Wealth Taxes UK are increasingly becoming a focal point in the discussions surrounding the upcoming November Budget, as urgent calls for reform echo from various quarters. Chancellor Rachel Reeves faces mounting pressure from TUC trade unions, which argue that implementing wealth taxes is essential for enhancing public services funding amidst rising living costs. The General Secretary, Paul Nowak, has underscored the importance of a more progressive tax system that could include levies on bank profits, which have soared in recent years, as well as taxes on online gambling revenues. With the UK budget 2023 approaching, the balance of equity in taxation is at the forefront of public discourse, stressing the need for wealthier individuals to contribute more. As the political landscape shifts, the push for a comprehensive wealth tax reveals deep concerns over fiscal fairness and the sustainability of public services.

The discussion surrounding wealth taxation in the UK is intertwined with broader economic strategies aimed at ensuring equitable funding for essential services. Advocates for wealth levies emphasize the necessity for affluent sectors, including major banks, to adequately share the fiscal burden, especially given their recent record profits. Rachel Reeves, amid pressures from various labor factions and public sentiment, is being urged to consider a restructured tax framework that balances the contributions of higher-income brackets with the needs of ordinary citizens. This dialogue highlights alternative approaches to funding public infrastructure and the social contract, inviting a deeper examination of fiscal policy and its implications for social equity. As the debate unfolds, the implications of potential taxes on wealth may shape the future of economic policy in the UK.

The Case for Wealth Taxes in the UK Budget

The call for wealth taxes in the UK budget has gained momentum, particularly from organizations like the TUC, which represents a coalition of trade unions. Chancellor Rachel Reeves faces increasing pressure to incorporate these taxes into her financial plan, especially as public sentiment shifts towards greater accountability for the wealthy. General Secretary Paul Nowak articulates that a progressive tax system can address glaring inequalities and enhance funding for vital public services, an issue that resonates with many citizens who have been affected by austerity measures and cutbacks over the years.

As the Chancellor prepares for the November Budget, the potential impact of implementing a wealth tax cannot be overstated. With the backdrop of record profits reported by banks and financial institutions, there is a strong argument for ensuring that these entities contribute fairly to the economy. Reeves has previously emphasized balancing taxation on wealth with growth priorities, but as economic pressures mount and borrowing costs soar, the public may very well demand more robust action addressing wealth inequality.

Rachel Reeves and the TUC’s Vision for Public Services Funding

Rachel Reeves, as the Chancellor, has a pivotal role in shaping the future of public services funding in the UK. The TUC’s stance, led by Paul Nowak, highlights the necessity for progressive investment strategies, including the taxation of bank profits and taxing sectors that have historically escaped regulation. This reflects a broader understanding that financial contributions from wealthier sectors are crucial for the sustainability of public services, which have been under strain for years.

Moreover, the ongoing debate underscores the potential benefits of such taxes, which could not only enhance public services but also contribute to economic growth. Notably, other nations, such as Spain, have seen positive results by implementing wealth taxes, suggesting that the UK could follow suit. Reeves’s acknowledgment of the need to explore various revenue streams indicates an evolving approach to managing the country’s fiscal policies, particularly as cooperation with trade unions becomes increasingly important.

Taxing Bank Profits: A Necessary Step?

The argument for imposing a bank profits tax has gained unprecedented support within the Labour movement and among public service advocates. Paul Nowak’s assertion that the largest banks in the UK profited immensely over the past year reinforces the urgency of this discussion. In light of rising interest rates, which contribute to these windfall gains, there is a compelling case for ensuring that banks contribute their fair share to the nation’s economy. Taxation of bank profits could ensure that public services receive necessary funding without placing additional strain on working families.

Critics of increased taxes on banks, such as Lloyds CEO Charlie Nunn, argue that additional taxation could harm economic growth and investment in the sector. However, there remains a broader dialogue about whether the current high profitability of banks allows for a competitive banking environment alongside fair taxation. As Reeves prepares for the upcoming budget discussions, the question looms large: can the government strike a balance that encourages financial health while ensuring the contributions of banks to public welfare?

Public Sentiments on Wealth Taxation

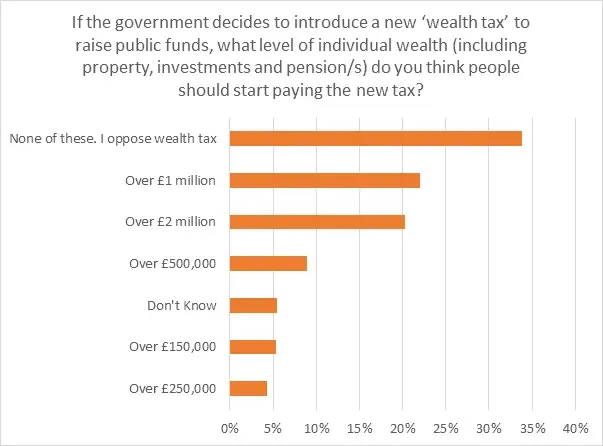

Recent polling conducted by the TUC indicates a growing approval for the introduction of wealth taxes among the public, especially among voters who have shifted from traditional Labour to Reform UK. This suggests a distinct sentiment for change among constituents who feel that the existing systems do not adequately address wealth inequality. Mr. Nowak’s comments reflect a sense of urgency to respond to these sentiments in order to maintain trust in mainstream politics.

If the government fails to act on these pressing issues in November’s budget, there is a genuine risk that disillusioned voters might turn towards more radical alternatives, such as those offered by Reform UK. This underlines the importance of listening to public opinion in fiscal discussions, as sustainable policy-making requires broad-based support from the electorate. The forthcoming budget presents a crucial opportunity for the Labour party to demonstrate its commitment to addressing wealth disparities and fulfilling the electorate’s desires.

The Intersection of Tax Policy and Economic Growth

The proposed wealth taxes and various other fiscal measures are being tightly interwoven with the broader narrative of economic growth in the UK. Rachel Reeves and her team must navigate the complexities of ensuring that fiscal policy does not deter foreign investment while addressing domestic inequality. With increased scrutiny on wealth and corporate profits, there is a growing expectation that financial institutions and wealthier individuals will partake in the collective economic recovery.

This balance will not only define the Labour government’s reputation but will also set the tone for future public services funding. Navigating the thin line between taxation and growth will require innovative thinking and a commitment to transparency in how funds are allocated, particularly in education, health, and infrastructure. The government’s ability to demonstrate a tangible link between tax policy and improved public services will be critical in maintaining public trust during these deliberations.

Navigating Debt and Borrowing Limits

With UK borrowing costs at a 27-year high, Chancellor Rachel Reeves must carefully consider how to balance increasing public investment with the constraints of her own fiscal rules. This situation necessitates a nuanced approach to taxation, where higher taxes on wealth could potentially alleviate some of the pressures brought about by stringent borrowing limits. The discussion around wealth taxes becomes increasingly relevant as the government strives to adhere to self-imposed fiscal parameters while meeting public demands.

The discourse emphasizes the necessity for a transparent approach to tax reforms, especially as these policies will ultimately impact every taxpayer in the UK. Ensuring that taxes are perceived as fair and appropriate can help the government avoid backlash while still striving to enhance public resources. As the Chancellor prepares her budget, it remains pivotal to promote the idea that these measures will contribute to long-term economic stability and public welfare.

Reform and Political Alternatives in the UK

The impending changes in public sentiment could lead to significant political shifts if the government does not meet the expectations of its constituents. Mr. Nowak’s warning about the potential for disenchantment underscores the need for the Labour party to deliver on its promises. Failing to do so might lead constituents to explore alternatives offered by parties like Reform UK, which can present more radical fiscal policies.

Political reform discussions are crucial in these contexts, emphasizing a need for the Labour movement to be receptive to public concerns especially regarding economic inequality and the funding of essential services. Keeping track of voter sentiment will be vital not just for electoral success, but for restoring faith in the political system itself. The upcoming budget could either reinforce confidence in existing parties or provoke greater shifts towards the far-right options.

A Broader Conversation on Taxation and Wealth

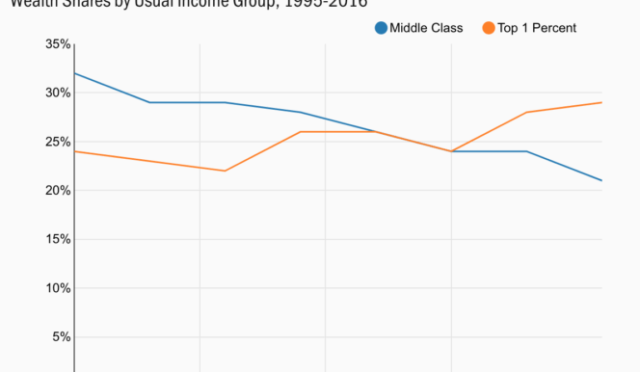

As the debate around wealth taxes heats up, an inclusive and mature conversation about taxation is imperative. It is not merely about increasing taxes but about establishing a fair system where those with the broadest shoulders contribute adequately to the society they benefit from. The incoming economic advisor, Baroness Shafik, has shown an inclination towards progressive policies, potentially facilitating a broader discussion on this complex issue. Aspects of wealth and land taxation must be revisited in the context of promoting equity.

Moreover, fostering such discussions publicly can demystify taxation and present it as a collective responsibility rather than a punishment. The recognition that the public is not naive and appreciates the necessity for tough choices must guide policymaking. Engaging the public in these discussions could help build support for necessary reforms and reinforce the idea that taxation can indeed fund essential public services that benefit everyone.

Preparing for the November Budget: Key Challenges Ahead

The November budget represents a critical juncture for Chancellor Rachel Reeves as she navigates numerous economic challenges and political pressures. With the continued demands from unions like the TUC advocating for wealth taxes, the Chancellor must carefully weigh public expectations against practical fiscal limits. This budget will be a litmus test for Labour’s ability to balance growth, fairness, and public service funding while under the scrutiny of both party factions and the general public.

In conclusion, the upcoming budget must reflect a comprehensive understanding of the complexities of wealth taxation and its potential impact on public confidence in the Government. As Reeves prepares to unveil her plans, the importance of a transparent and inclusive process can resonate deeply with voters, reinforcing trust in the government to enact policies that will pave the way for equitable economic growth and better public services.

Frequently Asked Questions

What are the proposed wealth taxes in the UK by Rachel Reeves for the upcoming budget?

In the upcoming UK Budget, Rachel Reeves is urged to consider various wealth taxes, including a tax on windfall profits of banks and financial institutions, and potentially a new tax on online gaming and gambling companies, as advocated by union leader Paul Nowak.

How could a wealth tax in the UK help fund public services?

Implementing wealth taxes in the UK, as suggested by the TUC, could provide essential funding for public services. By taxing higher profits and wealthier individuals, the government can reinvest these funds into public services, meeting the increasing demand and expectations of citizens.

What is the stance of the TUC on wealth taxes in the context of the UK budget?

The TUC is advocating for a progressive tax system that includes wealth taxes to finance public services. They argue that taxing the profits of high street banks and financial institutions is vital to ensure that those with the broadest shoulders contribute fairly to support public funding.

How might bank profits tax impact the financial sector in the UK?

A proposed bank profits tax could require UK banks to contribute a greater share of their record profits to the economy. While some banking leaders oppose higher taxes, the TUC argues this approach will ensure a sustainable and fair financial sector, allowing banks to remain profitable while supporting public investments.

What alternatives to wealth taxes are being considered in the UK budget?

Alternatives to direct wealth taxes being discussed include equalizing capital gains taxes with income tax and implementing targeted taxes on specific sectors, like private jets and second homes, as previously outlined by Rachel Reeves.

How do wealth taxes fit into the Labour party’s fiscal rules?

Wealth taxes could play a crucial role in the Labour party’s fiscal strategy by helping to meet the Chancellor’s borrowing limits. By increasing taxes on wealth and substantial profits, the government can adhere to its fiscal responsibilities while ensuring public services are adequately funded.

Why is there a push for wealth taxes now in the UK?

There is a renewed push for wealth taxes in the UK due to escalating public demand for improved services and the financial struggles many face amid rising borrowing costs. Union leaders emphasize that implementing wealth taxes could alleviate the burden on public services and ensure financial equity.

What impact could wealth taxes have on investors in the UK?

While there are concerns that wealth taxes might deter investors, proponents, like the TUC, assert that the UK continues to be an attractive investment landscape. Historical data shows that significant tax changes have not led to a mass exodus of high-net-worth individuals from the UK.

| Key Point | Details |

|---|---|

| TUC’s Urging | The TUC calls on Chancellor Rachel Reeves to consider new wealth taxes for the upcoming Budget to improve public service funding. |

| Progressive Tax System | Paul Nowak emphasizes the need for a progressive tax system that includes taxes on banks’ windfall profits and online gaming companies. |

| Treasury Response | The Treasury asserts that the balance is right in taxing the wealthy, referring to new taxes on private jets and second homes. |

| Capital Gains Tax | Mr. Nowak suggests equalizing capital gains tax with income tax as a part of the discussions. |

| Government Borrowing | UK borrowing costs are at a 27-year high, intensifying the need for tax increases in the November Budget. |

| Pressure on Banks | There is significant pressure on banks to contribute more due to record profits in a high-interest environment. |

| Public Opinion | Polling indicates strong voter support for wealth taxes to fund public services. |

| Political Landscape | There is a risk of disillusionment with mainstream politics if the government fails to deliver on tax reforms. |

Summary

Wealth Taxes UK are becoming a focal point of discussion as the TUC advocates for more progressive taxation policies to support public services funding. With rising borrowing costs and public demand for accountability, the government is under pressure to reconsider its tax strategies, particularly for financial institutions benefiting from substantial profits. The upcoming Budget on November 26 offers a critical moment for Chancellor Rachel Reeves to act decisively, balancing fiscal responsibility with the public’s desire for substantial change.