The debate around a Wealth Tax UK is heating up as policymakers, including Labour’s Rachel Reeves, confront a significant public finance deficit. With mounting pressure to explore new revenue streams, advocates argue that a UK wealth tax proposal could address the pressing issue of wealth distribution in the UK, where the richest households hold a disproportionate share of assets. This approach has sparked intense wealth tax debates, centering on potential gains and pitfalls associated with such a levy. Proponents suggest that a well-structured wealth tax could help lessen economic inequality while providing critical funding for public services. As the chancellor weighs her options, understanding the impact of a wealth tax in the UK remains crucial for shaping a fairer economic landscape.

The concept of a fiscal levy on personal assets, commonly referred to as a wealth tax, has surfaced prominently in political discussions across the UK. High-profile figures, including Rachel Reeves, are examining ways to pivot towards a fairer tax system that addresses stark disparities in wealth distribution. Analyses of potential policies highlight the impact an asset-based tax could have on reducing the burden on low to middle-income earners while increasing contributions from the wealthiest individuals. As wealth tax debates unfold, the effectiveness and feasibility of implementing such measures within the existing economic framework are becoming focal points for economists and policymakers alike. A careful examination of past and present models worldwide could provide valuable insights into the viability of a UK wealth tax.

Understanding the UK Wealth Tax Proposal

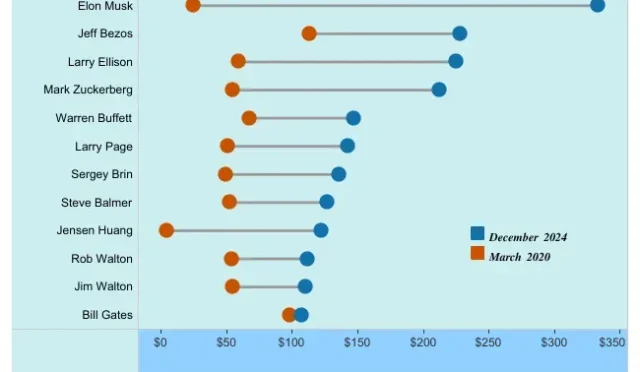

The debate surrounding the UK wealth tax proposal has been gaining momentum in recent months, particularly as individuals and economists call for measures to alleviate the financial disparity in wealth distribution. Rachel Reeves acknowledges the urgency of addressing the £40 billion deficit and is contemplating the introduction of a wealth tax as part of a broader strategy. Given that just 15,800 individuals own over £505 billion collectively, the potential expansion of the tax base through a wealth levy could contribute significantly to reducing this deficit while fostering a fairer system of wealth distribution in the UK.

A wealth tax could help target the wealthiest households in Britain, particularly those that hold substantial assets. Unlike conventional tax hikes that affect the majority, this strategy might focus on the top echelon of earners, thereby generating substantial revenue without straining the average citizen. As highlighted by various economists, a targeted wealth tax could raise between £12.7 billion and £22.9 billion. By effectively tapping into the vast reserves of fortune held by the elite, this policy could provide a sustainable solution to the fiscal challenges currently facing the treasury.

The Impact of a Wealth Tax on UK Economy

The impact of a wealth tax on the UK economy could be profound, influencing both fiscal health and economic growth dynamics. Implementing such a tax would require assessments on assets, which may face challenges due to potential avoidance strategies from wealthy individuals. However, should the government harness modern technology and data analytics, the efficiency of tax collection could improve, mitigating the fears surrounding tax dodging. Additionally, as proposed by various financial analysts, the fiscal intake from such a tax could supplement public services that are underfunded due to the ongoing deficits.

Moreover, the wealth tax could serve as a pivotal point in transforming the conversation around wealth distribution in the UK. Engaging the wealthy in contributing to public finances may assist in reducing the socio-economic gap, which has been exacerbated by stagnated wages and rising living costs. This approach could become a moral imperative, compelling individuals to recognize their role in the society’s economic ecosystem. While challenges remain, the potential upside of incorporating a wealth tax into the UK’s fiscal strategy underscores the necessity for innovative solutions to long-standing economic issues.

Wealth Tax Debates: Pros and Cons

The wealth tax debates in the UK have uncovered a myriad of opinions, both supporting and opposing this proposed levy. Advocates argue that a wealth tax is necessary for addressing the inequities within the current taxation framework. They suggest that taxing the richest individuals could redistribute wealth, subsequently funding essential public services and welfare programs that have suffered in austerity measures. Furthermore, with growing economic inequality, there is a compelling argument for ensuring the wealthy contribute fairly to society.

On the flip side, critics of a wealth tax raise concerns about its practicality and effectiveness. Some argue that such a tax may lead to capital flight, where wealthy individuals might relocate or find loopholes to avoid paying dues. Additionally, the administrative costs associated with implementing a wealth tax could outweigh the gains, particularly if avoidance rates are high. This dichotomy outlines the complexities of introducing a wealth tax—balancing equity, revenue generation, and the potential disincentives for investment and economic growth.

Rachel Reeves and the Wealth Tax Discussion

Rachel Reeves stands at the forefront of the wealth tax discussion, grappling with the political ramifications and financial imperatives of introducing such a levy. As she seeks viable solutions to address the financial shortfall, there is increasing pressure from her party to embrace a wealth tax as a feasible option. By leaning into this conversation, Reeves not only addresses potential revenue generation but also aligns with a growing consensus that wealth inequality must be confronted head-on, making it a vital aspect of her fiscal strategy.

In her approach, Reeves aims to balance progressive ideals with economic realism. The Labour manifesto traditionally avoided explicit discussions on wealth taxes, but with the growing crisis, she may leverage the political capital from advocating for a wealth levy to garner public support. This ongoing discourse may reposition the Labour Party on the political spectrum, as they aim to resonate with the concerns of voters who feel the brunt of economic inequality, while also remaining faithful to their foundational principles.

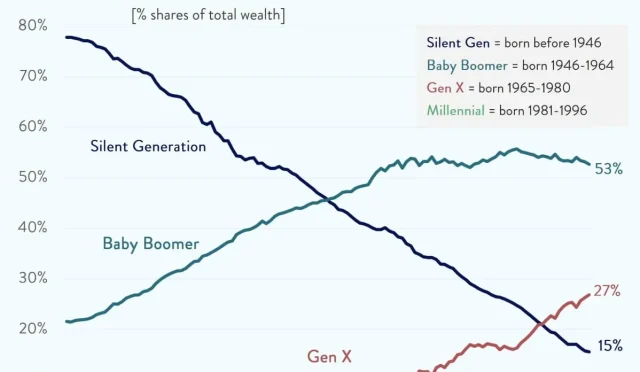

Wealth Distribution in the UK: A Closer Look

The stark disparity in wealth distribution within the UK is alarming, with the richest 10% of households controlling 58% of the nation’s wealth. This concentration raises critical questions about economic justice and the sustainability of such inequality. Addressing wealth distribution is essential not only for moral reasons but also to restore faith in the economic system that increasingly feels rigged against the average citizen. In this context, proposals for a wealth tax become incredibly relevant as they could serve as a corrective mechanism to balance the scales.

An examination of wealth distribution also highlights the need for progressive tax reforms that address these disparities. The implementation of a wealth tax could redistribute some of this concentrated wealth, providing additional funding for public services that benefit broader society. By reshaping the fiscal landscape, the most affluent could contribute to alleviating some of the strain faced by the poorer sections of society, thereby fostering social cohesion and economic stability.

Alternatives to Wealth Tax in the UK

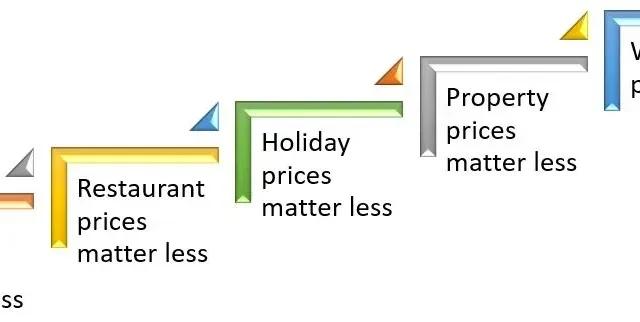

While the wealth tax is a significant point of contention, there are several alternative strategies that policymakers may consider to address the budget shortfall without straying from traditional tax ethos. Reforming existing taxes such as capital gains tax could yield high revenues while maintaining public support. By closing loopholes and making income from investment equally taxable as labor income, the government could generate necessary funds to address the deficit without the complexities that a wealth tax might entail.

Other proposals include revisiting inheritance tax rates or modifying exemptions, which could significantly increase tax revenues. Additionally, focusing on efficiency in public spending through technological advancements may help in plugging the gaps identified in fiscal management. Such alternatives allow for a reassessment of who contributes to the economy while potentially garnering broader public support compared to introducing a wealth tax.

Lessons from International Wealth Tax Models

Looking into international wealth tax models can provide valuable insights for the UK as it considers implementing its own version. Countries like Switzerland and Spain have maintained wealth taxes for an extended period, demonstrating how they can fund public services effectively while also addressing wealth disparities. These examples show that when crafted intelligently, a wealth tax can act as both a revenue source and a deterrent against extreme wealth accumulation.

However, the UK must learn from the pitfalls experienced by other countries that have seen wealth taxes dismantled due to evasion issues or public backlash. A well-defined approach that considers asset valuation methods and avoidance prevention is crucial for any proposed tax to be successful. By studying the successes and failures of existing models, the UK can craft a wealth tax proposal that maximizes revenue while minimizing negative societal impacts.

The Future of Tax Reform in the UK

As the UK grapples with a considerable fiscal hole, the future of tax reform remains a pivotal topic of discussion. Rachel Reeves and her team have the responsibility of navigating these waters carefully, ensuring that any adopted tax measures not only mitigate the current deficits but also evolve to meet the changing economic landscape. The public’s response to these changes will be crucial, as economic reform requires social buy-in to achieve lasting impacts.

Tax reform in the UK may very well hinge on the acceptance of progressive taxing methods, including the wealth tax, if proposed and well-structured. If successful in addressing economic disparities and engaging with citizens’ concerns about fairness, such reforms could herald a new era of fiscal policy aimed at fostering a fairer and more stable economic future for all.

Public Sentiment Towards Wealth Tax

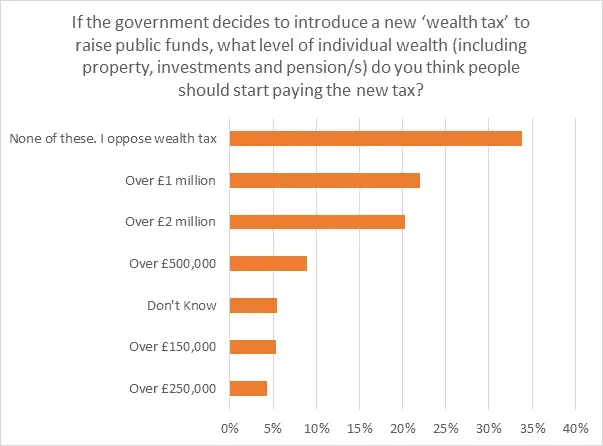

Public sentiment towards a wealth tax in the UK is a critical component of the ongoing debate, reflecting attitudes towards economic inequality and taxation. Surveys indicate that many citizens recognize the pressing need for financial contributions from the wealthiest segments of society. As the economic pressures escalate due to inflation and cost of living increases, many citizens feel that a wealth tax could provide a means for rectifying imbalances and generating funds for essential public services.

However, there is a degree of polarization regarding the concept. While proponents argue that the tax is an ethical necessity, there are apprehensions among the wealthier classes who may perceive the tax as punitive. Engaging with a diverse range of voices in this discussion can illuminate the public’s perspective, ensuring that any discussion of a wealth tax aligns with the broader sentiment of justice and fairness in taxation.

Frequently Asked Questions

What is the UK wealth tax proposal being discussed by Rachel Reeves?

The UK wealth tax proposal involves introducing a tax levied on the total value of individual assets in order to address the £40 billion deficit in public finances. Advocates like Rachel Reeves argue it could raise significant revenue to tackle inequality.

How would a wealth tax impact wealth distribution in the UK?

A wealth tax would primarily target the wealthiest individuals, with estimates suggesting that it could substantially affect the top 0.03% of wealth holders in the UK, thereby potentially improving overall wealth distribution.

What are the key arguments in the wealth tax debates in the UK?

The wealth tax debates in the UK revolve around its potential to generate significant revenue, address inequality, and the challenges of implementation. Critics highlight concerns about tax avoidance, administrative costs, and the feasibility of enforcing such a tax.

What are the financial implications of Rachel Reeves’ wealth tax proposal?

The financial implications of Rachel Reeves’ wealth tax proposal could raise between £17.6 billion and £22.9 billion annually, depending on levels of tax avoidance, making it a strong alternative to freezing income tax thresholds.

How does the concept of a wealth tax fit within existing taxation in the UK?

The concept of a wealth tax fits within existing UK taxation as it aims to complement other taxes like council tax, capital gains tax, and inheritance tax by targeting untaxed wealth across all asset types to prevent avoidance.

| Key Point | Details |

|---|---|

| Current Financial Situation | Rachel Reeves faces a £40 billion deficit in public finances. |

| Potential Tax Increase Options | Options being considered include income tax, national insurance, pensions, and capital gains tax. |

| Wealth Tax Support | There is growing support within the Labour Party for implementing a wealth tax to address inequality. |

| Wealth Distribution in the UK | The richest 10% of households own 58% of total wealth; the bottom 50% own just 5%. |

| Challenges of Implementing a Wealth Tax | Concerns include tax avoidance, administrative costs, and the political backlash it may provoke. |

| Success Stories | Countries like Spain and Switzerland effectively use wealth taxes to generate revenue. |

Summary

A wealth tax in the UK could provide a viable solution to address the significant fiscal deficit. With mounting pressures on the Chancellor Rachel Reeves to raise additional revenue, options like freezing tax thresholds and increasing national insurance are being weighed against the potential of a wealth tax. This tax could not only help in bridging the £40 billion gap in the public finances but also tackle the pressing issue of wealth inequality. However, the implementation challenges and potential avoidance issues must be carefully navigated. The success of wealth-tax models in other countries could provide valuable insights for a UK-specific approach.