Wealth transfer is a pivotal concept shaping the financial landscape as we witness an unprecedented inheritance boom fueled by demographic shifts. As older generations pass on their assets, millennials and wealth dynamics are changing, bringing both opportunities and challenges to young investors. This colossal transfer of wealth requires careful financial planning and wealth management strategies to ensure that recipients can effectively manage and grow inherited assets. Despite the potential for significant financial windfalls, a large segment of millennials may find themselves ill-equipped to handle this life-altering wealth, largely due to a lack of education and resources. Understanding the nuances of wealth transfer is essential for families aiming to navigate this transformative period successfully.

The process of asset bequeathing is gaining attention as recent studies spotlight a significant financial migration between generations. As older individuals prepare to pass their fortunes onto heirs, the implications for financial growth and responsibility are considerable. Young adults are particularly affected by these shifts, as they stand on the brink of a new economic reality that involves managing inherited funds and planning their financial futures. Yet, as younger generations grapple with evolving economic conditions and sometimes limited knowledge of wealth stewardship, the importance of tailored financial guidance comes to the forefront. Exploring these changing tides in financial heritage allows families to better prepare for the complexities of managing newfound resources.

Understanding the Great Wealth Transfer

The concept of the great wealth transfer refers to the massive migration of financial assets from one generation to another, particularly from aging baby boomers to younger generations. This transfer is further accelerated by demographic shifts, including the aging population and increasing life expectancy, resulting in a substantial inheritance boom. As baby boomers begin to pass on their wealth, estimates suggest that trillions of dollars will be inherited by younger demographics in the coming years. Understanding these dynamics is crucial for both wealth recipients and financial advisors who aim to prepare for the implications of such a tectonic shift in wealth distribution.

However, not all individuals will reap the benefits of this impending wealth boom. Research shows that millennials, a generation particularly hard-hit by economic challenges such as student debt and housing market barriers, may not experience life-changing wealth upon inheriting. Factors like socio-economic status, financial literacy, and the ability to manage wealth effectively will greatly influence who benefits from the great wealth transfer. Enhanced awareness of these challenges is essential for millennials as they navigate their financial futures.

Demographic Shifts and Their Impact on Wealth Distribution

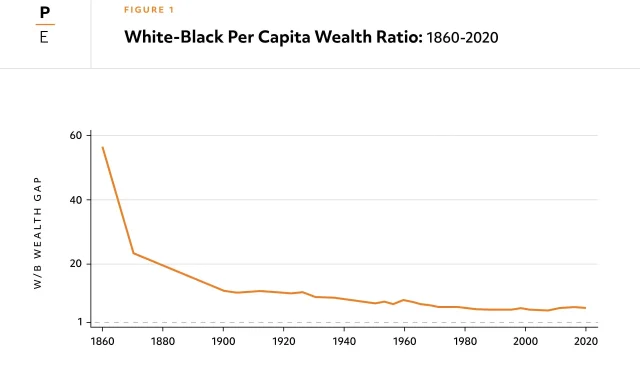

The demographic shifts currently underway are shaping the landscape of wealth distribution. As the population ages, a significant proportion of wealth is anchored in the hands of older generations who are now beginning to pass on their assets. This shift is moving wealth from more seasoned families to younger generations, including millennials and Generation Z. However, these demographic changes go beyond mere wealth transfer; they reflect broader economic trends and the challenges that today’s younger generations face in accumulating their own wealth.

Moreover, the impact of these demographic shifts also speaks to the necessity for effective wealth management strategies tailored for millennials. Financial planning becomes key here as young adults must prepare not only to receive their inheritance but also how to sustain and grow it in a fluctuating economic environment. Engaging with wealth management services can empower millennials to make informed decisions about their financial futures, especially as they stand to inherit significant wealth amidst the changing demographic landscape.

Navigating Millennial Wealth Challenges

While the great wealth transfer presents opportunities for millennials, several challenges need addressing to ensure they don’t miss out on their potential inheritance. Many millennials today are wrestling with issues such as crippling student loan debt, stagnant wages, and a high cost of living, all of which can hinder their financial aspirations and their ability to effectively manage wealth acquired through inheritance. These economic pressures require a proactive approach, integrating financial education into the broader conversation about wealth transfer.

Additionally, financial planning strategies must evolve to cater to the specific needs of millennials. This involves not only teaching essential financial literacy skills but also offering tailored investment guidance that aligns with millennial values, such as sustainability and ethical investing. By understanding these nuances, wealth managers can better serve the next generation, ensuring that they are prepared to engage with and benefit from the wealth that is being transferred to them.

The Role of Financial Planning in Wealth Transfer

Financial planning plays a pivotal role in ensuring that individuals, particularly millennials, are ready to capitalize on the wealth transfer occurring today. Without a structured financial plan, younger generations risk mismanaging inherited wealth, missing out on opportunities for growth, or facing significant financial pitfalls. Effective financial planning not only encompasses strategic investment and savings but also incorporates estate planning, which is becoming increasingly relevant in light of the great wealth transfer.

Moreover, millennials can benefit from the integration of modern financial tools and resources, emphasizing the importance of budgeting, investing apps, and online financial advisors. These resources can demystify financial planning and help young adults prepare for their financial futures, including potential inheritances. As demographic shifts continue, the proactive engagement in financial planning will enable millennials to navigate the challenges of wealth management effectively while preparing to leverage the wealth that is on the horizon.

Wealth Management Strategies for Future Generations

With the impending wealth transfer, effective wealth management strategies are essential for future generations who stand to inherit substantial assets. Financial institutions and advisors are now focusing on creating specialized products and strategies that cater specifically to millennials. This includes providing guidance on emotional aspects of wealth, as inheriting large sums can often lead to anxiety and poor decision-making without the right support.

Additionally, wealth management strategies also encompass educating young adults about diversification, risk assessment, and investment portfolio management. Millennials must learn to grow their inherited wealth wisely, ensuring a stable financial future that transcends economic fluctuations. Wealth managers can serve as educators and co-strategists, preparing this demographic to navigate the complexities of inherited wealth successfully.

Preparing for the Inheritance Boom: Tips for Millennials

As the inheritance boom looms, millennials are encouraged to prepare themselves both emotionally and financially for the wealth that may come their way. One effective approach involves having open conversations with family about wealth, inheritance expectations, and the values underlying financial decisions. Such discussions can demystify the inheritance process and help millennials understand their family’s financial landscape.

In addition, prospective heirs should focus on developing a robust personal financial plan that outlines their goals, spending habits, and investment aspirations. This plan should factor in potential inheritance as a unique addition to their overall financial picture. By establishing a comprehensive financial strategy, millennials can navigate the complexities of wealth transfer with confidence, ensuring they are not merely passive recipients but informed stewards of their families’ legacies.

The Importance of Financial Literacy Among Young Adults

In an age where financial literacy is paramount, millennials must prioritize education in personal finance to navigate their future influenced by the great wealth transfer. Financial literacy equips young adults with the skills needed to manage wealth effectively, recognize opportunities, and avoid common pitfalls associated with sudden wealth. This educational gap is critical, especially when considering that many heirs may not receive formal training on handling substantial assets inherited from family.

Emphasizing financial literacy should include understanding investment principles, tax implications of inherited wealth, and the importance of saving for emergencies. By collaborating with financial advisors and attending workshops or seminars, millennials can enhance their understanding of wealth management. This knowledge helps them make informed decisions about maintaining and growing their inheritance, enabling them to play a proactive role in their financial future.

Trends in Generational Wealth Transfer

The trends surrounding generational wealth transfer indicate compelling insights into how wealth is distributed and managed among different age groups. Currently, the primary trend suggests a focus on aligning values with financial decisions, particularly amongst millennials, who are increasingly interested in socially responsible and sustainable investing. This behavioral shift influences not just how wealth is transferred but also how it is communicated and engaged with across generations.

As these generational trends unfold, it is essential for both givers and receivers of wealth to recognize and adapt to new financial landscapes. Wealth managers should be aware of these changing attitudes towards wealth and invest in educational initiatives to bridge the gap between generations. This effort could lead to more harmonious financial relationships within families, ensuring that the benefits of the wealth transfer are maximized in a way that honors familial values and aspirations.

The Future of Wealth Management Amidst Economic Changes

Looking ahead, the future of wealth management needs to adapt continuously as economic changes reshape the landscape of the financial world. With demographic shifts underfoot and a massive wealth transfer on the horizon, wealth management professionals must embrace innovation, technology, and personalized approaches to cater to a new generation of clients. Emphasizing transparency and accessibility will be key in attracting younger clients who demand more than traditional models of wealth management.

Furthermore, as millennials take the helm of financial decisions within families, wealth management must become more collaborative and educational. By fostering an environment where young adults feel empowered to discuss wealth openly, the financial industry can help facilitate smoother transitions during inheritances. This shift not only aids in managing the wealth effectively but also nurtures a culture of financial literacy that will define the future of wealth management.

Frequently Asked Questions

What is the inheritance boom and how does it relate to wealth transfer?

The inheritance boom refers to the significant wealth transfer expected to occur as baby boomers pass on their assets to heirs. This wealth transfer is estimated to total trillions of dollars in the coming decades, affecting future financial planning and wealth management strategies.

How are demographic shifts impacting wealth transfer among millennials?

Demographic shifts, including an aging population and declining birth rates, are shaping the wealth transfer landscape. Millennials may face unique challenges in accessing inherited wealth due to these shifts, which could hinder their overall financial stability and wealth accumulation.

What role does financial planning play in navigating the inheritance boom?

Financial planning is crucial during the inheritance boom. Individuals receiving wealth need to strategize how to manage and grow their inherited assets effectively, ensuring they benefit from the wealth transfer rather than losing it through poor financial decisions.

Why might many millennials not benefit from the expected wealth transfer?

Many millennials may not benefit from the expected wealth transfer due to several factors, including differences in financial management, spending habits, and economic conditions that affect inheritance. Without proper wealth management, millennials may struggle to leverage any inheritable wealth.

What strategies can millennials employ for effective wealth management amid wealth transfer?

Millennials can adopt strategies such as budgeting, investing wisely, and seeking professional financial advice to make the most of any wealth transfer. This proactive approach can help them secure their financial future in the face of demographic shifts.

How does wealth transfer impact long-term financial stability for families?

Wealth transfer can significantly enhance long-term financial stability for families by providing additional resources for education, home ownership, and retirement. However, effective financial planning is essential to ensure that this wealth is preserved and utilized wisely.

What does the term ‘financial planning’ encompass in the context of wealth transfer?

In the context of wealth transfer, financial planning includes assessing assets, setting financial goals, creating budgets, investing for growth, and preparing for taxes and estate management to ensure that inherited wealth is effectively maintained and grown.

Are there any risks associated with the wealth transfer process?

Yes, risks associated with wealth transfer include the potential for mismanagement of assets, emotional stress during transitions, and possible disputes among heirs. It’s vital for families to communicate openly and establish clear estate plans to mitigate these risks.

| Key Point | Details |

|---|---|

| The Great Wealth Transfer | A substantial shift of wealth is occurring as older generations pass on their assets. |

| Demographic Shifts | The changing demographics are heavily influencing who inherits wealth. |

| Millennials and Wealth | Many millennials may not benefit significantly from this wealth transfer due to various economic factors. |

| Chayce Horton’s Insights | Chayce Horton provides analysis on the effects of the impending inheritance boom. |

Summary

Wealth transfer is a crucial topic in contemporary financial discussions. The great wealth transfer is amplifying as large sums of money are set to be inherited by younger generations. However, despite this significant shift, many millennials may find themselves excluded from these financial gains. Factors such as economic conditions, investment savvy, and financial literacy will play key roles in determining who will benefit from this golden opportunity. Addressing these disparities is essential to ensure that all generations can capitalize on the potential wealth that is being transferred.