Wealth Tax UK: Minister Dismisses Keir Starmer’s Plans

In recent discussions surrounding the UK government tax policy, a wealth tax UK has emerged as a contentious topic, particularly among the Labour Party’s ranks. With a backdrop of economic recovery post-pandemic, many have debated the feasibility and implications of such a tax. However, Business Secretary Jonathan Reynolds has firmly dismissed the notion, asserting that a Starmer administration would not pursue this avenue. “We’re not going to do anything foolish like that,” he stated during a recent interview, indicating a clear stance against implementing a wealth tax. This dismissal may highlight the broader challenges facing UK tax reforms as the government navigates fiscal responsibilities and electoral promises.

The concept of a taxation scheme targeting affluent individuals has sparked significant debate and varying opinions within political circles in the UK. A progressive tax on wealth could potentially reshape revenue generation strategies, appealing to many who advocate for increased funding for public services. However, conflicting views arise as high-profile politicians like Keir Starmer and Jonathan Reynolds argue against the practicality of enacting such measures. This ongoing discourse reflects an urgent need for clarity in the political landscape regarding fiscal policies and their socio-economic impacts. As discussions unfold, the implications of high-net-worth taxation continue to provoke critical questioning and scrutiny.

Keir Starmer’s Position on Wealth Tax in the UK

Keir Starmer, the leader of the Labour Party, has faced scrutiny over his stance on implementing a wealth tax in the UK. Despite growing advocacy for such a tax among certain party members, Starmer has firmly asserted that his administration will not pursue this policy. His decision reflects a broader ambition to appeal to a wide electorate while navigating the complex landscape of UK government tax policy, which includes considerations about economic recovery and public spending.

Starmer’s reluctance to endorse a wealth tax highlights the tension within the Labour Party. On one hand, some members believe a wealth tax could significantly contribute to funding public services; on the other hand, Starmer appears to favor more moderate approaches in fiscal legislation to avoid alienating potential voters. This balancing act is crucial as the party prepares for upcoming elections.

Labour Party Wealth Tax Proposals and Public Opinion

The idea of a wealth tax has been a point of contention within the Labour Party, stirring debates among its members and the general public. Advocates argue that a wealth tax could alleviate income inequality and provide necessary funding for healthcare and education. However, recent statements from figures like Business Secretary Jonathan Reynolds suggest that the party may not adopt such proposals. Reynolds emphasized the need for a cautious approach, urging citizens to ‘take this seriously’ as the nation braces for economic challenges ahead.

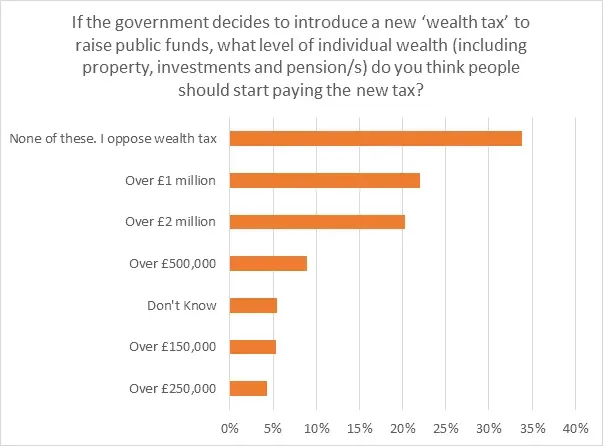

Public opinion on wealth taxes remains divided. While many support the concept of taxing the wealthy to fund vital services, there is also considerable concern about the practical implications, such as potential capital flight and impacts on investment confidence. Effective communication from the Labour Party about their tax policy alternatives will be critical in shaping perceptions about their economic plans without resorting to a wealth tax.

The Influence of Economic Policy on UK Elections

Economic policy is often at the heart of UK elections, influencing voter preferences and party strategies. The discussion surrounding a wealth tax is a clear example of how taxing rich individuals can become a focal point in political discourse. As the Labour Party explores its economic strategy, Starmer’s administration will aim to define its vision beyond contentious taxes, particularly as they seek to challenge the Conservative government following its longstanding grip on power.

Campaigning on economic issues like taxation and public investment can resonate deeply with voters, particularly in times of economic uncertainty. If the Labour Party can offer credible and appealing alternatives to a wealth tax, such as focusing on reforming existing tax systems or enhancing business support, it may strengthen their position in future elections.

Dismissing Wealth Taxes: A Strategic Political Move

The dismissal of a wealth tax by key Labour figures, including Keir Starmer and Jonathan Reynolds, might be seen as a strategic political move designed to mitigate risks. By publicly rejecting this highly debated tax proposal, the party signals its intention to distance itself from policies perceived as radical or unfeasible. This strategy aims to reassure moderate voters who may be skeptical about the party’s ability to manage the economy effectively.

In the context of UK government tax policy, the Labour Party’s stance on wealth taxes could also be an attempt to differentiate itself from other political parties. By focusing on fiscal responsibility and public consensus, Starmer hopes to build a more pragmatic platform that can attract a wider demographic while still championing social justice.

Jonathan Reynolds and the Practicality of Tax Reform

Jonathan Reynolds, as Business Secretary, plays a crucial role in shaping the dialogue around tax reform and governance in the UK. His comments about the unlikelihood of a wealth tax reflect a practical approach that prioritizes economic stability and attractiveness of the UK as a business hub. Reynolds’ emphasis on avoiding what he termed ‘foolish’ policies suggests an awareness of the complexities and potential fallout associated with sweeping tax reforms.

Tax reforms are often contentious, with competing interests balancing the need for revenue against the desire for a favorable business climate. Reynolds’ position implies that any future tax policy from the Labour Party will consider these factors closely, striving for a solution that encourages both investment and social progress without resorting to wealth taxes.

Economic Recovery Post-Pandemic and Tax Policy Implications

As the UK grapples with the aftermath of the pandemic, economic recovery becomes a crucial topic for political debate. The Labour Party’s discussion around tax policy is pivotal; with calls for sustainable funding for key sectors, many are looking towards wealth taxes as a potential source of revenue. However, as noted by Jonathan Reynolds, implementing such a tax could pose significant risks during recovery, potentially stalling investment and economic growth.

The implications for tax policy in a post-pandemic UK are manifold. The government will need to navigate public sentiment, economic realities, and the need for substantial funding for public services. This delicate balancing act means that while wealth taxes may linger in discussions, the immediate focus may shift towards more viable solutions that align with broader economic recovery goals.

The Role of Wealth Tax in Addressing Inequality

The discussion surrounding a wealth tax in the UK often aligns with broader conversations about economic inequality. Proponents argue that such a tax could help redistribute wealth and provide funding for critical social services, potentially addressing disparity in wealth distribution. Keir Starmer’s hesitation about adopting wealth tax proposals suggests a need to carefully consider not just the economic implications, but also the socio-political consequences of introducing such measures.

Economic inequality has become a critical issue for many voters, and addressing it will be central to any political campaign strategy. If the Labour Party can show a commitment to tackling inequality through alternative means without imposing a wealth tax, they may gain the trust of their constituents while also aiming to unite various factions within the party.

Alternatives to Wealth Tax: Labour’s Economic Strategy

In the ongoing debate about wealth taxes, the Labour Party has the opportunity to present alternative economic strategies that align with public demands. By promoting policies focused on taxing income and inheritance more effectively, the party may sidestep the contentious nature of a wealth tax while still addressing fiscal responsibilities. This strategic pivot could allow for a more comprehensive reform of the tax system that appeals to a broader voter base.

Moreover, exploring alternatives to wealth tax can provide the Labour Party with a pathway to connect with entrepreneurial voters who may be wary of policies seen as penalizing success. By developing a tax policy framework that emphasizes fairness without constraining economic innovation, the Labour Party can redefine its narrative in the face of public skepticism.

Potential Impact of Upcoming Elections on Tax Policy

The approach the Labour Party takes towards tax policy in the context of upcoming elections could significantly impact its success. As economic conditions evolve, the party must anticipate voter concerns and adjust its platform accordingly. Attention to public sentiment about taxation, particularly regarding wealth distributions, will be crucial for Starmer as he navigates his campaign.

Commitment to clear, fair, and reasonable tax policies may help bolster public trust in the Labour Party, especially amid intensified discussions about wealth inequality. Starmer’s ability to articulate a coherent economic vision without resorting to controversial proposals like a wealth tax could strengthen the party’s position in the electoral arena.

Frequently Asked Questions

What is the stance of the Labour Party on wealth tax UK?

The Labour Party has seen discussions around a wealth tax UK, but recent statements from Business Secretary Jonathan Reynolds indicate that a wealth tax will not be implemented under Keir Starmer’s leadership.

Has the UK government dismissed the wealth tax proposal?

Yes, the UK government has dismissed the wealth tax proposal. Business Secretary Jonathan Reynolds confirmed on GB News that under Keir Starmer’s administration, they will not pursue a wealth tax, indicating a clear stance against it.

Why does the Labour Party wealth tax proposal resonate with some supporters?

The Labour Party wealth tax proposal has gained traction among some members who argue it could address income inequality and raise necessary revenue. However, the leadership, including Keir Starmer, has officially rejected this idea according to Business Secretary Jonathan Reynolds.

What did Jonathan Reynolds say about the wealth tax in the UK?

Jonathan Reynolds stated that the idea of a wealth tax in the UK is ‘foolish’ and emphasized that under Keir Starmer’s administration, such a tax will not be implemented, urging the public to take this dismissal seriously.

How does the wealth tax UK relate to current UK government tax policy?

The wealth tax UK discussion is part of broader debates around UK government tax policy. However, with the Labour Party’s leadership ruling out a wealth tax, the focus may shift to other tax strategies under Keir Starmer’s administration.

What implications does the wealth tax dismissal have for Labour Party supporters?

The dismissal of the wealth tax by Keir Starmer’s administration could lead to discontent among Labour Party supporters who favor wealth redistribution. Business Secretary Jonathan Reynolds’ remarks suggest a desire to maintain a moderate approach in UK government tax policy.

| Key Point | Details |

|---|---|

| Wealth Tax Position | The UK government has dismissed the idea of a wealth tax. |

| Response from Labour | Some members within the Labour Party are advocating for a wealth tax. |

| Comment from Government Official | Business Secretary Jonathan Reynolds stated that a wealth tax is not under consideration. |

| Official Statement | Reynolds emphasized that the government will not pursue a wealth tax, labeling it as ‘foolish’. |

Summary

Wealth tax UK remains a topic of debate, but the latest statements from the UK government indicate a clear stance against its implementation. Business Secretary Jonathan Reynolds has publicly rejected the concept, urging the public to consider the implications seriously. While some factions within the Labour Party might support the idea, the current government maintains that such measures are not being taken seriously and will not be pursued.

#UKNews #WealthTax #KeirStarmer #EconomicPolicy #TaxReform