Wealth Tax: Rachel Reeves Considers Controversial Proposal

Wealth tax is taking center stage in the economic discussions led by Rachel Reeves, who shows no signs of backing down despite recent Chancellor warnings. As debates intensify, concerns over potential capital flight loom large, suggesting that high asset taxes could drive affluent individuals away from the UK. Critics argue that the proposed wealth tax, touted to generate £10 billion in tax revenue, may be unrealistic and counterproductive. The economic impact of such taxation remains a hot topic as stakeholders weigh its benefits against the risks. As the conversation evolves, understanding the nuances of a wealth tax becomes increasingly vital for policymakers and the public alike.

The concept of a wealth tax, often referred to as an asset tax or net worth tax, is prompting significant dialogue among political leaders and economists. In light of recent developments, Rachel Reeves continues to advocate for this levy, despite facing substantial caution from the Chancellor regarding its feasibility. The potential for capital flight — where wealthy individuals move their assets overseas to evade the tax — adds a layer of complexity to the discussion. Critics highlight the challenge of achieving the projected £10 billion in tax revenue, indicating a possible disconnect between expectations and economic realities. As this debate unfolds, the implications of such taxation strategies on the broader economic landscape warrant careful examination.

The Debate Surrounding Wealth Tax in the UK

Wealth tax has been a contentious issue in the UK, especially following discussions led by Rachel Reeves. Despite facing significant warnings from economists and political figures, Reeves stands firm on not dismissing the wealth tax concept outright. This comes amidst a backdrop of concerns regarding the potential economic impact of such a tax, particularly in light of Chancellor’s alarming predictions about ‘large-scale capital flight.’ Supporters of the wealth tax argue that it is a necessary tool for addressing wealth inequality and generating much-needed tax revenue for public services.

Critics, however, point to potential negative consequences, such as the flight of high-net-worth individuals seeking to relocate to more tax-friendly jurisdictions. The Chancellor’s fears of capital flight raise important questions about the feasibility of implementing a wealth tax effectively. Even if the government could collect £10 billion from a wealth tax, can this be sustained without driving away investors and entrepreneurs? This ongoing debate highlights the tension between raising necessary revenue and maintaining a stable economic climate in the UK.

Chancellor Warnings on Economic Impact of Wealth Tax

Chancellor warnings about the wealth tax hinge on fears of an adverse economic impact that could result from the implementation of such a policy. The term ‘capital flight’ has emerged prominently in discussions, referring to the rapid movement of financial assets out of the country. High earners and wealthy individuals might be discouraged from investing in the UK if they perceive the tax regime as punitive. This reaction could stifle economic growth and diminish the very tax revenue that the government aims to increase through a wealth tax.

Moreover, the Chancellor’s concerns aren’t just theoretical; historical precedents from other nations indicate that substantial wealth taxes can lead to increased tax avoidance and evasion. Investors often seek more favorable climates, which raises questions about whether the projected £10 billion in revenue from the wealth tax might turn out to be overly optimistic. As Rachel Reeves navigates this complex landscape, the stakes are high—striking a balance between social equity and nurturing an attractive environment for wealth creation will be crucial.

Capital Flight: A Growing Concern for UK Taxation Policies

Capital flight is a critical concern regarding the UK’s taxation policies, especially in relation to proposals such as the wealth tax. High-net-worth individuals have options; when faced with increased taxation, they may choose to relocate their financial assets to jurisdictions with more favorable tax regimes. This phenomenon can result in severe economic implications for the UK, hampering its ability to raise the necessary tax revenue needed for essential public services. As Rachel Reeves weighs the consequences of a wealth tax, the potential for capital flight looms large.

The implications of capital flight extend beyond just loss of tax revenue; they can hamper investment, reduce economic dynamism, and lead to job losses. As Chancellor’s warnings suggest, allowing wealthy individuals to transfer their assets could erode the tax base. This aggravates the challenge of economic management in a climate where high inflation and public spending demands are already pressing. Policymakers must carefully consider how to create a taxation framework that can sustain growth while addressing inequality.

Rachel Reeves’ Position on Wealth Tax Implementation

Rachel Reeves’ approach to the wealth tax reflects a nuanced understanding of the complexities surrounding public finance. While she acknowledges the warnings from Chancellor regarding the possible ramifications of capital flight, she remains committed to exploring this avenue as a means of enhancing tax revenue. By emphasizing fairness in taxation, Reeves aims to engage with public sentiment while trying to mitigate the risks highlighted by opponents of the wealth tax.

However, implementing a wealth tax would require taking a comprehensive view of the current economic landscape. This includes assessing the impact existing tax structures have on wealth distribution and considering incentives that might be necessary to prevent capital flight. Reeves’ stance appears to be a blend of advocating for progressive tax reform while remaining sensitive to the economic concerns raised by the Chancellor and other critics of the wealth tax.

Economic Impact of Tax Revenue Projections

When discussing proposed wealth taxes, the projected tax revenue plays a pivotal role. Rachel Reeves faces the daunting task of justifying claims that a wealth tax could generate significant income, potentially around £10 billion. Critics argue that these projections are overly ambitious, especially if high earners decide to move their assets abroad to avoid what they may perceive as excessive taxation. The Chancellor has sounded alarms, cautioning that unrealistic revenue expectations could lead to budget deficits and further economic instability.

Furthermore, the economic impact of tax revenue projections should account for behavioral responses from individuals affected by the wealth tax. If high-net-worth individuals perceive an increase in their tax burden, they might opt for less investment in the UK economy or even relocation. This could create a cycle of reduced economic activity, jeopardizing revenue forecasts and hindering public service funding. As such, crafting a wealth tax requires a careful balance between ambition and realism, ensuring that it doesn’t drive away the very wealth it seeks to tax.

Navigating Wealth Inequality through Tax Reform

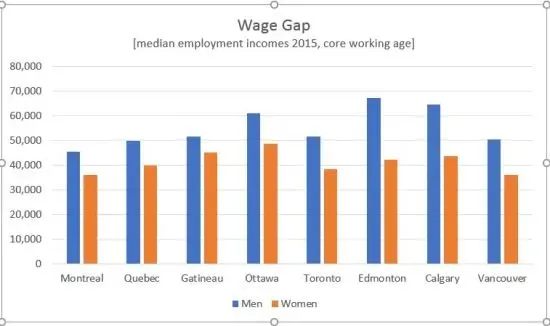

Addressing wealth inequality is a pressing issue facing many governments, including the UK. Proponents of a wealth tax suggest that it could be a significant step towards reducing the disparity between the affluent and the less fortunate. By reallocating wealth through taxation, funds could be channeled into essential public services like education and healthcare, thereby promoting greater social equity. Rachel Reeves, in her deliberations, aims to position a wealth tax not just as a means of revenue generation but as a tool for social justice.

Yet, any tax reform must also consider the economic implications of such shifts. Critics fear that a wealth tax could constrict growth if it leads to capital flight or discourages investment. To navigate this complex landscape, policymakers must ensure that their tax strategies address equity while also fostering a healthy economic environment. This might include comprehensive evaluations of existing tax law and the creation of incentives to retain high earners, all while striving to narrow the wealth gap in society.

Public Reception of Wealth Tax Discussions

The public reception of discussions around a wealth tax is varied, reflecting broader societal concerns about taxation and fairness. Many citizens support initiatives targeting wealth inequality, viewing them as essential for promoting fairness and reducing social disparities. Rachel Reeves taps into this sentiment when discussing the wealth tax, energizing public interest in the role of taxation in shaping society. This highlights an opportunity for policymakers to engage citizens in meaningful conversation about sustainable tax reform.

Conversely, there exists a significant contingent of the public that remains wary of the potential consequences of a wealth tax. Concerns about capital flight, the efficacy of tax collection, and its impact on economic growth resonate strongly among those who fear that such a policy might favor intellectual pathologies. The balance of these perspectives requires careful consideration as broader discussions about the wealth tax continue; ensuring that any proposal reflects both public sentiment and economic viability will be key.

Long-Term Implications of Implementing a Wealth Tax

The long-term implications of implementing a wealth tax in the UK are multifaceted and warrant thorough examination. If executed effectively, a wealth tax could potentially alter the economic landscape by funding public programs aimed at reducing inequality. Rachel Reeves argues for the necessity of addressing wealth disparity in a sustainable manner, which could help cultivate greater economic stability. However, the specter of capital flight looms ominously, casting doubt on the feasibility of such a tax.

Moreover, the long-term success of a wealth tax would hinge on public acceptance and compliance. If high earners perceive the tax as punitive, the risk of tax evasion may increase, ultimately undermining the intended benefits of such a tax. Thus, any wealth tax proposal must not only focus on immediate revenue generation but also consider long-term economic health and societal acceptance, ensuring that it integrates with broader fiscal policies.

Finding Common Ground on Tax Strategies

In the ongoing discourse about wealth tax, finding common ground among policymakers, economists, and the public becomes paramount. Rachel Reeves’ stance showcases a willingness to engage in dialogue around progressive taxation, fostering an environment where divergent opinions can coexist. Engaging stakeholders from various backgrounds is critical in developing a robust tax policy that actively reduces inequality without sacrificing economic growth. This dialogue can lead to innovative solutions that balance revenue generation while maintaining a favorable business climate.

Furthermore, common ground can emerge through shared objectives in addressing wealth inequality. By framing the wealth tax as part of a broader strategy aimed at social equity, all parties can work towards policies fostering inclusive economic growth. This approach not only strengthens the legitimacy of a potential wealth tax but also enhances public trust in government fiscal responsibilities. Ultimately, alignment across different sectors of society is crucial to crafting tax strategies that reflect collective values and promote enduring economic health.

Frequently Asked Questions

What is a wealth tax and why are leaders like Rachel Reeves considering it?

A wealth tax is a tax based on the value of owned assets, such as property, stocks, and investments. Rachel Reeves has indicated interest in this tax as a potential means to generate substantial tax revenue, despite receiving warnings from the Chancellor about potential economic impacts.

What warnings did the Chancellor give regarding the implementation of a wealth tax?

The Chancellor warned that implementing a wealth tax could lead to ‘large-scale capital flight’, where wealthy individuals might relocate their assets or themselves to avoid taxation, thus impacting the overall effectiveness of the tax.

How much revenue is a wealth tax projected to generate according to Rachel Reeves?

Rachel Reeves has faced skepticism regarding the wealth tax’s potential effectiveness, especially claims that it could generate £10 billion, as many experts believe that such projections may be unrealistic.

What are the economic impacts of a wealth tax as highlighted by critics?

Critics argue that a wealth tax may discourage investment and innovation, leading to negative economic impacts. The Chancellor’s warnings emphasize concerns that such a tax might drive high-net-worth individuals away, resulting in reduced tax revenue overall.

How does capital flight relate to the discussion of wealth tax in the UK?

Capital flight is a significant concern in discussions about wealth tax, as experts warn that if the tax is perceived as punitive, it could prompt wealthy individuals to move their assets overseas, ultimately undermining the intended tax revenue.

What are the potential benefits of a wealth tax as suggested by supporters?

Supporters of a wealth tax argue that it can address income inequality and provide essential funding for public services. Advocates like Rachel Reeves believe that, if structured effectively, it could enhance tax revenue without excessively harming the economy.

What are the key arguments for and against wealth tax in the context of Rachel Reeves’ position?

Key arguments in favor include increasing equity and targeting wealth concentration, while arguments against often cite the risk of capital flight and the difficulty in accurately assessing wealth for tax purposes. Rachel Reeves remains open to exploring the concept despite these concerns.

| Key Points |

|---|

| Rachel Reeves supports exploring a wealth tax despite criticism. |

| Warnings of potential capital flight due to wealth tax implementation. |

| Skepticism about the feasibility of generating £10 billion from the tax. |

Summary

Wealth tax has become a contentious issue as policymakers weigh its potential benefits against economic risks. Despite warnings of capital flight and doubts about its revenue-generating capabilities, Rachel Reeves maintains a stance open to discussions on wealth tax. This debate highlights the challenges of balancing equity with economic stability.