic equity. As the push for wealth tax gains momentum, it raises questions about the future direction of socio-economic reform in Wales and the impact on citizens’ livelihoods.

The topic of wealth taxation in Wales, proposed by figures like Mark Drakeford, delves deep into the issues of financial disparity and welfare reform. By emphasizing the need for a tax system that burdens the affluent, Drakeford seeks to shift public policy in a direction that prioritizes the well-being of the underprivileged. The push to address the two-child benefit cap underlines a larger narrative in Wales about supporting families and mitigating poverty levels. With increasing discussions around economic fairness, the challenge ahead for policymakers is to balance taxation with sustainable growth, ensuring that any changes contribute to reducing child poverty and supporting social equity. As the political environment evolves, the call for wealth tax reflects a growing recognition of the need to reshape how wealth is distributed within society.

The Case for a Wealth Tax in Wales

Mark Drakeford’s advocacy for a wealth tax highlights the urgent need to address economic disparities in Wales. By proposing a tax on the wealthy, Drakeford aims to leverage funds to support social programs or infrastructure projects that can uplift lower-income communities. This approach aligns with his assertion that the core issue of economic inequality stems from the way wealth is distributed. Introducing a wealth tax could serve as a viable step in promoting fairness within the fiscal system, encouraging more responsible wealth management and distribution.

Additionally, implementing a wealth tax in Wales could alleviate financial pressures faced by the most vulnerable populations. It might generate significant revenue that could be redirected towards initiatives aimed at reducing child poverty, particularly as Drakeford emphasizes the need to lift families out of hardship. In a context where hanging onto wealth is a choice, tapping into those resources through taxation could transform the lives of ordinary Welsh citizens, reducing the gap between the affluent and the impoverished.

Impact of the Two-Child Benefit Cap on Welsh Families

The two-child benefit cap has been a significant point of contention in recent discussions regarding welfare policy in Wales. Mark Drakeford deems the removal of this cap as a ‘moral imperative’ crucial for combatting child poverty. Critics argue that this limit unfairly punishes larger families and exacerbates economic disenfranchisement. By capping benefits based on the number of children, many families find themselves struggling to make ends meet, further perpetuating cycles of poverty and inequality in the region.

Drakeford estimates that abolishing the two-child benefit cap could potentially lift around 500,000 children out of relative poverty, with a financial implication of £3.4 billion annually. This statistic serves to illustrate the profound impact that welfare reform can have on the well-being of families in Wales. As the country faces a critical juncture leading up to the next election, addressing policies like the two-child cap may prove essential for the Labour Party to regain support from constituents who feel overlooked.

Child Poverty Reduction Strategies Under Welsh Government Policies

The Welsh government has made strides in implementing policies aimed at reducing child poverty, recognizing it as a pressing issue affecting many households. These strategies include prioritizing education and awareness initiatives that elevate the discourse surrounding child welfare. By focusing on policies that address the root causes of economic hardship, such as housing affordability and access to childcare, the Labour government under Drakeford has aimed to create an environment where families can thrive, rather than just survive.

In addition, the government’s approach incorporates various welfare reforms that serve to bolster financial support for families in need. Initiatives developed in tandem with local organizations demonstrate cooperation and targeted action towards eradicating economic inequality. However, as opponents like Sir Keir Starmer suggest, addressing child poverty effectively will require a multi-faceted strategy; solely relying on taxation may not suffice. A comprehensive approach that combines fiscal measures with educational and social resources is essential.

Economic Inequality: A Growing Concern in Wales

Economic inequality has become a predominant issue in Wales, particularly under the strain of the current cost-of-living crisis. Mark Drakeford’s calls for a wealth tax are rooted in the conviction that wealth concentration among a small segment of the population exacerbates disparities. This inequality not only diminishes the quality of life for many individuals but also hampers economic growth at a broader level. Addressing this problem necessitates innovative policies that go beyond traditional taxation methods, potentially including wealth redistribution initiatives.

The widening gap between the rich and the poor means that many communities in Wales are left deprived of necessary resources for development. By focusing on wealth redistribution, the Welsh government could pave the way for a more equitable society, fostering an atmosphere where all citizens have the opportunity for success. Such measures, if executed effectively, can help cultivate a sense of unity among the population, reducing tensions bred from economic disparity.

Responses to Mark Drakeford’s Wealth Tax Proposal

Drakeford’s proposal for a wealth tax has sparked varied reactions within the political landscape, with figures like Sir Keir Starmer expressing caution over its potential impact on economic growth. Critics argue that simply raising taxes on the wealthy may dissuade investment and stagnate prosperity in the region. This sentiment reflects a broader debate on the most effective path to achieving economic resurgence, especially in the face of the upcoming Senedd election, where Labour’s positioning may hinge on fiscal strategies.

In contrast, supporters of Drakeford’s proposal argue that engaging wealthy individuals in contributing to public welfare through taxes is necessary for sustainable growth. They believe that a wealth tax could provide a foundation for funded programs that alleviate poverty, improve education, and support vulnerable populations. This dialogue encapsulates the ongoing struggle between fostering economic growth and ensuring equitable support for all citizens in Wales.

Labour’s Strategy for Addressing Economic Inequality

As Labour gears up for the impending Senedd elections, addressing economic inequality has become a centerpiece of their campaign strategy. Mark Drakeford’s calls for a wealth tax and the abolition of the two-child benefit cap are clear indicators of the party’s commitment to identifying and reworking welfare policies that impact the lives of citizens. The Labour party aims to present a robust plan that resonates with constituents who are concerned about economic outcomes in their communities.

However, as recent polling suggests a decline in Labour’s popularity, the party’s approach must be both bold and nuanced. Emphasizing policies that directly confront issues such as poverty and economic disparity could galvanize their base, while also appealing to voters who are on the fence. The party’s involvement in crafting comprehensive solutions that resonate across demographic lines may not only bolster their chances in the election but also pave the way for meaningful reforms that address the underlying challenges facing Welsh society.

The Importance of Child Welfare in Economic Policies

Focusing on child welfare within economic policies highlights the connection between social stability and productive economic frameworks. Mark Drakeford’s focus on reducing child poverty through welfare reforms and tax policies underscores the reality that investing in children today yields long-term benefits for society. Improved welfare provisions lead to healthier, more educated children who will grow up to become responsible, contributing members of society.

The intersection of child welfare and economic policy makes it imperative for policymakers to consider the impacts of taxation and social services on the youngest populations. By prioritizing initiatives that enhance the quality of life for children, the government fosters an environment conducive to growth and equality. The emphasis on child welfare not only addresses immediate needs but also contributes to a more robust economy in the long run, highlighting the multi-faceted benefits of such an approach.

Navigating Political Turmoil Ahead of Elections in Wales

As the Welsh Labour Party navigates the turbulent political landscape leading up to the 2026 Senedd elections, the conversation surrounding economic inequality takes center stage. With growing competition from other parties like Plaid Cymru and Reform UK, Labour must refine its platform to resonate with disillusioned voters. Mark Drakeford’s proposals for a wealth tax and reforms in welfare are crucial parts of this strategy, representing a decisive shift in addressing the concerns of the electorate.

Recognizing and responding to the aspirations of citizens facing economic challenges could prove pivotal for Labour’s future. The political messaging around wealth distribution and welfare reform needs to be both strategic and compassionate, signaling to voters that the party is committed to tangible improvements in their lives. As the election date approaches, clarity in policy propositions will be essential for Labour to regain trust and support.

Future Implications of Welfare Reform in Wales

The implications of proposed welfare reforms, particularly concerning Drakeford’s wealth tax and the elimination of the two-child benefit cap, could reverberate throughout Wales for years to come. Successfully implemented reforms could lead to significant shifts in the social landscape, offering necessary relief to lower-income families and reducing the levels of child poverty that currently plague the region. The correlation between fiscal policy and societal wellbeing highlights why these discussions are of paramount importance.

As stakeholders debate and refine proposals, it’s crucial to consider how these changes will not only impact immediate families but will also shape the economic trajectory of Wales. An equitable approach to taxation and welfare support could stimulate long-term economic growth and create a more just society. As central figures in the debate, politicians must remain vigilant and responsive to the needs of their constituents in order to foster an inclusive Wales.

Frequently Asked Questions

What is Mark Drakeford’s stance on wealth tax in Wales?

Mark Drakeford, the former First Minister of Wales, advocates for implementing a wealth tax in Wales to address economic inequality. He believes that the current distribution of wealth contributes to the growing divide between the rich and the poor, urging the Chancellor to take action to tackle these disparities.

How does the two-child benefit cap relate to wealth tax discussions in Wales?

The two-child benefit cap is a focal point in the discussions surrounding wealth tax in Wales. Mark Drakeford has described the removal of this cap as a ‘moral imperative’ to reduce child poverty, emphasizing that addressing such welfare policies could complement efforts to implement a wealth tax aimed at the wealthiest individuals.

What policies does the Wales government propose to combat economic inequality?

The Wales government, under the influence of leaders like Mark Drakeford, is proposing the introduction of a wealth tax and the abolition of the two-child benefit cap. These measures are seen as critical steps towards reducing child poverty and addressing the economic inequality prevalent in Wales.

Will a wealth tax improve child poverty reduction in Wales?

Yes, Mark Drakeford argues that a wealth tax, alongside other measures like removing the two-child benefit cap, could significantly improve child poverty reduction in Wales. He estimates that lifting the cap could potentially lift 500,000 children out of relative poverty, indicating a direct connection between wealth taxation and social welfare benefits.

What are the potential challenges in implementing a wealth tax in Wales?

The implementation of a wealth tax in Wales may face challenges such as the relocation of assets by wealthy individuals and opposition from political leaders like Sir Keir Starmer, who argues against heavy reliance on taxation for economic growth. However, experts believe there are practical ways to enforce such taxes effectively.

How does the conversation around wealth tax in Wales impact Welsh Labour’s political future?

The conversation around wealth tax and welfare reform poses significant implications for Welsh Labour’s political future, especially with upcoming elections. Recent polling suggests a shift in voter preference, compelling the party to address issues of economic inequality, including wealth taxation, to regain support and align with voter expectations.

What are the broader implications of wealth tax proposals for the economy of Wales?

Proposals for a wealth tax, as championed by Mark Drakeford, aim to mitigate economic inequality in Wales, potentially leading to a more equitable distribution of resources. This could result in better funding for social services and improvements in welfare support, thus enhancing overall economic stability in the region.

| Key Point | Explanation |

|---|---|

| Mark Drakeford’s Wealth Tax Proposal | The former Welsh first minister advocates for a wealth tax to reduce inequality. |

| Removal of Two-Child Benefit Cap | Drakeford sees this as crucial to tackling child poverty, claiming it could lift 500,000 children out of poverty. |

| Response from Labour Leader | Keir Starmer stated that a wealth tax won’t directly lead to economic growth. |

| Taxation on Specific Sectors | Drakeford suggested taxes on online gambling and banking profits to address wealth disparities. |

| Challenges Ahead for Welsh Labour | With recent polls showing a decline in support, Welsh Labour is facing an uphill battle in the next elections. |

Summary

Wealth tax in Wales is a pivotal topic as Mark Drakeford pushes for its introduction to address rising inequality in society. His proposals emphasize both the necessity of taxing the wealthy and rethinking welfare policies, including the removal of the two-child benefit cap. As political dynamics shift, the Welsh Labour party needs to address these pressing issues to regain support ahead of the upcoming elections.

#WealthTax #WalesPolitics #MarkDrakeford #TaxReformUK #EconomicJustice